Rigid Packaging Market Outlook - 2023

Global Rigid Packaging Market Size was valued at $496.72 billion in 2016. The rigid packaging market is projected to grow at a CAGR of 5.8% and is forecast to reach $729.14 billion by 2023. Rigid packaging includes usage of materials such as rigid plastics, metal, glass, and other for packaging applications. A wide variety of rigid packaging materials has been developed over a period of time. The global market growth is largely driven by increasing consumer goods demand, improving packaging recycling rates, and low cost of rigid plastic packaging. However, the rigid packaging market growth is restrained by factors such as increasing adoption of flexible packaging materials, Eurozone economic uncertainty, fluctuating raw material prices and stringent regulations.

Segment Overview:

The global Rigid Packaging Market is segmented based on material type, end-user industries, and geography. By material type, the market is categorized into plastics, metal, paper & paperboard, glass and others. The rigid plastics segment was the most dominant material type in 2016 and is expected to maintain its dominance over the forecast period 2017-2023. High adoption of rigid plastics for packaging is due to their low weight, maintaining freshness of the product, reduced breakage and low cost. The rigid plastics packaging market is expected to grow at a CAGR of 6.9% during the forecast period and is largely driven by increasing demand from fresh food & beverages, home & personal care goods, and pharmaceutical industries; and growth of the retail industry.

The fastest growing material type in global market is the others segmented which comprises of bioplastics and wood. Bioplastics are made from biodegradable feedstock, which enables them to degrade into the soil similar to other organic matter. The high growth for bioplastics in packaging is due to their rising awareness among the global population and their replacement with conventional plastics, which has led to both consumers and regulatory bodies opt for bioplastics instead.

The global rigid packaging market based on end-user industries has been classified into food & beverages, pharmaceuticals, personal care and others. The food & beverage segment dominated the market in 2016 and is expected to grow at a CAGR of 5.4% and is forecast to reach $439.49 billion by 2023. Rigid packaging plays a key role in food and beverage industry as these packaging materials provide longer shelf life to the food items. Rigid packaging products includes bottles, cans, ampules, aerosol containers, aluminum bottles and jars among others.

In comparison to other packaging type, rigid packaging containers provide unique benefits such as high impact strength, high stiffness and high barrier properties. The market in food & beverage segment is largely driven by the emerging economies of Asia such as China and India. Increasing demand for convenience food is expected to the rigid market for food and beverages. The fastest growing end user industry for rigid packaging market is the pharmaceutical industry segment. The growth in the pharmaceutical sector is driven by the advancement in the research and due to increased spending on medicines and technological innovations.

By geography, Asia-Pacific was the most dominant region for rigid packaging market in 2016. The dominance of the Asia-Pacific region is due to the presence of large number of food & beverage and personal care product manufacturers in the region. Asia-Pacific market is expected to grow at a CAGR of 6.9%. High economic growth rate and huge population in emerging markets of China and India are the major drivers for the market in Asia Pacific. North America and Europe are among the more mature market for rigid packaging. Major end user industries such as food & beverage and personal care have reached their peak levels which restrains the market growth in these regions.

Top Investment Pockets for Global Rigid Packaging Market

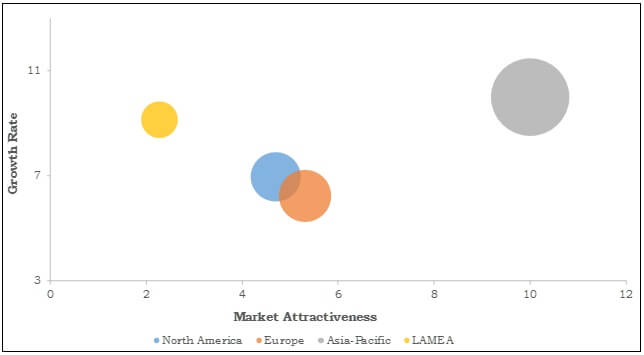

The top investment pockets for the global market are analyzed across North America, Europe, Asia-Pacific and LAMEA. Asia-Pacific was the most dominant region for market accounting for $223.02 billion in 2016. The Asia-Pacific market is expected to grow at a CAGR of 6.9% over the forecast period 2017-2023. The Asia-Pacific rigid packaging market is largely driven by the emerging economies of China, India, Bangladesh and others. The growing middle-class population in the region and growing single household with preference for small packaging units is driving the demand. Increasing urbanization and booming online sales are also some of the key drivers for the Asia-Pacific market.

Europe was the second most dominating region for rigid packaging market in 2016. The food and beverages and other personal care product industries in the region have attained a saturation point and many of the countries in the region have attained a high per capita consumption of packaged goods. The key driver for growth in the European market is the changing consumer lifestyle in developed countries and increasing disposable income in the emerging regions. Russia and Germany are the key market for rigid packaging in Europe.

Key Benefits

- This study provides an in-depth analysis of the global rigid packaging market along with future estimations to identify the potential investment pockets for stakeholders.

- It presents information regarding key drivers, restraints, and opportunities along with their impact analysis.

- Porters Five Forces analytical model illustrates the competitiveness of the rigid packaging market industry by analyzing various parameters such as threat of new entrants, threat of substitutes, strength of the buyers, and strength of the suppliers.

- Quantitative analysis of the current market and estimations from 2014 to 2022 is provided to highlight the financial competency of the market.

- The report includes the rigid packaging market share of key vendors and market current trends.

Key Segmentation

The global market is segmented on the basis of material type, end-use industries and geography.

By Material Type

- Plastics

- Metal

- Paper & paperboard

- Glass

- Others

By End-user

- Food & beverage

- Pharmaceutical

- Personal care

- Others (Electronics, industrial)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- Russia

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- LAMEA

- Middle East

- Latin America

- Africa

Key Players

- Amcor Limited

- Ball Corporation

- Bemis Company Inc.

- Berry Plastics Corporation

- DS Smith Plc

- Georgia-Pacific Corporation

- Holmen AB

- Plastipak Holdings Inc.

- Reynolds Group Holding

- Tetra Pak International

Rigid Packaging Market Report Highlights

| Aspects | Details |

| By Material Type |

|

| By End-user |

|

| By Geography |

|

| Key Market Players | Plastipak Holdings Inc., Ball Corporation, Amcor Limited, Bemis Company Inc., Tetra Pak International, Reynolds Group Holding, Holmen AB, DS Smith Plc, Georgia-Pacific Corporation, Berry Plastics Corporation |

Analyst Review

Packaging has become an important function of a product’s marketing mix. The packaging material surrounds, enhances and protects the goods. Without packaging, materials handling would be a disorganized, inefficient and costly exercise and modem consumer marketing would be virtually impossible. The packaging sector represents about 2% of Gross National Product (GNP) in developed countries and about half of all packaging is used to package food.

One of the key factor driving the growth of rigid packaging market is the increasing reuse and recycling of packaging materials globally. Recycling of packaging is being highly witnessed in metal, glass and rigid plastics. The recycling of metal packaging enables the saving of raw materials such as iron ore, aluminum and bauxite. Metal recycling also achieves significant energy savings. Metal packaging recycling achieves the same metal quality with lesser energy than required to obtain primary metal. With recycling of packaging materials CO2 and NOx emission can also be controlled. Apart from metals, rigid plastics are the other key packaging materials which have witnessed significant recycling rates. Many governments and industry players have formulated plans to tackle plastics waste. The global plastic recycling is expected to increase from present 14% to over 70% over the next decade. Packaging companies are striving for constant collaboration that could reduce plastic production and increase recycling. The increasing packaging recycling rates drive the global rigid packaging market.

Loading Table Of Content...