Risk Advisory Service Market Research, 2032

The global risk advisory service market was valued at $115.8 billion in 2022, and is projected to reach $448.9 billion by 2032, growing at a CAGR of 14.8% from 2023 to 2032.

Risk advisory services are a type of professional consulting service provided by firms or professionals to help organizations identify, assess, and manage various risks that could affect their operations, finances, reputation, or compliance with regulations. Firms that specialize in risk advisory services employ experts in various fields, such as risk management, cybersecurity, compliance, and financial auditing, to provide tailored solutions to their clients, helping them navigate complex risks and regulatory challenges.

The rise in business complexity in various businesses has driven the demand for risk advisory services. Companies face various risks from cyber threats and to manage these risks effectively, risk advisory services help companies navigate this complexity by offering tailored solutions and strategies, ensuring that businesses can operate smoothly and avoid costly disruption. Thus, this factor propels the growth of the risk advisory service market.

Furthermore, growing regulatory compliance requirements drive the growth of the market. In addition, globalization and digitalization give rise to unforeseen risks such as cyberattacks, data breaches, and supply chain disruptions propel the adoption of risk advisory services. However, lack of awareness among businesses and regulatory challenges hinders the risk advisory service market growth. On the contrary, with the rapid digitization of businesses and the increasing reliance on technology, cyber threats have become a major concern that created a surge in demand for risk advisory services. Therefore, growing cybersecurity threats are expected to provide lucrative growth opportunities to the risk advisory service market in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the risk advisory service market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the risk advisory service market outlook.

Segment Review

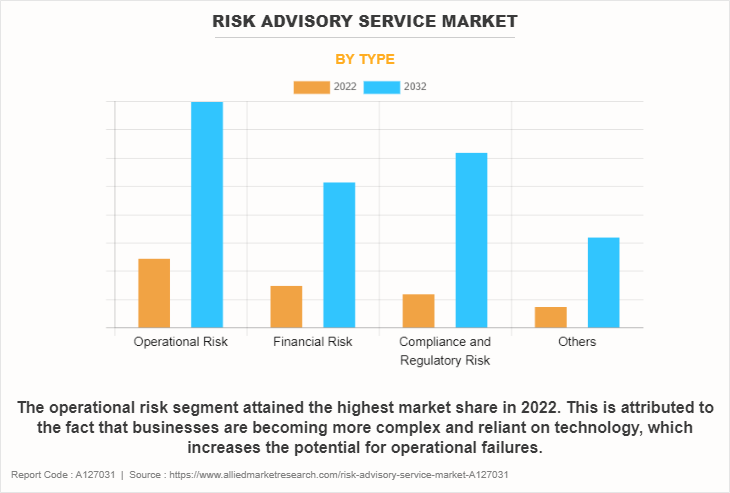

The risk advisory service market is segmented into type, organization size, industry vertical, and region. On the basis of type, the risk advisory service market is bifurcated into operational risk, financial risk, compliance and regulatory risk, and others. On the basis of organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of industry vertical, the risk advisory service market is divided into BFSI, IT and telecom, healthcare, retail and e-commerce, government and public sector, manufacturing, and others. On the basis of region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By type, the operational risk segment acquired a major risk advisory service market share in 2022. This is attributed to the fact that businesses are becoming more complex and reliant on technology, which increases the potential for operational failures. Furthermore, regulations and compliance requirements are becoming strict, making companies more focused on risk management. However, the compliance and regulatory risk segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the high-profile cases of regulatory breaches that have raised awareness about the consequences of non-compliance, encouraging firms to invest in proactive risk management.

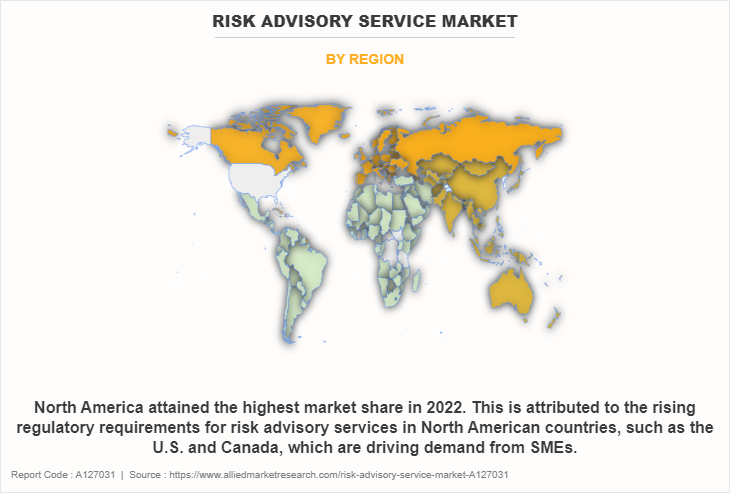

Region-wise, North America dominated the risk advisory service market share in 2022. This is attributed to the rising regulatory requirements for risk advisory services in North American countries, such as the U.S. and Canada, which are driving demand from SMEs and mid-size enterprises (MSMEs). In addition, increasing cybercrimes have led to a rise in demand for risk advisory services in North America owing to growing awareness of customers related to their financial data theft incidents. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to its developing economy coupled with the increased adoption of advanced technologies by SMEs operating within the Asia-Pacific region thereby creating lucrative growth opportunities for the risk advisory service market players in this region.

The key players operating in the risk advisory service market include Deloitte Touche Tohmatsu Limited, PwC, KPMG International Limited, RSM International Ltd., Weaver and Tidwell, L.L.P., MBG Corporate Services, Cherry Bekaert, BDO Global, Grant Thornton International Ltd (GTIL), and CLA Global TS. These players have adopted various strategies to increase their market penetration and strengthen their position in the risk advisory service industry.

Market Landscape and Trends

The world is witnessing a surge in the frequency, duration, and severity of extreme weather events, posing an escalating threat to both businesses and communities worldwide. Furthermore, consumer preferences have shifted toward climate-friendly products and services, while investors and regulators are intensifying their demands for sustainable business practices and transparent reporting from corporations. Thus, to provide advisory services that deal with the challenges posed by climate change, key players in the risk advisory service market adopt acquisition as their key strategy to sustain their growth in the market. For instance, in September 2023, Zurich Resilience Solutions, the commercial risk advisory and services unit of Zurich Insurance Group, joined forces with KPMG Switzerland, a prominent professional services firm, to provide cutting-edge advisory services addressing the multifaceted challenges posed by climate change.

The COVID-19 pandemic had a moderate impact on the risk advisory service market size. This is attributed to the widespread adoption of remote work, supply chain disruptions, and financial uncertainties. This led to a surge in demand for risk advisory services, as companies sought expert guidance to navigate these uncertain times. However, as the pandemic continued, some businesses faced financial constraints and reduced their spending on consulting services, including risk advisory.

Top Impacting Factors

Increase in Business Complexity

In today's fast-paced business world, companies face a multitude of risks, from cyber threats to regulatory changes. These risks are becoming more complex and interconnected, making it challenging for businesses to manage them effectively. Risk advisory services provide expertise in identifying, assessing, and mitigating these risks. They help companies navigate this complexity by offering tailored solutions and strategies, ensuring that businesses operate smoothly and avoid costly disruptions.

For instance, in October 2022, Cherry Bekaert acquired Accume Partners (Accume), a trusted risk and compliance advisory leader and innovator in delivering integrated solutions to highly regulated industries from Nadavon Capital Partners. The acquisition of Accume expands Cherry Bekaert's focus on providing internal audit, risk and compliance offerings to the financial services industry. Thus, these factors foster the risk advisory service market growth.

Growing Regulatory Compliance Requirements

Governments and industry regulators are continuously introducing new rules and regulations that companies must adhere to. Non-compliance results in fines, legal issues, and damage to a company's reputation. Risk advisory services assist organizations in staying compliant with these evolving regulations. They offer guidance on how to adapt to changing legal requirements, helping companies avoid penalties and maintain their reputation as responsible and ethical entities. Therefore, these factors propel the growth of the risk advisory service market.

Growing Cybersecurity Threats

With the rapid digitization of businesses and the increasing reliance on technology, cyber threats have become a major concern. Hackers and cybercriminals are constantly evolving their tactics, making it essential for organizations to protect their data and systems. This heightened cybersecurity risk created a surge in demand for risk advisory services. These services help companies identify vulnerabilities, develop robust security strategies, and respond effectively to cyber incidents. As more businesses seek to safeguard their digital assets, the risk advisory service market has seen substantial growth, offering expertise in combating cyber threats and ensuring the security of sensitive information.

For instance, in July 2021, The Risk Advisory Group established a standalone specialist security intelligence services company, Dragonfly, to provide security experts at leading global organizations with the intelligence they need to anticipate geopolitical threats, plan with precision, and sustain their companies’ business advantage. The new business focuses on supporting clients with the content and platforms they need to mitigate risk in an increasingly complex, politicized, and unstable business risk environment. Therefore, these factors are expected to provide lucrative growth opportunities for the risk advisory service market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the risk advisory service market analysis from 2022 to 2032 to identify the prevailing risk advisory service market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the risk advisory service market segmentation assists to determine the prevailing risk advisory service market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as risk advisory service market trends, key players, market segments, application areas, and market growth strategies.

Risk Advisory Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 448.9 billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 175 |

| By Type |

|

| By Organizartion Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | PwC, BDO Global, Deloitte Touche Tohmatsu Limited, MBG Corporate Services, Cherry Bekaert, Weaver and Tidwell, L.L.P., RSM International Ltd., KPMG International Limited, CLA Global TS, Grant Thornton International Ltd (GTIL) |

Analyst Review

According to CXOs, typical providers of risk advisory services are multinational professional service networks of PWC, BDO, and Deloitte with experienced lawyers, risk consultants, and advisors. They offer experienced teams in areas that offer a range of risk advisory services to businesses and organizations in both private and public sectors. They work to identify & respond to risk and help to manage & control risk through internal audit, risk assurance, cyber security, technology, and project assurance as well as contract assurance.

In addition, key players in the risk advisory service market adopt acquisitions to enhance finance and risk digital transformation services and to provide a wider range of solutions for the financial services industry. For instance, in December 2022, EY acquired ifb SE (ifb), an international finance and risk transformation and compliance consultancy. The acquisition enhances the breadth and depth of EY's finance and risk transformation and compliance capabilities, creating greater opportunities for EY to support its clients.

The COVID-19 pandemic had a significant impact on the risk advisory service market size. This is attributed to the widespread adoption of remote work, supply chain disruptions, and financial uncertainties. This led to a surge in demand for risk advisory services, as companies sought expert guidance to navigate these uncertain times. However, as the pandemic continued, some businesses faced financial constraints and reduced their spending on consulting services, including risk advisory.

The key players in the risk advisory service market include Deloitte Touche Tohmatsu Limited, PwC, KPMG International Limited, RSM International Ltd., Weaver and Tidwell, L.L.P., MBG Corporate Services, Cherry Bekaert, BDO Global, Grant Thornton International Ltd (GTIL), and CLA Global TS. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With the increase in awareness & demand for risk advisory service across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The risk advisory service market is segmented into type, organization size, industry vertical, and region. On the basis of type, the market is bifurcated into operational risk, financial risk, compliance and regulatory risk, and others. On the basis of organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of industry vertical, the market is divided into BFSI, IT and telecom, healthcare, retail and e-commerce, government and public sector, manufacturing, and others. On the basis of region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Risk Advisory Service.

The risk advisory service market size was valued at $115.83 billion in 2022 and is projected to reach $448.86 billion by 2032, growing at a CAGR of 14.8% from 2023 to 2032.

The key players operating in the risk advisory service market include Deloitte Touche Tohmatsu Limited, PwC, KPMG International Limited, RSM International Ltd., Weaver and Tidwell, L.L.P., MBG Corporate Services, Cherry Bekaert, BDO Global, Grant Thornton International Ltd (GTIL), and CLA Global TS.

Loading Table Of Content...

Loading Research Methodology...