Roadside Assistance Market Research, 2033

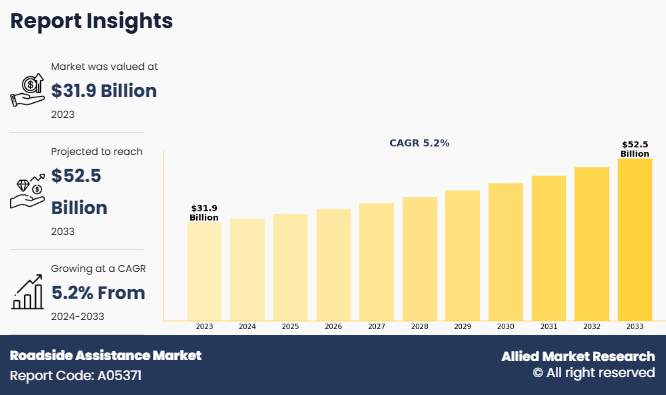

The global Roadside Assistance Market Size was valued at $31.9 billion in 2023, and is projected to reach $52.5 billion by 2033, growing at a CAGR of 5.2% from 2024 to 2033.

Market Definition

The roadside assistance market provides on-demand services to vehicle owners experiencing mechanical failures or emergencies while on the road. This market exists to ensure timely support for issues such as flat tires, dead batteries, fuel shortages, or lockouts, offering towing, repair, and other essential services. With an increasing number of vehicles on the road and the rising complexity of automotive technology, the need for professional roadside assistance has grown. Key benefits include enhanced driver safety, minimized vehicle downtime, and convenience, as these services can prevent minor issues from escalating into major problems, supporting both individual drivers and fleet operators.

In 2023, the major international passenger car Roadside Assistance Industrywitnessed a notable rise in new registrations. The European car market recorded over 12.8 million new vehicle registrations, marking a 14% increase compared to 2022. In the U.S., light vehicle sales experienced notable growth, climbing by 12% with nearly 15.5 million vehicles sold. The Chinese car market witnessed approximately 25.8 million new car registrations in 2023.

With an increasing number of individuals and businesses owning vehicles, the probability of encountering breakdowns, accidents, or other emergencies on the road rises. This growing ownership creates a need for reliable and prompt assistance services, providing an opportunity for roadside assistance providers to cater to a larger customer base. With a higher number of vehicles on the road, the demand for assistance services expands. Vehicle owners seek the assurance of having a professional service available to help them in case of unexpected incidents or vehicle malfunctions. This demand is especially prevalent in densely populated urban areas where traffic congestion and longer commutes increase the likelihood of encountering road-related issues.

Furthermore, increased vehicle ownership extends beyond private cars. The rise of commercial fleets, including delivery vehicles, rideshare vehicles, and other transport services, contributes to the growing demand for roadside assistance. These businesses rely on the uninterrupted operation of their vehicles to provide services, making efficient assistance crucial for their operations. As vehicle ownership continues to rise globally, the roadside assistance market benefits from a larger potential customer base.

To meet this demand, roadside assistance providers need to invest in expanding their service networks, enhancing service quality, and leveraging technology to efficiently dispatch assistance and ensure customer satisfaction. Therefore, these factors further drive demand for the roadside assistance market.

However, modern vehicles are equipped with intricate computer systems, sensors, and specialized components that require specific knowledge and expertise to diagnose and repair. Roadside assistance providers must continually invest in training their technicians and equipping them with the latest diagnostic tools and equipment. However, the rapid pace of technological advancements may make it challenging to keep up with the evolving requirements, potentially leading to a shortage of skilled technicians capable of addressing complex vehicle issues.

From a customer perspective, the increase in technological complexity of vehicles creates a perception that repairs and assistance services are best handled by authorized dealerships or specialized technicians. Some vehicle owners prefer taking their vehicles to dealership service centers that have direct access to manufacturer expertise and advanced diagnostic tools, rather than relying on roadside assistance providers.

This shift in customer preference potentially restrains the demand for roadside assistance services. Thus, the increasing technological complexity of vehicles may pose challenges for the roadside assistance market.

As vehicles grow older, their susceptibility to mechanical breakdowns, component failures, and other issues that necessitate professional assistance increases. This creates a growing need for reliable roadside assistance services to support and rescue stranded drivers. Many countries have experienced a gradual increase in the average age of vehicles on the road due to factors such as improved vehicle durability, economic considerations, and changing consumer preferences. Older vehicles are more prone to breakdowns and mechanical failures due to wear and tear, outdated components, and outdated technology. As a result, owners of aging vehicles are more likely to require roadside assistance when they encounter unexpected problems.

The demand for roadside assistance services is particularly pronounced in regions with a high concentration of older vehicles. These vehicles may lack the advanced features and reliability of newer models, making them more susceptible to breakdowns and emergencies. Owners of aging vehicles, especially those who rely on them for daily transportation or commercial purposes, seek the support and expertise of roadside assistance providers to ensure prompt and efficient resolution of issues.

To meet the demand generated by the aging vehicle fleet, roadside assistance companies must have the expertise and resources to handle a variety of older vehicle models, including knowledge of outdated technologies and components. They need to invest in training their technicians and equipping them with the necessary tools and parts to address the specific needs of older vehicles. Thus, the increasing number of aging vehicles on the road presents a significant opportunity for the roadside assistance market.

Segmental Overview

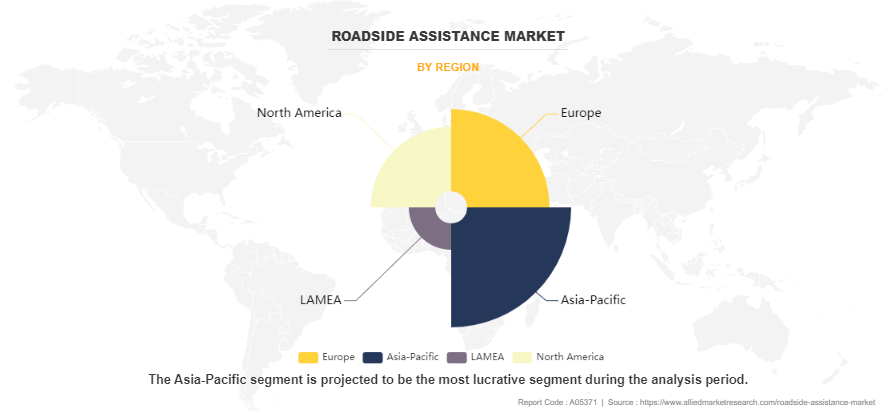

The Roadside Assistance Market Size is segmented into service, vehicle, provider, and region. Depending on service, it is fragmented into towing, jump start/pull start, lockout/replacement key service, fuel delivery, and others. By vehicle, the market is differentiated into passenger vehicles and commercial vehicles. By provider, it is classified into OEM, motor insurance, independent service provider, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

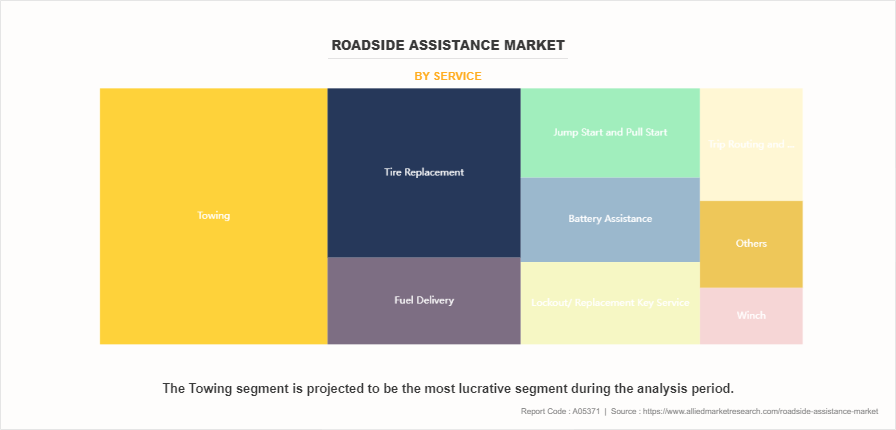

By Service

Based on the service, the Towing segment held the highest Roadside Assistance Market Share in 2023 and is likely to remain dominant during the Roadside Assistance Market Forecast period. This is attributed to the increasing number of vehicle breakdowns, accidents, and mechanical failures that require towing services, particularly as the number of vehicles on the road continues to rise globally. Additionally, the convenience of immediate towing assistance and partnerships between roadside assistance providers and towing companies are driving the dominance of this segment.

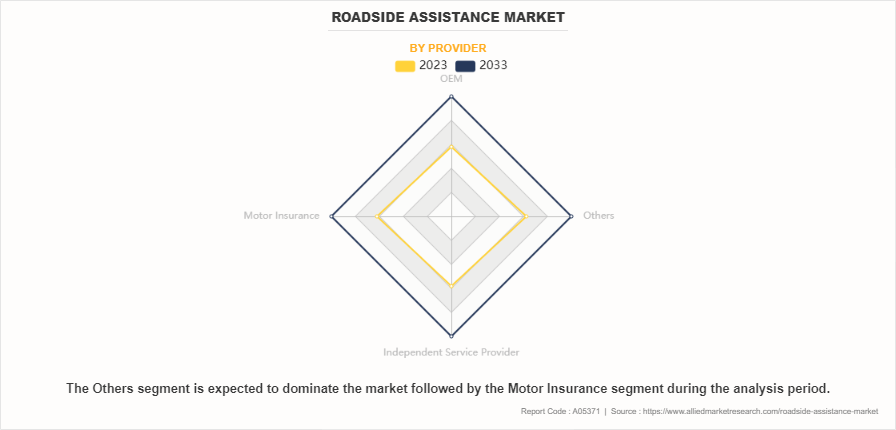

By Providers

Based on provider, the Motor Insurance segment held the highest market share in 2023 and is likely to remain dominant during the Forecast period. This is attributed to the widespread inclusion of roadside assistance services as part of comprehensive motor insurance policies. As more consumers seek bundled services to simplify their insurance needs, motor insurance companies have become the primary providers of roadside assistance, offering added value to policyholders.

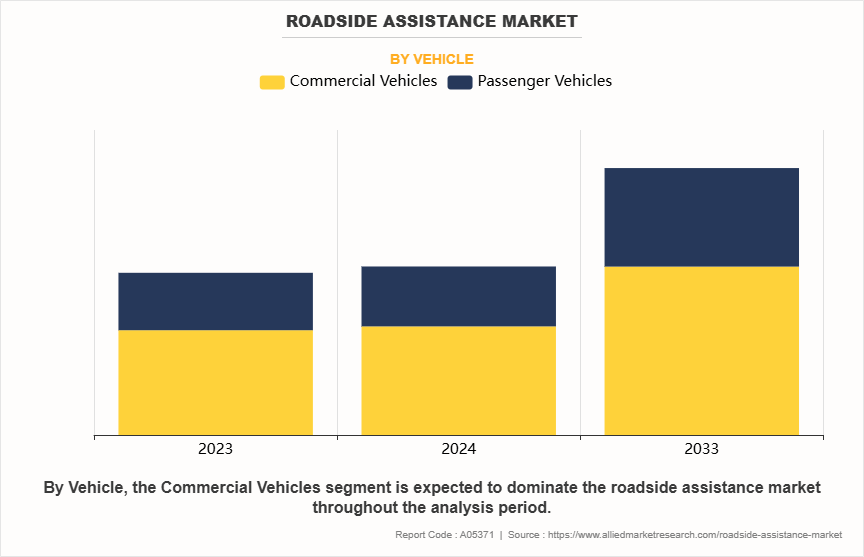

By Vehicles

Based on vehicles, the Commercial Vehicles segment held the highest market share in 2023, and is likely to remain dominant during the Forecast period. This is attributed to the growing commercial transportation and logistics sector, where fleet operators prioritize minimizing downtime caused by breakdowns. Commercial vehicles, such as trucks and delivery vans, rely heavily on roadside assistance services to maintain operational efficiency and reduce business losses.

By Region

The North America region held the highest market share in 2023, and is likely to remain dominant during the Forecast period. This is attributed to the rapid urbanization, rising vehicle ownership, and expanding road networks in countries such as China, India, and Japan. Additionally, growing awareness of the benefits of roadside assistance services, coupled with government initiatives to improve infrastructure, has propelled the market in this region to dominate.

Competitive Analysis

The roadside assistance market analysis includes top companies operating in the market such as Agero, Allianz Global Assistance, Allstate Insurance Company, ARC Europe SA, AutoVantage, Falck A/S, Paragon Motor Club, Roadside Masters, SOS International, and Viking Assistance Group AS. These players have adopted various strategies to increase their market penetration and strengthen their position in the roadside assistance industry.

Key Developments

- May 2023, Allianz Partners, a subsidiary of Allianz SE, formed a partnership with Fisker Inc., a company dedicated to developing highly emotional and sustainable electric vehicles. This collaboration aims to offer Fisker customers in Europe comprehensive roadside assistance services.

- February 2021, ARC Europe SA announced a strategic partnership with Medallia, Inc., the major player in customer and employee experience and engagement, to improve the experience of roadside assistance for customers.

- April 2021, ARC Europe SA announced a strategic partnership with Aiways, a Chinese EV manufacturer that is deploying its vehicles in Europe. The two companies have signed a three-year contract to deliver mobility solutions, including Roadside Assistance, to Aiways' EV drivers.

- October 2021, ARC Europe SA partnered with Lynk & Co., a global mobility provider for roadside assistance and electric services in Europe. Under this partnership, ARC Europe SA will deliver comprehensive mobility solutions to drivers of Lynk & Co. across all countries for the next three years.

- July 2024, Agero, Inc. partnered with Ford Motor Company to deliver industry-leading roadside assistance solutions to Ford drivers across the U.S. Furthermore, Agero expanded its premier roadside assistance offerings to include advanced programs and service enhancements for Ford̢۪s growing segment of electric vehicle (EV) owners.

- May 2023, Allianz Partners, a subsidiary of Allianz SE, formed a partnership with Fisker Inc., a company dedicated to developing highly emotional and sustainable electric vehicles. This collaboration aims to offer Fisker customers in Europe comprehensive roadside assistance services.

- February 2021, ARC Europe SA announced a strategic partnership with Medallia, Inc., the major player in customer and employee experience and engagement, to improve the experience of roadside assistance for customers.

- April 2021, ARC Europe SA announced a strategic partnership with Aiways, a Chinese EV manufacturer that is deploying its vehicles in Europe. The two companies have signed a three-year contract to deliver mobility solutions, including Roadside Assistance, to Aiways' EV drivers.

- October 2021, ARC Europe SA partnered with Lynk & Co., a global mobility provider for roadside assistance and electric services in Europe. Under this partnership, ARC Europe SA will deliver comprehensive mobility solutions to drivers of Lynk & Co. across all countries for the next three years.

- July 2024, Agero, Inc. partnered with Ford Motor Company to deliver industry-leading roadside assistance solutions to Ford drivers across the U.S. Furthermore, Agero expanded its premier roadside assistance offerings to include advanced programs and service enhancements for Ford̢۪s growing segment of electric vehicle (EV) owners.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the roadside assistance market analysis from 2023 to 2033 to identify the prevailing roadside assistance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the roadside assistance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global roadside assistance market trends, key players, market segments, application areas, and Roadside Assistance Market Growth strategies.

Roadside Assistance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 52.5 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 329 |

| By Service |

|

| By Provider |

|

| By Vehicle |

|

| By Region |

|

| Key Market Players | Viking Assistance Group AS, Allstate Insurance Company, Allianz, Paragon Motor Club, Agero, Inc., Roadside Transportation LLC, ARC Europe, AutoVantage, Falck A/S, SOS International |

Analyst Review

The roadside assistance market has experienced significant growth in recent years and continues to expand due to increase in vehicle ownership, urbanization, and the need for convenient & reliable emergency support.

Roadside assistance is an extra protection that enables aid in an emergency. Moreover, a few well-known automakers, including Hyundai, offer temporary support free of charge. Companies provide numerous services including streamlining the service request process, reducing response times, and ensuring the availability of highly trained & professional technicians to ensure competitiveness in the market.

Furthermore, technology plays a vital role in improving the roadside assistance experience. Various key players focus on emerging technologies such as mobile applications, GPS tracking, and telematics to enhance communication, enable efficient dispatching of service providers, and provide real-time updates to customers, which further boost demand for the roadside assistance market. Integrating digital platforms and self-service options may also empower customers to manage their assistance needs more independently.

The roadside assistance market is fragmented with the presence of regional vendors such as Agero, Allianz Global Assistance, Allstate Insurance Company, ARC Europe SA, AutoVantage, Falck A/S, Paragon Motor Club, Roadside Masters, SOS International, and Viking Assistance Group AS. Major players operating in this market have adopted various strategies that include product launch and acquisitions to reduce supply and demand gaps. With increase in awareness and demand for roadside assistance across the globe, major players have collaborated on their product portfolio to provide differentiated and innovative products.

The global roadside assistance market was valued at $31,907.9 million in 2023, and is projected to reach $52,512.8 million by 2033, registering a CAGR of 5.2% from 2024 to 2033.

The Roadside assistance market is product type, and region. 2024-2033 would be the forecast period in the market report.

The towing segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Roadside assistance market was valued at $31,907.9 million in 2023.

The Roadside assistance market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Roadside assistance market report.

The top companies that hold the market share are Agero, Allianz Global Assistance, Allstate Insurance Company, ARC Europe SA, AutoVantage, Falck A/S, Paragon Motor Club, Roadside Masters.

Loading Table Of Content...

Loading Research Methodology...