Robotics and Automation Actuators Market Research, 2032

The global robotics and automation actuators market was valued at $13.2 billion in 2022 and is projected to reach $45.2 billion by 2032, growing at a CAGR of 13.2% from 2023 to 2032.

Actuators are devices that convert energy into mechanical motion or force. They are used to control and move various types of systems, such as valves, switches, and motors. Actuators can be powered by a variety of sources, including electricity, hydraulic pressure, or air pressure, and are often used in industrial, automotive, aerospace, and robotics applications. Actuators come in a wide range of types, including electric, hydraulic, pneumatic, and mechanical. Some common examples of actuators include motors, solenoids, relays, and linear actuators. These devices are used to control the motion or position of a system, such as opening or closing a valve, turning a wheel, or moving a robotic arm.

Actuators and soft actuators are essential components in various types of machinery and equipment, where they play a vital role in controlling and automating different processes. Industrial automation actuators are used to perform a wide range of tasks, from simple tasks such as opening and closing doors to more complex tasks such as controlling the position and speed of a robotic arm. Different types of actuators are used for different purposes. Electric actuators, for example, use electric motors to generate motion and force, while hydraulic and pneumatic actuators use hydraulic fluid or compressed air to achieve the same results.

Mechanical actuators use simple mechanisms such as gears, levers, and pulleys to generate motion and force. Actuators can be either linear or rotary. Linear actuators generate motion in a straight line, while rotary actuators generate rotational motion around an axis. Both types of actuators can be used to control the motion and position of a system, depending on the requirements of the application.

The robotics and automation actuators market outlook is expected to witness notable growth during the forecast period, owing to increasing demand for industrial robots, process enhancement ability in 3D printing using linear actuators, and a surge in the use of robots in the healthcare and transportation sectors. Moreover, the increase in the use of intelligent actuators for robotics and industrial automation is expected to provide lucrative opportunities for the growth of the robotics and automation actuators market during the forecast period. On the contrary, high installation costs are a restraint for the robotics and automation actuators market growth during the forecast period.

Segmentation Overview

The robotics and automation actuators market forecast is segmented into Type, Actuation, and End-Use Industry.

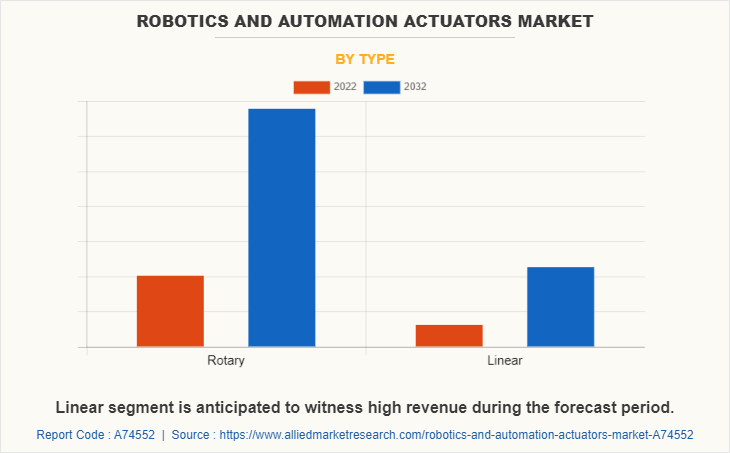

Based on type, the robotics and automation actuators industry is divided into rotary and linear. In 2022, the linear segment dominated the market in terms of revenue, and will acquire a major market share till 2032.

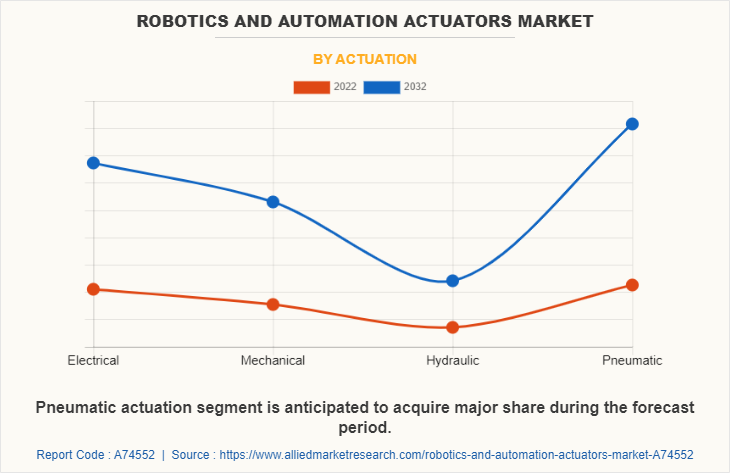

Based on actuation, the market is segregated into electrical, mechanical, hydraulic, and pneumatic. The pneumatic segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

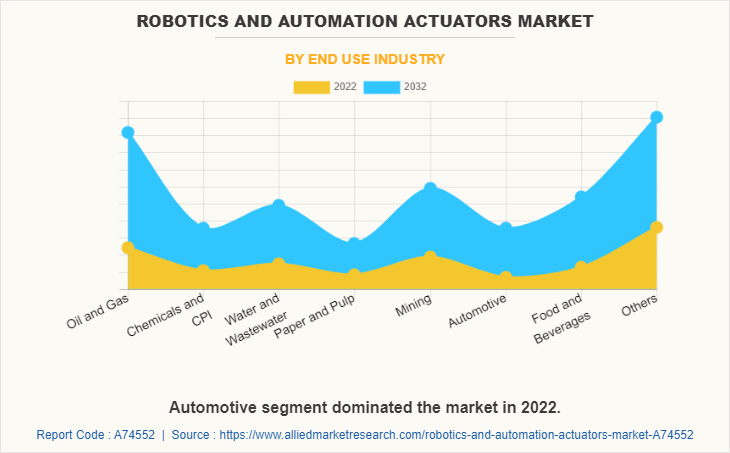

Based on end-use industries, the market is segregated into oil and gas, chemicals and CPI, water and wastewater, paper and pulp, mining, automotive, food and beverages, and others. The automotive segment acquired the largest share in 2021 and is expected to grow at a significant CAGR from 2023 to 2032.

Region-wise, the robotics and automation actuators market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Europe remains a significant participant in the robotics and automation actuators market.

Competitive Analysis

Competitive analysis and profiles of the major global robotics and automation actuators market players that have been provided in the report include ABB Ltd, Altra Industrial Motion (Regal Rexnord), Crane Holdings, Co., Curtiss-Wright Corporation, Flowserve Corporation, IMI, MISUMI Group Inc., Moog, Rockwell Automation, and SMC Corporation.

Country Analysis

Country-wise, the U.S. acquired a prime share in the robotics and automation actuators market in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Germany dominated the robotics and automation actuators market in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's robotics and automation actuators with a CAGR of 13.45%.

In Asia-Pacific, China is expected to emerge as a significant market for the robotics and automation actuators industry, owing to a significant rise in investment by prime players due to a rise in electric vehicles (EVs), manufacturing units, and favorable government subsidies for the micro, small and medium enterprises (MSMEs) of rural areas in the region.

By the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA robotics and automation actuators market size has been witnessing improvement, owing to the growing inclination of companies towards research and development for the extraction of oil and gas across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 13.26% from 2023 to 2032.

Historical Data & Information

The global robotics and automation actuators market is highly competitive, owing to the strong presence of existing vendors. Vendors of robotics and automation actuators market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

ABB Ltd, Altra Industrial Motion (Regal Rexnord), Crane Holdings, Co., Curtiss-Wright Corporation, Flowserve Corporation, IMI, MISUMI Group Inc., Moog, Rockwell Automation, and SMC Corporation are the top companies holding a prime share in the robotics and automation actuators market opportunity. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others to expand their foothold in the robotics and automation actuators market.

- In March 2023, Rockwell Automation, Inc., made a strategic investment in READY Robotics, a pioneering company in software-defined automation and a Rockwell Technology Partner. READY Robotics’ ForgeOS platform enables operators to control and program the most popular brands of robots from a single user-friendly interface with minimal training.

- In March 2023, ABB opened a state-of-the-art, fully automated, and flexible robotics factory in Shanghai, China. The 67,000 m2 production and research facility represents a $150 million investment by ABB and will deploy the company’s digital and automation technologies to manufacture next-generation robots, enhancing ABB’s robotics and automation leadership in China.

- In March 2023, SMC Corporation introduced a new CG1 Series Air Cylinder, EX600-W Wireless Compact Remote Unit, and updated MSQ series rotary tables. The company supports industrial automation by supplying products and solutions centered around pneumatic control engineering.

- In November 2022, the World Skill Centre (WSC) signed a memorandum of understanding (MoU) with ABB India Ltd (ABB) to collaborate in the field of Robotics for the automation industry. The objective of the MoU is to facilitate knowledge transfer and develop WSC staff and students in the area of Robotics Technology.

- In October 2022, IMI Remosa unveiled a new 172,000 square foot (16,000 square meters) factory in Sardinia as part of its ongoing mission to bolster its manufacturing capabilities and accelerate the transition to greener industrial energy sources. The 484,000 square feet site (45,000 square meters), which employs over 200 people, will manufacture valves and hydraulic actuating systems for critical applications in petrochemical industries, alongside new green energy products, such as its new IMI VIVO Electrolyser.

- In July 2022, Moog Inc. and Triumph Group, Inc. agreed to work together for four years to offer maintenance, repair, and overhaul solutions for the cargo door and landing gear actuation control systems of Boeing 787 airplanes belonging to an Asia Pacific operator. This required assistance is expected to be done through Moog's Aftermarket Total Support Program (MTS), and the work is estimated to take place at TRIUMPH Actuation Products and Services' hydraulic actuation centers of brilliance located in Washington, Clemmons, Yakima, and North Carolina.

- In April 2021, Moog Industrial Group added a new system to the Electrohydrostatic Actuation System (EAS) product family for industrial machinery. The latest model is the Compact EAS, intended for applications requiring high dynamics and power density, which uses programmable cycles and demands high levels of accuracy and repeatability. Testing machines for automobile components is one target application. In metalworking, examples include metal pressing, cutting, forming, and bending. Operations involving pressing, punching, and cutting other materials, including glass, ceramics, plastics, and leather, will also benefit from its high level of performance.

- In December 2020, SMC Corporation made a partnership and became a master distributor of Soft Robotics Inc. (Bedford, MA) for strategic global markets. This strategic partnership will empower SMC Corporation’s global sales team to bring Soft Robotics’ groundbreaking robotic technology to its customers around the world.

- In July 2020, ABB India opened a new facility in Bengaluru that would enable it to deliver robotic applications and digital solutions for a variety of industries, including automotive, food & beverage, electronics, and other upcoming sectors.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the robotics and automation actuators market from 2022 to 2032 to identify the prevailing robotics and automation actuators market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the robotics and automation actuators market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global robotics and automation actuators market trends, key players, market segments, application areas, and market growth strategies.

Robotics and Automation Actuators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 45.2 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 339 |

| By Type |

|

| By Actuation |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Flowserve Corporation, SMC Corporation, Moog Inc., Rockwell Automation, Inc., Curtiss-Wright Corporation, IMI, Crane Holdings, Co., ABB Ltd., MISUMI Group Inc., Altra Industrial Motion (Regal Rexnord) |

Analyst Review

The market for robotics and automation actuators is expected to grow significantly in the coming years. The growth of the robotics and automation actuators market refers to the expected increase in demand for actuators used in robotics and automation systems. Actuators are devices that convert electrical, hydraulic, or pneumatic energy into mechanical motion, and they play a critical role in controlling the movement and positioning of various parts in robotics and automation systems.

The growth of this market is driven by various factors such as the increase in adoption of automation and robotics in manufacturing processes, the rise in demand for industrial automation across different industries, and the need for high precision & speed in manufacturing processes. In addition, the development of advanced actuators that are capable of performing complex tasks with high accuracy and speed also drives the growth of the robotics and automation actuators market.

As the demand for automation and robotics continues to increase across different industries such as automotive, aerospace, healthcare, and consumer electronics, the demand for high-performance actuators is expected to grow significantly in the coming years. This is expected to create significant opportunities for companies operating in the robotics and automation actuators market, driving innovation and further development of advanced actuators for automation and robotics systems.

Various industries have adopted automation and robotics systems to increase productivity and efficiency in manufacturing processes. Actuators play a crucial role in these systems, enabling precise control of the movement of various parts, thereby reducing errors and increasing productivity. Collaborative robots, also known as cobots, are designed to work alongside humans in manufacturing processes. Actuators used in cobots are designed to be safe, lightweight, and precise, making them ideal for use in collaborative environments. The increase in adoption of cobots is expected to drive the growth of the robotics and automation actuators market. Therefore, the growth of the robotics and automation actuators market is expected to continue in the coming years, driven by the rise in adoption of automation and robotics systems in various industries, technological advancements, and the need for energy-efficient and collaborative solutions.

Collaborative robots and smart actuators are the upcoming trends of Robotics and Automation Actuators Market in the world.

Automotive is the leading application of Robotics and Automation Actuators Market.

Europe is the largest regional market for Robotics and Automation Actuators

The global robotics and automation actuators market was valued at $13,175.64 million in 2022.

ABB Ltd, Altra Industrial Motion (Regal Rexnord), Crane Holdings, Co., Curtiss-Wright Corporation, Flowserve Corporation, IMI, MISUMI Group Inc., Moog, Rockwell Automation, and SMC Corporation are the top companies to hold the market share in Robotics and Automation Actuators

Loading Table Of Content...

Loading Research Methodology...