Roofing Chemicals Market Research, 2033

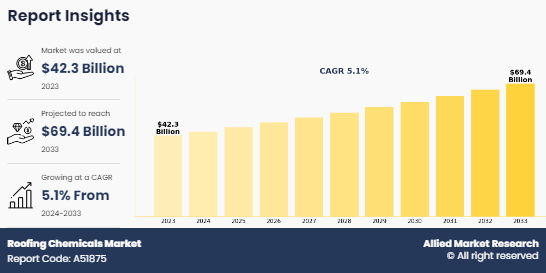

The global roofing chemicals market was valued at $42.3 billion in 2023, and is projected to reach $69.4 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033. Innovations in roofing chemical formulations are expected to drive the growth of the roofing chemicals market during the forecast period. Polymer-based roofing chemicals have become increasingly popular due to their superior properties such as flexibility, adhesion, and weather resistance. However, environmental concerns are expected to hamper the growth of the roofing chemicals market. An increase in emphasis on green building practices is expected to create opportunities for the roofing chemicals market throughout the projected period.

Introduction

Roofing chemicals encompass a wide range of substances used in the construction and maintenance of roofs to enhance their durability, weather resistance, and overall performance. One of the primary categories of roofing chemicals is waterproofing compounds. These compounds are designed to prevent water ingress through the roof, thereby protecting the underlying structure from water damage. Waterproofing chemicals typically include sealants, membranes, and coatings that create a barrier against moisture. They are commonly used in flat roofs, where pooling water can pose a significant threat. Additionally, waterproofing compounds are applied to joints, seams, and other vulnerable areas to enhance the overall integrity of the roofing system.

Reflective coatings are another type of roofing chemical that serves a vital function in reducing heat absorption and lowering cooling costs. These coatings are typically applied to the surface of the roof to reflect sunlight and prevent excessive heat buildup. By minimizing heat transfer into the building, reflective coatings help reduce the demand for air conditioning and mitigate the urban heat island effect. Reflective coatings are commonly used in regions with hot climates and high solar exposure, where they can significantly improve the energy efficiency and comfort of buildings.

According to the U.S. Department of Energy (DOE), buildings in the U.S. contribute significantly to energy consumption and greenhouse gas emissions, with 40% of energy used and 35% of emissions produced. About 40% of this energy is for heating, while 10% is for cooling nationwide. In hotter regions such as the southern U.S., heating accounts for 30% and cooling for 20% of energy usage. Cool-roof coatings represent a promising advancement to help reduce energy usage and emissions, particularly benefiting building owners in hot climates. The cool roof coatings contain infrared reflective pigments. These pigments reflect infrared radiation, which is responsible for a significant portion of the heat absorbed by roofs.

Key Takeaways:

- The roofing chemicals industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2024-2032).

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global roofing chemicals market and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The roofing chemicals market share is highly fragmented, with several players including BASF SE, Dow, SIKA CORPORATION, GAF, Inc, Owens Corning, Johns Manville, Saint-Gobain, DuPont, Akzo Nobel N.V., and PPG Industries. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion, of the players operating in the roofing chemicals market growth.

Market Dynamics

Innovation in roofing chemical formulations involves the development of advanced polymers and coatings. Manufacturers are investing in research and development to create polymers that offer superior weather resistance, UV protection, and flexibility. These advanced polymers enable roofing materials to withstand harsh environmental conditions, including extreme temperatures, heavy rainfall, and high winds, thereby extending the lifespan of roofs and reducing maintenance requirements. New formulations of coatings offer improved waterproofing, thermal insulation, and reflective properties, helping to enhance energy efficiency and reduce cooling costs for buildings. Additionally, self-cleaning and anti-microbial coatings are being developed to mitigate the growth of algae, mold, and other contaminants on roofs, improving aesthetics and prolonging the life of roofing materials.

In December 2022, Jim Rhubart Roofing offered Roof Maxx, which is a spray-on coating that’s designed specifically for the treatment of fiberglass-asphalt shingles. Roof Maxx can additionally serve as a highly effective preventative treatment. The soy-fusion technology behind the Roof Maxx solution allows it to penetrate dry, brittle, and highly aged roof shingles. This enhances the flexibility and resilience of fiberglass asphalt.

As per the Kansas Department of Commerce, in March 2024, GAF, which is a standard industries company and North America’s largest roofing and waterproofing manufacturer, invested more than $300 million in Newton by constructing a new shingle plant. The estimated 275,000-square-foot facility created more than 130 high-skilled manufacturing jobs in management, engineering, and operations.

Roofing materials can contain hazardous substances such as heavy metals, asbestos, and certain polymers. Heavy metals such as lead and cadmium, as well as asbestos, are particularly worrisome due to their toxicity and potential to cause harm to both human health and the environment. Proper handling, disposal, and maintenance of roofing materials are crucial to minimize the risks associated with these hazardous substances. Additionally, the emission of volatile organic compounds (VOCs) from roofing materials during manufacturing, installation, and use can contribute to air pollution, smog formation, and respiratory problems, impacting both human health and the environment. Moreover, the growing awareness and concern among consumers, architects, and building owners about the environmental and health impacts of roofing chemicals are influencing purchasing decisions and driving the demand for eco-friendly and sustainable alternatives.

Segments Overview

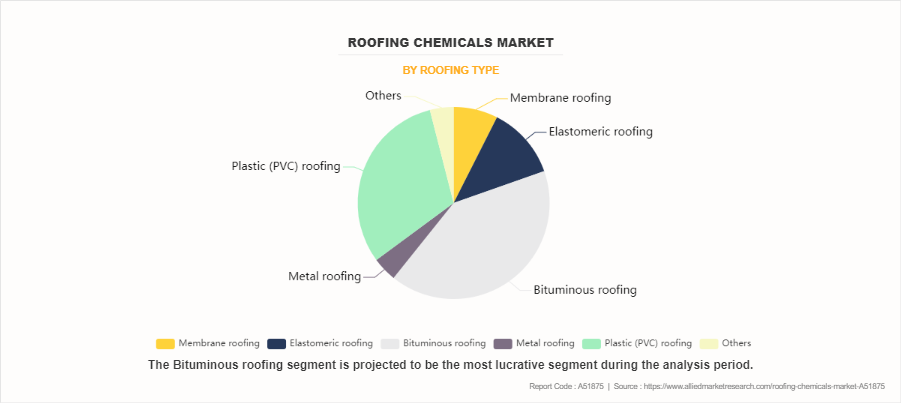

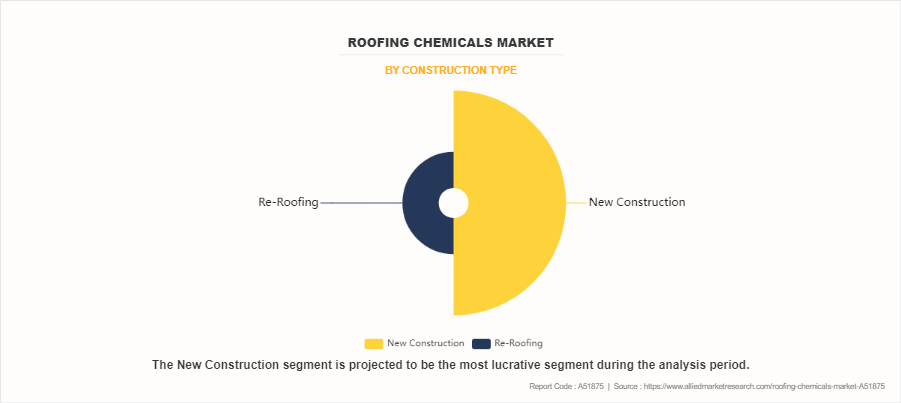

The roofing chemicals market is segmented into material type, roofing type, construction type, application, and region. On the basis of material type, the market is classified into acrylic, asphalt, elastomer, epoxy resin, styrene, and others. On the basis of the roofing type, the market is divided into membrane roofing, elastomeric roofing, bituminous roofing, metal roofing, plastic (PVC) roofing, and others. On the basis of the construction type, the market is bifurcated into new construction and re-roofing. On the basis of the application, the market is categorized into residential, and non-residential. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

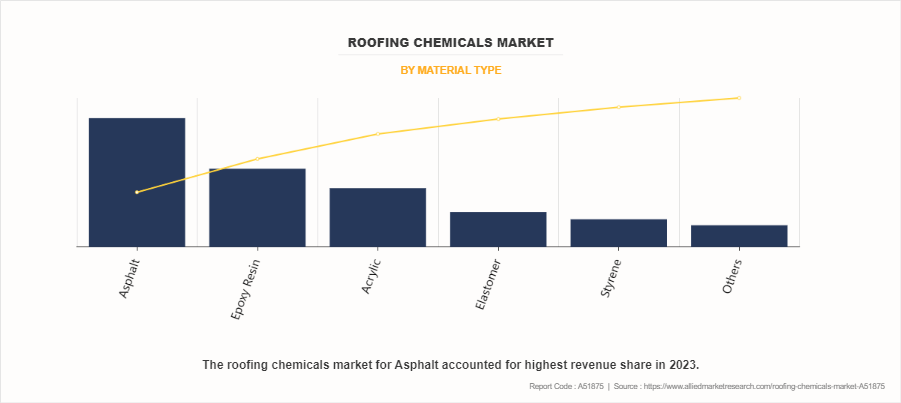

On the basis of material type, the asphalt segment dominated the roofing chemicals market accounting for more than one fourth of the market share. Asphalt modifiers such as styrene-butadiene-styrene (SBS) and styrene-butadiene rubber (SBR) are commonly added to enhance the flexibility and elasticity of asphalt. This modification improves the material's ability to withstand temperature fluctuations without cracking or becoming brittle, thus extending the lifespan of the roofing system.

On the basis of roofing type, the bituminous roofing segment dominated the roofing chemicals market accounting for more than one third of the market share growing with the CAGR of 4.8% during the forecast period. Fibers such as fiberglass and polyester are commonly added to bituminous roofing materials to provide reinforcement and strength. Fibers help prevent cracking, improve dimensional stability, and enhance tear resistance, especially in areas prone to high winds and seismic activity.

On the basis of construction type, the new construction segment dominated the roofing chemicals market accounting for more than half of the market share. Adhesives are used to bond roofing materials together, including shingles, membranes, and insulation boards. Common types of roofing adhesives include asphalt-based adhesives, solvent-based adhesives, and water-based adhesives. Asphalt-based adhesives offer strong bonding properties and are commonly used in built-up roofing systems.

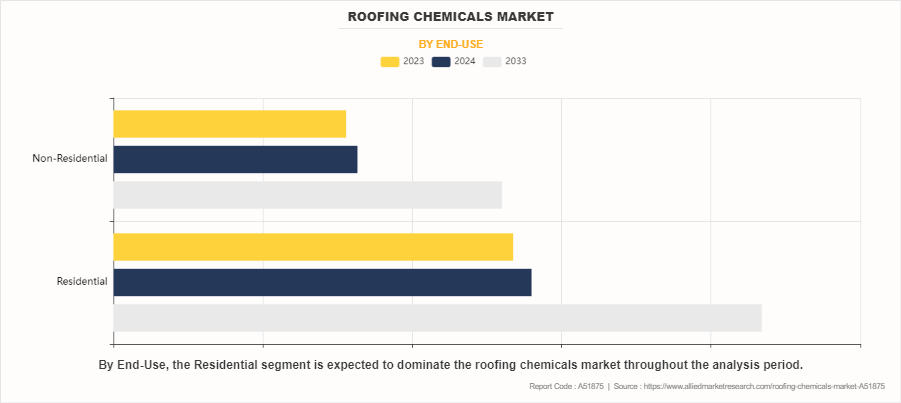

On the basis of end-use, the residential segment dominated the roofing chemicals market accounting for more than half of the market share growing with the CAGR of5.0% during the forecast period. Roofing chemicals are also used for repairing and reinforcing roofing materials. Adhesives are commonly employed to bond roofing membranes, shingles, and tiles together, providing added strength and stability to the roof structure. These adhesives are designed to withstand the rigors of the environment, including exposure to UV rays, temperature fluctuations, and high winds.

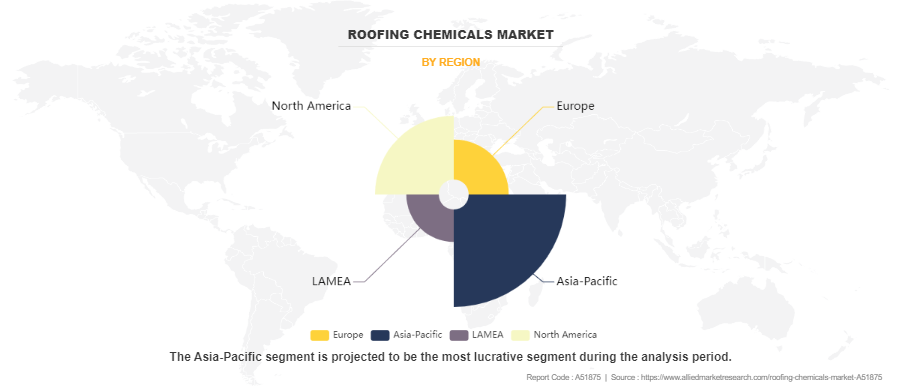

Region-wise, Asia-Pacific dominated the roofing chemicals, growing with a CAGR of 5.5% during the forecast period. Roofing chemicals play a crucial role in ensuring the durability, resilience, and longevity of roofs, particularly in the challenging climatic conditions often found in the Asia-Pacific. In India, roofing chemicals are widely used to address the challenges posed by the country's diverse climatic conditions. With regions experiencing both extreme heat and heavy monsoon rains, waterproofing chemicals are essential to protect buildings from water damage. Bitumen coatings and polymer-modified membranes are commonly applied to roofs to create a waterproof barrier.

Competitive Analysis

The major players operating in the roofing chemicals market include BASF SE, Dow, SIKA CORPORATION, GAF, Inc, Owens Corning, Johns Manville, Saint-Gobain, DuPont, Akzo Nobel N.V., and PPG Industries. In November 2021, Saint-Gobain announced significant investments to enhance its roofing shingle production capacity. Approximately $100 million was allocated to double production capacity at one of its plants in Southeastern U.S. Additionally, investments totaling $62 million were made to expand production capacity by 13% at facilities in Athens, Georgia, and Chowchilla, California.

Recent Key Developments in the Roofing Chemicals Market

- The U.S. Department of Labor Bureau of Labor Statistics predicts that by 2023, there is around 5,920,300 roofers in the U.S. This represents a 5%-6% increase in the next five years. Over 100,000 roofing companies in the U.S., which an increase of 1.6% from 2022. Roofing chemicals are gaining popularity in the U.S. due to superior protection against UV radiation, moisture, mold, and corrosion, which can extend the lifespan of roofs.

- As per the VinylRoofs, in September 2022, Poly Vinyl Chloride (PVC) roofing reflects 80% of sunlight and helps keep cities cooler. Roofs make up to 35% of the urban fabric, so implementing sustainable PVC roofs can rapidly change cities. Roofs are replaced every 15-20 years, on average a replacement rate of 5-7% per year.

Parent Market Overview

- The roofing market is classified on the basis of roofing material, roofing type, application, and region. By roofing material, the market is divided into bituminous roofing, metal roofing, tile roofing, and others. By application, the market is classified into residential, commercial, and industrial. By roofing type, the roofing market is bifurcated into flat roof, and slope roof.

- Major players in this roofing market focus on designing efficient roofing systems to ensure long-term performance even in the harshest weather conditions. Technological innovations such as green roofing, eco-friendly roofing materials, and drones for roof inspections have increased the demand for roofing products.

- The key players profiled in the roofing market report include 3M Company, Atlas Roofing Corporation, BASF SE, Johns Manville, Duro-Last, Inc., E. I. Du Pont De Nemours, Inc., Owens Corning, Sika AG, Standard Industries Inc., and The Dow Chemical Company.

Historic Trends of the Roofing Chemicals Market

- In the 1820s, the use of asphalt as a roofing material began to gain popularity in the U.S., marking a significant milestone in the history of roofing. Asphalt, derived from natural deposits or refined from petroleum, offered several advantages over traditional roofing materials of the time, such as thatch, wood, and clay tiles.

- In the 1930s, the invention of modified bitumen roofing membranes marked a significant advancement in the roofing industry. These membranes revolutionized bituminous roofing systems by incorporating modifiers such as plastic or rubber, enhancing their performance and durability.

- In the 1970s, polyurethane foam roofing systems experienced a surge in popularity due to their unique combination of lightweight construction, excellent insulation properties, and ease of application. These systems became particularly favored for commercial and industrial roofing applications.

- In the 2000s, advancements in polymer chemistry revolutionized the roofing industry with the development of innovative materials such as thermoplastic polyolefin (TPO) and polyvinyl chloride (PVC) membranes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the roofing chemicals market analysis from 2023 to 2033 to identify the prevailing roofing chemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the roofing chemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global roofing chemicals market trends, key players, market segments, application areas, and market growth strategies.

Roofing Chemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 69.4 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Material Type |

|

| By Roofing Type |

|

| By Construction Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | BASF SE, Sika Corporation, Akzo Nobel N.V., Owens Corning, PPG Industries Inc, Saint-Gobain, Dow, Johns Manville, DUPONT, GAF, Inc |

Analyst Review

According to the opinions of various CXOs of leading companies, the global roofing chemicals market was dominated by the asphalt material type.

Repair and renovation activities drive the growth of the roofing chemicals market. Aging buildings require regular maintenance and repair to address wear and tear, structural deterioration, and weather-related damage to roofing systems. Roofing chemicals play a vital role in these maintenance activities by sealing cracks and joints, reinforcing weak spots, and protecting against water infiltration, which can lead to costly leaks and structural damage if left untreated. Renovation projects aimed at upgrading or modernizing existing buildings often involve the refurbishment or replacement of roofing materials to improve performance, enhance energy efficiency, or comply with building codes and regulations. Roofing chemicals are essential components in these renovation efforts, providing solutions for waterproofing, insulation, and weatherproofing to extend the lifespan of roofs and enhance their functionality.

In August 2022, Owens Corning, a leading American company specializing in insulation, roofing, fiberglass composites, and related products, finalized its acquisition of Natural Polymers, LLC. Natural Polymers, headquartered in Cortland, Illinois, is known for manufacturing spray polyurethane foam insulation primarily used in building and construction projects.

Volatility in raw material prices is expected to hinder the market expansion during the forecast period. Petroleum-based chemicals and polymers are key ingredients in many roofing chemical formulations, including coatings, sealants, adhesives, and membranes. Changes in the prices of crude oil and other petrochemical feedstock directly influence the cost of manufacturing roofing chemicals. Sudden spike or decline in raw material prices can disrupt supply chains, increase procurement costs, and erode profit margins, especially for manufacturers with limited pricing flexibility or long-term supply contracts.

The global roofing chemicals market was valued at $42.3 billion in 2023 and is projected to reach $69.4 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

The major players operating in the roofing chemicals market include BASF SE, Dow, SIKA CORPORATION, GAF, Inc, Owens Corning, Johns Manville, Saint-Gobain, DuPont, Akzo Nobel N.V., and PPG Industries.

The roofing chemicals market is segmented into material type, roofing type, construction type, application, and region. On the basis of material type, the market is classified into acrylic, asphalt, elastomer, epoxy resin, styrene, and others. On the basis of the roofing type, the market is divided into membrane roofing, elastomeric roofing, bituminous roofing, metal roofing, plastic (PVC) roofing, and others. On the basis of the construction type, the market is bifurcated into new construction and re-roofing. On the basis of the application, the market is categorized into residential, and non-residential. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Environmental concerns are the main restraint of roofing chemicals market.

Asia-Pacific is the largest region for roofing chemicals market.

Asphalt is the leading material type of roofing chemicals market.

An increase in emphasis on green building practices are the upcoming trends of roofing chemicals market in the world.

Loading Table Of Content...

Loading Research Methodology...