Royal Jelly Market Research, 2031

The global royal jelly market size was valued at $1.4 billion in 2021, and is projected to reach $2.1 billion by 2031, growing at a CAGR of 3.9% from 2022 to 2031.

Royal jelly is a white, homogeneous paste-like material made up mostly of water, protein, lipids, and essential minerals. It is secreted from the hypopharyngeal glands inside the heads of worker bees. The worker bees feed the queen larvae, and the royal jelly is different from worker brood food as it has more mandibular gland secretions and greater sugar content of 34% with a distinct sugar spectrum. Protein concentration ranges between 9 and 18%, with major royal jelly proteins (MRJPs) accounting for 80 percent of the total, and the proteins are water-soluble. Royal jelly is high in free amino acids, such as glycine, lysine, and glutamic acid. Royal jelly contains lipids such as fatty acids, beeswax, phenols, corticosteroids, and phospholipids.

Consumers are looking for nutritional products to maintain a healthy lifestyle as the increase in the level of pollution, and unhealthy eating habits in consumers have become more prevalent. The nutritious value of royal jelly is piquing consumers' curiosity. Consumers are becoming more knowledgeable about royal jelly and its applications. Gamma globulins, which are crucial amino acids in the immune response, are found in royal jelly. The amino acid also includes a small amount of asparagine, which aids in tissue development. The lipids in royal jelly contain 10-hydroxy-2-decanoic acid (10-HDA), which aids in development, the hormone system, and the immunological system. The popularity of royal jelly among customers is driving up demand for the product. In previous decades, the predominant application of royal jelly in North America and Europe was in cosmetics. Currently, with the increase in popularity of royal jelly, the primary usage of royal jelly has been increasing in the nutritional supplement industry which is expected to increase the royal jelly market size.

The food and beverage and cosmetic sector are among the most competitive, and market competitors must create innovations to capture the attention of consumers and improve sales. Market participants are creating unique food and drinks infused with the nutritional advantages of royal jelly to sustain brand sales and keep customers interested in the brand. For instance, Sugi Bee Garden has introduced a special drink named Royal Jelly Drink Gold, infused with pure royal jelly. The nutritional value provided by royal jelly goods is one of the primary elements pushing people to purchase royal jelly products. The inclusion of shakes and shakes blended with royal jelly would persuade fitness enthusiast consumers to choose the items. Furthermore, the widespread use of royal jelly in face masks, emollients, and other products might be a game changer because royal jelly is particularly useful for healing skin problems and is projected to present customers with a unique experience. As a consequence, the development of new product types is expected to drive the royal jelly market growth.

The growing demand for low-cost royal jelly, increase in trade restrictions, and intense rivalry is hurting the growth of the royal jelly market, resulting in deterioration of product quality and increasing the sale of fake royal jelly in the market. Small scale business owners enter the market, and due to high fluctuation in the prices, they use low-quality royal jelly to make a good profit margin for themselves. On the other hand, the reputed brand's products cost a fortune, and consumers are keen to look for products that are low in cost. The rising demand for products from a reputed brand at a low cost and the supply gap of royal jelly in the market give rise to the sale of counterfeit royal jelly in the market. For instance, the sale of fake Australian royal jelly is prominent in China. The high availability of counterfeit royal jelly is harming the royal jelly market demand.

During the period of COVID-19, the unavailability of labor was a major cause of the decline of the bee population. Bee colonies require daily surveillance, as the workers take care of the bee, and they are responsible for collecting the royal jelly from the hives. The unavailability of daily surveillance of the bee hives resulted in the high mortality rates of bees in different bee colonies from around the globe. The lower production of royal jelly in the market forced the small manufacturers to mix milk, honey, and other ingredients with royal jelly to increase the volume of the product, and cater to the market demand. The availability of adulterated royal jelly in the market was an additional blockhead in the growth of the royal jelly market.

Furthermore, COVID-19 has had a detrimental influence on the larger economy of the affected nations, hurting economic development, the efficient operation of financial markets, foreign currency values, and interest rates. Changes in customer buying behavior diminished demand for the royal jelly products, lowering sales and profitability thus harming the business. Customers' insolvency, leading to additional provisions for credit losses, lower consumer demand, including transaction delays or cancellations, and counterparty failures all had a detrimental influence on their business.

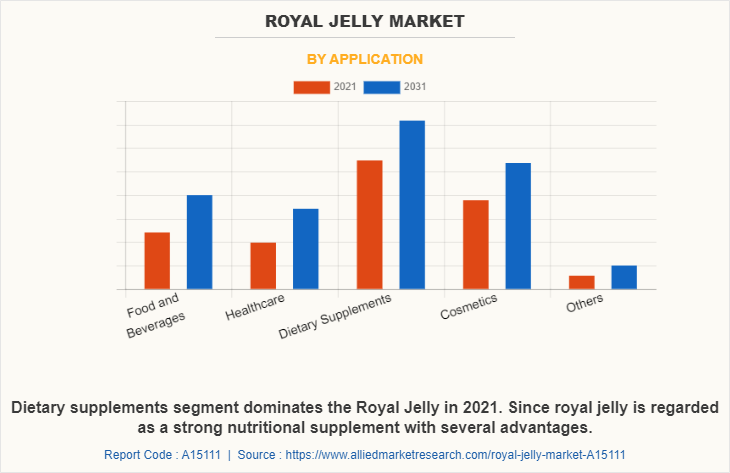

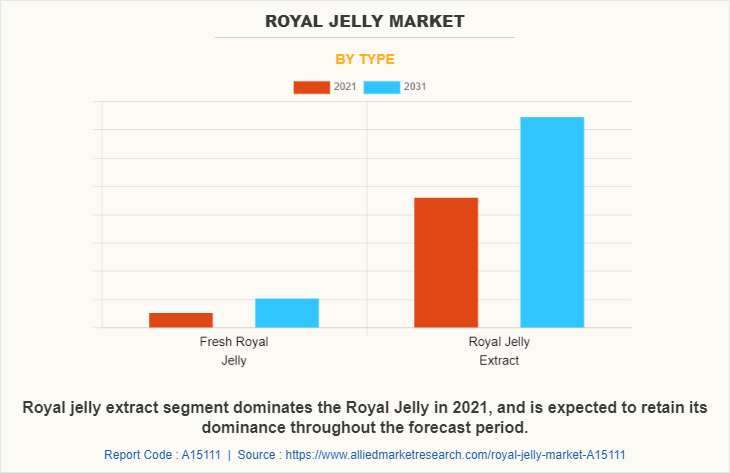

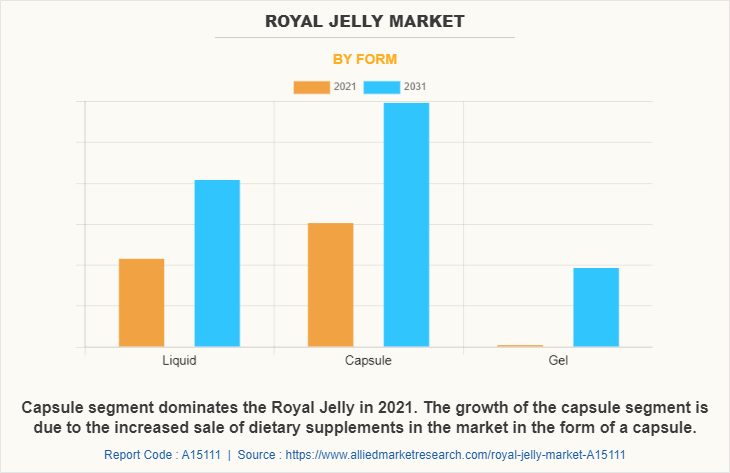

The royal jelly market is segmented into application, type, form, and region. Depending on the application, the market is classified into food & beverages, healthcare, dietary supplements, cosmetics, and others. Depending on type, it is segregated into fresh royal jelly and royal jelly extract. By form, it is categorized into liquid, capsule, and gel. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Belgium, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, and rest of Asia-Pacific), and LAMEA (Middle East, Africa, and Latin America).

On the basis of application, the dietary supplement segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. The dietary supplement segment was growing, with a CAGR of 2.6%. The growth of this segment is due to the higher availability of royal jelly dietary supplements in the market and the growing consumption by global consumers to maintain their health and fulfill their daily vitamin and mineral requirement. Since royal jelly is regarded as a strong nutritional supplement with several advantages, global customers are interested in acquiring the product and incorporating it into their diet. Royal jelly is ingested raw in unaltered liquid form and in capsules & soft gels, where the royal jelly is turned into a powder by lyophilization. The overall products of royal jelly fall under the category of dietary supplements as royal jelly is mostly used in the nutraceutical sector.

On the basis of type, the royal jelly extract segment gained a major share in the global market in 2021 and is expected to sustain its market share during the royal jelly market forecast period. The growth of this segment is due to the increased usage of freeze-dried royal jelly in different sectors as it is easy to handle and has a lower chance of deterioration than fresh royal jelly. Dietary supplements are not regulated at all and do not require a prescription. Together with the royal jelly product's demand and widespread availability, offers a favorable environment for royal jelly extract sales growth. The royal jelly extract is mostly added in dietary capsules and soft gels, accounting for the vast bulk of royal jelly extract sales in the dietary supplement industry. The rising popularity of royal jelly's advantages is encouraging food makers to include royal jelly extract in their products.

According to royal jelly market analysis, on the basis of form, the capsule segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. The growth of the capsule segment is due to the increased sale of dietary supplements in the market in the form of a capsule. The royal jelly capsule is widely accessible on the market, and producers are seeking innovative product developments to entice consumers and enhance their awareness of the product. To boost the medical efficacy of the product, the makers are combining royal jelly with additional vitamins, minerals, and organic herbs.

Region-wise, Asia-Pacific dominated the market in 2021, with a CAGR of 3.0%, as a higher percentage of the population prefers to use royal jelly products in the Asia-Pacific countries due to its health benefits and the product has a higher availability in the Asia-Pacific region. The major use of royal jelly in Asia-Pacific is in the nutraceutical sector and the least is in the cosmetics sector. Japan in the Asia-Pacific region has the highest share in nutraceuticals and the royal jelly dietary supplement is one of the most preferred products. The surge in the prevalence of obesity and diabetes in the Asia-Pacific population is posing a threat to the growth of illness which provides an opportunity for the growth of royal jelly supplements. The industry is witnessing an increase in the demand for cosmetics infused with royal jelly as customers are getting influenced by western culture and the usage of royal jelly cosmetics.

The players operating in the global royal jelly market have adopted various developmental strategies to expand their royal jelly market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Durham's Bee Farm, Glory Bee, Jiangshan Bee Enterprise, Nestlé S.A., Now Health Group, Inc., Nu-Health Products, Shamee Bee Farm Source Naturals, Inc, Y.S. Organic Bee Farms, and Yamada Bee Farm, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the royal jelly market analysis from 2021 to 2031 to identify the prevailing royal jelly market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the royal jelly market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the royal jelly industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global royal jelly market trends, key players, market segments, application areas, and market growth strategies.

Royal Jelly Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | Y.S. Organic Bee Farms, Yamada Bee Farm, Inc., Puritan’s Pride, Swanson Vitamins, Nu-Health Products, Durham's Bee Farm, Source Naturals, Inc., Thompson Health, Solgar Inc., NOW Health Group, Inc. |

Analyst Review

According to CXOs, the declining population of bees and decreasing bee colonies are the main factors that are decreasing the production of royal jelly and making way for the availability and sales of adulterated royal jelly in the market. The higher the availability of an adulterated product, the lower the growth rate of the global market. On the other hand, the introduction of new technologies in the market to harvest and store royal jelly at a lower cost will help the manufacturers to reduce the overall price of the royal jelly extract in the market.

Further, the CXOs stated, that the growth of royal jelly as a dietary supplement in the Western hemisphere and the increasing use of royal jelly in the manufacturing of cosmetics in the Eastern Hemisphere will provide new doorways for the expansion of market growth for royal jelly. With the increase in digital promotions and campaigns, the manufacturers will be able to convey the correct message to their consumers which will reduce the misconception about the product and help to build trust between the consumers and the companies in the future.

The global royal jelly market size was valued at $1.4 billion in 2021, and is projected to reach $2.1 billion by 2031

The global Royal Jelly market is projected to grow at a compound annual growth rate of 3.9% from 2022 to 2031 $2.1 billion by 2031

The key players profiled in this report include Durham's Bee Farm, Glory Bee, Jiangshan Bee Enterprise, Nestlé S.A., Now Health Group, Inc., Nu-Health Products, Shamee Bee Farm Source Naturals, Inc, Y.S. Organic Bee Farms, and Yamada Bee Farm, Inc.

Region-wise, Asia-Pacific dominated the market in 2021

Increase in the standard of living. Growth of the online retail platform.

Loading Table Of Content...