Rubber Flooring Market Research, 2032

The Global Rubber Flooring Market size was valued at $1.1 billion in 2023, and is projected to reach $1.6 billion by 2032, growing at a CAGR of 4.3% from 2024 to 2032.

Market Introduction and Definition

Rubber flooring is a flooring material made from natural or synthetic rubber, recognized for its durability, resilience, and versatility, making it suitable for various applications in both commercial and residential environments. Rubber flooring is available in various forms, including tiles, sheets, and mats, and it is easier to install using different methods, such as adhesive bonding or interlocking systems.

Rubber's durability and its ability to absorb shock is highly valued in places such as gyms and playgrounds to improve safety. Rubber flooring offers a comfortable surface with its cushioned texture, reducing fatigue for individuals who stand or walk for longer period. It demands minimal maintenance, simply requiring regular cleaning with gentle detergents.

Key Takeaways

The rubber floorings market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major rubber flooring industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rubber flooring market growth, driven by several factors. Rise in awareness about the benefits of rubber flooring, such as its durability, safety features, and ease of maintenance, is fueling demand for rubber flooring across commercial, residential, and industrial sectors. Furthermore, increase in focus on sustainability is driving manufacturers to create environmentally friendly rubber flooring options, which is leading to a broader range of market prospects. However, the industry faces certain restraints and challenges, including fluctuation in raw material prices and availability of alternatives, such as vinyl and laminate flooring. Moreover, economic uncertainties such as global trade tensions, political instability, fluctuation in commodity prices, and currency fluctuation pose challenges to market growth. The demands for construction and renovation projects are impacted by changes in economic conditions, thereby influencing consumer spending. In addition, the growth of the rubber flooring market forecast is expected to be restricted due to rise in compliance costs caused by strict regulations pertaining to environmental standards and chemical usage. Nevertheless, surge in trend toward wellness-focused environments and integration of technology in flooring solutions present promising rubber flooring market opportunity for innovation and market expansion. The rubber flooring market is expected to witness steady growth and evolution in the coming years as industries continue to prioritize safety, comfort, and sustainability.

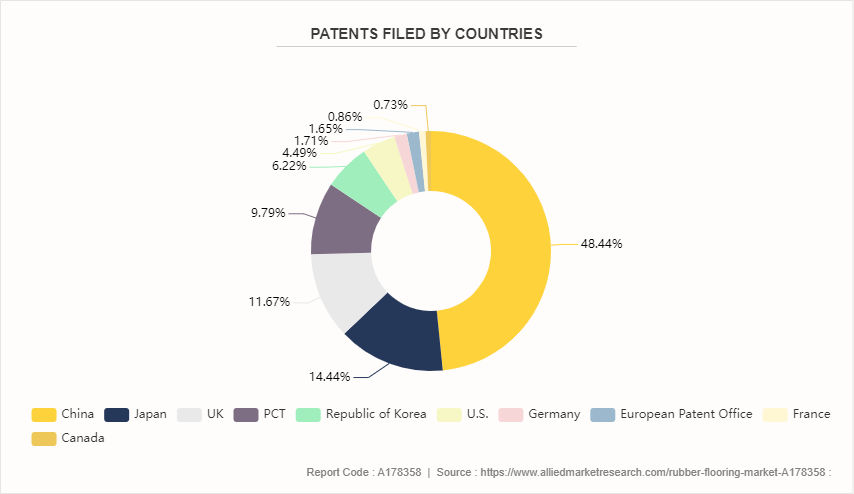

Patent Analysis of Global Rubber Flooring Market Country Wise

The given data highlights the global distribution of patents related to rubber flooring, showcasing China's dominant position with 48.45% of the patents. Japan follows with 14.44%, indicating significant activity in the region. The UK holds 11.67%, reflecting its contribution to innovation in rubber flooring. The Patent Cooperation Treaty (PCT) applications account for 9.79%, underscoring the international interest in rubber flooring technology. The Republic of Korea, with 6.22%, also demonstrates a notable presence in the market. The U.S., historically a leader in patent activity, represents 4.49% of the patents, showing moderate involvement. Germany (1.71%) , the European Patent Office (1.65%) , France (0.86%) , and Canada (0.73%) have smaller shares, indicating less but still relevant contributions to the field. This distribution suggests a diverse landscape of innovation with a strong emphasis on Asian and European regions, particularly China and Japan, leading advancements in rubber flooring technology. The data underscores the competitive and geographically varied nature of the rubber flooring patent landscape.

Market Segmentation

The rubber flooring market is segmented into type, distribution channel, application, and region.

By type, the market is divided into natural rubber and synthetic rubber. As per distribution channel, it is segregated into direct sales (manufacturer to end user) , distributors and wholesalers, retail outlets, and online retail platforms.

By application, the market is classified into commercial (offices, retail spaces, and hospitality) , residential (homes and apartments), and industrial (warehouses and factories).

Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Market Segment Outlook

By type, the synthetic rubber segment held more than half of the highest market share in 2023 due to its versatility, durability, and cost-effectiveness. Synthetic rubber, created using chemical methods, provides uniform quality, improves longevity, and protects against wear & tear, rendering it suitable for a wide range of applications such as high-traffic zones in commercial, industrial, and residential environments.

By distribution channel, the distributors and wholesalers segment held the highest market share in 2023, accounting for nearly two-fifths of the rubber flooring market share. It provides essential services such as bulk purchasing, inventory management, and logistics, catering to contractors, retailers, and end users. In addition, distributors often offer value-added services such as product training and technical support, enhancing customer satisfaction and loyalty.

Regional/Country Market Outlook

The rubber flooring market in North America is set to experience consistent growth due to various factors. The stability of the construction industry in the region, along with rise in investments in commercial and residential infrastructure projects, plays a significant role in driving the expansion of the market. Moreover, Moreover, rise in awareness of sustainability and safety standards is driving demand for eco-friendly and durable flooring solutions, such as rubber. Furthermore, surge in popularity of rubber flooring in sectors such as healthcare, education, and sports facilities boost the market growth. In addition, technological advancements, including integration of smart features and antimicrobial properties, enhance the attractiveness of rubber flooring products. However, challenges such as fluctuation in raw material costs and regulatory constraints hinder market growth. Nonetheless, North America offers significant opportunities for manufacturers and suppliers in the rubber flooring industry.

In May 2024, All India Rubber Industries Association demands for higher import duty on rubber-finished products to promote the interests of local producers and farmers.

In August 2023, rise in disparity between the production and consumption of natural rubber (NR) in India, coupled with low global market prices, is driving imports to reach unprecedented levels. NR consumption has been growing at a faster pace than production in the last few years and the country has resorted to more imports to bridge the gap. While the NR production was 839, 000-ton, consumption touched 13, 50, 000 ton in 2022-23. In the past year, there was a significant increase in output, surpassing 800, 000 tons after a considerable period of time. This achievement was primarily attributed to the improved yield from the northeastern states. Consequently, the import figures experienced a decline of 3%, reaching 530, 000 tons.

Competitive Landscape

Major players operating in the rubber flooring market include Roppe Corporation, Nora Systems, Gerflor Group, ARTO, KRAIBURG Relastec GmbH & Co. KG, Dinoflex, Havwoods International, Mats Inc., Forbo Flooring System, and Tarkett Group. Other players in the rubber flooring market includes American Biltrite Inc., Mondo S.p.A., Polyflor Ltd., and others.

Recent Key Strategies and Developments

In January 2022, Gerflor Group, a global producer of resilient flooring for residential, commercial, transport, and sport environments, announced the production of rigid core products. Gerflor is in the process of finalizing arrangements for a site in the southeastern region of the U.S. Moreover, it is expected to commence the establishment of an operational facility that possesses the capability to manufacture exclusive rigid wall and flooring solutions.

In February 2023, Wearwell launched a surface style to their 24/Seven LockSafe ergonomic flooring system. This customizable ergonomic flooring features patented interlocks that stay secure in use, solving the decades old problem of separated tiles and imminent trip hazards. The 24/Seven LockSafe system is made up of large 3' x 3' rubber tiles and requires no tools for assembly, reducing installation and configuration time and improving efficiency. The interlocks of 24/Seven LockSafe ensure reliable connections in every direction, reducing concerns of tile separation under high foot traffic conditions

In October 2023, the Indian Department for Promotion of Industry and Internal Trade (DPIIT) notified the World Trade Organization (WTO) of the Quality Control Order (QCO) for rubber flooring materials. This rule aims to deter fraudulent activities, safeguard consumers, protect human health and environmental safety, and maintain quality standards.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rubber flooring market analysis from 2024 to 2032 to identify the prevailing rubber flooring market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the rubber flooring market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global rubber flooring market trends, key players, market segments, application areas, and market growth strategies.

Rubber Flooring Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.6 Billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | KRAIBURG Relastec GmbH and Co. KG, Tarkett Group, Gerflor Group, Mats Inc., Dinoflex, Nora Systems, Havwoods International, Roppe Corporation, American Biltrite Inc., Forbo Flooring System |

Increasing demand for eco-friendly and sustainable products, growth in commercial and residential sectors and integration of smart technology into flooring, such as underfloor heating systems and sensor-embedded flooring for health are the upcoming trends of Rubber Flooring Market in the globe

Commercial segment has the leading application of Rubber Flooring Market

North America is the largest regional market for Rubber Flooring.

The rubber flooring market was valued at $1.1 billion in 2023

Roppe Corporation, Nora Systems, Gerflor Group, ARTO, American Biltrite Inc. Relastec GmbH & Co. KG, Dinoflex, Havwoods International, Mats Inc., Forbo Flooring System, and Tarkett Group

Loading Table Of Content...