SaaS Escrow Services Market Research, 2033

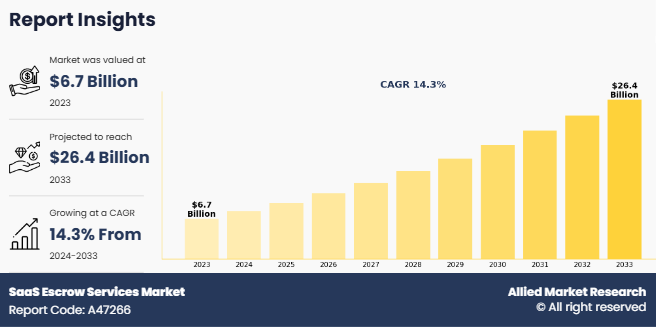

The global SaaS escrow services market size was valued at $6.7 billion in 2023, and is projected to reach $26.4 billion by 2033, growing at a CAGR of 14.3% from 2024 to 2033.SaaS escrow secures access to a running instance of a third-party cloud application that is critical to ensuring a company's business continuity. As such, it helps avoid both temporary and long-term disruption to the end-users regular business operations and consequently, prevents financial loss regardless of their developers or suppliers operational status. In other words, SaaS escrow is a specialized software protection solution designed to protect cloud-native software applications from internal and external threats, critical errors, or incorrect configurations that can adversely affect business functions.

Key Takeaways

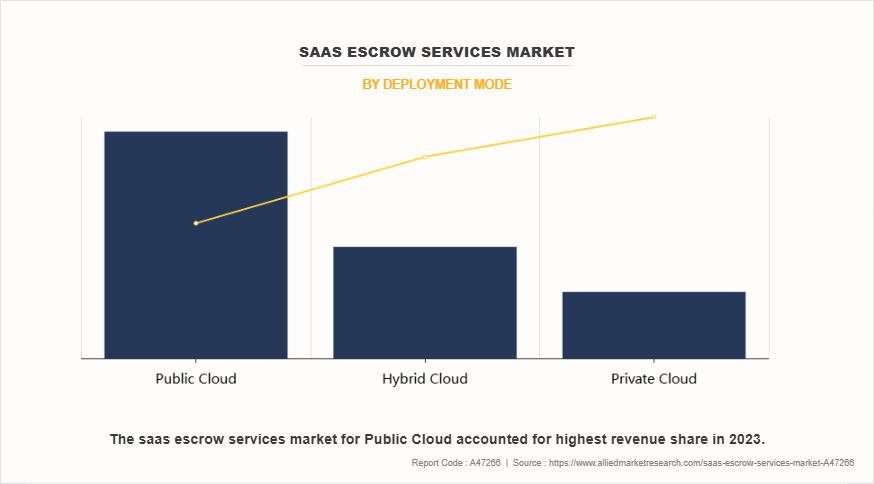

By deployment mode, the public cloud segment held the largest share in the SaaS escrow services market in 2023.

By enterprise size, the large enterprise segment held the largest share in the SaaS escrow services industry in 2023.

By industry vertical, the energy and utility segment is expected to show the fastest market growth during the forecast period.

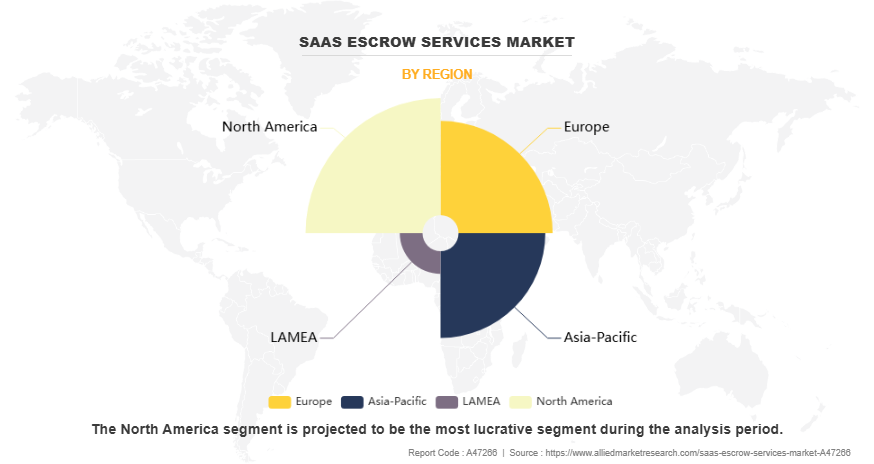

Region-wise, North America held the largest SaaS escrow services market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Although SaaS offers its advantages such as cost reductions, ease of accessibility, and effortless scalability, many companies are not carefully planning the adoption of these SaaS applications. According to SaaS escrow services market insights, establishing a SaaS escrow agreement helps, a company tprotect themselves from a potential sudden loss of access to critical SaaS services, whether temporary or long-term. It also secures direct access to a running copy of the software and their own customer data in case release conditions are met.

On the contrary, it is undeniable that cloud services meet the current trend, mostly due to their cost advantages. However, they may entail specific risks. SaaS escrow enables to take full advantage of modern cloud services while potential risks of failure are minimized at the same time. hese benefits are expected to drive attractive opportunities for growth across the SaaS escrow services market size during the forecast period.. Furthermore, as software shifts away from the traditional on-site licensing model, SaaS.

Segment Review

The global SaaS escrow services market is segmented into deployment mode, enterprise size, industry vertical, and region. The report provides information on various deployment modes including public cloud, private cloud, and hybrid cloud. Furthermore, the major enterprise sizes covered in the study include large enterprises and small & medium-sized enterprises. Moreover, it outlines the details of the industry verticals, such as BFSI, manufacturing, IT & telecom, retail & e-commerce, energy & utility, healthcare, media & entertainment, and others. In addition, it analyzes the current market trends across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

On the basis of deployment mode, the global SaaS escrow services market share was dominated by the public cloud segment in 2023 and is expected to maintain its dominance in the upcoming years. This is attributed to the widespread adoption of public cloud infrastructure, which offers cost-effective, scalable, and flexible solutions for businesses. However, the private cloud segment is expected to witness the highest growth due to higher security and easier maintenance.

Region-wise, North America dominated the market share in 2023 for the SaaS escrow services market owing to the increase in usage of SaaS escrow services in BFSI, retail, healthcare, and other sectors to improve businesses and the customer experience which is anticipated to provide lucrative growth opportunities for the SaaS escrow services market in North America. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of advanced technology and higher adoption of cloud-based solution and services that propel the growth of the market in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the SaaS Escrow Services Market include Ardas Group, Escrow London, EscrowTech International, Inc., Harbinger Escrow, NCC Group, Iron Mountain, Escrow4all, Praxis Technology Escrow, SES-Escrow, Innovasafe, Inc., Vaultinum, Escrow Alliance, Escrow Global, National Software Escrow, Inc., RegistraSoft, Lincoln-Parry SoftEscrow, Inc., APP - Agence Pour La Protection Des Programmes, Codekeeper, Escrow Europe and Legal Escrow & Arbitration Services Limited.. These players have adopted various strategies to increase their market penetration and strengthen their position in the SaaS escrow services industry.

Recent News in the SaaS Escrow Services Industry

In October 2022, IGS and Vaultinum signed a partnership agreement for more robust technology "Due Diligence". This tool analyses every line of a software's source code to identify its strengths and vulnerabilities in 3 main areas including cyber security, intellectual property, and scalability.

In May 2021, NCC group acquired Iron Mountain Corporation's escrow segment. This acquisition further helps the company to grow its escrow segment.

In June 2021, Global software resilience and cyber security expert NCC Group has acquired Iron Mountain Escrow Intellectual Property Management (IPM) business. Together, these two businesses will offer a rich, complementary set of services to customers globally, including industry-leading software verification solutions and, excitingly, a cloud resilience proposition Escrow-as-a-Service (EaaS).

Top Impacting Factors

Driver

Increase in adoption of SaaS escrow services across enterprises

The last few decades have shown a tremendous rise in entrepreneurs with their small and medium organizations. Upsurge in demand for cloud-based services due to the advantages offered such as cost cutting, and business flexibility proves to be an advantage to the startup businesses. The need for SaaS-based services is rising due to the growth of these enterprises including SMEs. Most of the IT enterprises need advanced technology of SaaS escrow services to flourish their businesses and leave their footprints in various geographies.

The SaaS escrow services provide a range of functional advantages and actively contribute to the market's expansion. The functional benefits provided by the cloud include eliminating the need for upgrades and installations, optimizing the use of IT staff, and enabling the efficient management of distributed resources.. Elimination of regular upgrades and installation proves beneficial to the user as the responsibility of upgrade, patch, and add on installations remains with the service provider. Use of SaaS escrow services reduces the workload of the staff in maintaining infrastructure and helps them to work in other projects making more operative use of IT staff.

Moreover, the resources are evenly distributed and can be used by every individual in the cloud. The use of SaaS Escrow services provides recovery and backup solutions, which improve the agility of the business. For instance, in July 2021, Escrow service provider Castler launched the country's first white-label digital escrow solution Castler SmartEscro to make financial transactions safe and secure. The New Delhi-based startup has partnered with ICICI Bank and certified trusteeship companies to ensure complete safety and transparency for clients. Their solution includes quick opening of digital escrow accounts for transacting parties, along with eKYC.

Restraints

High cost of innovation and budget constraints

Vendors are constantly offering solutions based on the demands of various business sizes. However, end users are progressively migrating toward less expensive alternatives such as unpaid or free decryption tools in the market, which negatively impacts the growth of the global SaaS escrow services market. Furthermore, high maintenance and customization expenses for preventing digital threat are hindering the market.

Moreover, efficient process of SaaS escrow services needs renewal fees, licensing fees, and other fees, which incur additional costs, thus limiting the SaaS escrow services market growth. In addition, lack of internal IT expertise in some industries requires training for end users to maximize the efficiency of various solutions, which adds to the cost of ownership of the systems, thereby restraining the growth of the global market.

Opportunities

Rapid changes in business model software due to geographical expansion of the businesses

Businesses are going through rapid change due to changing demand of customers, strict regulations, and economical changes. To study the changing demands of customers, it is essential for a company to constantly interact with customers, which is possible through implementation of SaaS escrow services. Businesses are now engaged in the enhancement of productivity and different business operations.

In addition, it provides companies with ample growth opportunities to adapt to changing business models and meet evolving market demands. Organizations are expanding their geographical presence through acquisition and partnership. Integration and collaboration of business is possible through implementation of SaaS escrow services, which enable them to centralize their business operations. Synchronization & collaboration of business documents and their rapid sharing is possible by the use of cloud-based services. This trend of geographical expansion is a key factor expected to drive growth across the SaaS escrow services market Forecast period..

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the SaaS escrow services market analysis from 2023 to 2033 to identify the prevailing SaaS escrow services market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the SaaS escrow services market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global SaaS escrow services market trends, key players, market segments, application areas, and market growth strategies.

SaaS Escrow Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 26.4 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 372 |

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | APP - Agence Pour La Protection Des Programmes, SES-Escrow, Legal Escrow & Arbitration Services Limited, Innovasafe, Inc., Escrow Alliance, Praxis Technology Escrow, Iron Mountain, Escrow Europe, Escrow Global, Codekeeper, Harbinger Escrow, Ardas Group, Escrow London, National Software Escrow, Inc., NCC Group, RegistraSoft, Vaultinum, EscrowTech International, Inc., Escrow4all, Lincoln-Parry SoftEscrow, Inc. |

Analyst Review

The SaaS escrow services market is going through enormous transformation and growth. As customer demand and expectations are evolving with rapid pace of digitalization, legacy infrastructures are making it difficult to accommodate these customer needs. This has compelled industries to adopt emerging technological change in their operating environment. The cloud has evolved to be the dominant technology in the race of technological changes. Hence, an increase in adoption of subscription-based products is expected to boost the global market at an exponentially high rate in the coming years.

Next-generation digital businesses are leveraging SaaS capabilities and preparing for a future of integrated solutions. These include vendor selection, migration tactics, process optimization, cloud security, multi-cloud environments, hybrid & digital infrastructures, data center outsourcing strategies, cloud optimization, cloud computing, PaaS, IaaS, SaaS, and others.

Furthermore, extreme agility and accessibility capabilities of a cloud dominate the SaaS escrow services market. Investing in a SaaS escrow vendor who can introduce automated deposits as standard will provide extra benefits. In addition to this, verification testing provided by the SaaS escrow vendor on a regular basis can ensure that the system is deployable and operational, offering added advantages to the business. According to studies, there has been a huge shift in cloud and Software-as-a-service (SaaS) adoption globally, notably with government, large enterprise, and financial institutions. Although SaaS offers its advantages such as cost reductions, ease of accessibility, and effortless scalability, many companies are not carefully planning the adoption of these SaaS applications.

By doing so, they may not have considered the disadvantages that may occur. Insufficient data security is one top concern, with many businesses just assuming their SaaS provider can take care of their security and software resilience needs. Cost effective and easy to deploy SaaS continuity escrow solutions helps them to mitigate against the risks associated with modern service delivery methods and the growing responsibility of cloud service providers. For instance, the New Delhi-based startup Escrow service provider, Castler partnered with ICICI Bank and certified trusteeship companies to ensure complete safety and transparency for clients, with the launch of the country's first white-label digital escrow solution “Castler SmartEscro.” Their solution includes quick opening of digital escrow accounts for transacting parties, along with eKYC

A SaaS escrow service is a legal agreement where a third-party escrow provider securely holds the software's source code, data, or access credentials to ensure business continuity in case the SaaS provider fails to meet its obligations.

The base year is 2023 in the SaaS escrow services market.

The forecast period for the SaaS escrow services market is 2024 to 2033.

The total market value of the SaaS escrow services market was $6.7 billion in 2023.

The market value of the SaaS escrow services market in 2033 will be $26.4 billion.

Loading Table Of Content...

Loading Research Methodology...