The global satellite connectivity market was valued at $11.12 billion in 2021, and is projected to reach $22.12 billion by 2031, growing at a CAGR of 7.3% from 2022 to 2031.

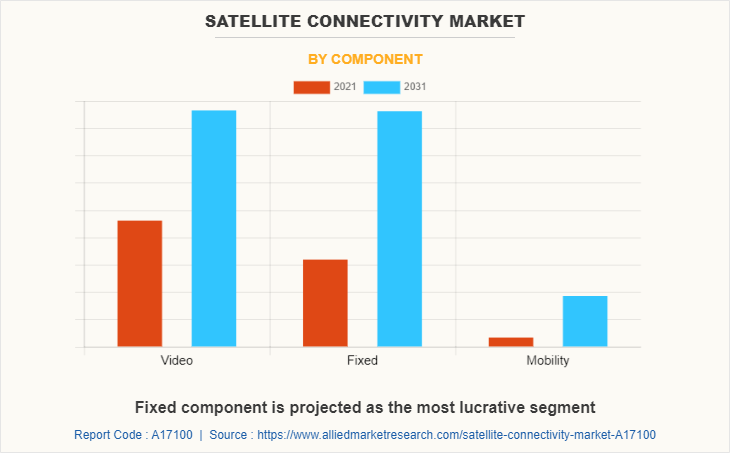

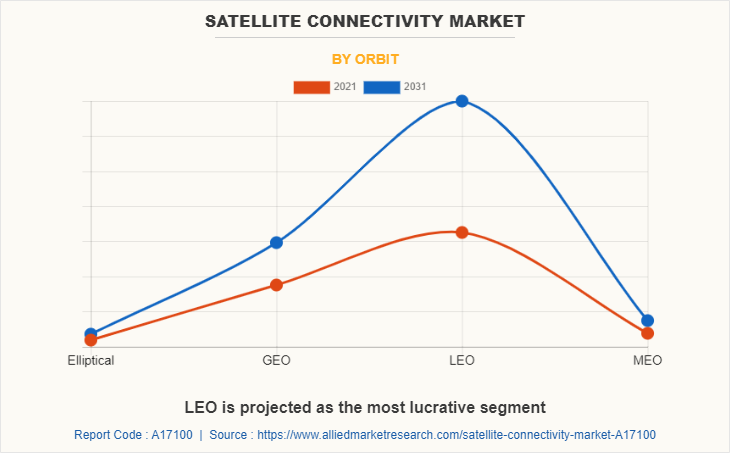

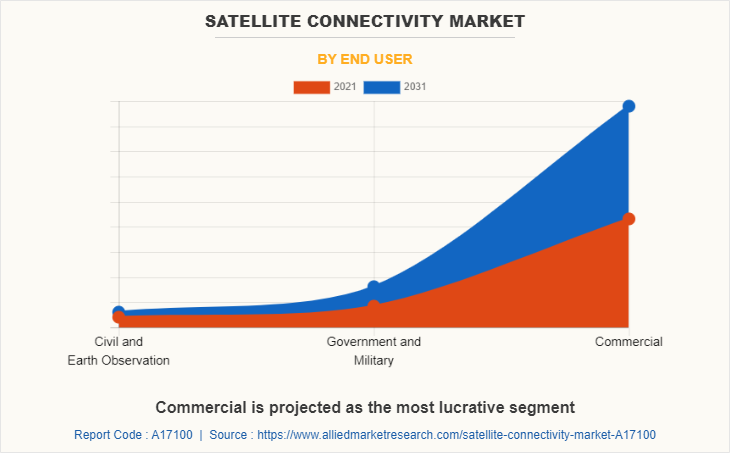

The satellite connectivity market is segmented into Component, Orbit and End User.

Artificial or man-made satellites orbit the earth or other celestial objects for analyzing and predicting the solar system and universe. Moreover, the satellites are utilized for various applications such as television signals, phone calls, positioning technology, and military. Satellite connectivity is achieved through the transmission of radio waves from satellites, and capturing & processing of information from antennas and transponders installed at different locations on earth. Space organizations are increasing satellite launches globally to overcome the maximum distance signal transmission constraint associated with the conventional signal connectivity system. The satellites relay digital and analog signals for transmitting voice, video, and data across several locations globally.

Furthermore, increase in government investment in space exploration, and increase in satellite launches across the globe is expected to drive the satellite connectivity market during the forecast period. In addition, rise in adoption of satellite constellation further support the market growth during the forecast period. Moreover, strict government regulations associated with satellite launches and high initial investment associated with satellite launch services are anticipated to hamper the market growth. Whereas, rising satellite applications, the surge in demand for satellite data, and the growing integration of AI, ML, and cloud computing in the space sector offer lucrative opportunities to market players during the forecast period which support the market expansion. For instance, in April 2021, Northrop Grumman announced the successful docking of its Mission Extension Vehicle 2 to Intelsat 10-02 a commercial satellite. Mission Extension Vehicle 2 is a robot spacecraft that extends the life of satellites.

The satellite connectivity market is segmented on the basis of end-user, orbit, component, and country. The end-user is bifurcated into civil & earth observation, government and military, and commercial. Depending on the orbit, the market is categorized into elliptical, GEO, LEO, and MEO. On the basis of component, it is classified into video, fixed, and mobility. Region wise, the satellite connectivity industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global satellite connectivity market are ASELSAN A.S., General Dynamics Corporation, HONEYWELL INTERNATIONAL INC, Indra, Israel Aerospace Industries Ltd., L3Harris Technologies, Inc, Leonardo S.p.A., Norsat International Inc, Thales, and Viasat Inc. are studied in the report.

Rise in government investment in space exploration activities

Over the last decade, 19 space exploration or planetary missions have been launched by countries such as the U.S., India, China, Russia, and Japan as well as agencies such as the European Space Agency (ESA) and Space Development Agency (SDA). The government budget across the globe is increasing every year. The governments are investing in sponsoring space exploration missions and supporting infrastructure. There were times when a lack of monetary resources restricted the space programs. In the current scenario, the situation has turned due to intense competition in the space industry. In addition, many nations are investing in enhancing their satellite connectivity and facilities to be launch-capable nations and stay ahead in the space race. For instance, the National Aeronautics and Space Administration (NASA) had $19,500 million, China National Space Administration (CNSA) had $11,000 million, and European Space Agency (ESA) had a $6,300 million government budget for the space industry in 2019. Thus, increase in spending & government space investment in such activities drives the growth of the global satellite connectivity market.

Increase in satellite launches across the globe

The use of satellites for telecommunication, earth observation, national security, surveillance, R&D, government communications, space observation, and remote sensing has fueled the satellite industry growth. In addition, the number of satellites that are being launched is increasing every year. CubeSat is a miniature satellite that has been used exclusively in LEO for 15 years, which is further driving the satellite connectivity equipment demand.

This boost in the satellite industry positively influences the launch service market. In addition, as the Satellite Industry Association (SIA) released the 2021 State of the Satellite Industry Report (SSIR), the number of operational satellites on-orbit increased by over 37% as compared to 17% in 2019, with 3,371 satellites. Moreover, in 2020, the overall global satellite industry revenue grew by 1.4% as compared to 2019, and was led by satellite manufacturing revenue and satellite industry revenue. In addition, companies are taking active steps by launching new satellites. For instance, in January 2020, Rocket Lab's NROL-151 light-class electron launcher took off from its privately owned launch site in New Zealand. Thus, increase satellite launches drives the growth of the global satellite connectivity industry.

Stringent government regulations associated with satellite launches

Radio signal transmissions require various regulatory permissions, licenses, and standards to be followed. These regulations vary according to international, regional, and local agencies. Stringent regulations have been introduced by governments to prevent harmful interference of satellite usage. Furthermore, strict policies to protect data associated with satellite imaging for improved national security have been introduced. In addition, other regulations such as satellite landing rights and frequency licensing make it tougher for new players to enter the satellite connectivity industry.

Several environmental regulations hamper the market include International Traffic in Arms Regulations (ITAR), Missile Technology Control Regime (MTCR), UN, and the United Kingdom Space Act. Space agencies and governments across the world are defining regulatory environments to control the development of space sectors. The regulatory environment constrains the growth of the market.

Increase in satellite applications

Increased applications and adoption of artificial intelligence (AI) and the Internet of Things (IoT) have paved the way for intelligent transportation systems (ITS). These systems allow users to track vehicles and allow freight companies to quickly exchange and receive information. Using satellite connectivity for transportation enables seamless and continuous data transmission between vehicles and transportation hubs, connecting global network gaps. Therefore, the use of satellites for connectivity over transportation networks, including logistics, provides the market with lucrative growth opportunities. Furthermore, satellite connectivity provides robust and ubiquitous connections over large geographic areas.

Therefore, satellite connectivity is highly preferred, especially in a variety of applications across all industries, including marine and aviation. Moreover, increase in demand for satellite broadband connections for such mobility-based applications is expected to drive the demand for satellite connectivity services during the forecast period. In the shipping industry, satellite broadband services are in high demand in all segments of the shipping market, including merchant ships, leisure yachts, cruise ships, container ships, fishing vessels, and offshore applications. Satellite connectivity improves operational efficiency across marine ecosystems and provides essential connections to support the operational needs of humanitarian organizations around the world. Thus, increase use of satellite connectivity services in different applications such as maritime, communication, and telematics is expected to offer various opportunities for satellite connectivity market players throughout the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite connectivity market analysis from 2021 to 2031 to identify the prevailing satellite connectivity market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the satellite connectivity market segmentation assists to determine the prevailing market opportunities.

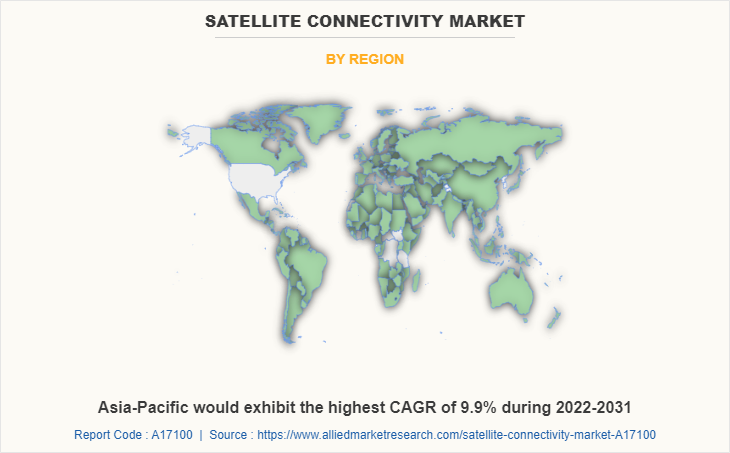

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global satellite connectivity market trends, key players, market segments, application areas, and market growth strategies.

Satellite Connectivity Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Orbit |

|

| By End User |

|

| By Region |

|

| Key Market Players | Honeywell International Inc, ViaSat Inc, Indra, Aselsan AS, Thales Group, Leonardo SpA, L3Harris Technologies Inc, General Dynamics Corporation, Norsat International Inc, Israel Aerospace Industries Ltd |

Analyst Review

The global satellite connectivity market has a promising future for existing market players. Increase in the applications of satellite connectivity services such as mobile network 2G/3G/4G cellular backhauling for urban & rural areas as well as consumer broadband connectivity, enterprise, defense, maritime, and oil & gas, is expected to drive the growth of the market. The major players in the market have developed and launched new satellites and communication software to cater to a wider customer base across various nations globally. For instance, in January 2022, Fleet Space Technologies, an Australian manufacturer, developed the first 3D-printed satellite, which enables custom-made satellites at much lower cost than conventional ones.

Furthermore, increase in satellite launches from various countries such as the U.S., Russia, India, Japan, the UK, and Germany, as a result of growing security concerns is expected to increase the demand from defense sector during the forecast period. Moreover, the incorporation of newly launched technologies such as remote sensor sensing technology and laser technology in medium earth orbit (MEO), and low earth orbit (LEO) is anticipated to provide lucrative growth opportunities for the market.

Furthermore, the satellite connectivity market is projected to witness considerable growth, especially in North America, owing to the presence of sophisticated infrastructure to undertake space programs and the earliest & highest adoption of satellite connectivity across various industries. Commercial and government space organizations are adopting various innovative techniques to provide better quality communications to both commercial players and individuals.

In addition, the demand for satellite connectivity is expected to grow significantly in various applications such as broadband connectivity, enterprise, defense, maritime, and oil & gas. The market players have adopted product launch, acquisition, and partnership strategies to enhance their product portfolios and expand their geographical reach. Furthermore, emerging economies are projected to provide lucrative growth opportunities to the market players during the forecast period

The market valued $11.12 billion in 2021 and is expected to be valued at 22.12 billion by 2031

North America is the largest regional market for Satellite Connectivity

Rise in demand for satellite-based internet throughout the world

Commercial is the leading application of Satellite Connectivity Market

Honeywell International Inc, General Dynamics Corporation, Thales Group, ViaSat Inc, and Indra are the top companies that hold significant market share in Satellite Connectivity market

Loading Table Of Content...