Seat Covers Market Research, 2034

Market Introduction and Definition

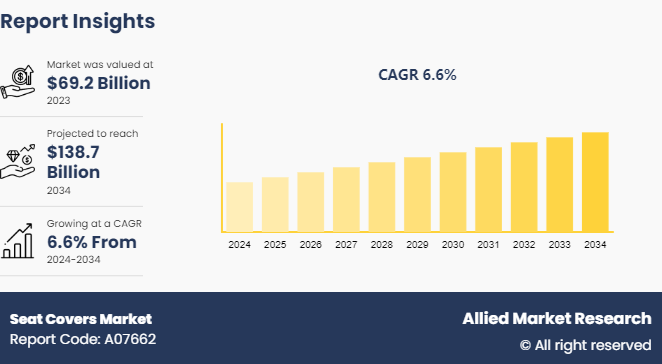

The global seat covers market was valued at $69.2 billion in 2023, and is projected to reach $138.7 billion by 2034, growing at a CAGR of 6.6% from 2024 to 2034. Seat covers are protective and decorative accessories designed to fit over vehicle seats, providing both functional and aesthetic benefits. They serve to protect original upholstery from wear and tear, spills, stains, and other forms of damage. Seat covers are made from various materials such as fabric, leather, vinyl, or synthetic blends, which enhances the comfort of the seat, offers additional cushioning, and incorporates features such as heating or cooling. They come in various styles and designs, allowing customization to match personal preferences or vehicle interiors. Seat covers are available for different types of vehicles, including cars, trucks, SUVs, and motorcycles, and can be tailored to fit specific seat configurations. They play a crucial role in maintaining the interior appearance and resale value of the vehicle.

Key Takeaways

The seat covers market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of seat covers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Growth in global automotive sales has significantly surged demand in the seat covers market, as more vehicles on the road translate into a larger potential customer base for aftermarket accessories. According to the U.S. Department of Transportation, global car sales reached 66.7 million units in 2022, which reflected a steady increase from 2021. This rise in vehicle ownership has driven consumers to invest in seat covers for protection and personalization, enhancing both the aesthetic appeal and longevity of their car interiors. In addition, the expanding middle-class population in emerging markets has contributed to higher automotive sales, further fueling the demand for protective seat covers industry. As more consumers seek to maintain the value of their vehicles, the seat covers market share continues to experience vigorous growth.

However, the high cost of premium seat covers has restrained market demand by limiting accessibility for price-sensitive consumers. While premium seat covers offer superior quality, durability, and customization, their higher price points deter a significant portion of potential buyers, particularly in regions with lower disposable incomes. Consumers often opt for more affordable alternatives or delay purchasing premium covers altogether, impacting overall seat covers market growth. Moreover, the availability of counterfeit products at lower prices further hampers the genuine premium seat covers market demand. Thus, price sensitivity creates a barrier to seat covers market expansion, particularly in developing markets where cost remains a critical factor in purchasing decisions.

Furthermore, the development of smart seat covers with integrated technology has created new seat covers market growth opportunities by appealing to tech-savvy consumers seeking enhanced functionality and convenience. For instance, seat covers such as the Nissan Zero Gravity Seats integrate advanced temperature control and lumbar support, improving comfort during long drives. Similarly, the Ford Smart Seat covers feature pressure sensors that adjust seating positions automatically for optimal posture and reduced fatigue. In the luxury segment, Mercedes-Benz has introduced seat covers with embedded massage functions and customizable climate settings, offering a personalized driving experience. As automotive interiors become more connected, these innovative features are increasingly attractive to consumers, driving seat covers market size and encouraging manufacturers to expand their product lines to meet the rising interest in tech-integrated seat covers.

Value Chain Analysis of Global Seat covers Market

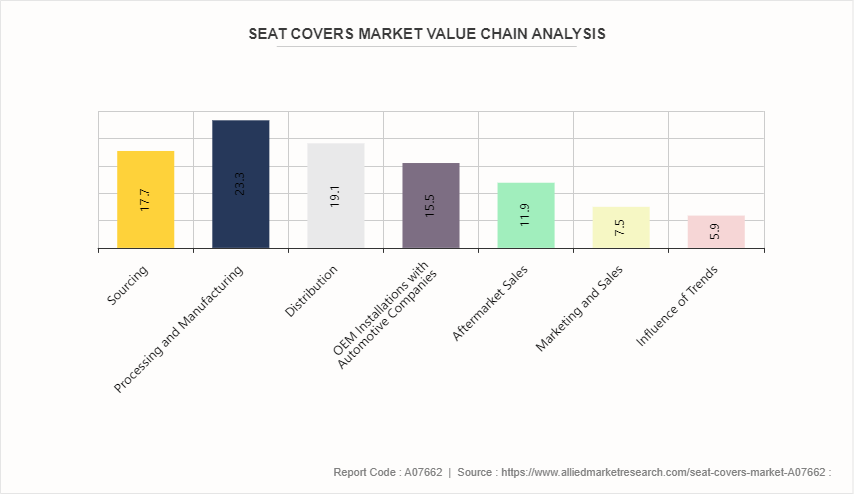

The value chain of the seat covers market involves several key stages, starting with the sourcing of raw materials, such as fabrics, leather, and synthetic materials. These materials are then processed and manufactured into seat covers by suppliers, who focus on cutting, stitching, and adding protective or aesthetic features. Once produced, the seat covers are distributed through various channels, including wholesalers, retailers, and online platforms. Manufacturers often collaborate with automotive companies for original equipment manufacturer (OEM) installations, while aftermarket sales target consumers looking for upgrades or replacements. The final stage involves marketing and sales efforts, where brands highlight features like durability, customization, and protection to attract buyers. The value chain is influenced by trends in materials, technology, and consumer preferences.

Market Segmentation

The global seat covers market is segmented into material type, vehicle type, technology, end user, and region. On the basis of material type, the market is categorized into fabric, leather, and others. As per vehicle type, the market is classified into passenger cars, commercial vehicles, two-wheelers, off-road vehicles, and others. According to technology, it is fragmented into conventional seat covers, and smart seat covers. On the basis of distribution channel, the market is divided into original equipment manufacturer (OEM) , auto parts retailers, supermarkets/hypermarkets, specialty stores, automotive workshops, and online sales channel. Region wise, the hair seat covers market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for seat covers in the U.S. has been high due to several factors. The U.S. has a large and active automotive market, with over 280 million registered vehicles as of 2023. In addition, American consumers prioritize vehicle customization and protection, with 70% of car owners investing in accessories such as seat covers to enhance the comfort and appearance of their interiors. The rise in outdoor activities and pet ownership has also fueled demand, as 50% of U.S. households own at least one pet, leading to a need for durable, protective seat covers. Furthermore, 60% of drivers in the U.S. have cited the desire to maintain resale value as a key reason for purchasing high-quality seat covers.

The Asia-Pacific region offers specific growth opportunities in the seat covers market due to several distinct factors. The region has seen a surge in demand for two-wheelers and compact cars, particularly in densely populated urban areas, where consumers seek practical and affordable seat covers tailored to these vehicle types. Moreover, there has been a rise in demand for seat covers with advanced climate-control features, driven by the region's diverse and often extreme weather conditions. In addition, the growth of e-commerce platforms in Asia-Pacific has also expanded access to a wider range of seat cover options, which has made it easier for consumers to purchase customized and imported products. Finally, local manufacturers have increasingly adopted innovative production methods to offer cost-effective, yet high-quality seat covers, attracting budget-conscious buyers during the seat covers market forecast period.

Industry Trends:

Advanced protective features have significantly influenced the global seat covers market by addressing consumer needs for durability and ease of maintenance. Car owners, particularly families, pet owners, and outdoor enthusiasts, increasingly seek seat covers with waterproof, stain-resistant, and anti-microbial properties. These features have become essential for maintaining the interior quality of vehicles, driving manufacturers to integrate nanotechnology and advanced coatings. The trend reflects a shift toward practicality, as consumers opt for seat covers that offer long-lasting protection against spills, stains, and wear. As a result, advanced protective features have become a key selling point, setting a new standard in the market for functional and resilient seat covers.

Minimalistic and modern designs have emerged as a popular trend in the seat covers market. In 2023, 60% of car owners preferred sleek, understated designs that complemented the overall aesthetic of their vehicles. This trend has been particularly prominent among younger consumers, with 70% of Generation Z and Millennials favoring minimalist styles over traditional, ornate patterns. A survey revealed that 50% of buyers associated minimalistic designs with higher quality and sophistication, while 40% believed it enhanced the perceived value of their vehicles. The shift toward modern aesthetics has also been reflected in color choices, with 55% of consumers opting for neutral tones such as black, gray, and beige, which align with contemporary interior design trends.

Competitive Landscape

The major players operating in the seat covers market include Covercraft Industries, LLC, Faurecia, Lear Corporation, Katzkin Leather, Inc., Saddleman, FH Group International, Inc., Carhartt, CalTrend, Wet Okole, and Johnson Controls, Inc.

Recent Key Strategies and Developments

In July 2024, OxGord introduced eco-friendly seat covers made from recycled materials to respond to the growing demand for sustainable automotive products, appealing to environmentally conscious consumers.

In March 2024, Carhartt released their precision fit seat covers, emphasizing tailored fit and rugged durability. The covers were aimed at customers needing heavy-duty protection, particularly in work vehicles and outdoor environments.

In January 2024, Katzkin expanded their custom leather seat cover offerings with more color options and stitching patterns. The new range targeted luxury vehicle owners seeking personalized interior enhancements with high-quality leather.

In June 2023, CalTrend introduced the pet series seat covers, designed specifically for pet owners. The covers featured protected stitching and anti-slip backing, addressing the common concerns of pet hair and claw damage while providing a secure fit.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the seat covers market analysis from 2024 to 2034 to identify the prevailing seat covers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the seat covers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global seat covers market trends, key players, market segments, application areas, and market growth strategies.

Seat Covers Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 138.7 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 293 |

| By Material Type |

|

| By Vehicle Type |

|

| By Technology |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Johnson Controls, Inc., FH Group International, Inc., Wet Okole, CalTrend, Faurecia, Saddleman, Katzkin Leather, Inc., Lear Corporation, Covercraft Industries, LLC, Carhartt, Inc. |

Upcoming trends in the global seat covers market include sustainable materials, smart features, custom designs, and enhanced durability for extended use.

The leading application of the seat covers market is for automotive use, including both original equipment manufacturer (OEM) installations and aftermarket upgrades for vehicles, focusing on protection, comfort, and aesthetics.

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2023.

The global seat covers market was valued at $69.2 billion in 2023.

The major players operating in the seat covers market include Covercraft Industries, LLC, Faurecia, Lear Corporation, Katzkin Leather, Inc., Saddleman, FH Group International, Inc., Carhartt, CalTrend, Wet Okole, and Johnson Controls, Inc.

Loading Table Of Content...