Seaweed Market Research, 2033

Market Introduction and Definition

The global seaweed market was valued at $7.0 billion in 2023, and is projected to reach $16.1 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. Seaweed, a diverse group of marine algae, plays a crucial role in aquatic ecosystems and human societies. These plant-like organisms, which include red, green, and brown algae, grow in saltwater environments and lack true roots, stems, or leaves. Seaweed's significance spans multiple domains: ecologically, it provides habitat for marine life, produces oxygen, and aids in carbon isolation. As a food source, it's rich in nutrients and widely consumed, particularly in Asian cuisines. Industrially, seaweed is valuable for its hydrocolloids, used in food, cosmetics, and pharmaceuticals. It shows promise in medical applications, biofuel production, and environmental remediation. Economically, seaweed supports coastal livelihoods through harvesting and farming. Its cultural importance is evident in traditional uses across various coastal communities.

Key Takeaways

The seaweed market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major seaweed industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The expansion of the food and beverage industry significantly rises the market demand for seaweed. As consumers increasingly seek healthier, sustainable, and exotic ingredients, seaweed's rich nutritional profile and unique flavors are being incorporated into a wide array of products. From snacks and salads to beverages and seasonings, the versatility of seaweed makes it a valuable ingredient in innovative culinary applications. This trend is particularly strong in health-conscious and environmentally aware markets, where seaweed's benefits align with consumer preferences. Furthermore, the rise of plant-based and vegan diets boosts demand for seaweed as an alternative protein source. With the food and beverage industry continuously evolving to meet these consumer trends, the incorporation of seaweed not only enhances product appeal but also drives significant seaweed market growth, ensuring a steady demand for this versatile marine resource.

However, the seaweed market faces significant restraints owing to its seasonal and environmental dependence. Seaweed cultivation is highly influenced by environmental factors such as water temperature, salinity, and light availability, leading to variability in yield and quality. Seasonal changes can result in periods of low production, causing supply inconsistencies and price volatility. In addition, adverse environmental conditions like pollution, ocean acidification, and climate change further impact seaweed growth, harvest and seaweed market size. These challenges are particularly pronounced in regions where seaweed farming is not well-established or lacks technological advancements. As a result, manufacturers and suppliers face difficulties in maintaining a steady and reliable supply chain, which can hamper the widespread adoption and integration of seaweed into various industries.

Moreover, innovation in product development is creating substantial opportunities in the seaweed market. With advancements in food technology and processing techniques, new seaweed-based products are being introduced, catering to diverse consumer preferences and dietary needs. From seaweed-infused snacks and beverages to plant-based meat alternatives and functional supplements, these innovative products highlight seaweed's versatility and health benefits. In addition, the development of seaweed-derived bioplastics and packaging materials aligns with the increasing demand for sustainable and eco-friendly solutions. Enhanced extraction methods are also enabling the use of seaweed bioactive compounds in pharmaceuticals and cosmetics, expanding seaweed market share. These innovations not only diversify the product offerings but also enhance consumer appeal, driving market growth. By continuously exploring new applications and improving product quality, the seaweed industry can capitalize on emerging trends and maintain a competitive edge in the global market.

2023 Seaweed State of the Industry

According to Phyconomy, it tracked 41 investments in seaweed startups in 2023, slightly more than last year, and twice as much compared to 2020. However, the total disclosed amount invested dropped by almost 1/3 compared to 2021 seaweed market forecast. In Europe, the number of startups receiving funding remained high, but the cheques got smaller. Investment fell back to $34M, half of 2021 ($67M) . North America saw the opposite trend. Fewer startups raised, on average, larger rounds. Down Under, a small uptick in deals is in line with expectations as more startups are popping up. Europe remains the place where most seaweed startups are born, although the rest of the world is also picking up the seaweed bug.

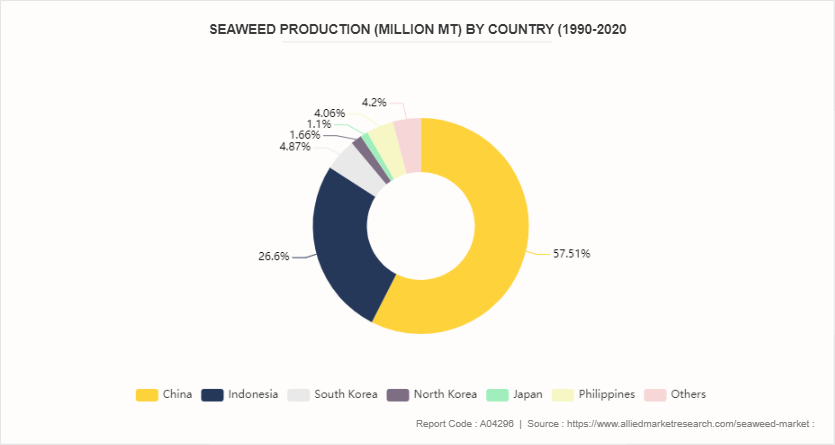

Seaweed production (Million MT) by country

The provided data represents seaweed production volumes by country, measured in metric tons (MT) . China leads the global seaweed production with a substantial volume of 20.8 Million MT, highlighting its dominance in the industry. Indonesia follows with 9.62 Million MT, showcasing its significant contribution to the global seaweed supply. South Korea and the Philippines also have notable production volumes, with 1.76 Million MT and 1.46 Million MT respectively. North Korea and Japan produce smaller, yet still substantial, quantities of 0.6 Million MT and 0.3 Million MT. The category labeled "Others, " which includes various other countries, contributes a combined total of 1.52 Million MT to the global seaweed market.

This data underscores the prominence of Asian countries in seaweed production, with China and Indonesia together accounting for the vast majority of the world's supply. These figures reflect the strategic importance of seaweed farming in these regions, driven by factors such as favorable coastal environments, established aquaculture practices, and growing market demand for seaweed-based products.

Market Segmentation

The seaweed market is segmented into product type, application and region. On the basis of product type, the market is divided into red, green and brown. As per application, the market is segregated into foods, medicines, chemical & fertilizers, animal feed additives, building materials, energy sources. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asia-Pacific region holds the maximum share in the seaweed market owing to several key factors. Favorable climatic conditions and extensive coastlines create ideal environments for large-scale seaweed cultivation. Countries like China, Indonesia, and South Korea have long-established aquaculture industries and advanced farming techniques, leading to high production volumes. In addition, seaweed is deeply integrated into the culinary traditions and dietary habits of the region, driving strong domestic demand. The Asia-Pacific region also benefits from significant investments in research and development, enhancing cultivation methods and expanding the range of seaweed-based products. Furthermore, government support and favorable policies promote sustainable seaweed farming practices. These factors, combined with a growing awareness of seaweed's health benefits and its applications in various industries such as food, cosmetics, and biofuels, contribute to the Asia-Pacific region's dominant position in the global seaweed market.

Industry Trends:

Increased Use in Functional Foods and Beverages: Seaweed is being increasingly incorporated into functional foods and beverages due to its high nutrient content. Products like Kelp, seaweed snacks, seaweed-infused drinks, and seaweed-based health supplements are gaining popularity among health-conscious consumers. For instance, according to a report by the Food and Agriculture Organization (FAO) , seaweed farming production increased from 2.2 million tonnes in 2000 to over 30 million tonnes in 2018.

Expansion in Beauty and Personal Care Products: Seaweed's bioactive compounds, such as antioxidants and anti-inflammatory agents, are being utilized in the beauty and personal care industry. Seaweed extracts and sea tangle are increasingly found in skincare, haircare, and cosmetic products, valued for their natural and beneficial properties.

Bioplastics and Biofuels: Seaweed is emerging as a sustainable raw material for producing bioplastics and biofuels. As the world shifts towards more eco-friendly alternatives, seaweed-based materials are gaining traction for their biodegradability and low environmental impact. According to research from the European Bioplastics association shows that bioplastics made from seaweed could reduce carbon footprints by up to 70%.

Competitive Landscape

The major players operating in the seaweed market include COMPO EXPERT GmbH, GimMe Health Foods LLC, Cargill, Incorporated, Irish Seaweeds, Mara Seaweed Ltd., Brandt, Inc., Groupe Roullier, Maine Coast Sea Vegetables, Inc., Annie Chun's, Inc., Qingdao Gather Great Ocean Algae Industry Group Co., Ltd.

Recent Key Strategies and Developments

September 2022, CadalminTM LivCure extract, a patent-protected nutraceutical product developed by the ICAR-Central Marine Fisheries Research Institute (CMFRI) from seaweeds to combat non-alcoholic fatty liver disease, will be available in the market soon. The product contains 100% natural bioactive ingredients extracted from select seaweeds. The product is made using eco-friendly green technology to improve liver health and is the 9th nutraceutical developed by CMFRI.

In February 2021, WavePure is a seaweed powder range based on native seaweed obtained without any chemical modification. Cargill's first series under this innovative range is WavePure ADG which is recognized as a traditional food ingredient in the EU. It includes WavePure ADG 8250, which is based on a blend of Gracilaria seaweeds, and which contributes to the mouthfeel and maintains stability in gelled dairy desserts, with limited impact on sensorial profile.

Key Sources Referred

TradeImeX

World Wildlife Fund (WWF)

Food and Agriculture Organization of United Nations

Hatch Innovation Services

World Bank

Bellona

Scientific American

The Cool Down

The Earth Bound

UN Trade and Development (UNCTAD)

National Institute of Food and Agriculture

India Business and Trade

Phyconomy

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the seaweed market analysis from 2024 to 2033 to identify the prevailing seaweed market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the seaweed market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global seaweed market trends, key players, market segments, application areas, and market growth strategies.

Seaweed Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16.1 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Annie Chun's, Inc., GimMe Health Foods LLC, COMPO EXPERT GmbH & Co. KG, Brandt, Inc., Groupe Roullier SA, Cargill, Incorporated, Maine Coast Sea Vegetables, Inc., Mara Seaweed Ltd., Qingdao Gather Great Ocean Algae Industry Group Co., Ltd., Irish Seaweeds |

Analyst Review

Seaweed, also called as marine macro-algae, is categorized on the basis of thallus color, namely red, brown, and green. Among all the seaweeds, red seaweeds are the largest and most abundant of the seaweeds, and thus hold a dominant position in the global seaweed market.

Increase in health awareness and changes in lifestyles and taste preferences among consumer have boosted the demand for seaweed products. As inhabitants from Asia-Pacific countries have migrated to North American and European countries, the demand for seaweed as food has increased, thereby driving the market growth. For instance, Nori, commonly used by Japanese to wrap a sushi roll, are found in American grocery stores such as whole foods, which sell it as roasted seaweed snacks. Moreover, in North America, seaweed farmers have adopted various innovative techniques such as the vertical or 3D farming using the water column to grow seaweeds. In recent years, the European policies have pushed for the development of seaweed farming as part of the European Union’s Blue Growth initiative to explore seaweed application in various end-use industries. Thus, growing application of seaweed such as animal feed, fertilizer, biofuel, and wastewater treatment and untapped markets in North America and Europe are anticipated to open new opportunities for seaweed manufacturers.

However, the volatility in the prices of seaweed and changes in weather patterns hamper the seaweed market growth.

Seaweed market was valued at $7.0 billion in 2023, and is estimated to reach $16.1 billion by 2033

The global Seaweed market is projected to grow at a compound annual growth rate of 8.7% from 2024 to 2033 reach $16.1 billion by 2033

Some of the key players in the seaweed market include COMPO EXPERT GmbH, GimMe Health Foods LLC, Cargill, Incorporated, Irish Seaweeds, Mara Seaweed Ltd., Brandt, Inc., Groupe Roullier, Maine Coast Sea Vegetables, Inc., Annie Chun's, Inc., Qingdao Gather Great Ocean Algae Industry Group Co., Ltd.

Asia-Pacific region was the highest revenue contributor to the market in 2023 and is expected to grow at a significant CAGR during the forecast period

Expansion of Food and Beverage Industry, Rising Demand for Plant-Based Products, Sustainable and Eco-Friendly

Loading Table Of Content...