Second Hand Tire Market Research: 2032

The Global Second Hand Tire Market Size was valued at $8.1 billion in 2018, and is projected to reach $12.5 billion by 2032, growing at a CAGR of 4% from 2023 to 2032. Second hand tires are used tires which are sold at a relatively lower cost having minimum tread depth as required by the law in a particular country. Generally, a depth of 0.8 mm for two-wheeler tires and 1.6mm for other vehicle tires are considered safe, below which many countries have categorized unfit for use and illegal. Thus, second hand tires that have more than the allowed tread depth are sold in the market.

Market Dynamics

The second hand tire market is experiencing rapid growth, especially in the last few years, primarily due to the growth in the number of automobiles such as passenger cars, commercial, agricultural, and industrial vehicles globally. Rapid population growth across the world propels the demand for automobiles. Small vehicle owners show growing interest in second hand tires due to their lower usage and cost-effectiveness. These tires are preferred because they have experienced less usage, particularly in comparison to commercial vehicles, and are subjected to lower weight loads.

Surge in the number of vehicles is expected to boost the demand for refurbished or retread tires, especially in developing nations like India and China. One key reason is that these tires are relatively more affordable while still meeting all the necessary safety standards. Furthermore, ready availability of second hand tires is also responsible for the growth of the secondhand tires market. Second hand tires are very popular in developing economies, owing to various factors such as cost-effectiveness, the desire for more affordable options, or environmental considerations. Interested buyers can easily buy a single tire as well as tires in a lot from a local tire shop or a dealership.

Tire shops and dealerships often inspect the tires for quality and may provide some level of warranty or guarantee, which further impacts the market positively. Moreover, online platforms such as Alibaba.com, Craigslist, eBay, and others often have listings for used tires, where buyers can search for tires in their local area or nearby regions and contact sellers directly to negotiate the price and arrange for a purchase. Buyers do not have to struggle a lot to buy tires of their choice with reasonable safety and price; thereby, positively impacting the sales of second hand tires and eventually the second hand tire market outlook.

Tires are typically made with the highest standards of safety due to their critical application in the movement of vehicles. It should also be noted that tires are the only components of vehicles that touch the ground; which makes them highly susceptible to many damages, including punctures, sidewall fractures, and others.

These damages are undetectable to unprofessional or unskilled people, and if any person buys them, they are in grave danger. Additinally, excessive tread wear is another major safety concern, and can lead to decreased grip, especially on wet or slick terrain, and raises the possibility of sliding or hydroplaning. Realizing these dangers a few countries, including the UAE has banned the sales of second hand tires in the country. Other countries which includes India, Saudi Arabia, Nigeria, and many have banned the import of used tires, primarily to reduce the incoming of potential rubber waste in the country which is difficult to get rid of.

Moreover, a growing focus on sustainable development is expected to be a major second hand tire market opportunity for the growth of the key players. Tires are produced by extracting raw materilas and transportating them to a factory where the materials is processed. This entire process may negatively impact the environment, as these processes require substantial amounts of energy, which is mainly derived from fossil fuels. In addition, the raw materials which include many kinds of natural and synthetic rubber as well as petroleum-based chemicals, steel, and various other additives, can negatively disrupt the environment. Therefore, rising demand for demand for sustainable development which advocates the use of recycled materials or reusing old materials until it is safe to do so is expected to drive second hand tire market growth.

Major world events including COVID-19, and inflation have had severe impacts on the growth of the market in the past. Earlier, the lockdowns led by COVID-19 limited the growth of the market for at least two years. Fortunately, by mid-2022, most of the locked-down regions were opened to trade and the market recovered. However, the recovery path did not last for long, and the inflation fuelled by the Ukraine-Russia war has become a major new obstructing event for the second hand tire market growth.

The inflation, which has pushed major economies like Germany into recession has led to an increase in the prices of oil and gas which eventually made shipment and transportation expensive around the world. A majority of the cost component of second hand tires is contributed during their transportation, and increased price of the shipment services has led to an increase in the prices of the second hand tires. Due to this, a majority of the users plan on delaying their purchase of second hand tires or reluctantly buy them but in limited quantities. Thus, such major world events are having a negative impact on the market growth.

Segmental Overview

The second hand tire market is segmented on the basis of type, design, vehicle type, and region. By type, the market is divided into tube and tubeless second hand tires. Depending upon design, the market is categorized into radial and bias second hand tires. The vehicle type considered in the report are two wheelers, passenger cars, commercial vehicles, and others. The market is also analyzed across the world, parted into regions including North America, Europe, Asia, Pacific, Latin America, the Middle East, and Africa.

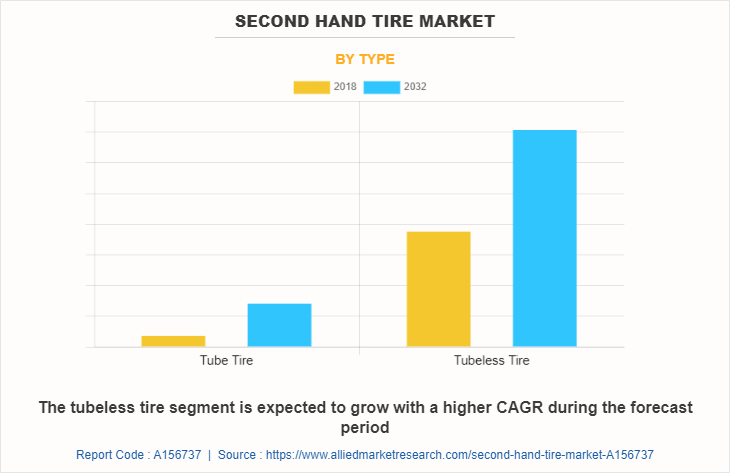

By Type:

Tube and tubeless used tires make up the majority of the secondhand tire industry. In terms of revenue, the tubeless second-hand tire segment dominated the second hand tire market share in 2022. During the forecast period, the same category is anticipated to rise with a higher CAGR. Since only a tire, inner tube, and rim are needed for their creation, tube tires are less expensive since manufacturing costs are lower. Vehicle owners choose tube tires over tubeless tires because they offer a smoother and more cushioned ride. In contrast, the demand for tubeless tires is increasing due to their versatility, dependability in the event of a puncture, robust construction that prevents them from exploding, and other advantages.

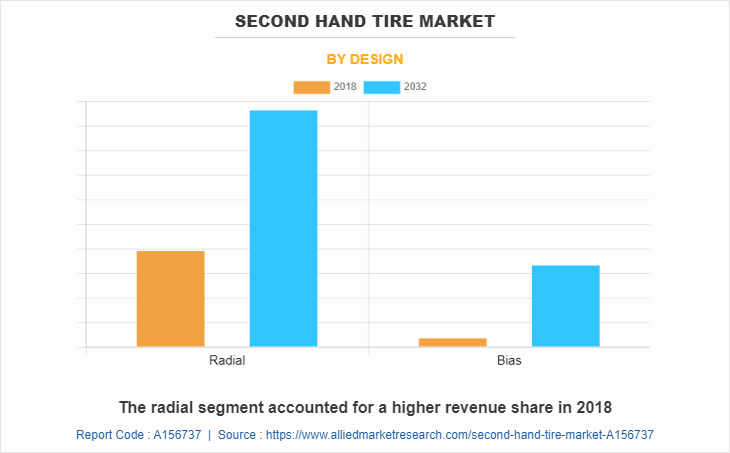

By Design:

The second hand tire market is divided into radial and bias second hand tires. In 2022, the radial segment dominated the second hand tire market, in terms of revenue, and the same segment is expected to witness growth at a higher CAGR during the forecast period. Radial tires are expensive; however, they have two or three times longer lifespan than other tires due to their superior construction and the positioning of cord plies at 90 degrees to the tread. These tires also offer better fuel efficiency.

Owing to higher durability, the condition of a typical second hand radial tire is relatively better. However, second hand bias tires have a shorter life-span. Thus, its high load capacity makes it a desirable choice of tire and, vehicle owners spend frequently on the purchase of these tires, which eventually has a positive impact on the demand for second hand bias tires.

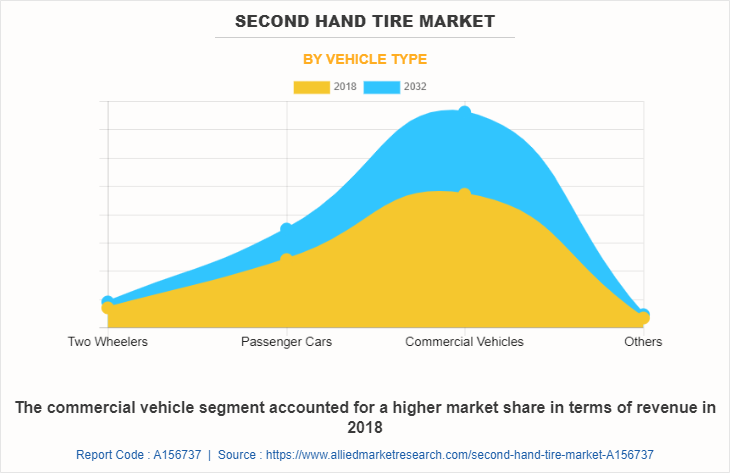

By Vehicles Type:

The second hand tire market is analysed for different types of vehicles which includes two wheelers, passenger cars, commercial vehicles, and others. In 2022, the commercial vehicles demanded a significant amount of second hand tires, and the same segment is expected to dominate the second hand tire market forecast by growing with a higher CAGR. The owners of commercial vehicles who particularly operate large fleets make use of cheaper second hand tires.

By purchasing these tires the commercial vehicle owners can save a lot of money during the time when the budget is less. Also, businesses who operate in highly competitive markets also make use of second hand tires so that they can divert the saved money to other business related operations.

By Region:

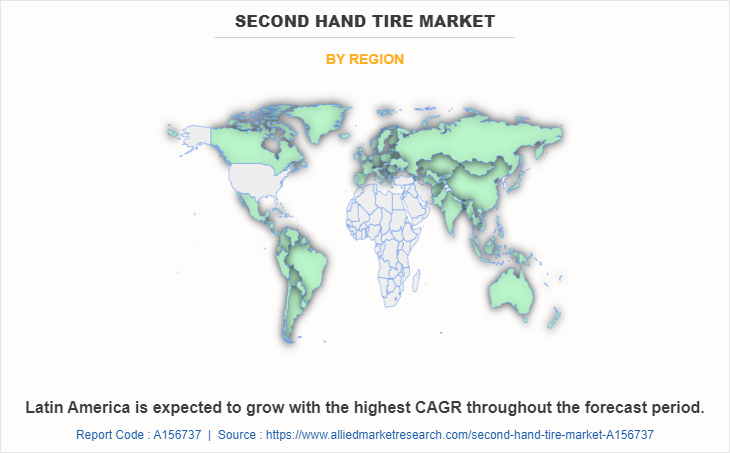

The year 2022 saw Asia leading the market in terms of revenue due to its high population growth rates and urbanization. On the other hand, LAMEA is projected to grow with a higher CAGR during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the second hand tire market are provided in the report. Major companies in the report include 2nd Time Around Tires, Allgemeine Gummiwertstoff und Reifenhandels GmbH, ASM Auto Recycling Ltd., BURD Automobile, Emanuel Tire, German Used Tires Co., JBees Tires, Liberty Tire Recycling, Tire Hut, and Turak Tyres. The major players are primarily involved in the export of second hand tires mostly from European and North American countries to countries in Latin America, Africa, and Asia-Pacific.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging second hand tire market trends, and historic data.

- In-depth second hand tire market analysis is conducted by constructing market estimations for key market segments between 2018 and 2032.

- Extensive analysis of the second hand tire market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The second hand tire market revenue and volume forecast analysis from 2023 to 2032 is included in the report, and 2022 is considered the base year.

- The key players within the second hand tire market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the second hand tire industry.

Second Hand Tire Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.5 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2018 - 2032 |

| Report Pages | 193 |

| By Type |

|

| By Design |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | German Used Tires Co., BURD Automobile, 2nd Time Around Tires, Turak Tyres, Liberty Tire Recycling, JBees Tires, ASM Auto Recycling Ltd., Allgemeine Gummiwertstoff und Reifenhandels GmbH, Tire Hunt, Emanuel Tire |

Analyst Review

The second hand tire market has witnessed significant growth in the past few years and is expected to keep growing in the future as well as with an increased pace. The primary reason associated with the growth is rise in the number of vehicles in developing nations where vehicle owners demand for relatively safe yet affordable tires.

Moreover, the UK is among the few countries, which have put in place specialized standards for second hand tires or part-worn tires. The Tyre Industry Federation in the UK estimates that nearly 5 million, or 10% of all tires purchased in the UK are in the part-worn category. The commonly expected standards suggest various points, on which the safety of tires is measured. For example, a tire with cuts longer than 25 millimeters or 10% of the section width of the tire (whichever is the greater), is safe. Moreover, the original grooves are clearly visible in their entirety and must be to a depth of at least 2mm in UK or 1.6 mm in Germany. There shall be no other physical damage to the tires such as exposed ply or chord, no lumps or bulges on internal or external surfaces.

The global second hand tire market is a highly fragmented market, where almost every tire repair shop sells second hand tires. However, many second hand tires in the market are not properly inspected, and the price of such tires is less than the thoroughly inspected tires.

Key factors driving the growth of the second hand tire market include growth in the number of automobiles, advantages of second-hand tires, and ready availability of second-hand tires.

The latest version of the global second hand tire market report can be obtained on demand from the website.

The global tire recycling market size was valued at $8,105.2 million in 2018.

The global second hand tire market size is estimated to reach $12,465.2 million by 2032, exhibiting a CAGR of 4.0% from 2023 to 2032.

The forecast period considered for the global second hand tire market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. In addition, historical period from 2018-2021 is also analysed.

Asia is largest regional market for second hand tire market.

Key companies profiled in the tire recycling market report include 2nd Time Around Tires, Allgemeine Gummiwertstoff und Reifenhandels GmbH, ASM Auto Recycling Ltd., BURD Automobile, Emanuel Tire, German Used Tires Co., JBees Tires, Liberty Tire Recycling, Tire Hut, and Turak Tyres.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...