Secured Lending Market Research, 2033

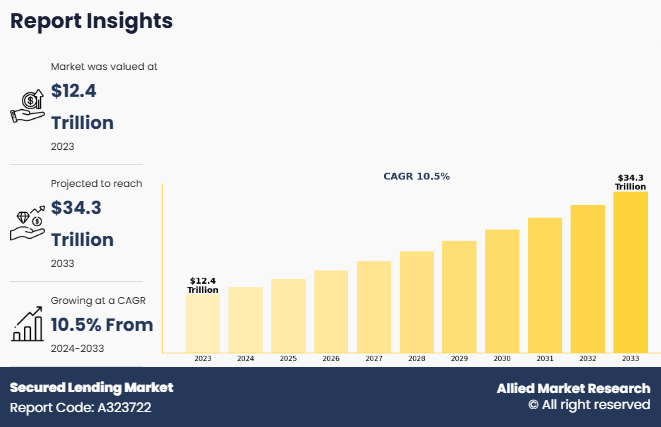

The global secured lending market was valued at $12.4 trillion in 2023, and is projected to reach $34.3 trillion by 2033, growing at a CAGR of 10.5% from 2024 to 2033. Secured loans represent a unique type of financial arrangement, in which borrowers provide valuable assets as collateral to lenders, allowing them to obtain the funds they need without restrictions. This collateral can take many forms, including residential properties, high-end vehicles, or even significant pieces of jewelry. A collateral is a fundamental concept that defines the nature of secured loans, as it is the physical asset provided to the lender. This collateral serves as protection, a defense against the risks associated with non-repayment. Secured lending typically offer borrowers more favorable terms due to this protection, often emphasized by the attraction of lower interest rates compared to unsecured loans.

Key Takeaways:

By loan type, the business loan segment held the largest share in the secured lending market for 2023.

By lender type, the banks segment held the largest share in the secured lending market for 2023

By end user, the large enterprise segment held the largest share in the secured lending market for 2023.

Region-wise, North America held largest secured lending market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Factors such as lower interest rates due to demand for loans secured by collateral and longer repayment periods reducing strain on cash flow positively impacted the growth of the secured lending market. In addition, increase in use of collateral makes it easier to meet loan requirements, giving lenders more confidence to approve loans, which is expected to fuel the growth of the market during the secured lending market forecast period.

Segment Review

The secured lending market is segmented into loan type, lender type, end user, and region. By loan type, the market is segmented into auto loans, mortgage loans, business loans, personal loans, and others. By lender type, it is categorized into banks, online lenders, credit unions, mortgage lenders, and others. By end user, the market is segmented into individuals, small & medium enterprises (SMEs), and large enterprises. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of loan type, the business segment dominated the secured lending market in 2023, driven by rise in demand for capital among small and medium-sized enterprises (SMEs) and large corporations. Businesses sought secured loans to finance expansions, purchase equipment, and manage working capital, contributing to the segment growth. The availability of collateral-backed financing options at competitive interest rates further supported the dominance of this segment. In addition, banks and financial institutions continued to offer tailored secured lending solutions, strengthening their market presence. Rise in infrastructure development, technological investments, and government initiatives to promote business growth also played a significant role in fueling demand. Moreover, with economic recovery post-pandemic, enterprises increasingly relied on secured loans for stability and expansion. The growing adoption of digital lending platforms further streamlined the loan approval process, enhancing accessibility for businesses.

Region wise, the Asia-Pacific dominated the secured lending market share in 2023, driven by rapid economic growth, increasing urbanization, and rise in demand for secured loans across various sectors. The expansion of small and medium-sized enterprises (SMEs), coupled with government initiatives to boost financial inclusion, contributed significantly to the region's market growth. In addition, surge in homeownership, infrastructure development, and equipment financing fueled the demand for mortgage and auto loans. The presence of major financial institutions and rise in adoption of digital lending platforms further accelerated secured lending activities in the region. Countries such as China, India, and Japan witnessed rise in credit demand, supported by favorable interest rates and improved banking regulations. Moreover, technological advancements in loan processing and risk assessment enhanced accessibility to secured loans. With a strong focus on economic expansion and financial sector modernization, the Asia-Pacific region remained a key player in the secured lending market in 2023.

Competition Analysis

The report analyzes the profiles of key players operating in the secured lending market such as Social Finance, Inc., Truist Financial Corporation, Barclays PLC, Goldman Sachs Group, DBS Bank Ltd., Wells Fargo, Bank of China, The Hongkong and Shanghai Banking Corporation Limited, Qollateral LLC, AMERANT BANK, N.A, JPMorgan Chase & Co., Citigroup Inc., Bank of America Corporation, The PNC Financial Services Group, Inc., TD Bank, Cholamandalam Investment and Finance Company Ltd., Scotiabank, Antares Capital LP, Zions Bancorporation, and M&T Bank Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the secured lending industry.

Recent Product Launch in the Secured Lending Market

In August 2024, Paisabazaar shifted its focus from unsecured to secured lending due to RBI's new guidelines. The company partnered with 25 lenders, which aimed to become a major home loan distribution platform, offering various secured lending products. It planned to deploy 300 field staff in key cities to cover 33-35% of the market. This is expected to significantly enhance market presence, offer wide range of secured lending products, and capture larger customer base, which in turn, augment the growth of the global secured lending market size.

In July 2024, the Office of the Comptroller of the Currency (OCC) finalized a regulation in collaboration with federal agencies to establish quality control standards for automated valuation models (AVMs) utilized by mortgage originators and secondary market issuers. Banks that employ AVMs for credit decisions or securitization are required to adopt policies that guarantee the accuracy of AVM estimates, prevent data tampering, avoid conflicts of interest, perform random sample testing, and adhere to nondiscrimination laws. This collaboration aims to ensure that AVMs used in the mortgage lending process are reliable, transparent, and reduce the potential for errors, fraud, or discrimination in the property valuation process, thereby accelerating the growth of the secured lending market.

In December 2024, Pacific Investment Management Company (PIMCO) raised $2 billion for a new asset-based finance strategy, including equipment-based lending and aviation finance, and consumer debt. This move marks PIMCO's entry into the growing private-credit market, which offers flexible financing to small and medium-sized businesses (SMBs) through nonbanking financial institutions. Private credit, unlike public fixed-income assets, is privately issued and less regulated, providing more flexibility and fewer roadblocks for borrowers. This is expected to strengthen PIMCO's position in the private-credit market, offering more flexible financing options to SMBs and further driving the growth of the secured lending industry.

Top Impacting Factors

Driver

Lower interest rates making it more affordable for borrowers

Increase in adoption of secured lending services, which provide low interest rates is directly influencing the growth of the global secured lending market size. Choosing lower interest rate loans helps borrowers to save on interest, allowing them to use the savings for other financial goals or necessities. Moreover, lower interest rates improve the chances of loan approval, as borrowers find it easier to fulfill repayment requirements, resulting in greater access to capital. Consequently, offering lower interest rates helps build customer loyalty and satisfaction, as borrowers are more likely to return to lenders who provide cost-effective solutions. These factors are expected to contribute to the increased adoption of secured lending services with lower interest rates, which in turn, drives the secured lending market growth.

Furthermore, rise in adoption of secured lending services with low interest rates has provided construction companies with a cost-effective way to finance large-scale projects. In emerging industries such as construction sector, firms can secure loans at lower interest rates by using assets like land, buildings, equipment, or future project revenue as collateral. In addition, secured lending with low interest rates supports in cash flow management and operational stability ensuring construction companies to meet financial requirements and complete projects on time without high-interest burdens, driving secured lending market growth. For instance, in November 2024, The Federal Reserve announced its second interest rate cut of 2024, reducing the benchmark rate by 0.25% points to a range of 4.5% to 4.75% amid cooling inflation. This move provides relief to Americans facing high borrowing costs.

Restraints

Risk of Asset Loss in case of default

The major challenge for the growth of the secured lending market is the substantial risk associated with asset loss in case of default. In the event, if a borrower defaults on a loan, the lender can seize the collateral, such as a home, car, or business property. Losing these valuable assets can be financially devastating, particularly if they are essential for daily living or business operations. In addition, failing to repay a secured lending can negatively impact the borrower's credit score, making it more difficult for them to obtain future loans, credit cards, or mortgages. This lasting damage can significantly affect their financial stability. Furthermore, in some cases, the asset being seized may not cover the entire loan amount, especially if its value has decreased over time, as seen with depreciating vehicles or properties. As a result, the borrower might still owe money to the lender even after the asset has been taken, leading to a situation of negative equity. In addition, the risk of losing a major asset, like a home or vehicle, can create significant stress and anxiety. This emotional strain can negatively impact borrowers' mental well-being. Moreover, for business owners using assets like machinery or property as collateral, defaulting on a loan could mean the end of their operations. Losing crucial equipment or property can halt production, lead to income loss, and prevent them from fulfilling contracts.

Opportunity

Digital transformation in secured lending Landscape

Increase in digital transformation lending presents a significant secured lending market opportunity to enhance operational efficiency, improve customer experiences, streamline risk assessment processes, and accelerate decision-making. Fintech companies like LendingClub, SoFi, and Upstart have revolutionized banking with fully digital loan experiences. These platforms use advanced algorithms and non-traditional data for credit assessments, enabling more inclusive lending. Digital identity verification solutions prevent fraud and ensure KYC compliance. Technologies such as biometrics, facial recognition, and digital document verification streamline onboarding, enabling quick and secure borrower authentication. As banking shifts to a customer-focused model, new ways to offer personalized services are essential. This advanced technology lets borrowers get personalized rates and terms before choosing a financial provider. These factors are expected to boost the growth of the secured lending market.

Moreover, emerging technologies like AI and ML are enhancing automation, minimizing human intervention, and offering cost efficiencies, thereby streamlining lending processes for both borrowers and loan officers. Banks and financial institutions are looking to achieve economies of scale at lower capital costs. Many are adopting cloud-native approaches for better portability and functionality. Cloud-based digital lending platforms enable loan officers to work from anywhere, simplifying business management. Loan origination systems (LOS) automate the entire lending process, from application to disbursement. They collect borrower information, run credit checks, and make initial underwriting decisions. Automation reduces errors, speeds up processing, and allows lenders to handle applications more accurately. In February 2025, Quicklend, a Bengaluru-based fintech startup founded by Raghuram Tirkutam, Arun Jadhav, and Abhishek Uppala in December 2023, offers a seamless platform for users to secure a loan against their mutual funds in just 30 minutes. This not only speeds up the lending process but also improves customer experience by offering a quick, efficient, and transparent platform with minimal paperwork.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the secured lending market analysis from 2023 to 2033 to identify the prevailing secured lending market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the secured lending market outlook segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global secured lending market trends, key players, market segments, application areas, and market growth strategies.

Secured Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 34.3 trillion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Loan Type |

|

| By Lender Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Social Finance, Inc., Barclays PLC, Wells Fargo, AMERANT BANK, N.A, Cholamandalam Investment and Finance Company Ltd., Qollateral LLC, The PNC Financial Services Group, Inc., DBS Bank Ltd., Bank of America Corporation, Zions Bancorporation, Antares Capital LP, Goldman Sachs Group, Citigroup Inc., The Hongkong and Shanghai Banking Corporation Limited, TD Bank, Truist Financial Corporation, Bank of China, M&T Bank Corporation, Scotiabank, JPMorgan Chase & Co. |

Analyst Review

Businesses acknowledge the significance of protecting confidential data transmitted over several financial channels, especially in industries such as banking and finance. Businesses consider the benefits of secured lending services, including the ability to access larger loan amounts, lower interest rates, improved cash flow management, and reduced risk for lenders. In addition, implementing effective secured lending services helps businesses to maintain financial stability, optimize cash flow, mitigate risks, improve customer trust, and drive long-term growth by offering secure and flexible lending solutions. Such factors are expected to provide lucrative opportunities for the market growth during the forecast period.

Furthermore, advancements in secured lending can drive innovation and collaboration by providing advanced data analytics and automation that enhance the loan origination, underwriting, and risk management processes. Advanced technologies can enable lenders to assess borrower risk more accurately by analyzing vast amounts of data, including credit history, collateral value, and market trends, allowing for more personalized loan offers. Moreover, it can help streamline the customer experience, reducing processing times and improving service delivery.

Moreover, the risk of asset loss related to secured lending services must be addressed. This requires a robust risk management framework, with developers tasked to assess collateral value, reduce defaults, ensure timely recovery, and ensure regulatory compliance. Businesses must evaluate the services based on the industry specific needs and requirements, including factors such as collateral types, risk tolerance, regulatory compliance and process optimization in this sector. By addressing these challenges, businesses can unlock the full potential of the secured lending market. This, in turn allows them to transform their operations, create value, and gain a competitive advantage in their industry. For instance, in August 2024, BharatPe launched secured credit products, including two-wheeler loans and loans against mutual funds (LAMF), for its merchants. In partnership with OTO Capital, merchants can get two-wheeler loans up to ?2.5 lakh with a 12-48 month repayment period. The partnership with Volt Money allows BharatPe to offer LAMF up to ?1 crore.

The Secured Lending Market is estimated to grow at a CAGR of 10.5% from 2024 to 2033.

The Secured Lending Market is projected to reach $ 34,332.0 billion by 2033.

The Secured Lending Market is expected to witness notable growth owing to lower interest rates, longer repayment periods, and easy-to-meet loan requirements in the secured lending market.

The key players profiled in the report include Social Finance, Inc., Truist Financial Corporation, Barclays PLC, Goldman Sachs Group, DBS Bank Ltd., Wells Fargo, Bank of China, The Hongkong and Shanghai Banking Corporation Limited, Qollateral LLC, AMERANT BANK, N.A, JPMorgan Chase & Co., Citigroup Inc., Bank of America Corporation, The PNC Financial Services Group, Inc., TD Bank, Cholamandalam Investment and Finance Company Ltd., Scotiabank, Antares Capital LP, Zions Bancorporation, and M&T Bank Corporation.

The key growth strategies of secured lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...