Secured Personal Loans Market Research, 2032

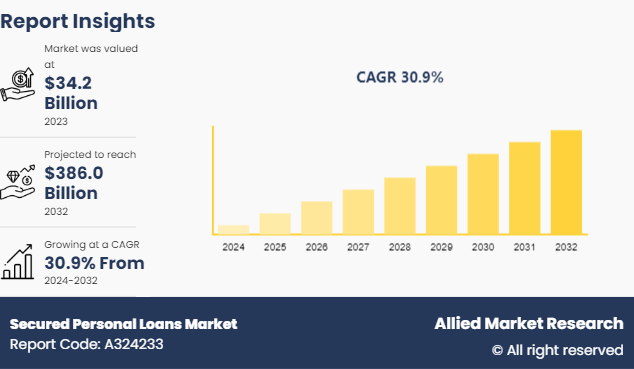

The global secured personal loans market size was valued at $34.2 billion in 2023, and is projected to reach $386.0 billion by 2032, growing at a CAGR of 30.9% from 2024 to 2032. Both personal loans and business loans can be secured, though a secured business loan may also require a personal guarantee. Personal loans typically have lower interest rates than credit cards and can be used to consolidate multiple credit card debts into a single and lower-cost monthly payment.

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A bank or lender can request collateral for large loans, for which the money is being used to purchase a specific asset or in cases where your credit scores are not sufficient to qualify for an unsecured loan. Secured loans may allow borrowers to enjoy lower interest rates, as they present a lower risk to lenders.

Key Takeaways

The secured personal loans market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major secured personal loans market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global secured personal loans markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The global secured personal loans market is growing due to several factors such as flexibility in load amounts and terms and increase in technological enhancements. However, higher interest rates, data security and privacy concerns act as restraints for the secured personal loans market. In addition, changes in demographic shift will provide ample opportunities for the secured personal loans market forecast development.

Secured personal loans typically offer lower interest rates as compared to unsecured loans as they are backed by collateral, which makes them an attractive option for borrowers looking to reduce the cost of borrowing. Since these loans are backed by collateral, lenders are often willing to provide higher loan amounts. This makes secured personal loans suitable for significant expenses such as home renovations, medical bills, or consolidating larger amounts of debt. These aforementioned factors are expected to propel the global secured personal loans market growth.

Demographic Insights of Personal Loans Market

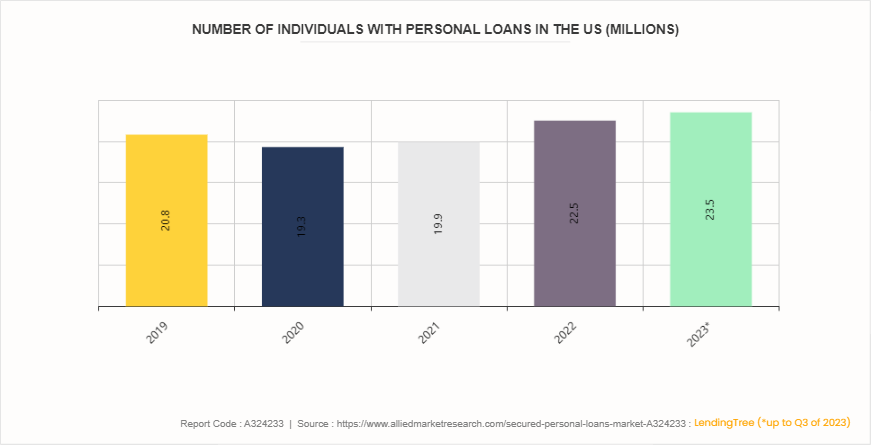

According to the LendingTree, as of the fourth quarter of 2023, 23.5 million Americans have a personal loan, up from 22.5 million in the fourth quarter of 2022. The number of people with loans dropped during the pandemic from the previous height of 20.8 million at the end of 2019 to 18.7 million in the second quarter of 2021. After that was the start of six increases in a row before the number dipped from 22.5 million in the fourth quarter of 2022 to 22.4 million in the first quarter of 2023. The number has increased every quarter since.

Market Segmentation

The secured personal loans market share is segmented into type, age, distribution channel, and region. On the basis of type, the secured personal loans market is segregated into P2P marketplace lending, and balance sheet lending. On the basis of age, the market is segregated into less than 30, 30-50, and more than 50. On the basis of distribution channel, the market is segregated into banks, credit unitions, online lenders, and peer-to-peer lending. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The adoption of secured personal loans market outlook varies across different countries, influenced by factors such as smart financial infrastructure, secured personal loans industry needs, regulatory frameworks, and investment in research and development. Developed countries such as the U.S., Germany, Japan, and South Korea have been at the forefront of home equity loans adoption. These countries possess advanced financial capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of secured financing solutions. In emerging economies such as China, India, Brazil, and Russia, there is a growing interest in secured personal loans fueled by rapid change in education system, and government initiatives to promote digitalization and innovation.

In February 2024, the U.S. Bank expanded client access to personal loans. The bank offers a wider range of clients the financial products they need, expanding access to credit and delivering more financial opportunity to more people.

In March 2024, the Japan Ministry of Education is expanding the scope of its financial aid provisions for non-Japanese students' university education. The Ministry offers scholarships, loans, and tuition reductions or exemptions through the Japan student services organization.

In March 2023, ArcelorMittal entered into a $5 billion loan agreement with a consortium of Japanese banks to finance the company's expansion plans in India.

Industry Trends:

In April 2024, Government of Canada launched the $5 billion Indigenous Loan Guarantee Program, to unlock access to capital for Indigenous communities, create economic opportunities, and ensure indigenous peoples share.

In October 2023, Government of Canada introduced new measures to ensure Canadians are treated fairly by their banks. These measures include protecting Canadians from rising mortgage payments, enhancing low-cost banking options, lowering non-sufficient fund (NSF) fees, and ensuring Canadians have an impartial advocate when they have complaints with their bank.

In September 2023, the U.S. Department of Education announced that more than 4 million student loan borrowers have registered in the Biden-Harris Administration's new Saving on A Valuable Education (SAVE) income-driven repayment (IDR) plan, including individuals who were transferred from the prior Revised-Pay-As-You-Earn (REPAYE) plan.

Competitive Landscape

The major players operating in the secured personal loans market include American Express, Avant, LLC, Barclays PLC, DBS Bank Ltd, Goldman Sachs, LendingClub Bank, Prosper Funding LLC, Social Finance, Inc., Truist Financial Corporation, and Wells Fargo.

Recent Key Strategies and Developments

In March 2023, Axis Bank partnered with Shriram Housing Finance Limited (SHFL) . Through this partnership, both the lenders will offer secured MSME (Micro, Small and Medium Enterprises) loans and home loans to the middle and low-income segment borrowers based in rural and semi-urban regions.

In June 2023, Thoughtworks partnered with Amazon Web Services. This approach to rapid delivery can put an end to multi-year big budget efforts to launch a new product and sets the scene for rapid product innovation and faster time to value.

In March 2022, BigPay launched its fully digital loans as part of the wider suite of financial services offerings. There has been an overwhelming demand for the personal loans, and it will be rolled out to more users over the coming weeks. BigPay Later Personal Loans are currently available to selected users and will be progressively rolled out to more and more people.

Key Sources Referred

Finaid

Lowa Student Loan

MEFA

OEDB

The Institute for College Access & Success

Key Benefits for Stakeholders

This report provides a quantitative analysis of the secured personal loans segments, current trends, estimations, and dynamics of the secured personal loans market analysis from 2023 to 2032 to identify the prevailing secured personal loans market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the secured personal loans market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global secured personal loans market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global secured personal loans market trends, key players, market segments, application areas, and secured personal loans industry growth strategies.

Secured Personal Loans Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 386.0 Billion |

| Growth Rate | CAGR of 30.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Age |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | American Express, Avant, LLC, Goldman Sachs, Social Finance, Inc., Avant, LLC, Prosper Funding LLC, Wells Fargo, Truist Financial Corporation, DBS Bank Ltd, Barclays PLC, LendingClub Bank |

The rise of fintech companies is transforming the secured personal loans market, with digital platforms offering faster and more user-friendly loan processing.

P2P maketplace lending is the leading type of Secured Personal Loans Market.

North America is the largest regional market for Secured Personal Loans in 2023.

$386.0 Billion is the estimated industry size of Secured Personal Loans in 2032.

American Express, Avant, LLC, Barclays PLC, DBS Bank Ltd, Goldman Sachs, LendingClub Bank, Prosper Funding LLC, Social Finance, Inc., Truist Financial Corporation, and Wells Fargo are the top companies to hold the market share in Secured Personal Loans.

Loading Table Of Content...