Self-Driving Car Insurance Market Research, 2032

The global self-driving car insurance market size was valued at $22 billion in 2022, and is projected to reach $88.1 billion by 2032, growing at a CAGR of 15.3% from 2023 to 2032.

Self-driving car insurance means and insurance coverage that is provided for autonomous cars. The cars are a combination of advanced sensors, algorithms and AI technologies to autonomously implement road navigator without human involvement. Self-driving car insurance policies involves different components such as liability, collision, comprehensive, cybersecurity and product liability. The liability helps in providing coverage for bodily injury, property damage due to self-driving car accidents and malfunctions. Furthermore, collision coverage helps in providing the cover in case of faulty accidents. In addition, comprehensive coverage helps in defending against cyber attacks and data breaches that can compromise with vehicle autonomous system. Moreover, product liability helps in providing coverage for manufacturers and developers in case of failing of self-driving technology.

The report focuses on growth prospects, restraints, and trends of the self-driving car insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the self-driving car insurance market outlook.

Key Takeaways

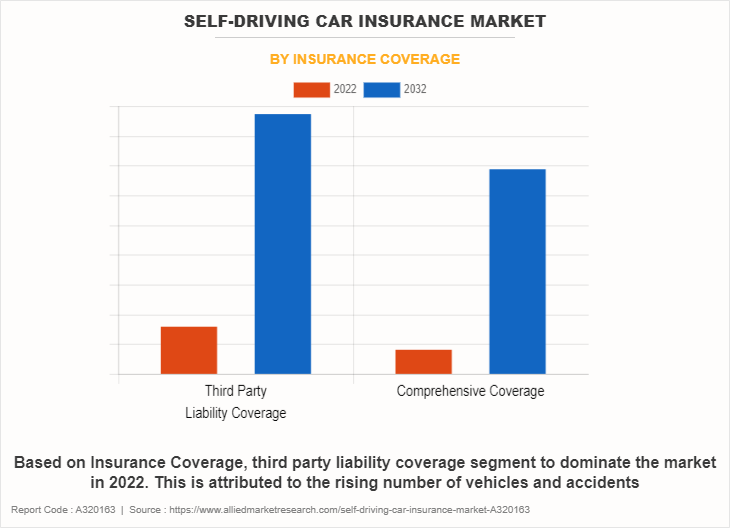

- Based on insurance coverage, the third-party liability segment held the largest market share in 2022

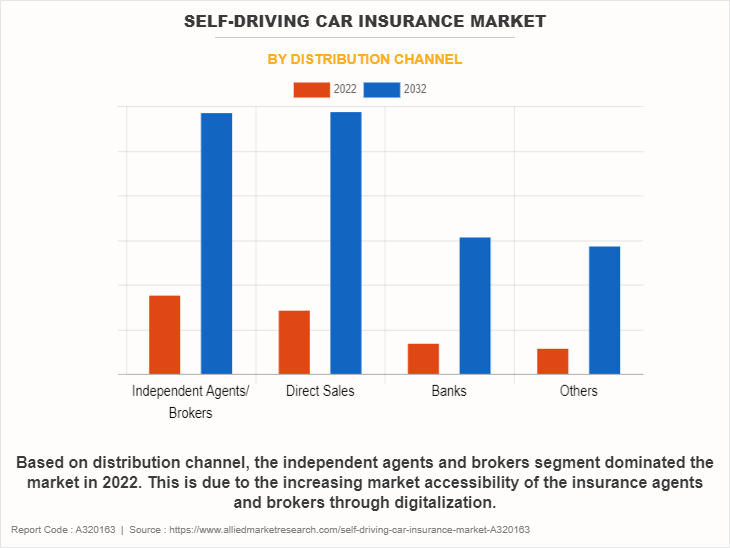

- Based on distribution channel, the insurance agents/brokers segment held the largest market share in 2022.

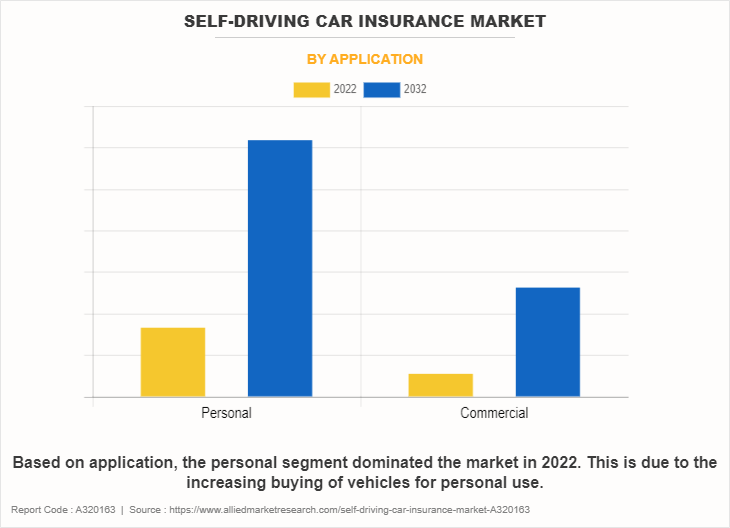

- Based on application, the personal segment held the largest share in self-driving car insurance market in 2022.

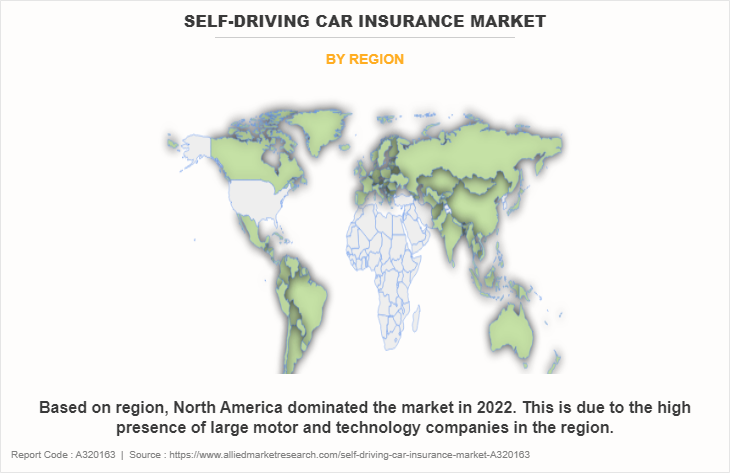

- Based on region, the North America segment held the largest market share in 2022.

Segment Review

The global self-driving car insurance market is segmented into application, insurance coverage, distribution channel and region. By coverage type the market is divided into third-party liability coverage, collision coverage, comprehensive coverage and others. By distribution channel, the self-driving car insurance industry is divided into insurance agents/brokers, direct response, banks, and others. By application, the market is bifurcated into personal and commercial. Region-wise, the self-driving car insurance market is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Based on insurance coverage, the third-party liability coverage segment held the largest self-driving car insurance market share in 2022. This is because of growing presence of vehicles and increasing collision chances.

Based on distribution channel, the insurance agents/brokers segment held the largest market share in 2022. This is due to the increasing advancements in the automotive technology which is demanding expert requirement for providing information about the product to the consumers.

Based on application, the personal segment held the largest market share in 2022 in the self-driving car insurance market trends, resulting in the self-driving car insurance market growth. This is because of growing personal vehicles.

Based on region, the North America segment held the largest market share in 2022. This is due to the high presence of automotive technology and insurance companies in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the self-driving car insurance market include Tesla, Nissan, Adrian Flux Insurance Services, Ford, Audi, Mercedes Benz, Volkswagen, General Motors, Mobile Eye, Allianz, TuSimple, China Pacific Group Insurance Company Limited, Industrial and Commercial Bank of China Limited (ICBC), and GEICO. These players have adopted various strategies to increase their market penetration and strengthen their position in the driverless car insurance market.

Recent Partnership in the Self-driving Car Insurance Market

- In July 2022, Allianz entered into a partnership with Check24 in Germany and Spain. The partnership alliance resulted in the launch of motor insurance in Germany. It also resulted in the launch of pilot phase in August. Future collaboration between Allianz Direct and CHECK24 will be focused on developing a fully digital business model with a particular emphasis on cost-conscious consumers. Both companies will bring their own core capabilities to the table.

- In March 2023, Admiral a UK based car insurance provider partnered with Cambridge Mobile Telematics (CMT) and launched little box pod solution that helps in lowering insurance prices for drivers of different ages. The solution is available for UK drivers. The POD works in unity with Admiral application to provide drivers with feedback on each trip and also provides a score that indicates driving safety. Drivers can follow their performance in the application and can improve their scores, that will help in reducing insurance premiums.

- In March 2020, Allstate entered into a partnership with Ford to connect vehicles with Allstate miles-wise program that is active in currently 14 states. Through the Miles-wise program, a consumer can only pay for the actual miles driven. Automobile insurance firms have long employed telematics devices, which can link to a vehicle's diagnostic port or gather data through a smartphone application. According to Allstate, these gadgets will eventually be replaced with data that is directly gathered from embedded modems in newer cars.

Market Landscape and Trends

The new advancements and innovations made by automotive companies in the self-driving technology is accelerating the position of technology giants. Developments in sensors, artificial intelligence, machine learning, and connectivity are increasingly progressing towards fully automated vehicles. Furthermore, insurers are slowly adapting products and services to accommodate unique risks that are associated with self-driving cars. It includes developing new models in relation to insurance, underwriting techniques and risk assessment tools that are tailored to address autonomous vehicles capabilities and limitations. Moreover, government and regulatory bodies are holding with legal polices related to self-driving car insurance market. In addition, regulations that are governing testing of vehicles, operations and insurance requirements that varies legally are evolving with changing technology, as the public acceptance for technology is increasingly growing.

Top Impacting Factors

Growing Advancements in Autonomous Technology

The improvement in autonomous technology is resulting in automakers and technology companies to invest in the development and deployment of self-driving cars. The increasing adoption of automatic vehicles is expanding the potential customer base for self-driving car insurance market, driving market growth. Furthermore, regulations that govern the legal requirements of self-driving cars are influencing market dynamics. Consistent regulatory frameworks are resulting in the certainty for insurers and encouraging investment in autonomous vehicle insurance products. Regulatory initiatives are aiming at promotion of safety, protection of users and allocation of liability to design and shape Insurance risk assessment and underwriting practices. Moreover, public perception and increasing curiosity for self-driving cares are two important factors that are playing a critical role in accelerating the demand for self-driving car insurance market. Consumers are becoming more familiar with autonomous technology and the potential benefits associated with the technology, thus increasing the demand for insurance products that are tailored specifically to autonomous vehicles. Factors that are influencing customer acceptance include safety concerns, technological trust, perceived benefits and personal experiences associated with autonomous vehicles. Therefore, all these factors are expected to drive the growth of self-driving car insurance market for the forecast period.

Regulatory Complexities

The regulations that govern the policies of self-driving car are subjected to swift changes as the technology is evolving. The increasing uncertainty in relation to insurance requirements, liability standards and regulatory compliance is creating challenge for insurers that are searching to enter the market and develop insurance products are that are more tailored to autonomous vehicles. Furthermore, to meet the regulatory requirements for self-driving car insurance market can be expensive and time-consuming for insurers. Compliance with diverse regulations across different jurisdictions may require significant resources for legal research, regulatory analysis, and administrative overhead, particularly for insurers operating in multiple regions. Moreover, determining the liability in accidents involving self-driving cars is a complex issue that involves clear legal frameworks and standards. Regulatory uncertainty regarding liability allocation between human drivers, vehicle manufacturers, software developers, and other stakeholders can complicate insurance underwriting, claims settlement, and dispute resolution processes. Therefore, all these factors are expected to restrain the growth of self-driving car insurance market for the forecast period.

Increasing Purchase of Vehicles

The increase in purchasing of vehicles is creating a larger pool for potential customers in the self-driving car insurance market. As each unit of new vehicle is being purchased, it is providing an opportunity to the insurer to offer coverage that is customized according to the specific needs of autonomous vehicle owners. Furthermore, today various latest motors come with advanced driver assistance systems (ADAS) and semi-autonomous features. The consumers are becoming more accustomed to the above following technologies as their interest is growing in the fully automatic vehicles. This trend is creating an increasing demand for insurance products that cater specifically to unique risks associated with self-driving cars such as software malfunctions and cybersecurity threats. Moreover, the purchasing of new vehicles is involving the replacement of older models. The consumers are switching towards latest vehicles that consist of more advanced technology, thus creating a market for self-driving car insurance market. Therefore, all these factors are expected to provide self-driving car insurance market opportunity during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the self-driving car insurance market analysis from 2022 to 2032 to identify the prevailing opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of self-driving car insurance market opportunity segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global self-driving car insurance market trends, key players, market segments, application areas, and market growth strategies.

Self-Driving Car Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 88.1 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Application |

|

| By Insurance Coverage |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | adrian flux insurance services, General Motors, Mobile Eye, Allianz, Mercedes Benz, Ford, Audi, Tesla, Volkswagen, Nissan |

Analyst Review

Self-Driving car insurance refers to coverage for automated vehicles, as they usually offer advanced safety features. The insurance premiums on self-driving cars may be lower than insurance fees for regular automobiles.

Key players in the self-driving car insurance market adopted different strategies to sustain their growth in the market. For instance, in May 2020, Tokio Marine, world largest property and casualty insurer launched an AI solution to process auto damage across its insurance operations in Japan. The AI solution uses computer vision to analyze automobile damage images in almost real-time and interpret them as a human would. Tokio Marine intends to leverage artificial intelligence (AI) to comprehend the entire spectrum of repair options at its disposal, encompassing suggested repairs, paint and blend procedures, and labor hours needed. By eliminating inefficiencies from the process and speeding up the remote assessment of claims, AI can help insurers and repairers agree on fixes more rapidly, getting consumers back on the road sooner. A significant Japanese insurer has integrated an AI system for auto damage assessment into the claims procedure for the first time. Furthermore, in March 2022, Berkshire Hathaway Inc., acquired Alleghany an insurance company for $11.6 billion Moreover, in February 2022 HSBC acquired AXA Singapore. The activities of AXA Singapore are an asset to HSBC's current local insurance division, HSBC Insurance Singapore Pte Ltd formerly known as HSBC Life Singapore. Several distribution channels, a sizable retail and corporate client base, and complementary insurance products offered by AXA Singapore would enable HSBC to significantly expand and broaden its wealth and insurance operations in Singapore. These players have adopted product launch strategy to increase their market penetration and strengthen their position in the self-driving car insurance industry.

The new advancements and innovations made by automotive companies in the self-driving technology is accelerating the position of technology giants. Developments in sensors, artificial intelligence, machine learning, and connectivity are increasingly progressing towards fully automated vehicles.

Personal is the leading application of Self-Driving Car Insurance Market

North America is the largest regional market for Self-Driving Car Insurance.

$22,022.32 million is the estimated industry size of Self-Driving Car Insurance.

Tesla, Nissan, Adrian Flux Insurance Services, Ford, Audi, Mercedes Benz, Volkswagen, General Motors, Mobile Eye and Allianz.

Loading Table Of Content...

Loading Research Methodology...