Self-Driving EV Market Research, 2031

The global self-driving electric vehicle market size was valued at $0.23 trillion in 2021 and is projected to reach $5 trillion in 2031, registering a CAGR of 36.3%.

The self-driving electric vehicle market is segmented into Vehicle Type, Type, and Level of Automation.

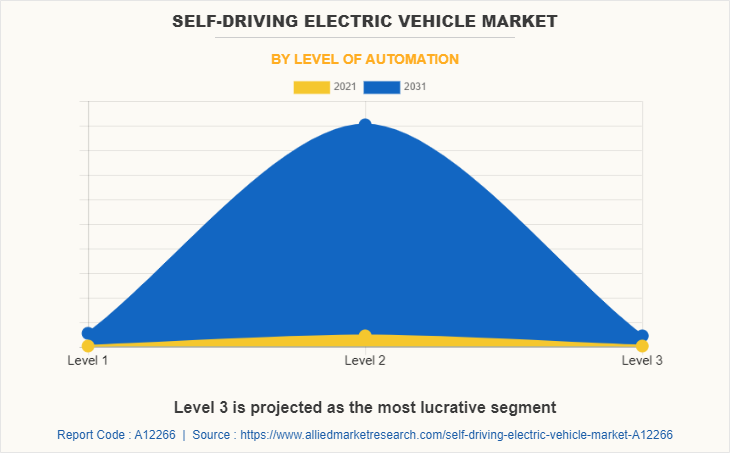

A self-driving electric vehicle is a vehicle that is powered by an electric motor and does not require the control of a human driver to operate the vehicle safely. These vehicles are also known as autonomous or “driverless” electric vehicles. Self-driving electric vehicles use a combination of sensors and software to control, navigate and drive the vehicle. Self-driving electric vehicles include five levels of automation.

Factors such as growth in the rise in demand for low-emission, and safe transportation, the surge in the development of safety features, and supportive government initiatives drive the growth of the self-driving electric vehicle market. However, high manufacturing and maintenance costs, and privacy and security issues hinder the growth of the market. Furthermore, technological advancement & research, and the growing use of self-driving electric vehicles for ride-hailing and delivery services offer remarkable growth opportunities for the players operating in the market.

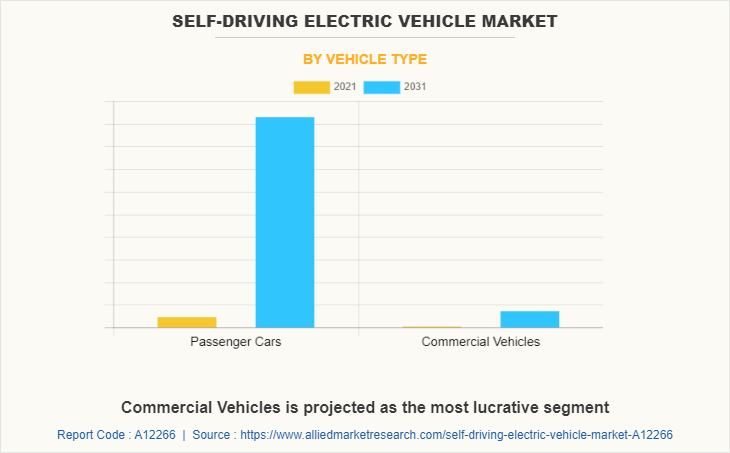

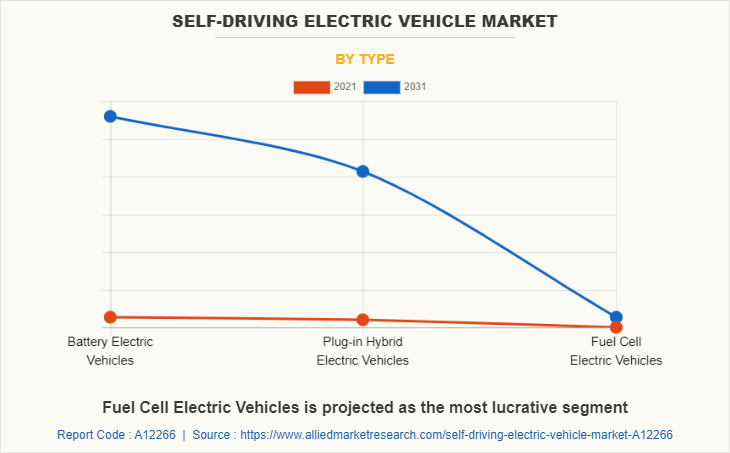

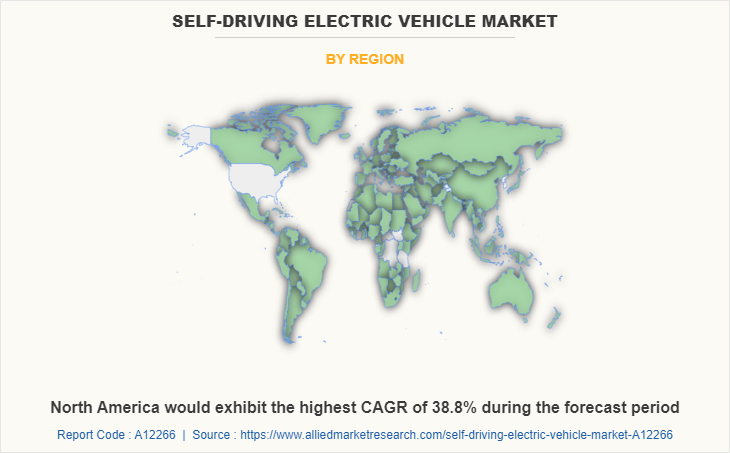

The self-driving electric vehicle market is segmented on the basis of the level of automation, vehicle type, type, and region. By level of automation, it is bifurcated into Level 1, Level 2, and Level 3. By vehicle type, it is fragmented into passenger cars, and commercial vehicles. By type, the market is classified into battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific includes countries such as China, India, Japan, South Korea, and the rest of Asia-Pacific. Advancements in automation technology and new initiatives by governments of various countries in the region are expected to drive the growth of the market. Supportive regulatory frameworks, government funding, and investments in autonomous technologies are expected to drive the growth of the market in the region.

Moreover, automakers and autonomous technology companies develop collaboration strategies to design and commercialize electric autonomous vehicles for various industries. For instance, in September 2021, Chinese autonomous driving company WeRide launched its first cargo van for urban logistics services. WeRide is expected to commercialize its first self-driving van at scale by collaborating with Chinese automobile manufacturer Jiangling Motors (JMC) and Chinese express delivery company ZTO Express. The company claims that the van is equipped with Level 4 autonomous capabilities. Such factors are expected to drive the growth of the self-driving EV market in the region.

Europe comprises Germany, France, the UK, Italy, and the rest of Europe. Investment by governments of various countries for the development of self-driving electric vehicles and the launch of autonomous vehicles boosts the growth of the market in Europe. The rise in urbanization and increase in government support for vehicle safety, and the surge in the adoption of Advanced Driver Assistance Systems (ADAS) in electric cars. Moreover, the fast integration of new technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), cloud computing, and others. In addition, the increase in huge investment in the development of autonomous vehicles is expected to propel the growth of the market. For instance, in August 2022, Britain announced its plans to develop new laws and invest $119.09 million in funding for the production of self-driving vehicles by 2025.

The leading self-driving electric vehicle manufacturers are aiming to increase the self-driving electric vehicle market share with the launch of autonomous electric vehicles in the Asia-Pacific region. For instance, in August 2021, BMW Group unveiled the BMW iX5 Hydrogen, a Hydrogen NEXT concept car at the IAA Mobility 2021 in Munich. In addition, the company started the production of BMW iX5 Hydrogen model at the Research and Innovation Centre's pilot plant in Munich in December 2022. Numerous manufacturers collaborate with technology companies to launch self-driving electric vehicles in the market. For instance, in September 2021, Volkswagen and Argo AI (an autonomous driving technology company) announced the launch of the first ID Buzz test vehicle for autonomous driving. The companies shared plans to test and commercially scale the jointly developed, fully electric self-driving van.

Some leading companies profiled in the self-driving electric vehicle market report comprise Tesla, BMW AG, Volkswagen AG, Ford Motor Company, Volvo Group, Daimler AG, General Motors, Toyota Motor Corporation, Honda Motor Co. Ltd, and Hyundai Motor Company.

Rise in demand for low-emission, and safe transportation

Gasoline being a fossil fuel is not a renewable source of energy and is anticipated to get exhausted in the future. To support sustainable development, it is important to develop and use alternative sources of fuel. This involves the use of electric vehicles, which do not use gas and are more economical than conventional vehicles. Therefore, there is an increase in demand for emission-free vehicles across the globe, combined with the rising cost of fuel.

Moreover, according to National Highway Traffic Safety Administration, 38,824 number of people were killed in motor vehicle crashes in the year 2020. According to the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA), 94% of severe traffic accidents happen owing to human errors. A study of NHTSA defines the causes of traffic accidents as driver-related, vehicle-related, road-related, and atmospheric factors.

Self-driving electric vehicles emit fewer greenhouse gases and air pollutants and are able to contribute to traffic safety, increase economic and social benefits, and contribute to environmental protection. Self-driving electric vehicles sense the environment using sensors including radars, lidars, sonars, cameras, and others.

The vehicles have on-board sensors and evaluation equipment to receive a 360-degree view of their surroundings. Self-driving electric vehicles reduce the element of human error in driving and decrease the events of accidents and crashes. These vehicles provide efficient driving which results in more efficient fuel usage that reduces vehicle emissions. Therefore, an increase in the demand for safe and low-emission transport is expected to drive the growth of the self-driving electric vehicle market.

Surge in the development of safety features

Advanced Driving Assistance Systems (ADAS) are electronic systems that assist drivers by automating, adapting, and improving vehicle systems to make driving safer and more comfortable. ADAS receives input from multiple data sources, including radar, LiDAR, image sensors, and computer vision. There is an increase in the development of driver assistance systems (ADAS) to reduce road accidents and increase safety. These safety features take control over safety-critical functions (such as steering and braking) from the driver. Active safety measures such as Automatic Emergency Braking (AEB) and Lane Departure Warning (LKA) are examples of (semi-automated) ADAS technologies that help avoid human error and prevent accidents.

Moreover, manufacturers are increasingly installing safety systems and features in electric vehicles. For instance, in December 2022, EKA, an electric vehicles manufacturer, and a subsidiary of Pinnacle Industries Limited, and NuPort Robotics, a Canadian autonomous trucking company, announced the deployment of Level 2 autonomy with ADAS features for EKA Mobility’s electric bus. Therefore, such developments to create technologically advanced, efficient, and safe transportation with the help of safety features are expected to boost the growth of the market.

High manufacturing and maintenance cost

Self-driving electric vehicles consist of more than 50 sensors including LiDAR, RADAR, and camera, which are installed all around the vehicle and help build a safety circumference. Any obstacle approaching the vehicle can be immediately detected using these sensors. However, these sensors are not economically priced. A high-quality long-range LiDAR can even cost up to $75,000. And apart from the hardware cost, the vehicle also needs software, which can extract information from the sensors and control the vehicle. Therefore, vehicle production and large-scale deployment with cost-effective hardware pose to be major challenges for manufacturers.

Self-driving electric vehicles require a variety of equipment and services. Self-driving electric vehicles require robust and redundant components that are professionally installed and maintained, increasing maintenance costs. Moreover, vehicle accessories such as remote start, active lane departure warnings, and security cameras typically cost thousands of dollars. It also requires a subscription to a navigation and security service. Vehicle owners need to subscribe to frequent software updates and navigation map services. In addition, sensors (cameras, radar, ultrasound) in advanced driver assistance systems are costly, which adds to the cost of the vehicle. Therefore, such high costs cost of a self-driving electric vehicle is expected to hinder the growth of the market.

Privacy and security issues

Self-driving electric vehicle technology can be manipulated for entertainment or crime. Due to their high degree of connectivity, self-driving electric vehicles can become attractive targets for cybercriminals for stealing financial data from drivers or weaponizing vehicles to carry out high-level terrorist attacks. Artificial intelligence (AI) systems make self-driving vehicles vulnerable.

These AI systems work continuously to recognize traffic signs and lane markings, recognize vehicles, estimate speed, and plan the route ahead. In addition to unintended threats such as sudden malfunctions of AI systems, there are intentional attacks aimed specifically at damaging safety-critical functions of AI systems. Such changes can cause AI systems to misclassify objects, potentially leading to the unsafe operation of self-driving vehicles. Therefore, such privacy concerns associated with self-driving electric vehicles are expected to hamper the growth of the market.

Technological advancement and research

Artificial Intelligence (AI) drives the development of level-4 and level-5 autonomous vehicles. Moreover, continuous research to achieve safe and smooth all-weather autonomous driving is expected to drive the growth of the market. For instance, in September 2022, researchers from the University of Oxford's Department of Computer Science teamed up with colleagues from Turkey's Bogazici University to develop a new artificial intelligence (AI) that is expected to enable autonomous vehicles (AVs) to achieve safer and more reliable navigation capabilities in any weather conditions.

In addition, Vehicle-to-Everything (C-2VX) harnesses the power of 5G for vehicle-to-vehicle (V2V), vehicle-to-vehicle (V2I), and vehicle-to-vehicle (V2N) communications. The low latency of 5G is expected to take autonomous driving to the next level.

5G will enable self-driving cars to react to their surroundings, detect obstacles, and relay this information to on-board computers in real-time. For instance, in June 2022, the 5G Carmen project, funded by the European Commission and coordinated by the Bruno Kessler Foundation introduced an autonomous driving pilot that combines low-latency vehicle features, autonomous driving, and driver assistance using a 5G mobile network across the borders from Italy to Austria and Austria to Germany. Such technological advancement and research are expected to bring significant opportunities for the growth of the market

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the self-driving electric vehicle market analysis from 2021 to 2031 to identify the prevailing self-driving electric vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the self-driving electric vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global self-driving electric vehicle market trends, key players, market segments, application areas, and market growth strategies.

Self-Driving Electric Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5007.9 billion |

| Growth Rate | CAGR of 36.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 417 |

| By Vehicle Type |

|

| By Type |

|

| By Level of Automation |

|

| By Region |

|

| Key Market Players | Daimler AG, Tesla, Ford Motor Company, TOYOTA MOTOR CORPORATION, General Motors, HONDA MOTOR CO.,Ltd, Volkswagen AG, hyundai motor company, BMW AG, Volvo Group |

Analyst Review

The global self-driving electric vehicle market is expected to witness growth owing to rise in the popularity of low-emission vehicles, and an increase in the adoption of safety systems.

Moreover, there has been an increase in testing and trials of autonomous electric vehicles for taxi and ride-hailing services. For instance, in October 2022, Motional signed a 10-year agreement to supply Hyundai's IONIQ 5-based level 4 autonomous vehicles to a U.S.-based ride-hailing company Uber Technologies Inc. Under this agreement, Motional started the supply of the all-electric IONIQ 5 driverless robot taxis to Uber. Such developments to explore the application of level 4 autonomous vehicles in taxi and ride-hailing services are expected to boost the growth of the market. In addition, there has been greater interest in the development of self-driving electric vehicle systems to electrify and improve the delivery of goods and services. For instance, in May 2022, Cruise, an autonomous subsidiary of General Motors, and BrightDrop announced to work together to develop a self-driving system that can be used in electric vans, opening up the possibility of autonomous delivery vehicles.

Furthermore, manufacturers aim to expand their electric and autonomous vehicle lineup and technology. For instance, in June 2021, General Motors announced to increase in the spending on electric and autonomous vehicles to $35 billion through 2025, a 30% increase from plans announced in the year 2020. The plan aims to compete against well-established players such as Volkswagen, Tesla, and others

The estimated industry size of Self-Driving Electric Vehicle is $0.23 trillion.

The top companies to hold the market share in Self-Driving Electric Vehicle are Tesla, BMW AG, Volkswagen AG, Ford Motor Company, Volvo Group, Daimler AG, General Motors, TOYOTA MOTOR CORPORATION, HONDA MOTOR Co. LTD, and Hyundai Motor Company.

The leading vehicle type of Self-Driving Electric Vehicle Market is passenger cars.

The largest regional market for Self-Driving Electric Vehicle is Asia-Pacific.

The upcoming trends of Self-Driving Electric Vehicle Market include integration of Artificial Intelligence (AI) to develop level 3, level 4 and level 5 autonomous electric vehicles, and rise in use of self-driving electric vehicles for ride-hailing and delivery services.

Loading Table Of Content...