Self Service Supermarket Sensor Market Research, 2032

The global self service supermarket sensor market size was valued at $3.4 billion in 2022, and is projected to reach $10.7 billion by 2032, growing at a CAGR of 12.6% from 2023 to 2032.Connectivity, digital transformation, and data are critical drivers of digital transformation. Businesses use digitization to create new products and services in order to improve customer satisfaction. Self-checkout technologies help customers purchase and pay via digital and contactless payments without the need for retail workers. The rising use of cashless payment options has led to increase in demand for self-checkout systems. These checkout systems are used to reduce customer wait times and give a unique shopping experience. Also, there is a rapid increase in electronic payment transactions worldwide due to the increased use of smartphones. In addition, renowned market players are collaborating to deploy self-checkout systems in retail establishments.

Automation is rapidly replacing traditional forces of transformation across several global industries. Self-checkout systems are likely to become more prevalent in warehouses and store operations due to the increased adoption of automation across sectors and industries like retail and hospitality. Self-check systems are becoming more popular due to features such as self-scan, pay, and order, which avoid long lines. In addition, the retail industry has significantly increased its adoption of robotic and automation products in recent years owing to the declining workforce.

There are various technical difficulties in installing self service supermarket sensor market systems as it can be difficult to combine several sensors, such as weight sensors, barcode scanners, and computer vision cameras, into a cohesive system. Sensor systems utilized in self-service supermarkets produce a lot of data, including information on inventory levels, consumer purchases, and traffic trends. It can be quite difficult to manage this data and make sure it is secure and accurate.

Increasing IoT adoption and technological advancements in retail settings are the main drivers of self service supermarket sensor industry. Retailers are investing into technology to reduce in-store problems. These problems are frequently connected to inventory mapping, customer experience, payment, and product information identification. Laser motion sensors, for instance, help retailers identify items that have been shoplifted or that have not been scanned at self-checkout counters. In addition, the implementation of self checkout (SCO) systems enables consumers to check out quickly without assistance from staff, offers in-store promotional opportunities, and aids customers in understanding various product features. Self-checkout systems, therefore, act as an additional touchpoint, enhancing customer engagement and the shopping experience for retailers.

The key players profiled in self service supermarket sensor market forecast report include Diebold Nixdorf, Incorporated ECR Software Corporation, FUJITSU, Gilbarco Inc., ITAB Group, NCR Corporation, Pan-Oston, PCMS Group Ltd., Strong Point, and Toshiba Global Commerce Solutions. Investment and agreement are common strategies followed by major market players. For instance, in September 2022, MUJI, a leading retailer, announced the installation of MishiPay's Self-Checkout Kiosks at its London stores. The self-service kiosks complement MishiPay's Mobile Self-Checkout technology, which the brand has already deployed across its European stores, to provide a complete self-checkout solution and enable autonomous checkout for all shoppers.

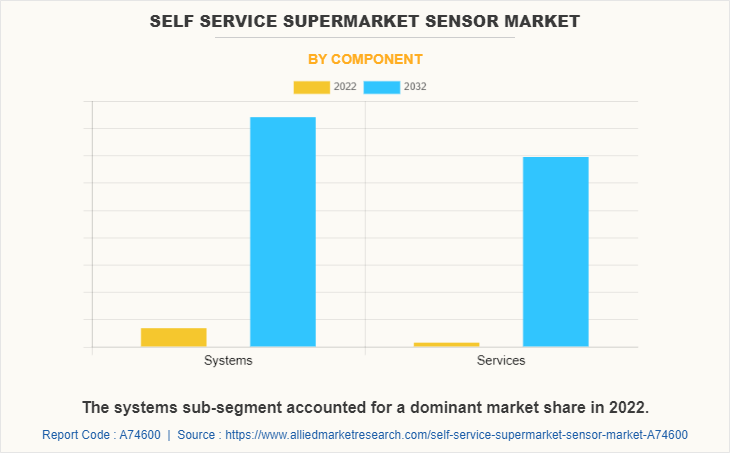

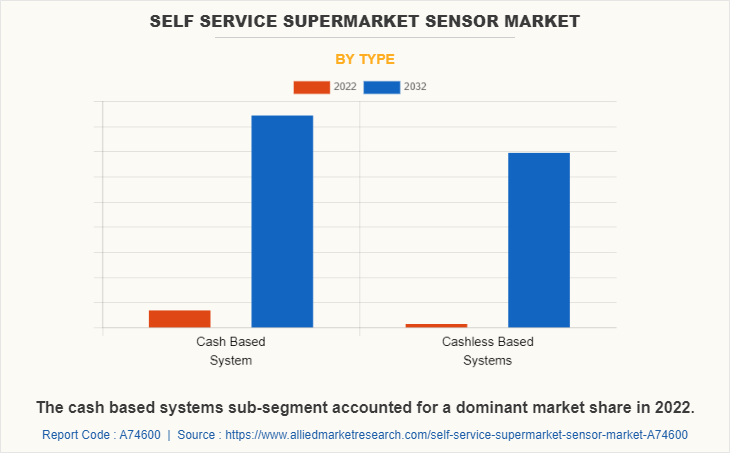

The self service supermarket sensor market overview is segmented on the basis of component, type, and region. By component, the market is divided into systems and services. By type, the market is classified into cash based systems and cashless based systems. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The self service supermarket sensor market is segmented into Component and Type.

By component type, the systems sub-segment dominated the market in 2022. The dominance of the systems sub-segment is due to rising adoption and acceptance of self-service checkout systems by supermarkets and retailers. These systems offer advantages such as increased checkout speed, labor costs, and superior client convenience. As a result, the demand for advanced sensor-based systems continues to rise, with the surge of this sub-segment in the self service supermarket sensor market. These are predicted to be the major factors driving the self service supermarket sensor market growth during the forecast period.

By type, the cash based systems sub-segment dominated the global self service supermarket sensor market share in 2022. Self-service checkout systems in supermarkets typically offer buyers the alternative to pay using cash, credit/debit cards, or mobile charge methods. However, the cash based sub-segment, which refers to customer’s usage of cash as their major fee approach at self-checkout stations, has been the dominant choice. There are several factors that have contributed to the dominance of the cash-based sub-segment. Majorly, money remains a widely accepted and familiar form of payment for many consumers.

By region, North America dominated the global market in 2022 and is projected to be the fastest-growing region during the forecast period. Firstly, North America has an incredibly developed retail sector, categorized by wide variety of supermarkets and grocery stores that have adopted self-service checkout systems. The adoption of self-service technology in the region has been driven by various factors such as the need for operational efficiency, price reduction, and improved customer experience. Furthermore, the presence of major global players in the retail technology industry, together with sensor producers and solution providers, has contributed to the dominance of North America. These businesses have made significant investments, primarily in R&D, to drive innovation and integrate advanced sensor technologies into self service supermarket sensor market opportunity in North America region.

Impact of COVID-19 on the Global Self Service Supermarket Sensor Industry

- The pandemic led to an increase in demand for contactless retail solutions, such as self-service checkout systems. Consumers have shown a preference for minimizing physical contact and interactions during purchasing. Customers who use self-service checkout can make their purchases fast and with little involvement with store workers.

- Supermarkets had put in place a variety of safety precautions to safeguard both customers and personnel. To maintain proper hygiene, self-service checkout kiosks had been outfitted with sanitization stations.

- Consumer behavior has changed as a result of the pandemic, including a greater emphasis on necessities and a preference for faster, more efficient purchasing experiences. Self-service checkout technologies have aided in meeting shifting consumer expectations by speeding up the checkout process and decreasing line-ups.

- The pandemic has prompted retailers to investigate new technology and innovations to improve the self-service checkout experience. This includes incorporating mobile payment options, scan-and-go technologies, and enhanced user interfaces to further speed the process and meet evolving consumer preferences.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the self service supermarket sensor market analysis from 2022 to 2032 to identify the prevailing self service supermarket sensor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the self service supermarket sensor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global self service supermarket sensor market trends, key players, market segments, application areas, and market growth strategies.

Self Service Supermarket Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.7 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Component |

|

| By Type |

|

| By Region |

|

| Key Market Players | ECR Software Corporation, ITAB Group, Fujitsu Limited, Diebold Nixdorf, Incorporated., PCMS Group Ltd., Pan-Oston, Gilbarco Inc., Strong Point, Toshiba Corporation., NCR Corporation |

A combination of cost savings, convenience, improved inventory management, technological advancements, and shifting consumer behavior are factors driving the market for self-service supermarket sensors. In the upcoming years, the market is anticipated to grow as long as these trends persist.

The major growth strategies adopted by self service supermarket sensor market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global Self service supermarket sensor market in the future.

Diebold Nixdorf, Incorporated, ECR Software Corporation, and FUJITSU are the major players in the Self service supermarket sensor market.

The cash based systems sub-segment of the type acquired the maximum share of the global self service supermarket sensor market in 2022.

Supermarkets, hospitality service providers, and retailers are the major customers in the global self service supermarket sensor market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global self service supermarket sensor market from 2022 to 2032 to determine the prevailing opportunities.

Customers can check out rapidly and easily without having to wait in long lines owing to self-service checkout systems. These applications are projected to drive the adoption of self service supermarket sensors. Also, customers’ overall shopping experiences can be enhanced and customer loyalty can be increased.

Self-service checkout systems can assist supermarkets in lowering labor costs due to the fact that they require fewer staff members to operate. Supermarkets can lower the chance of mistakes such as pricing, product inventory management, and theft by automating the checkout process. These current trends are projected to influence the self service supermarket sensors market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...