Semiconductor Foundry Market Research, 2032

The global semiconductor foundry market was valued at $106.9 billion in 2022 and is projected to reach $231.5 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032.

The semiconductor foundry industry holds a crucial position in the global electronics sector. They empower a diverse range of companies, from emerging startups to well-established technology leaders, to introduce their semiconductor designs to the market without the necessity for substantial investments in manufacturing facilities. This fosters innovation and competition within the semiconductor industry, propelling progress across various technological domains, encompassing consumer electronics, automotive applications, and beyond.

![]()

A semiconductor foundry, often known as a "foundry," is a specialized facility focused on the production of integrated circuits (ICs) or microchips. In contrast to integrated device manufacturers (IDMs) that handle both chip design and production, foundries concentrate exclusively on the manufacturing process. They offer a crucial service to companies and designers who may not have the necessary resources or infrastructure to produce semiconductors themselves. Foundries typically operate on a contractual basis, manufacturing chips based on the specifications and designs provided by their clients, commonly known as fabless semiconductor companies.

The procedures within a semiconductor foundry industry entail a series of intricate steps. The process of fabricating a chip commences with the fabrication of a silicon wafer, which serves as the foundation for constructing integrated circuits. With the help of photolithography and etching techniques, detailed patterns are etched onto the silicon wafer's surface, determining the electronic elements of the circuits. This is followed by processes such as deposition, where materials are applied onto the wafer, and doping, a method to modify specific areas to alter their electrical characteristics. Subsequent stages involve thermal treatments and metallization, facilitating the interconnection of various components. Finally, the wafer is divided into individual chips and subjected to testing to ensure operational functionality.

Segment Overview

The semiconductor foundry market is segmented into node size, applications, and region.

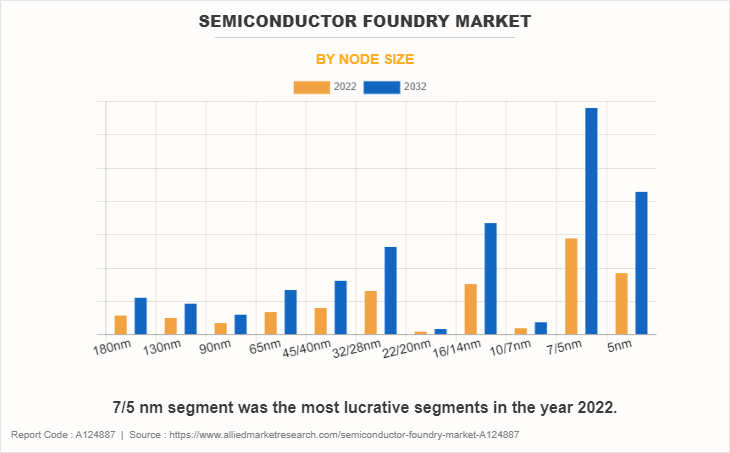

By node size, it is divided into 180nm, 130nm, 90nm, 65nm, 45/40nm, 32/28nm, 22/20nm, 16/14nm, 10/7nm, 7/5nm, and 5nm. In 2022, the 7/5nm segment dominated the market, and it is expected to acquire a major market share by 2032.

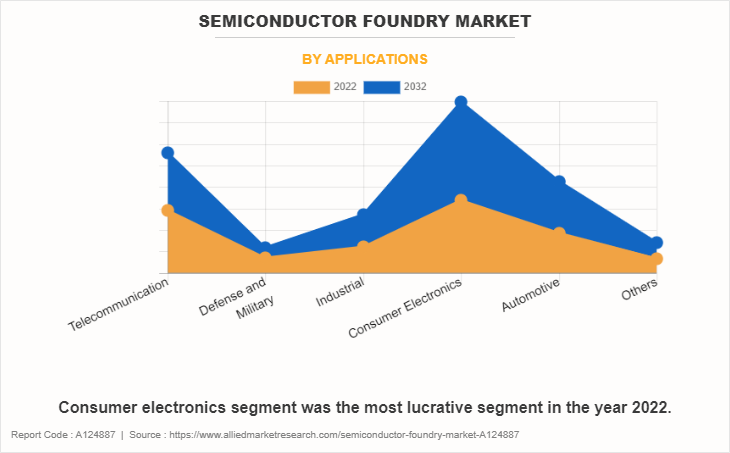

By application, it is segmented into telecommunication, defense and military, industrial, consumer electronics, automotive, and others. In 2022, the consumer electronics segment dominated the market, and it is expected to acquire a major market share by 2032.

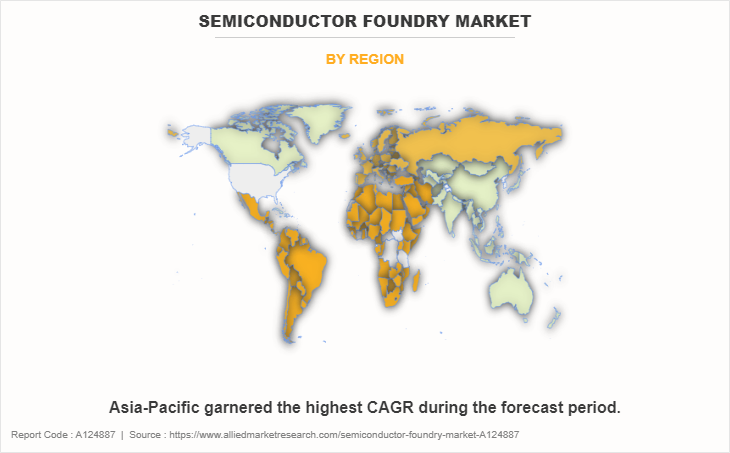

On the basis of region, the semiconductor foundry market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global semiconductor foundry market players that have been provided in the report include Globalfoundries Inc., Hua Hong Semiconductor Limited, Intel Corporation, Micron Technology, Inc., Samsung Electronics Co. Ltd, Semiconductor Manufacturing International Corporation (SMIC), Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, United Microelectronics Corporation, and X-FAB Silicon Foundries SE. To drive semiconductor foundry growth, a comprehensive strategy is crucial. This includes continuous investment in R&D to push chip technology boundaries, securing a competitive edge. Strong partnerships with design firms and an innovation-driven ecosystem enhance collaboration. Prioritizing advanced manufacturing processes ensures technological leadership. Efficiency, sustainability, and adaptability are key for long-term success, positioning the foundry at the forefront of the semiconductor foundry market size.

Region Analysis

Country-wise, the U.S. acquired a prime share in the semiconductor foundry market in North America and it is expected to grow at a significant CAGR during the forecast period.

In Europe, the UK, dominated the semiconductor foundry market share, in terms of revenue, in 2022 and it is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's semiconductor foundry market growth with a CAGR of 10.3%.

In Asia-Pacific, The rest of Asia-Pacific is expected to emerge as a significant market in the semiconductor foundry market industry, owing to a significant rise in investment by prime players due to an increase in the growth of manufacturing and packaging industries in rural and urban regions.

In the LAMEA region, Latin America held a significant market share in 2022. The LAMEA semiconductor foundry market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing the semiconductor foundry across this region in various applications such as healthcare, automotive, and others. Moreover, the Africa region is expected to grow at a high CAGR of 6.2% from 2023 to 2032.

Top Impacting Factors

The semiconductor foundry market forecast is expected to expand significantly during the forecast period owing to an increase in the utilization of consumer electronics, and a surge in Internet of Things (IoT) technology. In addition, the market is anticipated to benefit from an increase in investments in semiconductor wafer fabrication equipment and materials, during the forecast period. On the contrary, the complexities in manufacturing associated with the semiconductor foundry market outlook restrain the market growth during the forecast period.

Historical Data and Information

The global semiconductor foundry market is highly competitive, owing to the strong presence of existing vendors. Vendors of the semiconductor foundry market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

- In February 2023, Texas Instruments announced its plan to build a second 300-millimeter semiconductor wafer fabrication plant (or fab) in Lehi, Utah. The new fab will be located next to the company’s existing 300-mm semiconductor wafer fab and will operate as a single fab once completed.

- In June 2023, Samsung Electronics Co., Ltd., a world leader in advanced semiconductor technology, announced its latest foundry technology innovations and business strategy at the 7th annual Samsung Foundry Forum (SFF) 2023.

- In October 2022, Micron announced its plans to build a memory chip fabrication plant in upstate New York. It is anticipated that the foundry will be the size of 40 football fields and create about 50,000 jobs. It may spend up to $100B over the next 20 years on the facility.

- In May 2021, Intel Corporation announced an investment of $3.5 billion to equip its New Mexico operations for the manufacturing of advanced semiconductor packaging technologies, including Foveros, Intel’s breakthrough 3D packaging technology.

- In September 2023, GlobalFoundries announced the official opening of its US$4 billion expansion fabrication plant in Singapore. The expansion fab will produce an additional 450,000 wafers (300mm) annually, raising GF Singapore’s overall capacity to approximately 1.5 million wafers (300mm) each year.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the semiconductor foundry market analysis from 2022 to 2032 to identify the prevailing semiconductor foundry market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the semiconductor foundry market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global semiconductor foundry market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global semiconductor foundry market trends, key players, market segments, application areas, and market growth strategies.

Semiconductor Foundry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 231.5 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 289 |

| By Node Size |

|

| By Applications |

|

| By Region |

|

| Key Market Players | GLOBALFOUNDRIES Inc., Hua Hong Semiconductor Limited, Semiconductor Manufacturing International Corporation (SMIC), United Microelectronics Corporation, Intel Corporation, Samsung Electronics Co. Ltd, Texas Instruments Incorporated, X-FAB Silicon Foundries SE, Micron Technology, Inc., TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED |

Analyst Review

According to the perspectives of CXOs of a leading semiconductor foundry market company, there is a strong expectation for significant growth in the market in the coming years. These industry leaders believe that several factors will drive this growth and create ample opportunities for companies operating in the semiconductor foundry sector.

The semiconductor foundry sector is positioned for substantial expansion in parallel with the rising need for semiconductors across diverse applications. As technology progresses, semiconductors have become essential components in a broadening range of products and industries. This growth is propelled by trends like the Internet of Things (IoT), 5G telecommunications, artificial intelligence, and autonomous vehicles, all heavily reliant on advanced semiconductor technology. Foundries are uniquely placed to take advantage of this upsurge in demand, providing the expertise and infrastructure required to produce high-quality chips on a large scale.

A key driver behind the development of semiconductor foundries is the increase in use of IoT devices, which consists of an extensive array of products, from smart household appliances to industrial sensors, all utilizing specialized chips. Foundries play a vital role in furnishing the manufacturing capabilities essential for crafting tailor-made semiconductors for these applications. In addition, the advent of 5G technology is generating a surge in the need for high-performance chips capable of handling heightened data processing and transmission requirements. Foundries equipped with state-of-the-art processes are well situated to meet this demand and steer growth within the industry.

Furthermore, the ongoing advancement of artificial intelligence and machine learning technologies is spurring demand for specialized AI hardware. These applications call for chips with augmented computational prowess, an achievement possible through advanced semiconductor processes. Foundries that channel resources into research and development for producing high-performance AI chips will lead the way in this expanding market. The rise of autonomous vehicles presents a significant growth prospect for semiconductor foundries. These vehicles rely on a sophisticated ensemble of sensors and processing units, making advanced semiconductor technology a vital ingredient in their development. Foundries stand to gain from increased demand for custom-made chips tailored to this application as the automotive industry shifts towards autonomous solutions.

Thus, the semiconductor foundry industry is on the edge of substantial growth, propelled by the expanding use of semiconductors across a wide spectrum of applications, from IoT devices to 5G networks, AI technologies, and autonomous vehicles. Foundries that invest in cutting-edge processes and focus on meeting the distinct demands of these applications will be strategically positioned to thrive in this dynamic and evolving market

Use of 7/5nm technology node is the upcoming trends of Semiconductor Foundry Market in the world.

Consumer electronics is the leading application of Semiconductor Foundry Market.

North America and Asia-Pacific is the largest regional market for Semiconductor Foundry

The global semiconductor foundry market was valued at $106.9 billion in 2022.

Globalfoundries Inc., Hua Hong Semiconductor Limited, Intel Corporation, Micron Technology, Inc., Samsung Electronics Co. Ltd, Semiconductor Manufacturing International Corporation (SMIC), Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, United Microelectronics Corporation, and X-FAB Silicon Foundries SE are the top companies to hold the market share in Semiconductor Foundry.

Loading Table Of Content...

Loading Research Methodology...