Semiconductor IP Market Summary, 2032

The global semiconductor IP market was valued at $6.6 billion in 2022, and is projected to reach $14.6 billion by 2032, growing at a CAGR of 8.3% from 2023 to 2032. Semiconductor IP comprises pre-designed and pre-verified functional elements, necessary for crafting integrated circuits (ICs) and System-on-Chip (SoC) devices. These elements, including processors, memory modules, analog circuits, and diverse interface modules, are developed and licensed by specialized companies to semiconductor manufacturers and system designers.

![]()

Semiconductor IP is pivotal in expediting the chip design process, curbing development expenses, and enhancing overall operational efficiency. By integrating proven and standardized IP cores into their designs, manufacturers and designers can concentrate on application-specific aspects, rather than re-creating foundational components. This strategy is particularly crucial in an era characterized by intricate and advanced semiconductor technologies.

Segment Review:

The market is segmented into design IP, IP source, IP core, and application.

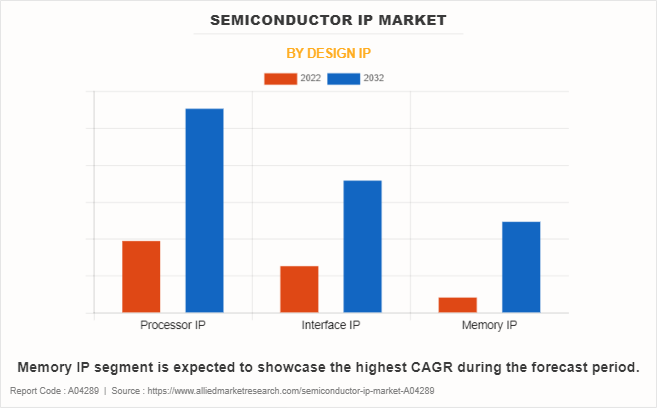

By design IP, the semiconductor IP market size is segmented into processor IP, Interface IP, and memory IP. In 2022, processor IP dominates the market in terms of revenue and is expected to follow the same trends during the forecast period.

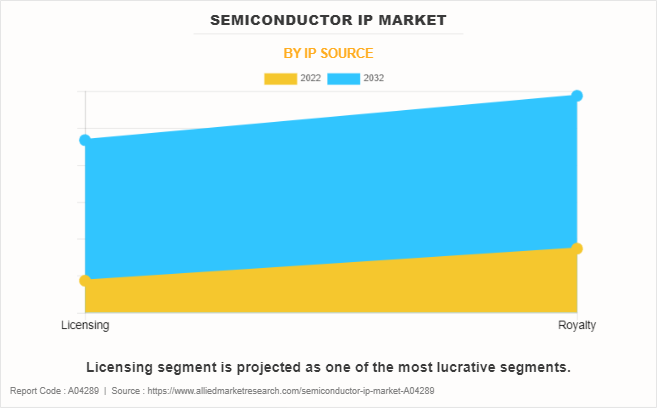

By IP source, the semiconductor IP market growth is divided into licensing and royalty. In 2022, the licensing segment is expected to grow at a high CAGR during the period of 2023-2032.

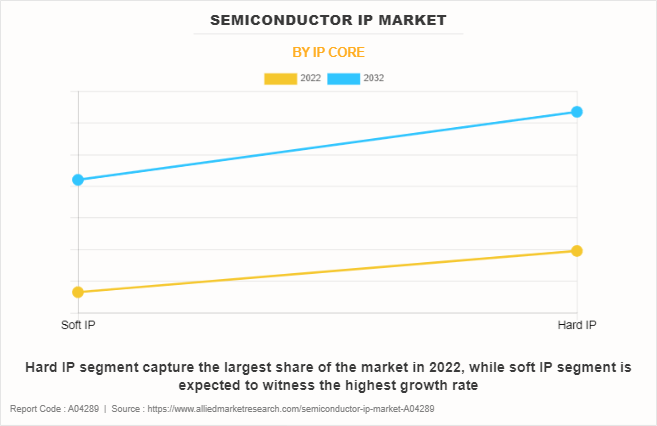

By IP core, the market is bifurcated into soft IP and Hard IP. In 2022, the hard IP segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

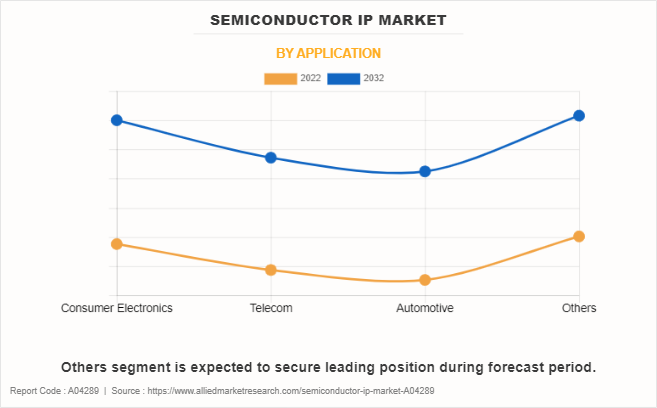

By application, the market is categorized into consumer electronics, telecom, automotive, and others. In 2022, the other segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the automotive segment is expected to grow at a high CAGR during the period of 2023-2032.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, and the rest of Europe), Asia-Pacific (China, India, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, Specifically China., remains a significant participant in the market.

Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced semiconductor IP which is driving the growth of the market in the Asia-Pacific region.

The scope of semiconductor IP market demand spans various applications, from telecommunications and automotive to consumer electronics and industrial devices. The market is dynamic, evolving continuously to meet the requirements of emerging technologies.

The adoption of semiconductor IP plays a pivotal role in stimulating innovation, facilitating expedited product launches, and fostering collaboration within the semiconductor design ecosystem. Semiconductor IP presents several advantages in chip design. It expedites development by supplying pre-validated components, decreasing time-to-market.

Cost-effectiveness is achieved as designers can license established IP cores instead of starting from the ground up. Design efficiency is heightened by enabling concentration on application-specific features, rather than foundational components.

Furthermore, the reuse of established IP cores enhances overall chip reliability and performance. Semiconductor IP's adaptability spans multiple industries, encouraging innovation and collaboration, and addressing varied applications in telecommunications, automotive, consumer electronics, and more.

An important factor propelling the market is the growing demand for contemporary system-on-chip (SoC) designs. The increasing prevalence of SoC designs is a result of the heightened intricacy observed in electronic devices, encompassing smartphones, IoT devices, and automotive systems.

With these applications requiring heightened functionality, performance, and integration, designers are adopting SoC architectures and utilizing semiconductor IP for the efficient incorporation of specialized components. This trend is fueled by the imperative for faster time-to-market and cost-effectiveness, as semiconductor IP enables the integration of pre-validated and standardized IP cores, reducing development cycles.

In addition, the adaptability of SoC designs addresses diverse industry needs, contributing to the continuous growth of the market. This heightened demand signifies a transformative shift towards more integrated, efficient, and flexible semiconductor solutions to meet the dynamic requirements of contemporary electronic systems.

However, infringement of patented technologies hinders the growth of the market. Unauthorized utilization or replication of patented semiconductor intellectual property diminishes incentives for innovation, dissuading companies from dedicating resources to research and development. This obstruction not only curtails fair competition but also triggers legal conflicts, diverting resources that could otherwise be invested in technological advancement.

Infringement poses a substantial risk to market expansion, introducing uncertainties surrounding intellectual property rights that may discourage companies from participating in the Semiconductor IP ecosystem. Effectively addressing and preventing patent infringements is crucial for cultivating an environment that fosters innovation, competition, and sustained growth within the market.

In addition, demand for semiconductor IP is expected to increase rapidly during the forecast period, owing to growing demand for integrated circuits. The market's resilience is rooted in its capacity to offer efficient and time-efficient solutions for chip design, facilitating rapid time-to-market and cost-effectiveness. The ongoing development of semiconductor technologies and the adaptability of IP solutions meet a range of industry requirements, fostering innovation.

Competitive Analysis

Competitive analysis and profiles of the major Semiconductor IP market players, such as Frontgrade Gaisler, Faraday, Arm Limited., Synopsys, Inc., Arteris, CEVA Inc., Cadence Design Systems, Inc., ALPHAWAVE SEMI, VeriSilicon, and Rambus Inc are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

North America-wise, the U.S. acquired a prime share in the semiconductor IP market in the North American region and is expected to grow at a CAGR of 7.18 % during the forecast period of 2023-2032. The U.S. holds a dominant position in the semiconductor IP market, owing to the increasing demand for connected devices.

In Europe, the UK dominated the Europe Semiconductor IP market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, Germany is expected to emerge as one of the fastest-growing countries in Europe's Semiconductor IP industry with a CAGR of 9.97%, owing to the rise in demand for automotive across the region.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to rising investment by key players in the manufacturing of electronic devices in this region. However, India is expected to emerge with the highest CAGR in the semiconductor IP market Asia-Pacific in this region.

In LAMEA, Latin America is growing the fastest in the Semiconductor IP market because of its growing economy, increasing disposable income, and ongoing expansion of consumer electronics throughout the area. Moreover, the Middle East region is expected to grow at a high CAGR of 9.83% from 2023 to 2032, owing to an increase in demand for consumer electronics.

Top Impacting Factors

The semiconductor IP market outlook is expected to witness notable growth owing to an increase in the adoption of wireless technology-based devices, a rise in demand for modern system-on-chip (soc) design, and a growing adoption of IoT and AI applications.

Moreover, the surge in demand for consumer electronics and technological advancement is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, intellectual property (IP) security concerns limit the growth of the semiconductor IP market

Historical Data & Information

The semiconductor IP market is highly competitive, owing to the strong presence of existing vendors. Vendors of semiconductor IP with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Expansion in the Semiconductor IP Market

In February 2022, Faraday Technology Corporation announced that it successfully delivered multiple Factory Automation ASIC projects mainly in the field of industrial IoT (IIoT). These designs include applications of industrial robots, PLC processors, controllers, and communication of industrial automation - implemented in 8‐ and 12‐ wafer process technologies.

Recent Joint Venture in the Semiconductor IP Market

In October 2023, Alphawave Semi joined Arm Total Design, an ecosystem to make specialized solutions based on Arm Neoverse Compute Subsystems (CSS) widely available across the infrastructure. The integration of Arm Neoverse CSS onto the advanced high-speed connectivity IP and chiplet- enabled custom silicon platforms from Alphawave Semi propels AI compute to new heights and paves the way for a new generation of SoCs tailored for hyperscaler and data infrastructure customers.

Recent collaboration in the Semiconductor IP market

In September 2023, Synopsys, Inc. collaborated with Intel and achieved end-to-end 64 GT/s interoperability between Synopsys‐™ IP for PCI Express (PCIe) 6.0 and Intel‐™s PCIe 6.0-enabled test chip.

In September 2023, Arteris, Inc. and Alchip Technologies, Ltd., a top-tier ASIC leader, announced a collaboration to enhance the delivery of high-performance SoCs with unmatched bandwidth and ease of physical design. This collaboration delivers highly optimized SoCs across various market segments.

In June 2023, Synopsys, Inc. collaborated with Samsung Foundry to develop a broad portfolio of IP to reduce design risk and accelerate silicon success for automotive, mobile, high-performance computing (HPC), and multi-die designs. This collaboration expanded Synopsys' collaboration with Samsung to enhance the Synopsys IP offering for Samsung's advanced 8LPU, SF5, SF4 and SF3 processes.

Recent Product Launch in the Semiconductor IP Market

In November 2023, Synopsys, Inc. launched RISC-V ARC-V Processor IP, enabling customers to choose from a broad range of flexible, extensible processor options that deliver optimal power-performance efficiency for their target applications.

In July 2023, Rambus Inc. launched Quantum Safe security IP products for data center and communications security. Quantum computers are able to rapidly break current asymmetric encryption, placing important data and assets at risk. The Rambus IP offers customers a complete post quantum cryptography (PQC) hardware security solution that protects valuable data center and AI/ML assets and systems.

In April 2023, Alphawave Semi launched its connectivity silicon platform on TSMC‐™s most advanced 3nm process with its ZeusCORE Extra-Long-Reach (XLR) 1-112Gbps NRZ/PAM4 serialiser- deserialiser ("SerDes") IP.

In April 2022, Synopsys, Inc. launched its neural processing unit (NPU) IP and toolchain that delivers the industry's highest performance and support for the latest, most complex neural network models. Synopsys DesignWare ARC NPX6 and NPX6FS NPU IP address the demands of real- time compute with ultra-low power consumption for AI applications.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the semiconductor IP market analysis from 2022 to 2032 to identify the prevailing Semiconductor IP market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the semiconductor IP market forecast segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global semiconductor IP market trends, key players, market segments, application areas, and market growth strategies.

Semiconductor IP Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.6 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 355 |

| By Design IP |

|

| By IP Source |

|

| By IP Core |

|

| By Application |

|

| By Region |

|

| Key Market Players | Arm Limited, VeriSilicon, Cadence Design Systems, Inc., CEVA Inc., Synopsys, Inc., Faraday Technology Corporation, ALPHAWAVE SEMI, ARTERIS, INC, Frontgrade Gaisler, Rambus Inc. |

Analyst Review

The global semiconductor IP market possesses high growth potential. Currently, the demand for IP core has been witnessed to increase, particularly in the developing regions such as China and India. Companies in this industry are adopting various techniques such as product launches and collaborations to provide customers with advanced and innovative product offerings. Semiconductor IP (Intellectual Property) refers to pre-designed and reusable blocks of digital or analog circuitry essential for integrated circuits (ICs). These components, such as processors, memory modules, or communication interfaces, enable efficient development of custom semiconductor designs, accelerating time-to-market for electronic devices like smartphones, and IoT devices.

Among the analyzed geographical regions, North America is expected to account for the highest revenue in the global market throughout the forecast period, followed by Asia-Pacific, Europe, and LAMEA. However, Asia-Pacific is expected to grow at a higher growth rate, predicting a lucrative growth for semiconductor IP market. Product launch, collaboration and acquisition business strategies were adopted by the major market players in 2022. For instance, in June 2023, Alphawave Semi announced collaboration with Samsung to include the 3nm process node. (Gbps) Ethernet and PCI Express Gen6/CXL 3.0, interfaces to build the complex systems-on-a-chip (SoCs) needed to keep pace with the rapidly growing demands of data-intensive applications such as generative AI and the associated infrastructure required by global data centers.

The semiconductor IP market demand is expected to grow significantly in the coming years, driven by the growing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) applications.

The Asia-Pacific region is expected to be a major market for the Semiconductor IP market owing to an increase in adoption of advanced technologies in the region.

Competitive analysis and profiles of the major Semiconductor IP market players, such as Frontgrade Gaisler, Faraday, Arm Limited., Synopsys, Inc., Arteris, CEVA Inc., Cadence Design Systems, Inc., ALPHAWAVE SEMI, VeriSilicon and Rambus Inc are provided in this report.

The semiconductor ip market to grow at a CAGR of 8.3% from 2023 to 2032.

The semiconductor ip market size was valued at $6.6 billion in 2022, and is estimated to reach $14.6 billion by 2032, growing at a CAGR of 8.3% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...