Senior Citizen Travel Insurance Market Research, 2032

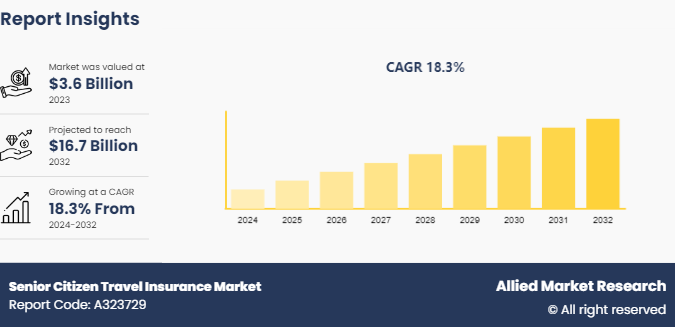

The global senior citizen travel insurance market was valued at $3.6 billion in 2023, and is projected to reach $16.7 billion by 2032, growing at a CAGR of 18.3% from 2024 to 2032. The market is driven by the increasing number of elderly travelers seeking specialized coverage for health-related risks, trip cancellations, and emergency medical assistance. Additionally, heightened awareness of the need for comprehensive protection during travel and the expansion of international tourism among seniors have contributed to market growth.

Market Introduction and Definition

The senior citizen travel insurance market refers to the specific segment in the travel insurance industry that caters to individuals aged 60 years and above who are seeking insurance coverage for their travel needs. This market recognizes the unique requirements and considerations of older travelers, including potential health issues, pre-existing medical conditions, and increased risk factors associated with age. Senior citizen travel insurance policies typically offer comprehensive coverage tailored to address the specific needs of older individuals, such as emergency medical assistance, trip cancellation protection, and coverage for lost or delayed baggage, and also provide retiree travel insurance. Providers in this market segment are expected to offer specialized insurance products that consider the health and mobility challenges that seniors may face while traveling, ensuring peace of mind and financial protection for older travelers embarking on domestic or international trips.

Key Takeaways

The senior citizen travel insurances market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected senior citizen travel insurance market forecast period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major senior citizen travel insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and senior citizen travel insurance market share.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives and senior citizen travel insurance market outlook.

Key Market Dynamics

The senior travel Insurance is primarily driven by rise in the number of older individuals who are actively traveling and exploring the world. As life expectancy rises and seniors maintain good health and vitality, they are more inclined to embark on domestic and international trips, creating a growing demand for travel insurance tailored to their specific needs. In addition, advancements in healthcare and medical technology have enabled seniors to travel with greater ease and confidence, further fueling the demand for insurance coverage that provides comprehensive protection against unforeseen events such as medical emergencies, trip cancellations, or lost belongings through senior citizen travel Insurance platform. However, the perception of higher risk is associated with insuring older individuals. Insurance providers may face challenges in underwriting policies for seniors due to age-related health concerns, pre-existing medical conditions, and the potential for more frequent senior citizen travel insurance claims. This can result in higher premiums, coverage limitations, or exclusions for certain medical conditions, which may deter some seniors from purchasing travel insurance or lead to dissatisfaction with the available options. Addressing these risk factors and effectively managing the balance between coverage and affordability for older travelers remains a significant challenge for insurance providers operating which hamper the market. Furthermore, companies increase and innovate their product offerings to meet the particular requirements of senior tourists and offers senior citizen travel insurance worldwide. By developing specialized insurance products that address the specific concerns of seniors, such as comprehensive medical coverage, emergency assistance services, and flexible policy options, providers can tap into a growing and underserved market segment. Collaborating with healthcare providers, travel agencies, and senior-focused organizations to promote the importance of travel insurance for older individuals can also help raise awareness and drive senior citizen travel insurance market growth.

Government Policies

Some countries or insurance providers may have age restrictions for senior citizens seeking travel insurance coverage. For example, a government regulation may specify that individuals above a certain age (e.g., 80 years old) must meet specific requirements or may have limited coverage options.

Medical Screening Requirements: Government regulations may require senior citizens to undergo medical screenings or provide health certifications before being eligible for travel insurance coverage. This is to ensure that individuals with pre-existing medical conditions are adequately covered during their travels.

Coverage Limitations: Governments may impose regulations that define the maximum coverage limits for senior citizen travel insurance policies and senior citizen travel insurance requirements . This could include limits on medical expenses, trip cancellations, or emergency evacuations, among other coverage aspects.

Consumer Protection Laws: Governments may have consumer protection laws in place to safeguard senior citizens from purchasing travel insurance. These laws may require insurance providers to disclose policy terms clearly, provide cancellation options, and offer refunds in certain situations.

Market Segmentation

The senior citizen travel insurance market is segmented into insurance cover, distribution channel, and region. On the basis of insurance cover, the market is divided into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. On the basis of distribution channel, the market is divided into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the UK, there is rise in awareness among older travelers about the importance of comprehensive insurance coverage, leading to increase in specialized products tailored to their needs. In the U.S., the market is characterized by a wide range of options from various providers, offering seniors flexibility and choice in selecting suitable travel insurance plans. In India, the senior citizen travel insurance market is expanding rapidly as more elderly individuals embark on domestic and international trips, prompting insurers to develop innovative solutions to cater to this demographic's specific requirements.

In January 2020, the Centers for Medicare & Medicaid Services (CMS) implemented regulations that impact senior citizens' travel insurance and Senior Citizen Travel Insurance suppliers. These regulations focus on Medicare coverage for seniors traveling abroad and how travel insurance can supplement their healthcare needs while outside the country. Seniors are advised to review their Medicare coverage and consider additional senior citizen travel insurance sector to ensure comprehensive protection during international travel.

In March 2021, the Financial Conduct Authority (FCA) introduced new guidelines for travel insurance providers regarding coverage for senior citizens. These guidelines aim to ensure that insurance policies are fair and transparent for older travelers, including those with pre-existing medical conditions. Senior citizens are encouraged to check for policies that comply with the FCA regulations to receive adequate coverage during their travels.

Industry Trends

Edge computing involves processing data closer to the source of generation, reducing latency, and improving real-time decision-making capabilities. In senior citizen travel insurance environments, integrating edge computing allows organizations to leverage the benefits of both centralized cloud resources and distributed edge devices. This trend enables businesses to efficiently manage and analyze data at the edge, enhancing performance and scalability while maintaining data security and compliance. By incorporating edge computing into senior citizen travel insurance architectures and senior citizen travel insurance specialist , organizations can optimize their IT infrastructure to meet the demands of modern applications and services, driving innovation and efficiency in their operations. For instance, in December 2021, Amazon web services launched AWS Outposts offering a fully managed services that extends AWS infrastructure to on-premises locations, enabling edge computing capabilities within hybrid cloud architectures.

AI and machine learning capabilities with senior citizen travel insurance architectures, organizations can enhance automation, optimize resource allocation, and improve decision-making processes. AI and machine learning algorithms can analyze vast amounts of data from both public and private cloud sources, providing valuable insights and predictive analytics to drive business growth and innovation increases the senior citizen travel insurance adoption. This trend enables businesses to leverage the power of AI to streamline operations, enhance security, and deliver personalized experiences to customers. By integrating AI and machine learning in senior citizen travel insurance environments, organizations can unlock new opportunities for efficiency, scalability, and competitive advantage in today's digital landscape. For instance, in October 2021, Google cloud introduced Vertex AI, providing business with tools to deploy and manage machine learning models across senior citizen travel insurance environments, enabling them to leverage AI capabilities effectively.

Competitive Landscape

The major players operating in the senior citizen travel insurance Industry include Zurich Insurance Group, AXA, Assicurazioni Generali S.p.A., PassportCard, Staysure, Just Travel Cover, American International Group, Inc., Trailfinders Ltd., Aviva, Insurefor.com. and others.

Recent Key Strategies and Developments

In March 2020, SeniorCare Insurance Agency introduced a travel insurance plan specifically designed for senior citizens, offering coverage for medical emergencies, trip cancellations, and lost luggage.

In August 2021, Golden Years Insurance launched a comprehensive travel protection plan tailored for older travelers, including coverage for pre-existing medical conditions and emergency medical evacuations.

In January 2022, SilverTraveler Insurance Services released a senior insurance product with features such as coverage for trip delays, emergency medical assistance, and 24/7 travel support.

Key Sources Referred

tataaig

consumeraffairs

nivabupa

bankbazaar

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the senior citizen travel insurance market analysis from 2024 to 2032 to identify the prevailing senior citizen travel insurance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the senior citizen travel insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global senior citizen travel insurance market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global senior citizen travel insurance market trends, key players, market segments, application areas, and senior citizen travel insurance market growth growth strategies.

Senior Citizen Travel Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.7 Billion |

| Growth Rate | CAGR of 18.3% |

| Forecast period | 2024 - 2032 |

| Report Pages | 215 |

| By Insurance Cover |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Zurich Insurance Group, American International Group, Inc., PassportCard, Assicurazioni Generali S.p.A., Staysure, AXA, Aviva, Insurefor.com, Just Travel Cover, Trailfinders Ltd. |

The senior citizen travel insurance market was valued at $3.6 billion in 2023 and is estimated to reach $16.7 billion by 2032, exhibiting a CAGR of 18.3% from 2024 to 2032.

An increase in life expectancy and a rise in healthcare costs are the upcoming trends of the Senior Citizen Travel Insurance Market around the globe.

Customized insurance products are the leading application of the Senior Citizen Travel Insurance Market.

North America is the largest regional market for Senior Citizen Travel Insurance.

Zurich Insurance Group, AXA, Assicurazioni Generali S.p.A., PassportCard, Staysure, Just Travel Cover, American International Group, Inc., Trailfinders Ltd., Aviva, Insurefor.com are the top companies to hold the market share in Senior Citizen Travel Insurance.

Loading Table Of Content...