SerDes Market Research, 2032

The Global SerDes Market was valued at $0.9 billion in 2023, and is projected to reach $2.7 billion by 2032, growing at a CAGR of 13.3% from 2024 to 2032.

Market Introduction and Definition

SerDes, short for Serializer/Deserializer, is a technology used in high-speed communications to convert data between serial and parallel formats. The serializer component converts multiple parallel data streams into a single serial data stream, while the deserializer reverses this process at the receiving end, converting the serial data back into parallel form. This technology is essential in applications that need efficient and high-speed data transfer, such as data communication, computer networks, consumer electronics, and automotive systems.

Key Takeaways

On the basis of component, the physical coding sub-block segment dominated the market in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of the industry vertical, the IT and telecom segment dominated the SerDess market size in terms of revenue in 2023.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

In March 2024, The U.S. Federal Communications Commission (FCC) allocated new spectrum for 5G wireless communications, which is expected to drive demand for high-speed SerDes (Serializer/Deserializer) devices used in 5G infrastructure equipment.

In May 2024, The Chinese government announced a plan to build a nationwide 5G network, which is expected to create a massive market for SerDes devices used in base stations, data centers, and other network infrastructure.

In June 2023, The Japanese government launched a new initiative to promote the development of high-speed SerDes technology for data centers and cloud computing applications. This initiative aims to enhance the performance and efficiency of data transmission in data centers, which are increasingly relying on high-speed SerDes links.

In July 2023, The European Commission announced a new research program to develop next-generation SerDes technology for high-performance computing (HPC) applications. This program aims to support the development of faster and more efficient SerDes solutions for data transfer between processors, memory, and other components in HPC systems.

Key Market Dynamics

The increasing adoption of cloud computing is expected to significantly boost the growth of the SerDes market during the forecast period. As cloud computing infrastructures expand, the demand for high-speed data transmission and efficient data processing grows, necessitating advanced SerDes technology. SerDes components facilitate rapid data transfer between integrated circuits, crucial for the performance of data centers and cloud services. The need for faster, reliable, and higher-capacity data communication solutions in cloud environments drives the integration of SerDes technology, propelling market growth. Data encoding/decoding and link aggregation enhance SerDes performance by optimizing data transmission rates and bandwidth. This connection is crucial for efficient communication in high-speed applications, driving SerDes market growth. Additionally, the rise in artificial intelligence, machine learning applications, and the proliferation of big data analytics further fuel the demand for enhanced data transmission capabilities provided by SerDes.

However, high development costs significantly hinder the SerDes industry. Developing advanced SerDes technology requires substantial investment in research and development (R&D) to enhance performance, speed, and efficiency. This financial burden is particularly challenging for smaller companies with limited resources. Moreover, the expense of specialized equipment, skilled personnel, and extensive testing needed to comply with industry standards further increases costs. The ongoing need for innovation to remain competitive in the rapidly changing semiconductor industry adds to the financial strain. As a result, high development costs can hinder the entry of new competitors and slow the overall growth of the SerDes industry.

Furthermore, the rise in integration of SerDes technology within consumer electronics presents a significant opportunity for the SerDes market. The demand for efficient, high-speed communication solutions like SerDes increases as consumer electronics become more advanced, with higher data processing and transmission requirements. Devices such as smartphones, tablets, gaming consoles, and smart home appliances rely on seamless data transfer and processing capabilities, which SerDes technology provides. This growing need for faster and more reliable data communication in consumer electronics drives the expansion of the SerDes market, offering substantial growth potential as manufacturers seek to enhance device performance and user experience.

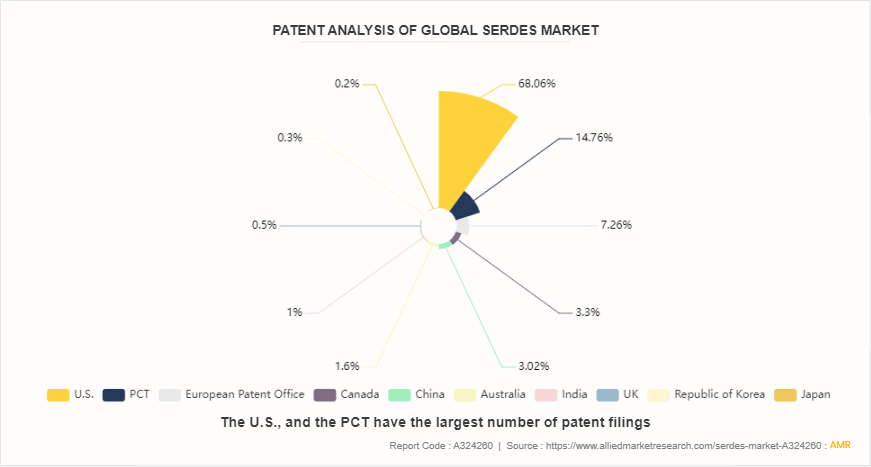

Patent Analysis of Global SerDes Market

The global SerDes market is segmented according to the patents filed in the U.S., PCT, European Patent Office, Canada, China, Australia, India, UK, Republic of Korea, and Japan. The U.S., and the PCT have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have maximum number of patent filings.

Market Segmentation

The SerDes market is segmented into component, industry vertical, and region. By component, it is divided into clock multiplier unit, lanes, and physical coding sub-block. By industry vertical, the market is classified into automotive, consumer electronics, IT and telecom, aerospace, military and defense, manufacturing, and others. Region wise, the SerDess market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

Based on component, the physical coding sub-block segment dominated the market in terms of revenue in 2023 and is expected to follow the same trend during the forecast period due to its critical role in ensuring data integrity and efficient transmission at high speeds. The physical coding sub-block is essential for encoding and decoding data to maintain signal quality and reduce errors during transmission. The importance of robust physical coding sub-blocks has increased as demand for high-speed data transfer in applications like data centers, telecommunications, and consumer electronics continues to grow.

Based on industry vertical, the IT and telecom segment held the highest market share in 2023 due to the substantial demand for high-speed data transmission and processing capabilities within the telecommunications and IT industries. With the expansion of 5G networks, increased data center activities, and the growing need for efficient data communication infrastructures, SerDes technology has become crucial. It enables faster, more reliable data transfer, which is essential for supporting the high bandwidth and low latency requirements of modern It and telecom applications.

Regional/Country Market Outlook

On the basis of region, the SerDes market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific holds the highest market share in the SerDes market in 2023 due to rapid growth of the consumer electronics and telecommunications sectors in countries like China, Japan, and South Korea. The region's significant investments in advanced technologies, such as 5G, artificial intelligence, and data centers, fuel the demand for high-speed data transmission solutions provided by SerDes technology. Additionally, the presence of major semiconductor manufacturers and the expansion of cloud computing infrastructure contribute to the market's growth. The increasing adoption of IoT devices and smart home technologies further propels the growth of the SerDes market in Asia-Pacific, making it the leading region in 2023.

Competitive Landscape

The major players in the SerDes market are Rambus, Texas Instruments Inc., ON Semiconductor Corporation, STMicroelectronics NV, ROHM Semiconductor, Renesas Electronics Corp (Japan) , NXP Semiconductors NV (Netherlands) , Maxim Integrated, Broadcom, and Cypress Semiconductor Corp.

Recent Key Strategies and Developments

In September 2022, The Arora v FPGA, a 12.5 Gbps high-speed SerDes interface, was introduced by Gowin Semiconductor. The business also contracted with WPG, the biggest distributor of semiconductors in Europe.

In August 2022, The Arora v FPGA, a high-speed SerDes interface with a 22nm 12.5 Gbps, was introduced by Gowin Semiconductor. Also, the business inked a contract with WPG, the biggest distributor of semiconductors in Europe.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

This SerDes market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the serdes market analysis from 2024 to 2032 to identify the prevailing serdes market opportunities. In the report SerDes market size is in $ billion from 2023 to 2032.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the SerDes market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players. The SerDes market share by key players is also covered in the report.

The report includes the analysis of the regional as well as global SerDes market trends, key players, market segments, application areas, and SerDes market growth strategies.

SerDes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.7 Billion |

| Growth Rate | CAGR of 13.3% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Component |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Rambus, Maxim Integrated Products, Inc., Renesas Electronics Corp (Japan), Texas Instruments Inc.,, Broadcom, ROHM Semiconductor, STMicroelectronics NV, Cypress Semiconductor Corp., ON Semiconductor Corporation, NXP Semiconductors NV (Netherlands) |

The Global SerDes Market was valued at $0.9 billion in 2023, and is projected to reach $2.7 billion by 2032, growing at a CAGR of 13.3% from 2024 to 2032.

The demand for the IT and telecom segment in the SerDes market is driven by the increasing need for high-speed data transmission and communication efficiency.

sia-Pacific holds the highest market share in the SerDess market in 2023 due to rapid growth of the consumer electronics and telecommunications sectors in countries like China, Japan, and South Korea. The region's significant investments in advanced technologies, such as 5G, artificial intelligence, and data centers, fuel the demand for high-speed data transmission solutions provided by SerDes technology.

The increasing adoption of cloud computing is expected to significantly boost the growth of the SerDes market during the forecast period. As cloud computing infrastructures expand, the demand for high-speed data transmission and efficient data processing grows, necessitating advanced SerDes technology.

The major players in the market are Rambus, Texas Instruments Inc., ON Semiconductor Corporation, STMicroelectronics NV, ROHM Semiconductor, Renesas Electronics Corp (Japan), NXP Semiconductors NV (Netherlands), Maxim Integrated, Broadcom, and Cypress Semiconductor Corp.

Loading Table Of Content...