Service Robotics Market Overview

The Global Service Robotics Market size was valued at $21084.5 million in 2020, and is projected to reach $293087.3 million by 2032, growing at a CAGR of 24.3% from 2023 to 2032. The service robotics market is expanding rapidly due to technological advancements. Coupled with rising industrialization and escalating labor costs, these developments are key drivers of growth. As industries seek automation and efficiency, service robots are becoming increasingly vital across sectors, accelerating market adoption and transforming operational landscapes worldwide.

Market Dynamics & Insights

- The service robotics industry in Europe held a significant share of over 40.4% in 2020.

- The service robotics industry in India is expected to grow significantly at a CAGR of 29.6% from 2023 to 2032.

- By type, professional service robotics is one of the dominating segments in the market and accounted for the revenue share of over 67.4% in 2020.

- By end user, the Construction and demolition end user segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $21.08 Billion

- 2032 Projected Market Size: $293.08 Billion

- CAGR (2023-2032): 24.3%

- Europe: Largest market in 2020

- Asia Pacific: Fastest growing market

What is meant by Service Robotics

Service robots are semi-automatic or fully automatic robots that are utilized to perform useful and dangerous tasks for humans. These robots assist humans in various sectors such as medical & healthcare, construction, automation, domestic, and entertainment. An internal control system operates these robots automatically, with the possibility to override the action manually. These service robots eliminate the chance of human error, manage time, and enhance the productivity by reducing the workload of the staff and laborers.

Service Robotics Market Dynamics

Earlier, service robotics was highly adopted in the automotive and manufacturing industries only. However, industries such as aerospace, healthcare, defense & security, electronics, and entertainment have adopted service robots to enhance productivity and manage time. Increased need for service robots in agriculture, farming, green plantation, and dairy products has created opportunities to develop new innovative products with the help of robots. Moreover, these robots are used extensively in automation of farming procedures to improve profits and reduce overhead costs. For instance, in February 2022, Naio Technologies, a French robot company, introduced Orio agriculture robot. Orio offers smart farming and sustainable serviceable solutions with advanced technology in robots and AI. Such trends are positively affecting the service robotics market.

Furthermore, the rise in demand from the healthcare sector during COVID-19 pandemic and care for the geriatric population has increased the sales of service robots. For instance, in June 2021, Hanson Robotics designed Humanoid Robot Grace to interact with isolated patients suffering from coronavirus disease. Similarly, the defense and security sectors have deployed robots for various applications such as mine detection, monitoring purposes, and bomb diffusion. For instance, in December 2021, the U.S. Army added exercise fighting enemy robots. This system allows them to get close to the enemy and neutralize them from a safe distance. In addition, in February 2022, the U.S. Army introduced 10X project for integrating, validating, and testing current AI and robotics capabilities for dismounted infantry. Hence, such a wide range of applications is expected to create growth opportunities for service robots during the forecast period. In addition, service robots offer companies various benefits such as reducing waste, increasing production, enhancing product quality, and removing the possibility of human error-related problems. Various companies have adopted service robotics solutions to save costs due to the ever-increasing costs of labor in developed countries. The desire for better service delivery in the global market drives organizations toward service robots solutions that can be operated using software, which also reduces the cost of labor management and training. Companies have been pushed to implement automation solutions as a result of a lack of qualified workers to manage operations and high labor expenses, which has aided the growth of the service robotics market. For instance, in 2021, there were 126 robots per 10,000 employees in China, which is up from 66 units 5 years ago, according to the International Federation of Robots.

Moreover, robots in the e-commerce sector play an important role in moving, shifting, and packaging of a high number of products that need to be shipped across the world. For instance, in June 2021, Amazon had 350,500 mobile unit robots in operation along with large number of human workforces. These robots are designed to transport and carry packages from one location to another without utilizing the labor workforce. This is anticipated to increase the production and speed of operation by eliminating errors and reducing time.

However, the initial cost of service robots is very high; thus, not every facility can afford them. This limits small & medium sized business to invest in high tech robots. Owing to low-volume manufacturing and slower returns on capital, these businesses frequently struggle to raise huge amounts of money. Moreover, combination of high-quality hardware with an effective software control system may lead to high initial investment costs of using robotics systems. This is therefore a big restraining factor for service robotics market growth.

Moreover, the expansion of medical, e-commerce, construction, and automotive sectors in developing countries across Asia-Pacific and LAMEA has led to the increased adoption of service robotics solutions for diverse domestic and professional applications. This trend is a major service robotics market opportunity, and is expected to result in a higher growth rate in the market. The surge in investments in robots, driven by the growing packaging and moving operations in the e-commerce sector, has led to an increased utilization of robots. For example, in January 2022, Reliance Industries Limited acquired a 54% stake in Addverb Technologies for $132 million, a startup specializing in robot manufacturing. These robots are intended for adoption in e-commerce warehouses to enhance energy production efficiency. Moreover, India has taken an initiative to support the growth of service robotics through the introduction of Robotics 2 under the Make in India campaign. Similarly, in February 2022, the U.S.-based MedTech startup Levita Magnetics opened a robotics and artificial intelligence (AI) center in Chile.

The service robotics market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for service robotics from the construction and industrial sectors. However, the healthcare, hospitality and food & beverages sector increased their demand for robots as they are perfect for performing desired operations near people without increasing the risk of infection. The COVID-19 has subsided, and the major manufacturers in 2023 have been performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for construction which is a major end-user sector of robots. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, a peace agreement between Ukraine and Russia can be devised, with the continued talks between different countries, which is expected to end the war between them and reduce global inflation.

Service Robotics Market Segmental Overview

The service robotics market is segmented on the basis of type, application, and region. On the basis of type, the market is bifurcated into professional service robotics, and personal service robotics. On the basis of application, the market is divided into agriculture, professional cleaning, inspection and maintenance, construction and demolition, transportation and logistics, medical, search, rescue, and security, hospitality, and others. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Indonesia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, and Rest of LAMEA).

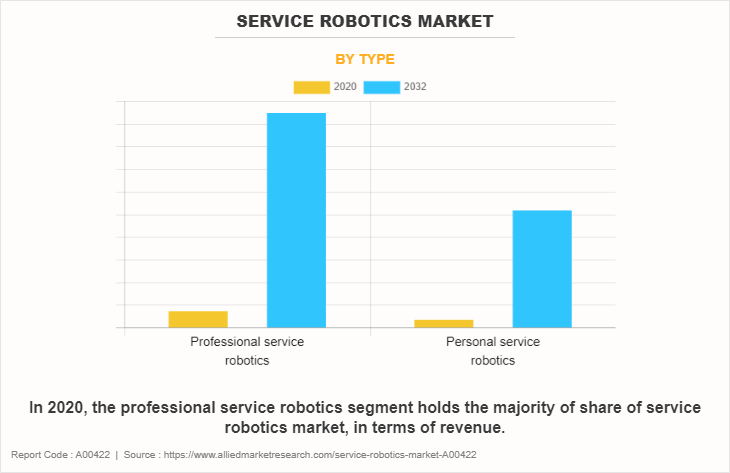

By Type:

The service robotics market is divided into professional service robotics, and personal service robotics. In 2020, the professional service robotics segment dominated the service robotics market share in terms of revenue, and the personal service robotics segment is expected to grow with a higher CAGR during the forecast period. Professional service robots are employed for commercial tasks such as factory, industrial, and manufacturing operations. These robots are expected to assist humans in commercial areas and perform specific tasks under the surveillance of trained professionals in various industries. For instance, industrial robots are often used in strenuous, dangerous, and repetitive tasks where automation technology is more adopted than labor workforce. In addition, service robots are used for quality control, inspection processes, and inventory & logistics management. They are generally equipped with vision systems or force control for accuracy.

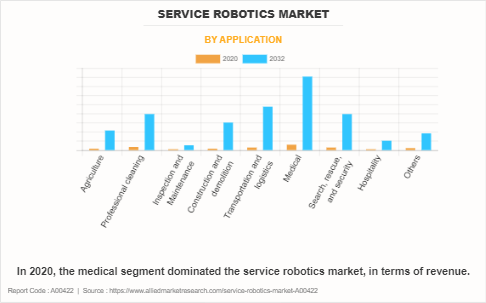

By Application:

The service robotics market is divided into agriculture, professional cleaning, inspection and maintenance, construction and demolition, transportation and logistics, medical, search, rescue, and security, hospitality, and others. In 2020, the medical segment dominated the market, in terms of revenue. The construction and demolition segment is expected to dominate the service robotics market forecast by growing with the highest CAGR during the forecast period. Robots are modernizing the medical sector, where they play an instrumental role in assisting healthcare professionals and enhancing patient care. Robots autonomously perform various tasks such as autonomously cleaning and preparing patient rooms, eventually minimizing person-to-person interaction. Additionally, with the growing number of communicable diseases such as COVID-19, and others, the integration of robots in clinics and hospitals has become increasingly crucial to reduce pathogen exposure. Furthermore, in healthcare facilities, robots equipped with AI-enabled medicine identification software speed up the identification, matching, and dispensing of medications, significantly reducing the time required for these processes.

By Region:

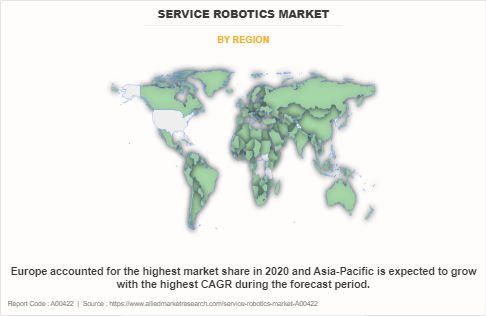

Europe accounted for the highest market share in 2020 and Asia-Pacific is expected to grow with the highest CAGR during the forecast period. Europe is the largest manufacturer and consumer of robots for applications such as delivery, security & inspection and disinfection. Industries such as healthcare have deployed a large number of disinfection robots in hospitals in Europe. Moreover, multiple hospitals across Europe are installing robotic systems to expand the benefit of robot assisted surgery. For instance, in October 2021, Medtronic Plc launched Hugo RAS System, a robotic assisted surgery system for gynecologic and urologic procedures. In addition, several retail and public dealing stores have started using disinfection robots post the COVID-19 outbreak to overcome spreading of the disease. For instance, in June 2020, the Milan Malpensa International Airport in Italy deployed disinfection robots to kill germs and avoid spread of virus among the travelers.

Moreover, expansion of industries in Germany has resulted in installation of robotic system to reduce workload pressure from employees. In textile industry, robots help in handling and palletizing heavy twin reels which provide relief for workers and enhance productivity. For instance, in September 2021, ABB robot has installed IRB 6700 to Huesker, a textile industry in Germany. The ABB IRB 6700 robot collects finished reels from production equipment, transports them to other machines for additional processing, and puts them into pallets for shipment.

Service Robotics Market Competition Analysis

Competitive analysis and profiles of the major players in the service robotics market are provided in the report. Major companies in the report iRobot Corporation, Intuitive Surgical Inc., Honda Motor Co., Panasonic Corporation, Aethon Inc., Yujin Robot Co. Ltd., Samsung Electronics CO., DeLaval, Robert Bosch GmbH, and AB Electrolux. Major players to remain competitive adopt development strategies such as product launches, business expansion, acquisitions, expansion, partnerships, and mergers. For example, in February 2021, DeLaval introduced its new robot collector series to its existing family of DeLaval robots. The new robotic collector series, including DeLaval robot collector RC550 and RC700, is designed for solid floors and is available with a working width of 155 and 180 cm. Similarly, in October 2021, Medtronic Plc launched Hugo RAS System, a robotic assisted surgery system for gynecologic and urologic procedure.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging service robotics market trends.

- In-depth service robotics market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the service robotics market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The service robotics market revenue and volume forecast analysis from 2023 to 2032 are included in the report.

- The key players within the service robotics market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the service robotics industry.

Service Robotics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 293087.3 million |

| Growth Rate | CAGR of 24.3% |

| Forecast period | 2020 - 2032 |

| Report Pages | 814 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Yujin Robot Co. Ltd., iRobot Corporation, AB Electrolux, Panasonic Corporation, Samsung Electronic Co., Ltd., Delaval, robert bosch gmbh, Intuitive Surgical Inc., Aethon Inc., Honda Motor Co., Ltd. |

Analyst Review

The service robotics market has observed huge demand in Europe, Asia-Pacific, and North America. The service robotics market is witnessing remarkable growth, driven by a surge in demand for automation across various sectors. As industries attempt to increase productivity and cost-effective solutions, service robots have emerged as invaluable assets. These versatile machines are not only streamlining operations but also contributing to a safer and more efficient working environment.

One notable driver of this growth is the increasing investment in research and development globally. Countries around the world are recognizing the potential of service robotics in revolutionizing traditional processes and addressing labor challenges. The demand for security and inspection robots is also high, indicating growing emphasis on safety across various sectors. As businesses look for advanced solutions for surveillance and facility monitoring, these robots are becoming more popular owing to their higher reliability and efficiency.

Moreover, developing countries such as India, and China, and developed countries such as Germany, the U.S., the UK, and others, have allocated considerable resources for the development of robots and take a significant share of the global market for service robotics. For example, the Indian government is aiming to position India as a global leader in robotics for manufacturing, healthcare, agriculture, and national security sectors by 2030. For this, the government is expected to unveil various supporting policies, which can be beneficial for the key players in the service robotics market.

Various market players have adopted strategies such as product launch, business expansion, acquisition, and agreement, to expand its business and strengthen its market position. For instance, in June 2021, Hyundai Motor Group acquired Boston Dynamics, a leader in developing mobile & advanced robots. With this acquisition, Hyundai Motor Group is seeking future technologies such as AI, smart factories, and robots.

Growth in the popularity of service robots in the industrial and non-industrial sectors, high labor costs in industries, and high investments in research & development activities drive the growth of the global service robotics market.

The latest version of the global service robotics market report can be obtained on demand from the website.

The global service robotics market size was valued at $21.0 billion in 2020.

The global service robotics market size is estimated to reach $293.0 billion by 2032, exhibiting a CAGR of 24.3% from 2023 to 2032.

The forecast period considered for the global service robotics market is 2023 to 2032, wherein, 2022 is the base year, 2023 to 2032 is the forecast duration. Additionally, the market is also analysed historically between 2020 and 2021.

Europe is the largest regional market for service robotics market.

Key companies profiled in the service robotics market report include iRobot Corporation, Intuitive Surgical Inc., Honda Motor Co., Panasonic Corporation, Aethon Inc., Yujin Robot Co. Ltd., Samsung Electronics CO., DeLaval, Robert Bosch GmbH, and AB Electrolux.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...