Servo Motors Market Research, 2032

The global servo motors market size was valued at $12.5 billion in 2022, and is projected to reach $21.3 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032. A servo motor is an electromechanical device that converts electrical energy into precise mechanical motion. It is widely used in industrial automation, robotics, and other applications where accurate control of position, velocity, and torque is required.

Servo motors operate based on a closed-loop control system, which means they continuously receive feedback from sensors, such as encoders or resolvers, to adjust and maintain their position or speed according to the desired setpoint. This feedback loop allows servo motors to achieve high levels of accuracy and repeatability in their motion.

Report Key Highlighters

- The servo motors market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the servo motors market growth.

Market dynamics

Servo motors are commonly used in various applications such as CNC machining, robotics, automated manufacturing, aerospace, and automotive systems. They offer precise control over motion, high torque-to-inertia ratio, fast response times, and flexibility in speed and torque characteristics, making them essential components in modern automation and control systems.Major drivers propelling the growth of the servo motors market include technological advancements enhancing motor efficiency and precision, increasing automation across industries demanding precise motion control, and the growing adoption of robotics in manufacturing and logistics, driving the need for high-performance motors. On the contrary, increase in trend of electric vehicle production, where servo motors find applications in various components, present a significant growth avenue for the market as electric vehicles gain traction globally. Servo motors typically have brushless designs, eliminating the need for brushes and commutators. This design feature reduces maintenance requirements, enhances reliability, and extends the service life of the motor, resulting in lower lifecycle costs for the end user. Many servo motors are equipped with digital communication interfaces such as Ethernet/IP, Profibus, or EtherCAT, enabling seamless integration into networked automation systems. This connectivity facilitates real-time monitoring, diagnostics, and control, enhancing overall system performance and productivity. It are designed for high efficiency, minimizing energy consumption and heat generation during operation. This efficiency is particularly beneficial in applications requiring continuous or frequent operation, helping to reduce operating costs and environmental impact. It offer a broad range of operating speeds, from low speeds to high speeds, without sacrificing torque or performance. This versatility makes them suitable for applications with varying speed requirements, such as printing presses, conveyor systems, and winding machines.

The servo motors exhibit rapid response times and high dynamic performance, enabling quick acceleration, deceleration, and changes in direction. This feature is crucial for applications requiring fast and agile motion, such as pick-and-place operations and high-speed packaging machinery. It provide precise control over speed, position, and torque, allowing for accurate motion control in applications requiring tight tolerances and high precision, such as CNC machining, robotics, and semiconductor manufacturing.

Segmental Overview

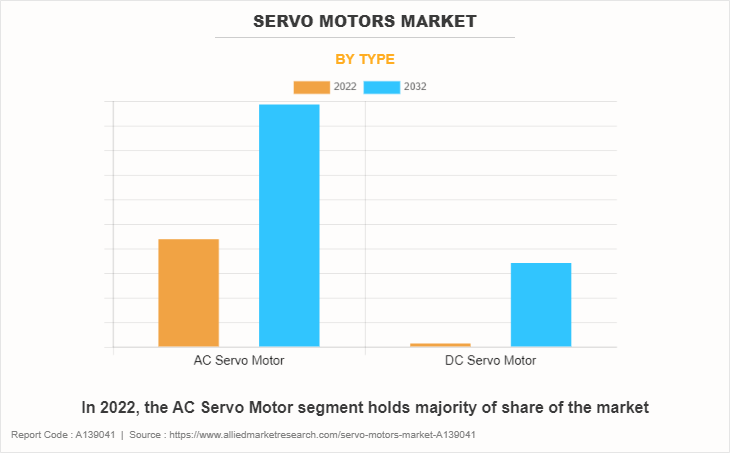

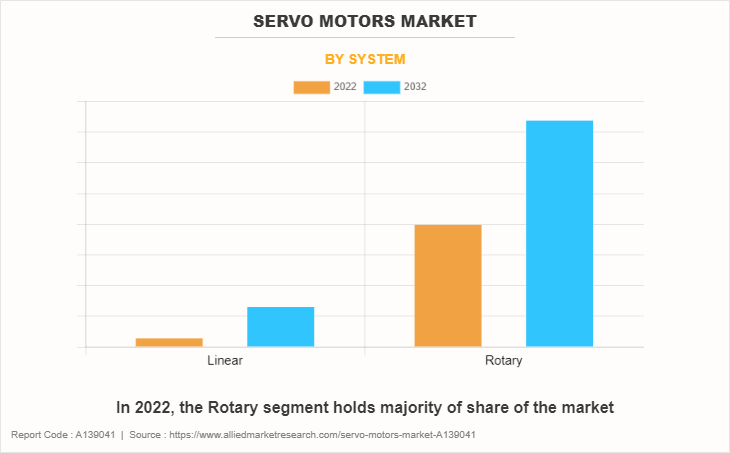

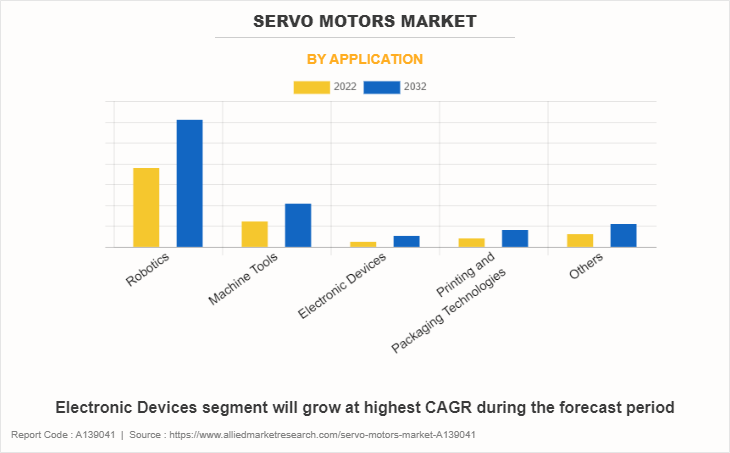

The servo motors market is segmented on the basis of type, system, application, and region. By type, the market is categorized into AC servo motor, and DC servo motor. Depending on system, the servo motors market is categorized into rotary, and linear. Based on application, the servo motors market is divided into robotics, machine tools, electronic devices, printing and packaging technologies, and others. Based on region, the market share is analyzed across North America, Europe, Asia-Pacific, and Latin America, and MEA.

The AC servo motor segment dominated the market in 2022, and DC servo motor segment it is expected to grow at a significant CAGR during the forecast period. DC servo motors provide accurate control over speed, position, and torque, making them suitable for applications where precise motion control is essential. They offer high resolution and repeatability, allowing for precise positioning and velocity control. AC servo motors exhibit rapid response times and high dynamic performance, enabling quick acceleration, deceleration, and changes in direction. This feature is crucial for applications requiring fast and agile motion, such as robotics, CNC machining, and automated assembly lines.

The rotary segment dominated the market in 2022, and the linear segment is expected to grow at a significant CAGR during the forecast period. Rotary servo motors provide precise control over position, velocity, and torque, enabling accurate and repeatable motion. They are capable of achieving high resolution and positioning accuracy, making them suitable for applications requiring fine-tuned control, such as CNC machining, robotics, and semiconductor manufacturing. Rotary servo motors exhibit rapid response times and high dynamic performance, allowing for quick acceleration, deceleration, and changes in direction. This feature is essential for applications requiring fast and agile motion, such as pick-and-place operations, high-speed printing, and packaging machinery.

The robotics segment dominated the market in 2022. Electronic Devices segment is expected to grow at a significant CAGR during the forecast period. Servo motors actuate the joints of robotic arms and manipulators, allowing them to move with precision along multiple axes. These motors provide the necessary torque, speed, and control to achieve complex motions required for tasks such as picking, placing, and assembly in manufacturing environments. Servo motors power the wheels, tracks, or legs of mobile robots, providing propulsion and maneuverability in various environments. These motors enable precise speed and direction control, allowing mobile robots to navigate autonomously in indoor or outdoor settings, including warehouses, factories, and outdoor fields.

The Asia-Pacific dominates the servo motors market share in terms of revenue in 2022. The Asia-Pacific region, particularly countries like China, Japan, South Korea, and India, has seen rapid industrialization and growth in manufacturing sectors. Servo motors are essential components in industrial automation, robotics, and machinery used in manufacturing processes. The expansion of industries such as automotive, electronics, consumer goods, and aerospace drives the demand for servo motors to enhance productivity, efficiency, and quality control. The automotive industry is a major consumer of servo motors for various applications, including assembly line automation, robotic welding, painting, and handling. With the Asia-Pacific region being a hub for automotive manufacturing, the increasing demand for passenger vehicles, commercial vehicles, and electric vehicles fuels the adoption of servo motors in automotive production facilities.

Asia-Pacific countries are leading producers of electronics, semiconductors, and electronic components. Servo motors are critical for precision machining, pick-and-place operations, wire bonding, and other processes in electronics and semiconductor manufacturing. The growth of consumer electronics, telecommunications, and semiconductor industries drives the demand for servo motors in this region.

The Asia-Pacific region is witnessing a surge in the adoption of industrial robots across various sectors, including manufacturing, logistics, and healthcare. Servo motors are key components in robotic arms, grippers, actuators, and other motion control systems. The demand for robots for tasks such as material handling, assembly, inspection, and packaging contributes to the growing demand for servo motors.

Competitive Analysis

Competitive analysis and profiles of the major global market players that have been provided in the report include Siemens AG, ABB Group, Yaskawa Electric Corporation, Rockwell Automation, Inc, Fanuc Corporation, Mitsubishi Electric Corporation, Parker Hannifin Corporation, Schneider Electric SE, Bosch Rexroth AG, and Lenze SE. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Top Impacting Factors

The global servo motors market is expected to witness notable growth owing to increasing adoption of automation across various industries, including manufacturing, automotive, electronics, and healthcare, drives the demand for servo motors. As industries seek to improve productivity, quality, and efficiency, servo motors play a crucial role in providing precise motion control solutions for automation applications.

Ongoing advancements in servo motor technology, such as improvements in motor design, feedback systems, control algorithms, and connectivity features, drive innovation and differentiation in the industry. Manufacturers continuously strive to enhance the performance, efficiency, and reliability of servo motors to meet the evolving needs of customers.

Recent product launches in the global servo motors market

On September 2022, Kinco launched new high-power servo motors to meet market demand. smaller size, optimized design, and longer cable options for diverse applications Kinco, a leading manufacturer of automation products, has recently launched a new series of high-power servo motors to cater to the growing demand for efficient and powerful motion control solutions. The new Extreme series includes three models: 1.5kW, 2.5kW, and 3kW, offering a wider range of power options for various industrial applications.

On May 2023, Kollmorgen unveiled the AKM23e servo motor series, offering exceptional torque density, low cogging, and smooth operation for high-precision motion control applications. Features include enhanced power density with continuous torque up to 75% higher than competitors. Reduced cogging for smoother operation and improved machine performance. Optimized for use with Kollmorgen‐™s AKD PD3 servo drives for a complete high-performance motion control solution.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging servo motors market trends and dynamics.

- In-depth servo motors market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the servo motors market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing servo motors market opportunity.

- The global servo motors market forecast analysis from 2022 to 2032 is included in the report.

- The key players within servo motors market overview are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the servo motors industry.

Servo Motors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 189 |

| By Type |

|

| By System |

|

| By Application |

|

| By Region |

|

Analyst Review

Several major trends are shaping the global servo motor landscape. One key trend is the integration of advanced technologies like Internet of Things (IoT) and Artificial Intelligence (AI) into servo systems, enhancing their capabilities for predictive maintenance, data-driven optimization, and real-time monitoring. Another significant trend is the focus on energy efficiency, leading to the development of servo motors with improved energy-saving features and eco-friendly designs. In addition, there is a noticeable shift towards compact and lightweight servo motors to meet the demands of smaller and more intricate applications, particularly in fields like medical devices and consumer electronics. The integration of servo motors with advanced motion control systems and the growing use of these motors in emerging sectors like renewable energy further underscore the evolving trends shaping the global servo motor market. Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction.

Technical advancement and growth in industrialization are trends of Servo Motors Market.

Robotics and machines tools are leading applications of Servo Motors Market

Asia-Pacific region is the largest regional market for Servo Motors

The global servo motors market was valued at $12,465.1 million in 2022.

Siemens AG, ABB Group, Yaskawa Electric Corporation, Rockwell Automation, Inc, Fanuc Corporation, Mitsubishi Electric Corporation, Parker Hannifin Corporation, Schneider Electric SE, Bosch Rexroth AG, and Lenze SE.

The global servo motors market is projected to reach $21,291.4 million by 2032

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The product launch is key growth strategy of Servo Motors industry players.

Loading Table Of Content...

Loading Research Methodology...