Set-Top Boxes (STB) Market Overview, 2032

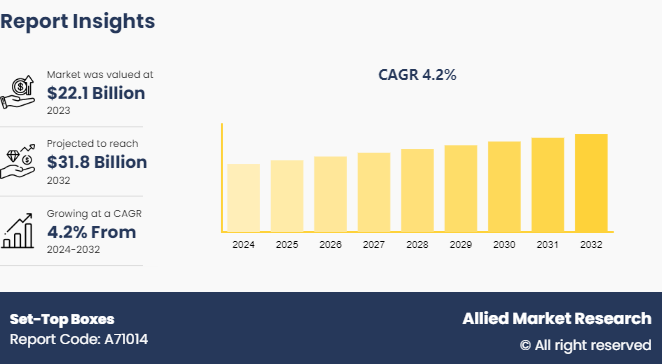

The Global Set-Top Boxes Market was valued at $22.1 billion in 2023, and is projected to reach $31.8 billion by 2032, growing at a CAGR of 4.2% from 2024 to 2032. This is driven by rising demand for digital television, high-definition content, and streaming services. Advancements in technology, including smart features and internet connectivity, boost adoption. Growing consumer preference for on-demand entertainment and government initiatives for digital broadcasting also contribute to market growth across regions.

Key Market Insights

- By technology, the satellite/DTH segment held the largest share in the Set-Top Boxes market size for 2023.

- By resolution, the HD segment held the largest share in the Set-Top Boxes market for 2023.

- By distribution channel, the offline segment held the largest share in the Set-Top Boxes market for 2023.

- By application, the residential segment held the largest share in the Set-Top Boxes market for 2023.

- Asia-Pacific is expected to witness the highest CAGR during the Set-Top Boxes market forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 31.8 Billion

- 2023 Market Size: USD 22.1 Billion

- Compound Annual Growth Rate (CAGR) (2024-2032): 4.2%

- North America: Dominated market share during forecast period

- Asia-Pacific: Highest CAGR during the forecast period

Market Introduction and Definition

A Set-Top Boxes Market is a hardware device that allows a digital signal to be received, decoded, and displayed on a television. The signal is a television signal or internet data and is received via cable or telephone connection.

Key Takeaways

- On the basis of technology, the satellite/DTH segment dominated the Set-Top Boxes industry in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of resolution, the HD segment dominated the Set-Top Boxes Industry size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of distribution channel, the offline segment dominated the Set-Top Box market size in terms of revenue in 2023. However, online segment is anticipated to grow at the fastest CAGR during the forecast period.

- On the basis of application, the residential sector segment dominated the Set-Top Boxes Industry size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

- In 2022, KAONMEDIA and 3 Screen Solutions (3SS) launched next-generation TV services for Scandinavia on a hybrid KAON BCM72180 PVR (set-top box) , an Android TV STB that supports DTH satellite, OTT, and IPTV, which was offered to over 1 million subscribers of Allente, a prominent TV distribution company in the Nordic region.

- In November 2022, DISH Network L.L.C. unveiled a new offer that locks in subscription prices on 3-year plans and guarantees no increase in prices to attract new long-term customers.

- According to TRAI, Tata Sky, a company of the Tata Group, recorded the highest share of about 33% of the Indian DTH market during the first half of 2021. During the measured time, the operator was ahead of Airtel, followed by Dish TV and Sun Direct. The remaining DTH operators further solidified their control of the market that year, except for Dish TV, which suffered a fall in its market share.

Key market dynamics

Rise in adoption of smart TVs and smart set-top box drives set-top box market growth. With smart TVs featuring internet connectivity and advanced functionalities, there is a growing need for compatible set-top boxes to access various streaming services and interactive content. This trend is driven by an increasing preference for on-demand content and streaming services over conventional cable or satellite TV options. As users strive for more personalized and convenient entertainment choices, the demand for smart set-top boxes expands, providing them with enhanced flexibility and control over their viewing experiences. For instance, in March 2022, Technicolor Connected Home partnered with Bouygues Telecom, one of France’s prominent network service providers with over 26.2 million fixed and mobile subscribers, to develop and deploy a futureproof and premium Android 4K ultra-high-definition (UHD) STB integrated with the best-in-class Wi-Fi that delivers video experiences to consumers throughout the French market.

However, government regulations related to the limited use of frequency bandwidth for the SBTs are anticipated to restrain market growth. These regulations aim to manage and optimize the use of the available frequency spectrum, potentially restricting the capabilities and functionalities of STBs. Such constraints hinder the development and deployment of advanced features in STBs, impacting their competitiveness and appeal to consumers. Consequently, the Set-top box market faces challenges in meeting evolving consumer demands and technological advancements within the constrained regulatory framework.

Furthermore, the integration of voice control and gesture recognition technologies into set-top boxes offers a significant growth opportunity for the market. These advanced features enable users to navigate and control their viewing experience hands-free, transforming usability. Voice commands facilitate effortless content search and channel switching, while gesture recognition adds an interactive dimension. This enhanced interface improves accessibility and positions set-top boxes as innovative entertainment hubs, appealing to consumers and driving market expansion.

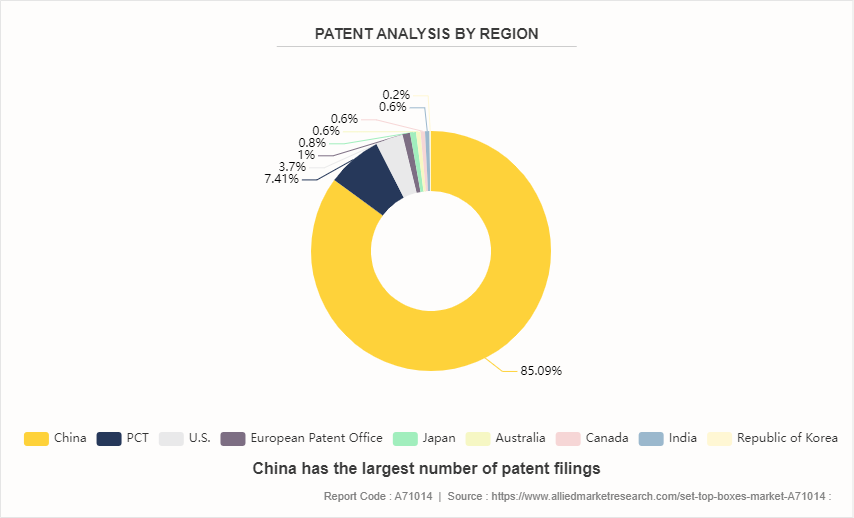

Patent Analysis of Global Set-Top Box (STB) Market

The global Set-Top Box (STB) market is segmented according to the patents filed in China, PCT, U.S., European Patent Office, Japan, Australia, Canada, India, and the Republic of Korea. China and PCT have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have the maximum number of patent filings.

Market Segmentation

The Set-Top Boxes Industry Report is segmented into technology, resolution, distribution channel, application, and region. On the basis of technology, the market is divided into Satellite/DTH, IPTV, Cable, and others. By resolution, the market is classified into SD, HD, UHD, 4K, and others. On the basis of distribution channel, the market is categorized into offline and online channels. On the basis of application, the market is fragmented into residential and commercial. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

By technology, the Satellite/DTH segment accounted for more than half of the market share in 2023 due to the widespread availability and accessibility of satellite broadcasting infrastructure, which enabled seamless distribution of television signals to a vast audience, overcoming geographical limitations and reaching remote or underserved areas. Moreover, the Satellite/DTH technology offers a diverse range of channels and content options, including high-definition (HD) and 4K programming, sports events, movies, and international channels, catering to diverse consumer preferences and interests.

By resolution, the HD segment held the highest market share in 2023, accounting for nearly half of the Set-Top Box (STB) market due to the increase in consumer demand for superior viewing experiences, characterized by sharper images, vibrant colors, and immersive audio, is propelling the adoption of HD STBs. The HD resolution offers significantly enhanced picture quality compared to standard definition (SD) , making it the preferred choice for consumers seeking a more engaging entertainment experience.

On the basis of distribution channel, the offline channel segment had the highest market share in 2023, as the offline channel offers personalized assistance from sales representatives, allowing consumers to make informed purchase decisions and receive immediate support for installation and troubleshooting. Moreover, the offline channel facilitates hands-on product demonstrations, fostering consumer confidence and trust in the quality and functionality of STBs, thereby driving higher sales volumes through physical retail outlets.

On the basis of application, the residential sector, had the highest market share for Set-Top boxes market insights in 2023, owing to the widespread adoption of digital television services in residential households, which drives the demand for STBs to access broadcast, cable, satellite, and internet-based content. Moreover, the increasing popularity of high-definition (HD) , ultra-high-definition (UHD) , and 4K television sets among consumers necessitates compatible STBs to deliver enhanced viewing experiences.

Regional/Country Market Outlook

On the basis of region, the Set-Top Box (STB) market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In Asia-Pacific, China accounts for the largest market share for Set-Top Boxes market size by country and is anticipated to grow at the fastest CAGR during the forecast period owing to factors such as rapidly expanding population, urbanization, and rising disposable incomes driving the demand for digital entertainment services, fueling the adoption of STBs across residential and commercial sectors. Moreover, the increasing penetration of digital television broadcasting, satellite TV, and broadband internet services in emerging economies like China, India, and Southeast Asian countries creates substantial opportunities for STB manufacturers and service providers.

Competitive Landscape

The major Set-Top Boxes manufacturer are Advance Digital Broadcast (ADB) , Commscope (ARRIS International, plc) , Coship Electronics Co.Ltd., Echostar Corporation, Huawei Technologies Co., Ltd, KaonMedia, Sagemcom SAS, Samsung Electronics Co. Ltd., Technicolor SA, LG CNS Co., Ltd.

Recent Key Strategies and Developments

- In August 2023, Reliance Jio announced launch of Jio set top box (STB) along with introduction of Jio Smart Home Services and Jio Router at Reliance Jio 46th Annual General Meeting (AGM) . Jio STB is anticipated to offer various services including TV channel streaming, games, streaming platforms, and applications such as JioCinema and JioTV+.

- In September 2022, a European set top box manufacturer, Vestel, announced the launch of its 4K ultra-high definition (UHD) 97XX series STB product. The STB product is expected to enhance consumer’s entrainment experience and features a compact minimalist design.

Key Sources Referred

- Semiconductor Industry Association (SIA)

- SEMI

- International Energy Agency

- IEEE Electron Devices Society (EDS)

- U.S. Department of Energy

- Global Semiconductor Alliance (GSA)

- World Economic Forum

- European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Set-Top Boxes Market Analysis from 2024 to 2032 to identify the prevailing set-top boxes (STB) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the set-top boxes (STB) market segmentation assists to determining the prevailing Settop box market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Cable Set Top Box market.

- Set-Top Boxes Market Share by Companies positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of regional as well as global set-top boxes (STB) market trends, Set-Top boxes for U.S., market Set-Top boxes company list, Set-Top boxes manufacturer, market segments, application areas, Set-Top boxes market forecast, Set-top boxes market data, Set-Top boxes sector analysis, and market growth strategies.

Set-Top Boxes (STB) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.8 Billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Technology |

|

| By Resolution |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | Samsung Electronics Co. Ltd, KaonMedia, Advance Digital Broadcast, Sagemcom SAS, Technicolor SA, Commscope, Coship Electronics Co.Ltd, LG CNS Co., Ltd, Echostar Corporation, Huawei Technologies Co., Ltd |

Loading Table Of Content...