SiC Fiber Market Reseasch –2028

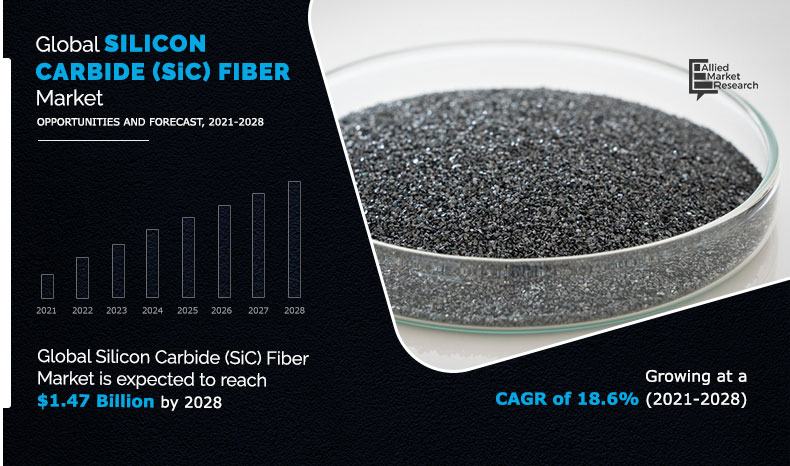

The global SiC fiber market forecast was valued at $0.38 billion in 2020, and is projected to reach $1.47 billion by 2028, growing at a CAGR of 18.6% from 2021 to 2028.

SiC (silicon carbide) fiber are mainly composed of silicon carbide molecules and they pose properties such as high stiffness, tensile strength, high chemical resistance, and low thermal expansion. Yajima process, chemical vapor deposition (CVD), and laser driven chemical vapor deposition (LCVD) are widely used for manufacturing of SiC fibers. Several research and developments are carried out to widen the application area of these fibers. For instance, silicon carbide fibers are reinforced with SiC composite matrix that are used in high temperature structural applications such as in gas turbine engines. These fibers are capable of withstanding structural and environmental conditions under the influence of high temperature range (up to 2700-degree Fahrenheit). In addition, ability to be engineered for specified stress level and wide operating temperature range makes them choice of material over other materials such as metallic superalloys, monolithic ceramics, carbon fiber composites, and oxide/oxide ceramic composites.

The growth of the global SiC fiber market is driven by increase in demand for silicon carbide fiber in the aerospace sector and adoption of SiC fiber in energy & power sector. SiC fiber possess excellent significant characteristics such as high heat resistance, chemical stability, high modulus, lightweight, durability, and others. These characteristics make them suitable to be used in the aerospace industry for a wide range of applications such as insulation for heat engines, nanotubes in turbines, ceramic matrix composites (CMC), and alternative to metallic alloys. Also, the utilization of SiC fibers in the aerospace industry brings environmental and economic benefits to the aircraft manufacturers by significantly reducing the weight and improving the fuel efficiency of the aircraft engines.

However, the wake of the COVID-19 pandemic has disrupted the entire demand & supply chain of various sectors. More than 100 countries have locked their international borders for transportation and non-essential trade activities. The manufacturing industries are also operating at half capacity during this pandemic situation owing to the risk of infection among the workforce. Furthermore, the liquidity crunch and financial crisis have decreased the demand for silicon carbide (SiC) fibers. In addition, the lockdowns have been imposed in the countries where aerospace & defense sectors are contributing a major share toward the growth of the economy such as the U.S., France, China, India, Germany, and others which in turn has resulted in reduced demand for SiC fibers.

On the contrary, the rise in demand for silicon carbide (SiC) fibers has grabbed the attention of both manufacturers and investors toward the SiC fibers market. Also, the increase in attention has surged the research & development-related activities for making SiC fiber more effective in high-temperature environments. For instance, a team of researchers at NASA has patented a non-oxide silicon carbide fiber named Sylramic-iBN that is capable to bear temperatures up to 3200C. This factor is anticipated to offer remunerative opportunities for the expansion of the global market.

The SiC fiber market is segmented into phase, application, and region. Depending on phase, the market is segregated into crystalline and amorphous. By application, it is divided into aerospace & defense, energy & power, industrial, and others. On the basis of region, the SiC fiber market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific garners the largest share in the global market, followed by North America and Europe. The major companies profiled in this report include American Elements, BJS Ceramics GmbH, Free Form Fibers LLC, GE Aviation, Haydale Technologies Inc., NGS Advanced Fibers Co., Ltd., Nippon Carbon Co., Ltd., Saint Gobain, SGL Carbon SE, and UBE Industries Ltd.

SiC Fiber market, by region

The Asia-Pacific SiC fiber market size is projected to grow at the highest CAGR of 21.50% during the forecast period and accounted for 19.70% of SiC fiber market share in 2020. China's defense sector is increasing rapidly which has forced the SiC fiber manufacturers to produce high-quality SiC fibers. According to a report published by the Military & Security Developments of China, the country intensified its efforts to advance & upgrade its military-grade weapons, and fighter jets. Also, countries such as India and Japan are witnessing a rapid increase in the set-up of new nuclear power plants where SiC fibers are widely used as temperature-resistant material for insulation purposes. These are the key factors augmenting the growth of the SiC fiber market in Asia-Pacific.

By Region

Asia-Pacific would exhibit highest CAGR of 21.50% during 2021-2028.

SiC fiber market, by phase

In 2020, the crystalline segment was the largest revenue generator, and is anticipated to grow at a CAGR 18.1% during the forecast period. The crystalline silicon carbide (SiC) fibers possess excellent properties such as high thermal resistance, high modulus, chemical stability, high strength, and other characteristics that make them suitable for a wide range of applications such as nuclear plants, power reactors, and refractories. However, the amorphous segment is predicted to grow with 19.3% CAGR due to utilization of amorphous-based SiC fibers in sectors such as aerospace & aviation, power industries, and metallurgical industries.

By Phase

Amorphous type is the most lucrative segment

SiC fiber market, by application

In 2020, the aerospace & defense segment was the largest revenue contributor, and is anticipated to grow at CAGR of 19.2% during forecast period. This is attributed to silicon carbide fibers properties such as lightweight, heat resistant, durable, chemically stable, shock resistant, and creep resistant. These characteristics make them suitable for a wide range of aerospace & defense applications such as insulation in engine parts, nanotubes in turbines. While the energy & power segment is anticipated to grow with 18.3% CAGR during the forecast period.

By Application

Aerospace & defense application is projected as the fastest growing segment

Technology Trend Analysis

- Silicon carbide (SiC) fibers are prized for their unique combination of strength, lightweight properties, and resistance to extreme temperatures. These characteristics make them indispensable in high-performance applications such as turbine engines and heat exchangers, where durability and thermal efficiency are paramount. Their ability to enhance energy efficiency and reduce overall system weight drives their adoption across industries.

- Innovations in SiC fiber fabrication, such as chemical vapor deposition (CVD) and polymer-derived ceramics, improve quality, consistency, and cost-efficiency. CVD ensures precise fiber formation at the atomic level, while polymer-derived ceramics enable scalable production by converting pre-ceramic polymers into fibers, meeting growing demand for high-performance materials in advanced applications.

- SiC fibers are crucial in nuclear reactors and power generation turbines because they offer exceptional thermal stability and resistance to radiation damage. These properties ensure durability and reliability in extreme environments, improving safety and performance while enabling advanced designs for high-temperature operations in next-generation energy systems.

Historical Trend Analysis for the SiC Fibers Market

- Early Development (1970s-1980s):

SiC fibers emerged during the 1970s as a high-performance material for extreme environments. Initially developed through chemical vapor deposition (CVD) techniques, they were primarily used in aerospace for reinforcing composites in engines and structural components.

- Limited Adoption Phase (1990s):

The 1990s saw limited industrial adoption due to high production costs and technical challenges. SiC fibers remained niche, focusing on military and aerospace applications. Research emphasized improving fiber strength and chemical stability.

- Advancements in Manufacturing (2000s):

Significant progress in polymer-derived ceramic methods and melt-spinning processes reduced costs and improved scalability. SiC fibers began expanding into energy and industrial applications, particularly in ceramic matrix composites (CMCs) for gas turbines.

- Diversification of Applications (2010s):

The market diversified into power generation, nuclear energy, and automotive sectors. SiC fibers gained recognition for their ability to withstand extreme temperatures and radiation. Increased funding for R&D accelerated their use in civilian aerospace and renewable energy systems.

- Modern Growth and Technological Integration (2020s):

Recent years have seen rapid market growth driven by increased adoption in hypersonic technologies, clean energy initiatives, and lightweight composites for aviation. Sustainability and manufacturing innovations have further boosted demand, with Asia-Pacific becoming a major hub for production and research.

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current SiC fiber market trends and future estimations from 2020 to 2028 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of SiC fiber market key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Sic Fiber Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe.

- The silicon carbide (SiC) fibers market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on the aerospace & defense sector. According to a report published by the U.S. Aerospace & Defense Industry (A&D), the defense sector in the U.S. has witnessed an enormous revenue loss of around $150,000 million amid the COVID-19 situation.

- More than 100 countries have locked their international borders for transportation and non-essential trade activities. For instance, the cargo airline volume of American Airlines has witnessed a 68% reduction in the shipment of goods in September 2020. This has hardly hit the performance of SiC fibers among the aerospace industry owing to their use in the insulation & manufacturing of other aircraft components.

- The temporary shutdown of industries have reduced the global power consumption (industrial load) amid the COVID-19 pandemic. According to a report published by the International Finance Corporation, the global electricity demand decreased by 2.5% in the first quarter of 2020 and is expected to decrease by 6% at the end due to shutdowns imposed in the various parts of the world. This has severely affected the demand for SiC fibers among the power sectors during the COVID-19 situation where SiC fibers are widely used in various high-temperature applications.

- However, several key players such as Free Form Fibers LLC, BJS Ceramics GmbH, GE Aviation, and others are constantly engaged in widening their footprints and looking for new investment opportunities amid the COVID-19 situation. For instance, Free Form Fibers LLC has concluded financing of $2.5 million for increasing the production of its rapid laser-driven chemical vapor deposition (R-LCVD) silicon carbide fiber in November 2020. This is expected to enhance the performance of the SiC fibers market post-COVID-19 scenario.

SiC Fiber Market Report Highlights

| Aspects | Details |

| By Phase |

|

| By Application |

|

| By Region |

|

| Key Market Players | Saint Gobain, Free Form Fibers LLC, GE Aviation, Haydale Technologies Inc., American Elements, BJS Ceramics GmbH, NGS Advanced Fibers Co., Ltd, Nippon Carbon Co., Ltd., SGL Carbon SE, UBE Industries Ltd |

Analyst Review

The global SiC fiber market is expected to exhibit high growth potential, owing to its application in aerospace & defense, energy & power, and industrial sectors. The crystalline silicon carbide (SiC) fibers possess excellent properties such as high thermal resistance, high modulus, chemical stability, high strength, and other characteristics that make them suitable for a wide range of applications such as nuclear plants, power reactors, refractories, and others. This is the major key market trend in the global market. Furthermore, developing economies such as China, India, and others are witnessing a rapid surge in the installation of nuclear power reactors. According to a report published by the Indian Department of Atomic Energy, 21 new nuclear power reactors with an installed capacity of 15700MW are set up in different parts of India. Thus, silicon carbide fibers being widely used for insulation purposes, which is another factor favorable for the growth of the global market. In addition, there is a rapid surge in metallurgical & heat treatment industries owing to the rise in infrastructure and construction activities. For instance, the new decarbonizing global framework of Tata Steel where SiC fibers are widely used in refractories & reinforcements. These factors are predicted to augment the growth of the global SiC fiber market.

The silicon carbide (SiC) fibers possess different significant properties such as heat resistance, corrosion resistance, high modulus, chemical stability, lightweight, and other characteristics that make it suitable to be used in a wide variety of energy & power components. They are used as reinforcements, refractories in land-based turbines, nuclear reactors, heat-resistant filters, curtains, belts, and other leisure equipment in power sectors. According to a report published by the Indian Brands Equity Foundation, power consumption in India is estimated to increase from 1,160.1TWh in 2016 to 1,894.7TWh in 2022. This may lead the Indian government and local authorities to set up more power plants in the region where SiC fibers are used extensively for high-temperature applications. This is not only gaining immense attention in the market but is also emerging as a key strategy in terms of gaining additional market demand.

Rise in demand of SiC fiber in aerospace sector and consumption of SiC fiber in energy & power sector are the key factors that are boosting the demand of SiC fiber market

The SiC fiber market size is projected to reach $1.47 billion by 2028.

American Elements, BJS Ceramics GmbH, Free Form Fibers LLC, GE Aviation, Haydale Technologies Inc., NGS Advanced Fibers Co., Ltd., Nippon Carbon Co., Ltd., Saint Gobain, SGL Carbon SE, and UBE Industries Ltd. are the top companies in the SiC fiber market

Aerospace & defence industry is projected to increase the demand of SiC fiber market

By phase, by application, and by region are covered in Sic fiber market.

The growth of the global SiC fiber market is driven by increase in demand for silicon carbide fiber in the aerospace sector and adoption of SiC fiber in energy & power sector. SiC fiber possess excellent significant characteristics such as high heat resistance, chemical stability, high modulus, lightweight, durability, and others. These characteristics make them suitable to be used in the aerospace industry for a wide range of applications such as insulation for heat engines, nanotubes in turbines, ceramic matrix composites (CMC), and alternative to metallic alloys. Also, the utilization of SiC fibers in the aerospace industry brings environmental and economic benefits to the aircraft manufacturers by significantly reducing the weight and improving the fuel efficiency of the aircraft engines. It is the major growth factor in the SiC fiber market.

Aerospace & defense and energy & power applications are expected to drive the adoption of SiC fiber.

COVID-19 has impacted negatively on the SiC fiber market. This is attributed due to • The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe. • The silicon carbide (SiC) fibers market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on the aerospace & defense sector. According to a report published by the U.S. Aerospace & Defense Industry (A&D), the defense sector in the U.S. has witnessed an enormous revenue loss of around $150,000 million amid the COVID-19 situation. • More than 100 countries have locked their international borders for transportation and non-essential trade activities. For instance, the cargo airline volume of American Airlines has witnessed a 68% reduction in the shipment of goods in September 2020. This has hardly hit the performance of SiC fibers among the aerospace industry owing to their use in the insulation & manufacturing of other aircraft components. • The temporary shutdown of industries have reduced the global power consumption (industrial load) amid the COVID-19 pandemic. According to a report published by the International Finance Corporation, the global electricity demand decreased by 2.5% in the first quarter of 2020 and is expected to decrease by 6% at the end due to shutdowns imposed in the various parts of the world. This has severely affected the demand for SiC fibers among the power sectors during the COVID-19 situation where SiC fibers are widely used in various high-temperature applications. • However, several key players such as Free Form Fibers LLC, BJS Ceramics GmbH, GE Aviation, and others are constantly engaged in widening their footprints and looking for new investment opportunities amid the COVID-19 situation. For instance, Free Form Fibers LLC has concluded financing of $2.5 million for increasing the production of its rapid laser-driven chemical vapor deposition (R-LCVD) silicon carbide fiber in November 2020. This is expected to enhance the performance of the SiC fibers market post-COVID-19 scenario.

Loading Table Of Content...