Silk Market Research, 2031

The global silk market was valued at $15.6 billion in 2021, and is projected to reach $34.1 billion by 2031, growing at a CAGR of 8.2% from 2022 to 2031. Silk is one of the luxurious fabrics and shimmering textile which is gaining huge popularity across the world. Some of the key qualities of silk fiber include its lustrous appearance, opulent feel, resilience, lightweight, and strength.

Silk is widely used in different types of clothing, such as gowns, wedding gowns, neckties, and scarves, as well as in many household items, such as wall hangings, pillows, upholstery, and draperies. Additionally, silk has less conductivity than other materials, which promotes its use in ties, shirts, haute couture garments, formal dress suits, robes, kimonos, and sundresses. The demand for silk is expected to increase as a result of the aforementioned crucial factors, which could ultimately lead to a flourishing global market.

The silk production requires less investment as it does not need complex machines and equipment for silk production. The silk sector is more labor-intensive than investment-intensive industries globally. These factors are projected to contribute to the market expansion. Increasing research and knowledge about Seri-by-products and Seri-waste products will be essential for the growth of the silk protein market in the upcoming years. One of the significant reasons for the increasing utilization of silk protein across several industries is the presence of dipeptides and tripeptides within them that can easily penetrate into the bloodstream by traveling from the dermis skin layer. Additionally, the presence of components such as natural amino acids in silk protein makes it desirable for various cosmetics and supplement manufacturing applications.

One of the factors limiting the silk market growth is the fluctuation of silk material prices. Additionally, inadequate market and storage facilities, lack of transportation options, and inadequate market trend information, particularly in the countries such as India, Brazil, and Uzbekistan, are some of the factors that are causing obstructions in the global market.

New companies working in this market are also developing novel ideas that may have a favorable effect on the sector. For instance, ReshaMandi, an agro-tech business based in Karnataka, enables silk growers to raise total revenue and improve silk quality through technology interventions. In May 2021, the company offered cutting-edge ‘AI & IoT led ecosystem technologies’ that assisted 5,500 silk producers in raising their income by 30%. The global market for silk may be further stimulated by such technological advancements and integration.

The key players profiled in this report include Anhui Silk Co. Ltd., AMSilk GmbH, EntoGenetics inc., Bolt Threads, Sichuan Nanchong Liuhe (Group) Corp., China Silk Group Co. Ltd, Zhejiang Jiaxin Silk Co., Ltd, Xuzhou Shengkun Silk Manufacturing Co., Ltd, Spiber Technologies, and Libas Textiles Ltd.

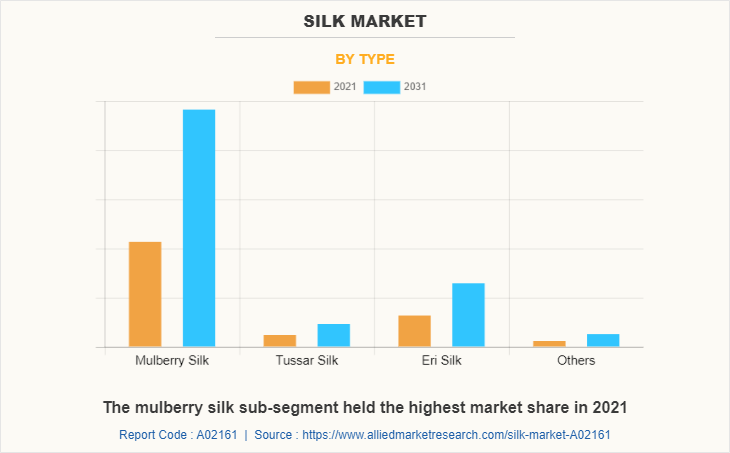

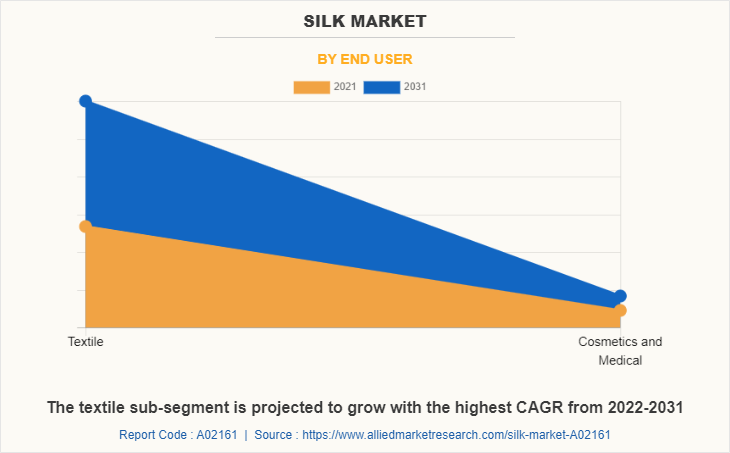

The global silk market is segmented on the basis of type, end user, and region. By type, the market is sub-segmented into mulberry silk, tussar silk, eri silk, and others. By end user, the market is classified into textiles and cosmetics & medical. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The silk market is segmented into Type and End User.

By type, the mulberry silk sub-segment is estimated to show the fastest growth during the analysis timeframe. This is because mulberry silk is one of the highest quality silks as the silkworms are nurtured in a way that creates the mulberry silk nourishing to humans. This is one of the softest natural silk that nourishes your skin. Mulberry silk have antibacterial and hypoallergenic properties and can treat skin conditions like atopic dermatitis.Owing to such unique features, there is a huge demand for mulberry silk, in the global market. These are predicted to be the major factors affecting the silk market size during the forecast period.

By end user, the textile sub-segment dominated the global silk market share in 2021. Textile is the leading end-use industry for silk owing to its remarkable features such as lightweight fabric, luxurious, and great strength. Moreover, silk plays a key role in the production of surgical sutures, clothing, silk comforter, and parachutes, which is further projected to propel the textile sub-segment, over the analysis timeframe. It is used in many different types of clothing, including wedding dresses, gowns, blouses, scarves, and neckties, as well as numerous domestic items, including pillows, wall hangings, draperies, and upholstery.

By region, Asia-Pacific dominated the global silk market in 2021 and is projected to remain the fastest-growing sub-segment during the forecast period. The market for the Asia-Pacific region is highly competitive and leading companies in the market are preferring numerous strategies to garner prominent share in the Asia-Pacific region. Countries such as India, Thailand, China, and Uzbekistan are the prominent players of silk in the Asia-Pacific region. For instance, in December 2021, India accounted for 26,587 metric tonnes (MT) production of silk. The share of mulberry silk was the largest in India and major silk-producing states in India are Andhra Pradesh, Bihar, Assam, Gujarat, Karnataka, and others. Additionally, the demand for silk is significantly attributed to the rising population worldwide along with an increasing number of startups with their novel innovations.

Impact of COVID-19 on the Global Silk Industry

- Businesses in the hospitality, retail, and tourism sectors had to re-evaluate their business models as a result of the COVID-19 pandemic. Additionally, throughout the pandemic, the global silk market saw declining growth, primarily as a result of the accessibility issues to transportation infrastructures.

- Additionally, local and foreign purchasers postponed or cancelled their purchases as a result of the market uncertainty, adding to the problems facing the sector. During the outbreak period, these factors had a negative impact on the world market for silk fibers.

- However, state statutory agencies are developing strategic measures to advance the silk sector. For instance, the Indian Ministry of Micro, Small, and Medium Enterprises (KVIC) in September 2021, developed Odisha's first silk yarn production center in an effort to increase local silk production and generate jobs. This project increased local employment and not only guaranteed the availability of tussar silk but also assisted in reducing the cost of silk production.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global silk market trends along with the silk market forecast

- The report elucidates the silk market opportunities along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building

- The report entailing the silk market analysis maps the qualitative sway of various industry factors on market segments as well as geographies

- In-depth analysis of the silk market segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Silk Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Zhejiang Jiaxin Silk Co., Ltd., Jiangsu Sutong Cocoon And Silk Co., Anhui Silk Co. Ltd., Amsilk GmbH, Libas Textiles Ltd., Sichuan Nanchong Liuhe (Group) Corp., Bolt Threads, Wujiang Wanshiyi Silk Co. Ltd., ShengKun Silk Manufacturing Co., Ltd., Wujiang First Textile Co., Ltd. |

Analyst Review

Increase and evolving application of silk in textile & apparel market worldwide is the key factor that is projected to drive the growth of the silk market during the forecast period. In addition, the silk market requires less investment because it does not require complex machines and equipment to produce. It is more labor-intensive than investment-intensive industry. These factors contribute to the market expansion. One of the main factors restricting the global silk market is the high price of raw silk. India, Japan, and Italy are among the countries that rely majorly on China for their raw silk needs. Such factors are having a detrimental effect on the silk industry globally. The rapidly rising demand for silk protein in sectors such as cosmetics and personal care, textile, pharmaceutical, and nutraceuticals are anticipated to provide remunerative opportunities for key players to maintain the pace of the global silk market in the upcoming years.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031. Asian countries such as India, Thailand, China, and Uzbekistan are the prominent players of silk in the Asia-Pacific region. The demand for silk is significantly attributed to the rising population worldwide along with increasing number of startups with their novel innovations.

The evolving applications of silk in the textile & apparel market worldwide is the key factor that is projected to drive the market growth. In addition, silk production requires less investment as it does not require complex machines and equipment, these factors are estimated to generate excellent opportunities in the silk market.

Silk have wide range of applications in clothing and textile sector.

Asia-Pacific is the largest regional market for silk.

The silk market is estimated to reach $29.9 billion by 2031.

The top leading companies in the silk market to hold the highest market share include Anhui Silk Co. Ltd., AMSilk GmbH, EntoGenetics Inc., Bolt Threads, Sichuan Nanchong Liuhe (Group) Corp., and China Silk Group Co. Ltd.

Loading Table Of Content...