SIM Card Market Research, 2032

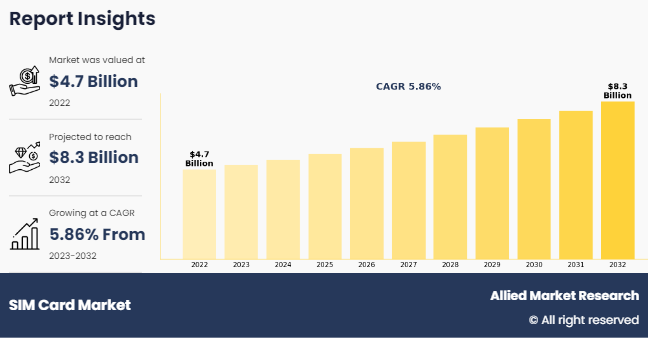

The Global Sim Card Market was valued at $4.7 billion in 2022, and is projected to reach $8.3 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

A SIM card, also called a subscriber identity module or subscriber identification module, is a small memory card that contains unique information that identifies it to a specific mobile network. This card allows subscribers to use their mobile devices to receive calls, send SMS messages, or connect to mobile internet services. The SIM card contains a small amount of memory that can store up to 250 contacts, some SMS messages, and other information used by the carrier who supplied the card.

The SIM card market is expected to witness notable growth owing to expansion of IoT and M2M Communication. Moreover, surge in demand for eSIM technology is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, the rising security concerns limits the growth of the SIM card market.

Key Takeaways of Sim Card Market Report

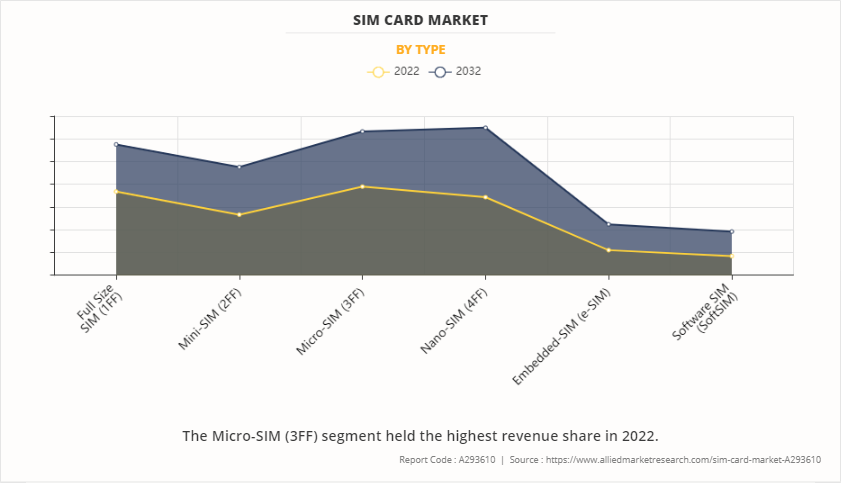

On the basis of Type, the Micro-Sim segment dominated the SIM card market size in terms of revenue in 2022. However, the Software Sim segment is anticipated to grow at the fastest CAGR during the forecast period.

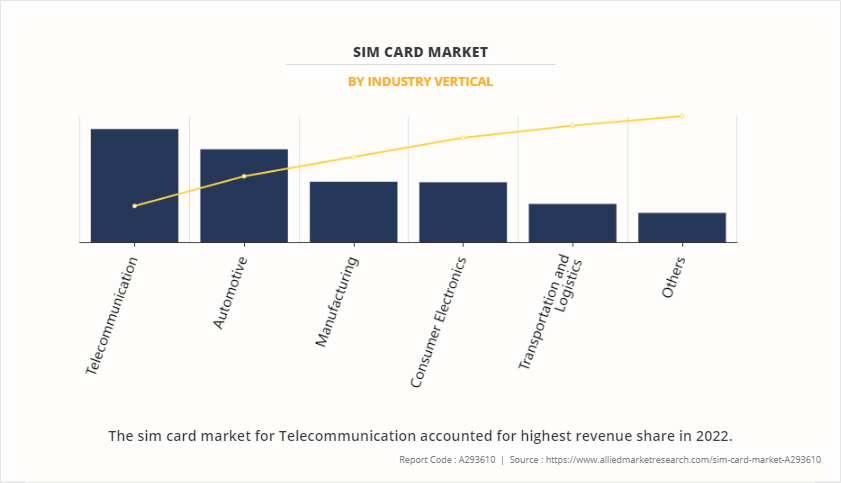

On the basis of industry vertical, the Telecommunication segment dominated the SIM card market size in terms of revenue in 2022. However, the Consumer Electronics segment is anticipated to grow at the fastest CAGR during the forecast period.

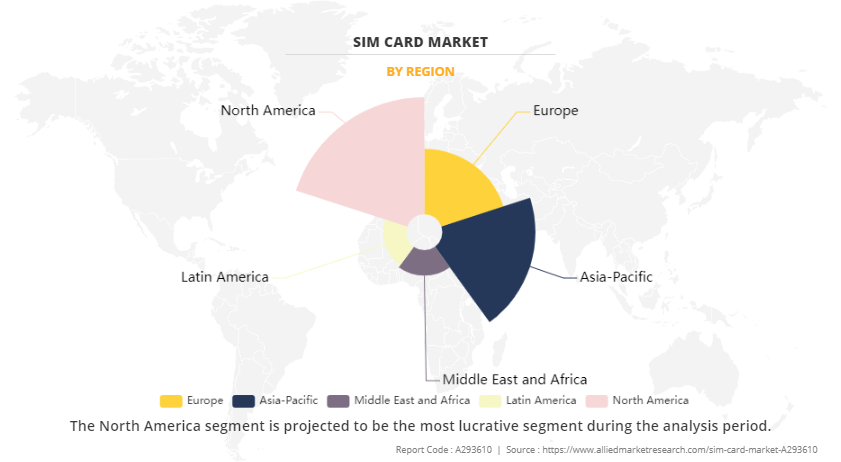

Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Segment Overview

The Sim card market is segmented into Type, Industry Vertical, and Region

On the basis of type, the market is divided into Full Size SIM (1FF), Mini-SIM (2FF), Micro-SIM (3FF), Nano-SIM (4FF), Embedded-SIM (Esim card), and Software SIM (SoftSIM). In 2022, the Micro-Sim segment dominated the market in terms of revenue. Moreover, the Software-Sim segment is projected to have the highest CAGR during the forecast period.

On the basis of industry vertical, the market is classified into Automotive, Consumer Electronics, Manufacturing, Telecommunication, Transportation & Logistics, and Others. In 2022, the Telecommunication, segment dominated the market in terms of revenue. However, the Consumer Electronics segment is expected to manifest the highest CAGR during the forecast period.

On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, Qatar, and rest of Middle East and Africa). Asia-Pacific, specifically China, remains a significant participant in the SIM card market with a CAGR of 7.11% due to high investments in the consumer electronics sector, which is driving the growth of the SIM card market size by country in Asia-Pacific region.

Competitive Analysis

Sim Card Companies and profiles including, Thales, Giesecke & Devrient GmbH., IDEMIA, Watchdata Systems Co., VALID, XH Smart tech, DZ Cards, HkCard Electronics co. Ltd, Hengbao, and Datang Telecom Technology are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022. For instance, on 17 May 2023, G+D strengthened its position in the loT market with the acquisition of MECOMO AG. International security technology group Giesecke & Devrient (G+D) has acquired MECOMO AG, a specialist in tracking and tracing solutions, with the contract signed. MECOMO, based in Munich/Unterschleissheim, Germany, is a software systems house that provides end-to-end (E2E) telematics solutions for industrial and logistics enterprises. Founded in 2000, the company is the market leader in German-speaking Europe for the digitalization of fleet-based logistics processes.

Market Dynamics

The increase in penetration of smartphone, IOT devices and the evolution towards e-SIM technology

The increasing penetration of smartphones, IoT devices, and the evolution towards eSIM technology significantly drives the SIM card market. Smartphones have become ubiquitous, with more people worldwide relying on these devices for communication, entertainment, and productivity. As IoT industry verticals proliferate across industries such as healthcare, automotive, and manufacturing, the demand for SIM cards to enable connectivity and data exchange between devices grows exponentially. Furthermore, the transition towards eSIM technology offers added flexibility and convenience, allowing users to remotely provision and manage SIM profiles without physical cards. This trend aligns with the growing preference for connected devices and seamless integration across ecosystems, driving the adoption of ESIM card-enabled devices and bolstering the demand for SIM card solutions.

Expansion of IoT and M2M Industry Verticals

The expansion of IoT and M2M industry verticals presents a significant opportunity for the SIM card market. With IoT devices becoming more widespread in various sectors like smart cities, industries, and healthcare, there's a rising demand for reliable connectivity solutions. SIM cards play a crucial role in facilitating this connectivity, ensuring secure and smooth communication between IoT devices and networks. Whether it's tracking assets, monitoring environmental conditions, or enabling remote healthcare, SIM cards enable essential data exchange and control functionalities for IoT implementations. In addition, as M2M communication advances, with devices communicating autonomously, there's a growing need for SIM cards tailored to specific M2M requirements. This creates a chance for Sim card manufacturers to develop specialized solutions for low-power networks, harsh environments, and other unique M2M industry verticals, fostering innovation and expansion in the SIM card market.

Market Saturation in Developed Regions

The saturation of mature markets, such as North America and Western Europe, represents a significant restraint factor for the SIM Card Market Statistics. In these regions, the widespread adoption of smartphones and SIM cards has reached a point where most consumers already own a device and subscribe to a mobile service. Therefore, the growth potential for new SIM card sales in these markets is limited. With a large portion of the population already equipped with smartphones and SIM cards, there are fewer opportunities for manufacturers to expand their customer base and increase sales volume. Moreover, in saturated markets, consumers may be less inclined to upgrade their devices or switch mobile operators frequently, further dampening demand for new SIM cards. On the other hand, SIM card manufacturers operating in these regions may face challenges in achieving significant revenue growth, forcing them to explore alternative strategies such as diversifying into emerging markets or focusing on value-added services to sustain their business.

Historical data and information

The SIM card market report is highly competitive, owing to the strong presence of existing vendors. SIM card market share by company with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to Sim card growth projections. The competitive environment in this market is expected to rise as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Developments in SIM Card Industry

In 17 May 2023, G+D strengthened its position in the loT market with the acquisition of MECOMO AG. International security technology group Giesecke & Devrient (G+D) has acquired MECOMO AG, a specialist in tracking and tracing solutions, with the contract signed. MECOMO, based in Munich/Unterschleissheim, Germany, is a software systems house that provides end-to-end (E2E) telematics solutions for industrial and logistics enterprises. Founded in 2000, the company is the market leader in German-speaking Europe for the digitalization of fleet-based logistics processes.

In 31 May 2022, TIM adopted IDEMIA's eSIM solution to meet IoT market demand in Brazil. IDEMIA's Smart Connect M2M solution enables mobile operators to offer connectivity services seamlessly and remotely. IDEMIA, the leader in identity technologies, and TIM, the largest mobile operator in Brazil in 4G coverage and pioneer in IoT projects, reinforced their partnership with eSIM management solutions for the Machine-to- Machine and Internet-of-Things markets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sim card market analysis from 2022 to 2032 to identify the prevailing SIM Card Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sim card market segmentation assists to determine the prevailing SIM Card Market Insights.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- SIM Card Manufacturerr positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sim card market trends,SIM Card Companies, market segments, application areas, and market growth strategies.

SIM Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.3 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | HkCard Electronics co. ltd, Giesecke & Devrient GmbH., Hengbao, VALID, Watchdata Systems Co., Thales, XH Smart tech, Datang Telecom Technology, IDEMIA, DZ Cards |

Analyst Review

The global SIM card market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for SIM card devices, particularly in developing regions, such as China, India, the UAE, and South Africa. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings.

The SIM card market is expected to witness notable growth owing to the rising smartphone adoption and the proliferation of data-intensive industry verticals such as healthcare and automotive. Moreover, the shift to embedded SIM (eSIM) technology is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, intense price competition within the SIM card market limits the growth of the SIM card market.

The key players profiled in the report include Thales, Giesecke & Devrient GmbH., IDEMIA, Watchdata Systems Co., VALID, XH Smart tech, DZ Cards, HkCard Electronics co. Ltd, Hengbao, and Datang Telecom Technology. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

The growing integration of embedded SIM technology in devices for streamlined connectivity, and the expansion of the Internet of Things (IoT) ecosystem are the upcoming trends of SIM card market.

Telecommunication is the leading application in the SIM card market.

North America is the largest regional market for SIM Card

In 2022, $4.7 billion is the estimated industry size of SIM Card.

Thales, Giesecke & Devrient GmbH., IDEMIA, Watchdata Systems Co., VALID, XH Smart tech, DZ Cards, HkCard Electronics co. Ltd, Hengbao, and Datang Telecom Technology are the top companies to hold the market share in SIM Card.

Loading Table Of Content...

Loading Research Methodology...