Single Trip Travel Insurance Market Research, 2034

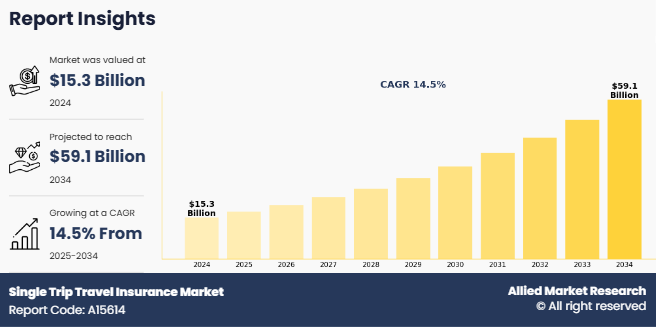

The global single trip travel insurance market size was valued at $15.3 billion in 2024, and is projected to reach $59.1 billion by 2034, growing at a CAGR of 14.5% from 2025 to 2034.

A single trip travel insurance policy provides coverage for a single domestic or international trip. The policy will last until the traveler returns home from the trip. All insurance companies have a cap on the number of days that are to be counted as a single trip. The single trip insurance policy covers the costs and losses of an international trip or a domestic trip. Typically, the insurance policy covers 180 days. However, the period of coverage would depend on the insurance provider.

Market Dynamics

The rapid digitalization of travel services and the widespread adoption of online insurance distribution platforms have emerged as powerful drivers for the single trip travel insurance market. With travelers increasingly relying on digital channels for ticket booking, itinerary management, accommodation selection, and payment processing, insurance providers have strategically aligned their offerings within these digital ecosystems. Online travel agencies, airline booking portals, mobile payment apps, and insurance aggregators now prominently integrate single-trip insurance options directly into the booking process, enhancing visibility and convenience for users. This streamlined purchase experience encourages consumers to compare benefits, evaluate pricing, and select suitable coverage with minimal effort.

The availability of instant policy issuance, digital documentation, and online claims support further enhances customer confidence and reduces friction associated with traditional insurance purchases. Digital platforms also enable insurers to develop innovative, personalized products using data-driven insights, ensuring better alignment with traveler preferences. As consumers increasingly expect efficiency, transparency, and accessibility in travel services, digital distribution channels continue to shape purchasing behavior and strengthen overall insurance penetration. This growing reliance on digital systems acts as a key facilitator for the single trip travel insurance market growth.

Escalating international healthcare costs and heightened financial exposure during medical emergencies play a vital role in driving the demand for single trip travel insurance market. Healthcare expenses in popular travel destinations‐”such as the U.S., Europe, and parts of Asia-Pacific‐”have grown substantially in recent years, with even basic treatments often carrying significant costs for uninsured travelers. Emergency hospitalizations, diagnostic tests, outpatient care, and medical evacuations can impose substantial financial burdens, making travel insurance an essential safeguard. Travelers are becoming increasingly aware of these risks, particularly in situations involving sudden illness, accidental injuries, or complications from pre-existing medical conditions.

The financial strain associated with accessing foreign healthcare services has led consumers to proactively secure single-trip policies that offer comprehensive medical coverage. In addition, currency fluctuations can further increase medical expenses, creating additional financial uncertainty. Insurance providers address these concerns by offering tailored medical coverage, emergency support services, and cashless treatment options through international assistance networks. As global medical inflation continues to rise and travelers prioritize financial security, the need to mitigate costly healthcare risks drives sustained demand for single trip travel insurance market.

The increasing diversification of global travel behavior creates a strong opportunity for insurers to introduce specialized single trip travel insurance market products designed for niche travel segments. Adventure tourism, destination weddings, cruise travel, student exchange programs, senior travel groups, eco-tourism, and medical tourism are gaining popularity, each requiring tailored coverage due to their unique risk profiles. Travelers engaging in activities such as trekking, scuba diving, skiing, or remote-area expeditions often encounter elevated safety risks, creating demand for policies that offer enhanced medical protection, evacuation benefits, and activity-specific add-ons. Similarly, cruise travelers require coverage for maritime medical emergencies, itinerary disruptions, missed port departures, and onboard health incidents.

Insurers can also design plans catering to students studying abroad or families traveling together, offering flexible benefits such as coverage for lost documents, emergency assistance, and trip interruptions. By aligning product features with the evolving needs of modern travelers, insurers can differentiate their offerings and capture niche segments with higher willingness to pay. The growing preference for experiential and theme-based travel strengthens the opportunity for insurers to develop highly customized, purpose-driven policies that enhance traveler confidence and support risk preparedness across diverse travel categories which is expected to propel growth of the single trip travel insurance market.

Low penetration levels in developing nations represent a major structural restraint for the single trip travel insurance industry, driven by economic, informational, and infrastructural limitations. In several low- and middle-income countries, travel insurance remains an underutilized financial product due to limited adoption of formal financial services and limited trust in insurance providers. Many consumers prioritize essential travel expenditures over optional financial protection products, particularly in regions with constrained disposable income levels. In addition, limited integration of insurance offerings within travel booking ecosystems‐”such as airline portals, travel agencies, and digital travel platforms‐”reduces visibility and accessibility of single trip travel insurance market options.

Regulatory variations and inconsistent policy enforcement across countries further restrict insurers from scaling operations and introducing standardized products that meet international travel requirements. The absence of targeted awareness campaigns, combined with insufficient digital infrastructure in rural and semi-urban areas, also restricts insurers‐™ reach to potential customer segments. Consequently, insurers face challenges in building distribution networks, tailoring region-specific products, and educating consumers about the benefits of travel insurance. These market constraints collectively slow adoption rates, limit single trip travel insurance market opportunity, and create regional disparities in insurance penetration, thereby restraining the overall expansion of the global single trip travel insurance industry.

Segmental Overview

The single trip travel insurance market is segmented on the basis of distribution channel, end user and region. By distribution channel, it is segmented into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. By end user, it is segmented into senior citizens, education travelers, business travelers, family travelers, and others. By region, the market is studied across North America, Western Europe, Asia-Pacific, and South America.

By Distribution Channel

By distribution channel, the insurance intermediaries segment held the major share of the market in 2024 and is anticipated to maintain its dominance during the single trip travel insurance market forecast period. Intermediaries are increasingly leveraging integrated booking platforms, real-time comparison systems, and automated advisory tools that allow travelers to evaluate multiple policy options instantly at the point of purchase. This seamless digital experience significantly reduces the complexity traditionally associated with insurance buying, thereby increasing adoption rates. Moreover, intermediaries possess deep customer insights derived from continuous interaction with diverse traveler segments, enabling them to recommend highly relevant and customizable single trip insurance products.

By End User

By end user, the family travelers segment held single trip travel insurance market share in 2024. Families typically include children, elderly parents, and dependents, which inherently increases the complexity and risk exposure associated with travel. As a result, travelers actively seek insurance products that provide extensive, end-to-end coverage against medical emergencies, trip cancellations, accidental injuries, loss of baggage, and unexpected disruptions that may impact the entire family unit. Rising disposable incomes, expanding preference for international vacations, cruise trips, theme-park holidays, and long-haul travel have further strengthened the demand for well-structured single trip travel insurance policies. Moreover, a substantial shift in consumer behavior‐”propelled by heightened awareness of global health uncertainties and safety concerns‐”has positioned insurance as an essential rather than optional component of family travel planning.

By Region

Region-wise, Asia-Pacific region held the major share of the single trip travel insurance market in 2024 owing to rapid rise in outbound travel, expanding middle-class populations, and increasing disposable incomes across major economies such as India, Japan, and Australia. The region is experiencing a substantial surge in international and domestic mobility driven by lifestyle shifts, improved air connectivity, and growing aspirations for leisure, business, and educational travel. As more travelers explore long-haul destinations and multi-country itineraries, the demand for comprehensive protection against medical emergencies, trip cancellations, lost baggage, and travel disruptions is rising sharply. Heightened awareness of global health risks and the financial burden of overseas medical treatment have further prompted Asian travelers to prioritize insurance as a mandatory component of trip planning.

Competition Analysis

Key players operating in the global single trip travel insurance market outlook include Bajaj Allianz General Insurance Company Limited., Care Health Insurance Limited., GeoBlue International Insurance Company, LLC, HDFC ERGO General Insurance Company Limited, ICICI Lombard General Insurance Company Ltd., IFFCO-Tokio General Insurance Company Limited., Nationwide Mutual Insurance Company, WORLD NOMADS PTY LTD, AGA Service Company, and Reliance General Insurance Company Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the single trip travel insurance market analysis from 2024 to 2034 to identify the prevailing single trip travel insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the single trip travel insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global single trip travel insurance market trends, key players, market segments, application areas, and market growth strategies.

Single Trip Travel Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 59.1 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 297 |

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Nationwide Mutual Insurance Company, WORLD NOMADS PTY LTD., IFFCO-Tokio General Insurance Company Limited., AGA SERVICE COMPANY, Care Health Insurance Limited., Bajaj Allianz General Insurance Company Limited., GeoBlue International Insurance Company, LLC, ICICI Lombard General Insurance Company Ltd., HDFC ERGO General Insurance Company Limited, RELIANCE GENERAL INSURANCE COMPANY LIMITED |

Analyst Review

The single trip travel insurance market is witnessing accelerated growth driven by heightened traveler awareness of potential risks, rising disposable incomes, and increasing global mobility across diverse traveler segments. As international and domestic travel volumes expand, customers are prioritizing comprehensive protection that safeguards against uncertainties such as medical emergencies, trip cancellations, lost baggage, and unforeseen disruptions. Industry leaders recognize the imperative to innovate product offerings by developing tailored, flexible insurance solutions that cater to the evolving needs of senior citizens, business travelers, students, and adventure tourists. Digital transformation is central to this evolution, with key players investing in advanced distribution channels, AI-powered underwriting, and seamless integration with travel booking platforms to enhance customer experience and expedite policy issuance. The increasing prominence of online travel agencies and fintech collaborations presents significant opportunities to extend market reach and improve policy penetration, particularly among digitally savvy millennials and emerging middle-class travelers.

From a strategic standpoint, CXOs emphasize the importance of forging robust partnerships with airlines, tour operators, and banks to embed insurance seamlessly within the travel journey, thereby reducing friction and increasing uptake. Furthermore, the growing demand for transparency, personalized pricing, and rapid claims settlement necessitates continual investment in data analytics and customer service excellence. The market also offers scope for differentiation through value-added services such as 24/7 global assistance, telemedicine, and specialized coverage for niche travel experiences. For industry leaders, aligning with shifting consumer expectations—marked by a preference for convenience, customization, and trust—while maintaining regulatory compliance and operational agility remains critical to sustaining competitive advantage and unlocking long-term growth in the single trip travel insurance market.

The single trip travel insurance market was valued at $15,314.50 million in 2024 and is estimated to reach $59,102.10 million by 2034, exhibiting a CAGR of 14.5% from 2025 to 2034.

The single trip travel insurance market is segmented on the basis of distribution channel, end user and region. By distribution channel, it is segmented into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. By end user, it is segmented into senior citizens, education travelers, business travelers, family travelers, and others. By region, the market is studied across North America, Western Europe, Asia-Pacific, and South America.

Asia is the largest regional market for single trip travel insurance

Key players operating in the global single trip travel insurance market include Bajaj Allianz General Insurance Company Limited., Care Health Insurance Limited., GeoBlue International Insurance Company, LLC, HDFC ERGO General Insurance Company Limited, ICICI Lombard General Insurance Company Ltd., IFFCO-Tokio General Insurance Company Limited., Nationwide Mutual Insurance Company, WORLD NOMADS PTY LTD, AGA Service Company, and Reliance General Insurance Company Limited.

The global single trip travel insurance market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...