Small Cell 5G Network Market Statistics, 2030

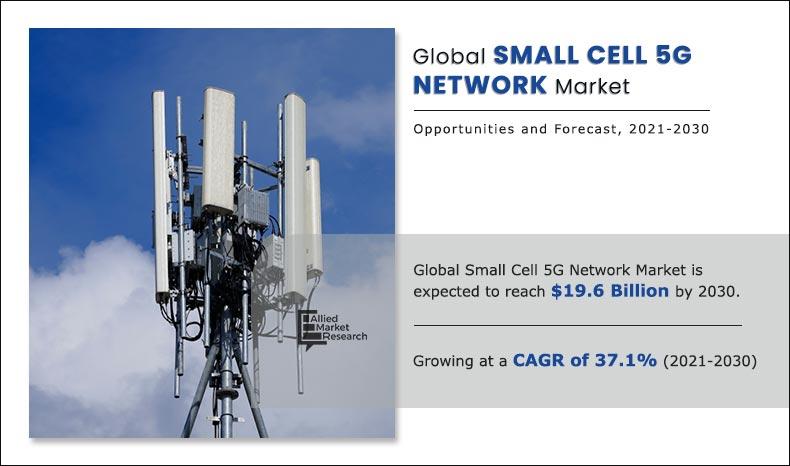

The small cell 5G network market size was valued at $858.0 million in 2020, and is projected to reach $19,628 million by 2030, growing at a CAGR of 37.1% from 2021 to 2030. Surge in investment in 5G infrastructure coupled with increase in funding for high-speed networks among numerous countries across the globe is expected to drive the growth of the global small cell 5G network market.

In 2020, solutions segment dominated the global small cell 5G network market. Small cell 5G solutions are widely used to integrate various technological aspects of a network device. Thus, increase has been witnessed in the demand for small cell 5G solution, owing to its ability to converge various hyperdense network architectures into advance scalable architectures. This, in turn, is expected to drive the adoption of small cell solutions. However, the services segment is expected to witness highest growth rate during the forecast period. Most of the industry verticals opt for all-in-one package solutions for any need in the transformations of services. Hence, rise in digital transformation has proliferated the adoption of small cell 5G network across diverse industry verticals, owing to its ability to increase capacity in operator networks across an array of locations and addresses. This is a major factor supporting the segment growth at a significant rate.

By Component

Services segment is projected as one of the most lucrative segments.

On the basis of radio technology, the standalone segment dominated the growth of the global small cell 5G network market. High penetration of mobile phones and rise in demand for high-definition content among consumers impel network service providers to shift from lower network generation services, that is, 2G, 3G, and 4G to 5G services.

Standalone small cells are primarily used in indoor wireless coverage solutions. However, non-standalone segment is expected to witness highest growth rate during the forecast period. Key factors driving the growth of non-standalone small cell 5G network market are rapid digital transformation among various industry verticals and increase in government initiatives for connected networks. Digital transformation has proliferated the demand for strong connectivity across various industries.

By Frequency Band

Millimeter wave (High-band) segment is projected as one of the most lucrative segments.

The report focuses on the growth prospects, restraints, and small cell 5G network market share analysis. The study provides Porter’s five forces analysis of the small cell 5G network industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the small cell 5G network market trends.

Segment Analysis

The global 5G small cell network market forecast is segmented into component, radio technology, frequency band, cell type, application, end user, and region. On the basis of component, the market is bifurcated into solution and services.

Depending on radio technology, it is categorized into standalone and non-standalone. By frequency band, it is classified into low band, mid band, and millimeter wave. As per cell type, it is segregated into femtocells, picocells, and microcells. The applications covered in the study include indoor application and outdoor application. According to end user, the market is differentiated into residential, commercial, industrial, smart city, transportation & logistics, government & defense, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific is projected as one of the most significant region.

Top Impacting Factors

Increase in trend of remote work due to the outbreak of the COVID-19 pandemic is driving the deployment of 5G small cell network among industries across the globe. This, in turn, is expected to boost growth of the market during the forecast period. In addition, factors such as increase in network densification, rise in mobile data traffic, and the emergence of Citizens Broadband Radio Service (CBRS) band boost the growth of the global small cell 5G network market.

Moreover, increase in investment in 5G infrastructure by numerous countries fuels the market growth. However, concerns related to 5G small cell backhaul and small cell deployment challenges are expected to hinder the small cell 5G network market growth. On the contrary, the emergence of Internet of Things (IoT) and rise in preference for ultra-reliable, low-latency communications are expected to provide lucrative opportunities for the expansion of the global market in the coming years.

Rise in Mobile Data Traffic

Mobile data traffic is internet content transferred to various mobile consumer electronics such as smartphones and tablets. Continuous increase in mobile data traffic across the world is driving the growth of the market. Global mobile traffic is expected to increase with a factor of 5, accounting 136EB per month by 2024. In addition, by 2024, 5G networks are expected to carry nearly one-third of the mobile data traffic, globally. Thus, owing to notable rise in mobile data traffic, the demand for technically advanced telecommunication network is likely to increase considerably.

Increase in network enhancement needs due to exponential increase in mobile data traffic is expected to fuel the market for small cell 5G network. The deployment of the 5G network will provide efficient network quality to consumers. Furthermore, in 2018, mobile data traffic grew more than 71% year over year globally, reaching more than 138 Exabyte’s for the year. Moreover, according to Cisco VNI Global Mobile Data Traffic Forecast, 2018–2022, mobile data traffic is expected to grow at a CVGR of 46% from 2018 to 2022, which is two times faster than the growth of global IP fixed traffic during the same period. By 2022, mobile data traffic will represent 20% of global IP traffic.

Emergence of Internet of Things (IoT)

Although 4G IoT technologies are being deployed to serve IoT needs, those offering are particularly suited for a set of applications with limited latency, bandwidth, and reliability requirements. The current performance and scalability of these 4G IoT technologies is lower than the targets for 5G, but sufficient to establish new connectivity business models. 5G small cells will be important to support 5G IoT use cases, as they can be deployed in high densities. In addition, they serve as the preferred choice to support the short propagation range of millimeter wave-based 5G small cell networks.

The demand for 5G infrastructure will increase in the upcoming years to support the IoT use cases such as massive IoT, which requires high connection densities of up to one million devices per square kilometer with low per-device data rates, which is anticipated to provide lucrative opportunities for the expansion of the global market.

It is estimated that overall IoT market will reach high as $11 trillion by 2025. In addition, 5G supports 10 times as many connections per square kilometer, which is important as there will be billions of IoT devices to connect. Support for more connections translates to less equipment in the network, smoother deployment, and faster deployment time are expected to increase the need for 5G small cell deployment.

What are the Impact of COVID-19 Pandemic on Small Cell 5G Network Market?

The size of the small cell 5G network market is estimated to grow from $858.00 million in 2020 to $19,628.00 million by 2030, at a CAGR of 37.1%. The current estimation of 2030 is projected to be lower than pre-COVID-19 estimates. The COVID-19 outbreak has low impact on the growth of the global small cell 5G network market, owing to the fact that the government and private sectors in emerging countries are working together to speed up the development of 5G infrastructure in the wake of the pandemic.

For instance, in Thailand, mobile network operators (MNO) are joining forces to provide 5G networks to hospitals. The Eastern Economic Corridor (EEC), which is a special development zone of Thailand, mandates that 5G must cover approximately 50% of the area in 2020, which means that the equipment installation must commence this year in industrial areas.

The governments of different developing economies are taking efforts to upgrade the automation systems in industries, which is anticipated to create potential opportunities for the 5G small cell deployment. In addition, these countries are focusing on other developments, which are related to 5G, including data storage facilities.

Furthermore, the outbreak of COVID-19 has boosted the digitization across every industry vertical, which will require more reliable, faster, and higher-capacity fifth-generation network to provide better connectivity. In addition, the demand for seamless connectivity will stay high for Internet of Things applications, as this is fundamental for many smart city features. Although the outbreak of COVID-19 led to delay in installation of 5G infrastructure in parts of China and Europe, its impact seems to have been limited. On the other hand, in some countries, the pandemic is providing numerous opportunities for accelerated rollout of 5G deployments.

For instance, the lockdown implemented by the government and restrictions on movement have made it easier to install physical infrastructure such as fiber and antennae. According to the insights received from CXO, higher demand for 5G was higher than previous year and the development of smart cities in emerging countries are projected to increase the 5G small cell deployments.

Key Benefits for Stakeholders

- This study includes the small cell 5G network market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and small cell 5G network market opportunity.

- The small cell 5G network market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in small cell 5G network market.

Small Cell 5G Network Market Report Highlights

| Aspects | Details |

| By COMPONENT |

|

| By RADIO TECHNOLOGY |

|

| By FREQUENCY BAND |

|

| By CELL TYPE |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | PCTEL, INC, RADISYS CORPORATION, ALTIOSTAR NETWORKS, INC, RADWIN, CAMBIUM NETWORKS CORPORATION, CASA SYSTEMS, INC, AVIAT NETWORKS, INC, BLINQ NETWORKS, IP.ACCESS LTD, BAICELLS TECHNOLOGIES, QUCELL INC, SHENZHEN GONGJIN ELECTRONICS CO., LTD, CERAGON NETWORKS LTD, CONTELA INC, COMBA TELECOM SYSTEMS HOLDINGS LTD |

Analyst Review

Top level executives are inclining toward wireless infrastructure, which is positively impacting the market growth. Mobile network operators are including small cells as a key component of their strategy for 5G network rollouts, as they are important for delivering reliable and consistent experiences for their subscribers. This is primarily due to better spectral efficiency, more reliable coverage, and improved overall network performance & capacity provided by 5G small cell, creating an opportunity to lower cost-per-bit. The adoption of small cells in this pre-5G/LTE-Advanced Pro (LTE-A Pro) transition is increasing, as it provides increased data capacity and helps service providers to eliminate expensive rooftop systems and installation or rental costs, which reduce the overall cost. In addition, it helps improve the performance of mobile handsets. For instance, if the phone is closer to a small cell base station, it transmits at lower power levels, which effectively consumes less battery power of the cell phone and substantially increases its battery life.

The global small cell 5G network market is moderately concentrated, and companies are focusing on leveraging new technologies for offering advanced small cell 5G network solutions to cater to the evolving end-user requirements. Key players have adopted various growth strategies to enhance and develop their product portfolio, garner maximum market share, and increase their market penetration. Furthermore, constant need has been witnessed for technological advancements in communication networks to adjust with the increasing mobile data traffic management demand due to which the adoption of small cell 5G network is expected to increase in the upcoming years. For instance, the northeastern part of the Asia-Pacific region is the most populated area and has generated the largest mobile data traffic share of about 30%, globally in 2019.

The emerging mobile broadband subscriptions is another factor adding to the regional market demand. In the current business scenario, substantial rise has been experienced in the usage of small cell 5G network solutions across Asia-Pacific. This is attributed to the fact that large population in this region has created an extensive pool of mobile subscribers for telecom companies.

Moreover, the region is the largest contributor to the total number of mobile subscribers across the globe, and is expected to add more subscribers to its network in the upcoming years. Asia-Pacific is further anticipated to dominate small cell 5G deployments in the upcoming years, due to its size; diversity; major shift toward digital transformation; and the logical lead taken by countries, including China, South Korea, and Japan. Furthermore, upsurge in mobile data traffic is positively impacting the small cell 5G network market growth. For instance, as per the Cisco Visual Networking Index (VNI) Global Mobile Data Traffic Forecast, Mobile data traffic is expected to grow at a CAGR of 46% from 2018 to 2022, reaching 77.5 Exabyte’s per month by 2022. On the other hand, the study states that by 2022, a 5G connection will generate 2.6 times more traffic than the average 4G connection. Thus, the demand for advanced telecommunication network has increased due to continuous rise in mobile data traffic. Furthermore, the demand for small cell 5G network is expected to increase in the upcoming years, due to increase in number of connected devices and requirement of small cells for large bandwidth applications. For instance, according to Cisco Systems Inc., almost 500 billion devices are expected to be connected to the internet by 2030.

The market is witnessing new product launches by the leading players. For instance, in June 2021, Qualcomm Technologies, Inc. launched second-generation Qualcomm 5G RAN Platform for Small Cells (FSM200xx), the industry’s first 3GPP Release 16 5G Open RAN platform. The features of this product as well as advancements and new spectrum support aim to drive unprecedented mobile experiences, accelerate 5G performance along with the availability to users worldwide, and reshape opportunities for homes, airports, hospitals, offices, stadiums, and manufacturing facilities. Such solutions are designed to help expand the small cell market and meet the growing demand for better mobile coverage & capacity while preparing networks for 5G and the Internet of Things (IoT) applications.

Loading Table Of Content...