Small Hydropower Market Research, 2033

The global small hydropower market was valued at $2.7 billion in 2023, and is projected to reach $3.4 billion by 2033, growing at a CAGR of 2.5% from 2024 to 2033.

Market Introduction and Definition

Small hydropower refers to the generation of electricity from water sources using relatively small-scale hydroelectric projects, typically with a capacity of up to 10 megawatts (MW) . These systems harness the kinetic energy of flowing water from rivers, streams, or other water bodies to produce renewable energy. As compared to large hydroelectric dams, small hydropower projects often involve less intrusive infrastructure and have a smaller environmental footprint, making them suitable for local and rural communities. They are implemented with minimal disruption to ecosystems and often serve as a reliable, sustainable energy source. Their development is supported by the growing emphasis on renewable energy and sustainability, providing an efficient solution for distributed power generation.

Key Takeaways

- The small hydropower market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major small hydropower industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Advancement and innovation in small-scale hydropower equipment such as improved turbine designs, advanced generators, and more durable materials have led to more efficient energy conversion and greater reliability in small hydropower projects. For instance, modern turbines are now designed to operate effectively across a broader range of flow conditions and can generate power from lower water flows than their predecessors. This increases the potential sites for small hydropower installations, making previously unsuitable locations viable. Furthermore, innovation in digital technology and automation have streamlined the operation and maintenance of small hydropower systems. Smart monitoring and control systems allow for real-time performance tracking and predictive maintenance, reducing downtime and operational costs. These technologies also facilitate better integration with other renewable energy sources and grid systems, enhancing the overall efficiency of energy production. All these factors are expected to drive the demand for the small hydropower market forecast period.

However, small hydropower project development necessitates a large initial infrastructure investment, which includes building dams, diversion structures, and turbines. These expenses may be unaffordable, especially for smaller developers or in areas with poor financial standing. Initial costs may increase as to the requirement for specialized tools and technology, as well as the costs involved in site preparation. All these factors hamper the small hydropower market growth. Advancement in turbine technology, such as the development of more efficient and smaller-scale turbines, have enhanced the ability to generate power from lower flow sites and reduced head conditions. These innovations make small hydropower projects more feasible in a wider range of locations, increasing their potential for development.

Moreover, improvements in automation and control systems have optimized the operation and maintenance of small hydropower plants, leading to more reliable and efficient energy production. Enhanced monitoring and diagnostic tools allow for better management of plant performance, minimizing downtime and improving overall energy output. All these factors are anticipated to offer new growth opportunities for the global small hydropower market throughout the forecast period.

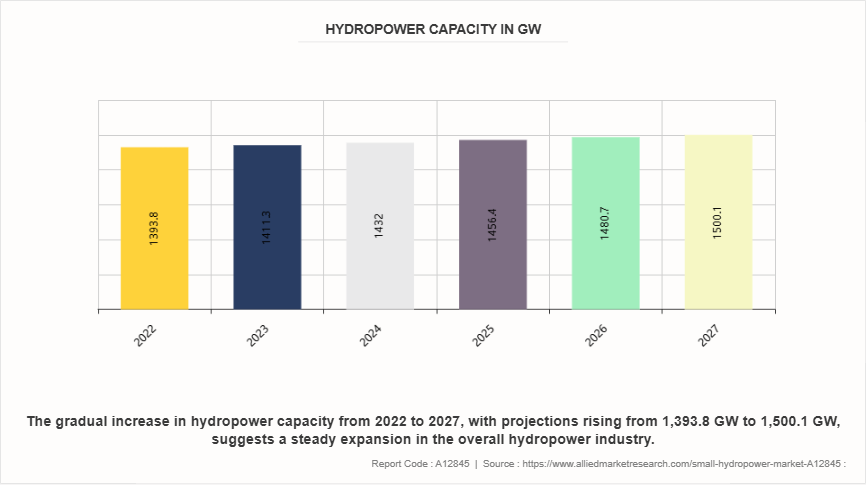

Hydropower Capacity in GW

The gradual increase in hydropower capacity from 2022 to 2027, with projections rising from 1, 393.8 GW to 1, 500.1 GW, suggests a steady expansion in the overall hydropower sector. This growth reflects a growing emphasis on renewable energy sources and a broader commitment to sustainable energy solutions. For the small hydropower market, this trend could result in heightened interest and investment, as the expansion of large-scale hydropower projects often leads to improved infrastructure and technological advancements that benefit smaller projects.

Market Segmentation

The small hydropower market is segmented into type, component, capacity, and region. Based on type, the market is classified into micro, and mini. By component, the market is classified into civil works, electromechanical equipment, and others. By Capacity, the market is divided into Up to 1 MW, 1-10 MW. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Rapid industrialization and urbanization across many Asian countries have led to an increased demand for electricity. Small hydropower projects offer a relatively quick and cost-effective solution to meet this growing energy need, especially in remote and rural areas where grid connectivity might be challenging. China witnessed to lead the regional market share as the Chinese government has always attached great importance to the construction of small hydropower. Small hydropower construction in China was initially aimed at supplying electricity for mountainous areas in collaboration with small-scale water conservations projects.

- Vietnam's Power Development Plan 8 (PDP8) , published in 2021, sets ambitious targets for renewable energy, aiming to achieve a 75% share by 2045. The plan includes specific goals for small hydropower capacity, targeting 4, 800 MW by 2025, 5, 000 MW by 2030, and nearly 6, 000 MW by 2045.

- In Asia, excluding India, the involvement of Chinese companies in nearly 45% of all hydropower plant capacity set to be built through 2030 could significantly impact the small hydropower market. This dominance by Chinese firms may lead to increased competition, technological advancements, and potentially lower costs in the small hydropower sector.

- China's substantial role in hydropower development in sub-Saharan Africa, where it is expected to be involved in nearly 70% of new capacity by 2030, is likely to have a significant impact on the small hydropower market. This involvement could lead to increased access to Chinese funding, technology, and expertise, potentially accelerating the development of small hydropower projects in the region.

Competitive Landscape

The major players operating in the small hydropower market include General Electric, Siemens AG, Natel Energy, Inc, Alstom SA, Toshiba Energy Systems & Solutions Corporation, Kawasaki Heavy Industries, Ltd., Voith GmbH & Co. KGaA, Bharat Heavy Electricals Limited, Mavel, a.s., Rentricity Inc, and Others.

Recent Key Strategies and Developments

- In July 2022, the Development Bank of the Philippines (DBP) has sanctioned USD 12.0 million to advance the 4.6 MW Dupinga Mini Hydropower project located in Gabaldon, Nueva Ecija. This funding is a significant step towards achieving the Philippine government's target of sourcing 30% of its hydro energy from renewable sources by 2030, underscoring DBP's commitment to supporting sustainable energy initiatives in the country.

- In July 2022, SMEC, a member of the Surbana Jurong Group, has been engaged to review the design and propose modifications required for three small hydropower plants in East Malaysia. Small hydro plants generate less than 30MW.

Industry Trends

- According to the Ministry of power hydroelectric power projects with aggregate capacity of 15 GW are under construction in the country. The hydro capacity is likely to increase from 42 GW to 67 GW by 2031-32, marking an increase of more than half of present capacity.

- U.S. conventional hydropower capacity increased 2.1 gigawatts (GW) from 2010 to 2022 due to a combination of upgrades to existing plants (1.6 GW) , new projects (0.7 GW) , and retirements (-0.2 GW) . Hydropower generation (262 terawatt-hours) represented 6.2% of total U.S. electricity generation and 28.7% of electricity from renewables in 2022.

Key Sources Referred

- Invest India

- International Renewable Energy Agency (IREA)

- International Energy Agency (IEA)

- India Brand Equity Foundation (IBEF)

- United Nations Industrial Development Organization

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the small hydropower market analysis from 2024 to 2033 to identify the prevailing small hydropower market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the small hydropower market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global small hydropower market trends, key players, market segments, application areas, and market growth strategies.

Small Hydropower Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.4 Billion |

| Growth Rate | CAGR of 2.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 360 |

| By Type |

|

| By Component |

|

| By Capacity |

|

| By Region |

|

| Key Market Players | Alstom SA, General Electric, Voith GmbH & Co. KGaA, Toshiba Energy Systems & Solutions Corporation, Mavel, a.s., Rentricity Inc, Bharat Heavy Electricals Limited, Natel Energy, Inc, Kawasaki Heavy Industries, Ltd, Siemens AG |

Expansion into off-grid and remote areas, Advancements in small-scale hydropower equipment are the upcoming trends of Small Hydropower Market in the world.

Mini is the leading type of Small Hydropower Market.

Asia-Pacific is the largest regional market for Small Hydropower.

$3.4 billion is the estimated industry size of Small Hydropower by 2033.

General Electric, Siemens AG, Natel Energy, Inc, Alstom SA, Toshiba Energy Systems & Solutions Corporation, Kawasaki Heavy Industries, Ltd., Voith GmbH & Co. KGaA, Bharat Heavy Electricals Limited, Mavel, a.s., Rentricity Inc, and others are the top companies to hold the market share in Small Hydropower.

Loading Table Of Content...