Smart Elevators Market Research: 2031

The Global Smart Elevators Market Size was valued at $18.5 billion in 2021, and is projected to reach $57.3 billion by 2031, growing at a CAGR of 12.1% from 2022 to 2031. Smart elevators are equipped with latest technology such as Internet of Things (IoT), Artificial Intelligence (AI), cloud computing, and various hardware and software. These systems together allow for proactive, condition-based analysis, predictive maintenance, real-time data sharing, destination prediction, enhanced security, and many other features. A smart elevator is energy efficient, user friendly, secure and safe, and experience minimum downtime. Both passenger as well as freight elevator systems have smart features, however, infotainment systems, enhanced interior designing, and other passenger specific features are not present in a smart freight elevator.

Market Dynamics

Increase in building construction and rise in demand for green buildings are a few of the major drivers of the smart elevators market. In addition, the increase in demand for smart elevators is attributed to the numerous features that set them apart from conventional elevators and place them in a higher class. Conventional elevators are not very efficient since their basic computing power cannot optimize the amount of time spent waiting by the users, Moreover, they are not very energy efficient, and do not incorporate any real-time monitoring of the elevator system. On the other hand, smart elevators are not only technologically advanced, but also have a wide variety of functions that contribute to their appeal among building developers. The use of autonomous systems in smart elevators helps optimize elevator movements, which in turn helps to reduce wait time, which ultimately leads to more efficient passenger transportation during peak hours.

Moreover, in contrast to conventional elevators, smart elevators make use of advanced security measures such as bio-metric, facial recognition, and other similar technologies to prevent any unauthorized access. In addition, smart elevators incorporate sensors and other systems, that constantly monitor the abnormal behavior shown by the elevators, which includes electric faults, excessive vibration, fire, sabotage, and others. The monitoring system is also responsible for scheduling the maintenance of the elevator, at the most convenient time when not a large number of people are affected by the out of order elevators.

In addition, other features such as touch screen interface, voice commands, gesture control, mobile app controllability, and other similar functions, make riding in smart elevators more comfortable and user-friendly. Connected elevators send their operational data to the cloud in real time, where it can be accessed any time by authorized personnel; thereby facilitating timely resolution of any problem that may arise. Such advanced features of smart elevators drive the growth of the smart elevators market. Moreover, there is an increase in number of high-rise buildings, owing primarily to rise in population urbanization.

As a result of these trends, cities across the world must accommodate an increasing number of people within their limited space. As a result, builders construct taller buildings that can accommodate a large number of people on a smaller footprint on the ground. Skyscrapers such as City Tower 1, Ciel Tower, Il Primo Tower 1 are under construction in the UAE. In addition, other countries such as India, China, Vietnam, Middle East countries and others are experiencing a significant increase in building construction. Elevators are widely used in high-rise buildings to provide residents with easy and quick access to different floors of the buildings.

However, high cost of smart elevators discourages builders from installing them in building projects that are on a limited budget. Thus, high cost of smart elevators is anticipated to restrain the smart elevators market growth.

Moreover, technology developments in the smart elevators industry are expected to provide lucrative opportunities for players that operate in the smart elevators market. For instance, in March 2023, Otis Elevator introduced Gen3TM digitally connected elevator which is now available in South Korea. The new offering includes Otis’s proprietary technology ‘Otis ONE technology’, which allows 24/7 real-time monitoring of equipment health and performance. In addition, it includes Otis eViewTM in-car infotainment display, which can connect to the 24/7 OTISLINE® customer support center via video chat in case of an emergency. Advancements in Internet of Things (IoT), Artificial Intelligence (AI), spatial technologies, cameras, and sensors are playing a major role in the smart elevators market growth.

In 2020, the COVID-19 pandemic shutdown the construction industry all across the world, leading to a halt in demand for smart elevator. This hampered the growth of the smart elevators market significantly during the pandemic. Moreover, number of people using elevators reduced significantly, due to social distancing norms. The major demand for smart elevators was previously noticed from major countries including the U.S., Germany, Italy, the UK, and developing countries having large population such as India, and China. These countries were badly affected by the spread of coronavirus, thereby halting demand for equipment and machinery. However, the severity of the COVID-19 pandemic has significantly reduced, owing to the introduction of various vaccines.

This has led to the full-fledged reopening of businesses involved in the smart elevators market, and also led to increased activities in the construction sector. Furthermore, it has been more than two and a half years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of the beginning of 2023, there was an observed increase in the number of COVID-19 infection cases, especially in China, which brought negative sentiments in the market, thus affecting the growth of the smart elevators market. Thus, businesses involved in smart elevator designing and manufacturing must focus on protecting their workforce, operations, and supply chains to respond to such crises which may rise again.

Segmental Overview

The smart elevators market is segmented on the basis of setup, carriage, application, and region. By setup, the market is divided into new deployment, modernization, and maintenance. By carriage, the market is bifurcated into passenger and freight. By application, the market is categorized into residential, commercial, and industrial. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

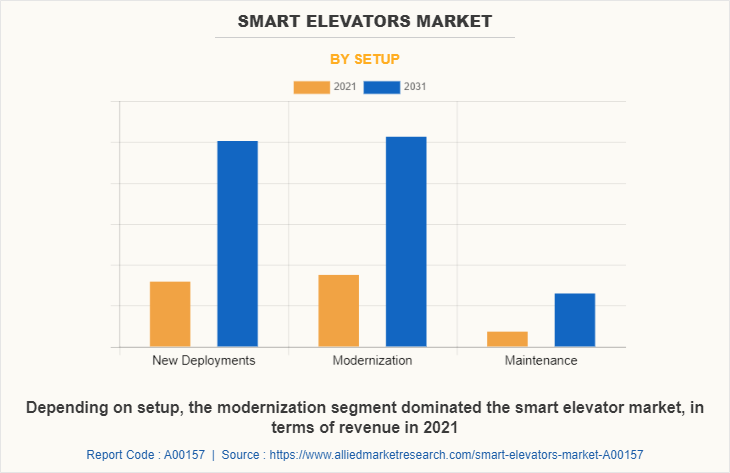

By Setup:

The smart elevators market is divided into new deployment, modernization, and maintenance. In 2021, the modernization segment dominated the smart elevators market, in terms of revenue, and the maintenance segment is expected to grow with a higher CAGR during the forecast period. The modernization segment includes the installation of new systems in an old elevator system to make it smart. Over time the technologies and statutory guidelines associated with the buildings change; thus, various amenities including elevators need to be modernized. With modernization services, conventional elevators are equipped with features such as real-time monitoring, cloud-based predictive maintenance solutions, enhanced user interface and infotainment systems, enhanced security and others. Furthermore, the maintenance segment includes the maintenance of already existing smart elevators in a building. Regular maintenance of smart elevators allows for longer life of the elevator and prevents unscheduled breakdowns.

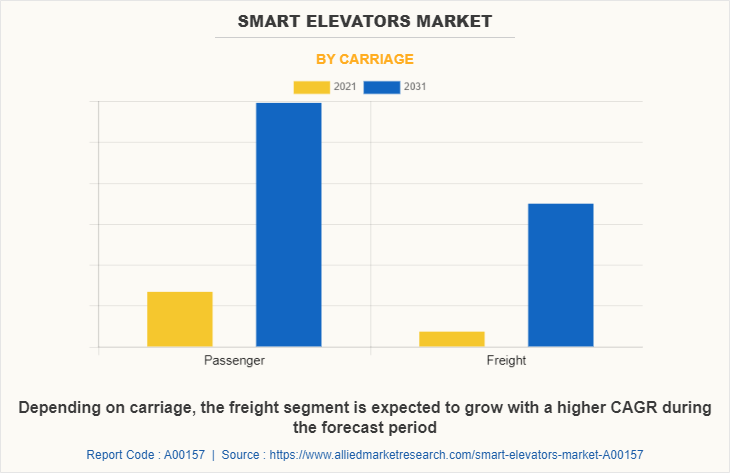

By Carriage:

The smart elevators market is classified into divided into passenger, and freight. The passenger segment accounted for a higher market share in 2021. On the other hand, the freight segment is anticipated to grow with a higher CAGR during the forecast period. Passenger elevators are one of the essential building components for mobility of people in buildings, especially in tall buildings. Elevators are used by old people, children, and other people with and without disabilities. The high market share of passenger segment is attributed to increase in population, including geriatric population who require safe, easy to operate, and fault free elevators. Moreover, just like passenger elevators, smart freight elevators are usually equipped with AI and IoT technologies for features such as real-time elevator behavior monitoring, predictive maintenance, and others. Surge in number of industrial, institutional, and commercial buildings is expected to drive the growth of the freight segment.

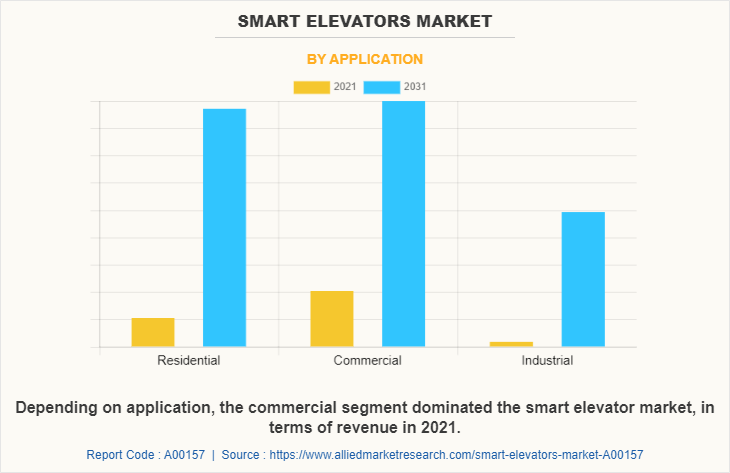

By Application:

The smart elevators market is categorized into residential, commercial, and industrial. Among these, the commercial segment accounted for a larger smart elevators market share in 2021. Technological advancements and high budgets have enabled offices, hospitals, retail outlets, malls, transportation systems, and other commercial buildings to modernize elevators and make them smart. In commercial elevator applications, keeping track of all people is essential for safety and security purposes. However, the residential segment is expected to grow with a higher CAGR during the market forecast.

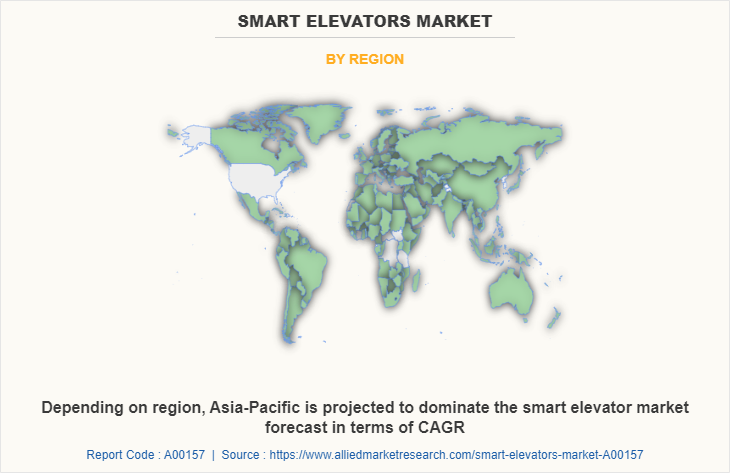

By Region:

The smart elevators market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America held the highest smart elevators market share. However, Asia-Pacific is anticipated to dominate the smart elevators market forecast by growing with a higher CAGR during the forecast period. The U.S. and Canada are wealthy nations, and standard for urban living are very high. In addition, the rate of adoption of new and latest technologies in all industrial and non-industrial sectors are relatively higher than other parts of the world, which is expected to drive the demand for smart elevators in buildings. New building construction and availability of a large number of tall buildings are playing a major role in driving the growth of the smart elevators market in the new installation segment, as well as in the maintenance and modernization segment in North America.

Moreover, high CAGR of Asia-Pacific is attributed to extensive economic growth and growth of population and urbanization in countries such as China, India, Vietnam, Indonesia, and others. In the past few decades, the global population has increased significantly and is expected to grow rapidly in the coming decades. According to the United Nations projections, at the end of 2022, the global population reached 8 billion, and is expected to increase to 8.5 billion by 2030, and in just 20 years after that it is expected to become 9.7 billion in 2050. Asia and Africa, especially the countries such as India, and China, are anticipated to contribute majorly to the rise in urbanization in the next 30 years. Such factors are driving the growth of the smart elevators market in the region, as well as in the world.

Competition Analysis

Competitive analysis and profiles of the major players in the smart elevators market are provided in the report. Profiled major players include, Hitachi Ltd., KONE Corporation, Otis Worldwide Corporation, Fujitec Co., Ltd., Robert Bosch GmbH, Halma PLC (Avire Trading Limited), Mitsubishi Electric Corporation, thyssenkrupp AG (TK Elevator), Hyundai Elevator Ltd, and Schindler Group. Major players, to remain competitive, adopt various development strategies such as product launch, product development, and others. For instance, in March 2023, TK Elevators, installed 22 TWIN elevator systems at 50 Hudson Yards on Manhattan’s West Side, New York. The TWIN elevator systems are equipped with advanced safety features for passengers, intelligent Destination Selection Control (DSC), and can transport up to 40% more passengers.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging smart elevators market trends and dynamics.

In-depth smart elevators market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the smart elevators market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing smart elevators market opportunities.

The smart elevators market forecast analysis from 2022 to 2031 is included in the report.

The key players within the smart elevators market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the smart elevators industry.

Smart Elevators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 57.3 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 229 |

| By Setup |

|

| By Carriage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Halma PLC(Avire Trading Limited), Robert Bosch GmbH, Mitsubishi Electric Corporation, Otis Worldwide Corporation, Hitachi Ltd., Hyundai Elevator Ltd, thyssenkrupp AG (TK Elevator), Schindler Group, Fujitec Co., Ltd., KONE Corporation |

Analyst Review

The smart elevator market has witnessed significant growth in the past few years owing to advancements in smart elevator technologies, as well as increased construction of tall buildings in various parts of the world.

Rise in population, especially in countries such as China, Vietnam, Indonesia, and India is playing a significant role in increasing the number of buildings, which eventually influences the smart elevator market growth. Furthermore, the rise in demand for green and energy efficient buildings is also a major factor driving the market growth. Moreover, in the coming years elevator users are expected to operate elevators using touchless technologies such smartphone apps or wearable device, as per a report from TK Elevator. The report also states that there is an expected rise in the demand for AI-enabled elevators that can keep passengers and properties safe. Furthermore, uncrowded lobbies, reduced waiting times, and quick mobility in the buildings are paramount features desired by any tenant.

However, the high cost of smart elevators is anticipated to restrain the market growth. Contrarily, user friendly features and features such as predictive maintenance, the ability to remotely diagnose issues in a smart elevator, and similar other features are expected to overshadow its high cost. Furthermore, features such as touchless mobile app technologies and Bluetooth-based technologies are also expected to become prominent features of smart elevators in the coming years.

Rise in construction of high-rise buildings, and rise in demand for green buildings, are a few among the upcoming trends of Smart Elevators Market in the world.

Smart elevators are used for the vertical mobility of people and freight in a building. Smart elevators include the latest technologies such as IoT and AI that make them superior to conventional elevators.

In 2021, North America held the highest smart elevator market share. However, Asia-Pacific is anticipated to dominate the smart elevator market forecast by growing with a higher CAGR during the forecast period.

The global smart elevator market size was valued at $18,458.7 million in 2021.

Major players profiled in the report includes, Hitachi Ltd., KONE Corporation, Otis Worldwide Corporation, Fujitec Co., Ltd., Robert Bosch GmbH, Halma PLC (Avire Trading Limited), Mitsubishi Electric Corporation, thyssenkrupp AG (TK Elevator), Hyundai Elevator Ltd, and Schindler Group.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By setup, which modernization segment held a major share of the Smart Elevators market in 2021.

The global smart elevators market size is projected to reach $57,320.3 million by 2031, registering a CAGR of 12.1% from 2022 to 2031.

Loading Table Of Content...

Loading Research Methodology...