Smart Glass And Smart Window Market Research, 2034

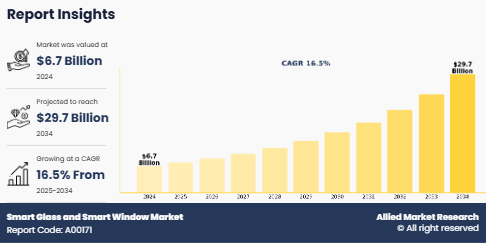

The Global Smart Glass and Smart Window Market was valued at $6.7 billion in 2024, and is projected to reach $29.7 billion by 2034, growing at a CAGR of 16.5% from 2025 to 2034.

Smart glass, also known as smart windows, intelligent glass, or switchable glass, is an advanced product that can change its optical properties in response to external stimuli or user commands. When activated, these next-generation adaptive glass adjust the glass's light transmission, enabling privacy control, glare reduction, heat insulation, and enhanced energy efficiency. They can adjust to varying light conditions and user preferences, allowing for on-demand tint control and creating a comfortable, customizable environment for users. In the construction industry, smart windows help optimize natural light, thereby reducing the need for artificial lighting and improving energy efficiency. In vehicles, they enhance visibility, minimize glare, and provide UV protection, contributing to a better driving experience and promoting energy conservation.

The applications of smart glass and smart windows are expanding across various industries, such as automotive, aviation, marine, and construction. In architecture, these technologies are being utilized for innovative building facades, privacy partitions, and curtain walls. Smart windows are increasingly being integrated into smart homes and eco-friendly buildings, improving energy efficiency and enhancing occupant comfort. In the automotive sector, smart glass is being incorporated into sunroofs, side windows, and rear windows, contributing to a better user experience and improved vehicle energy efficiency. In aerospace, smart windows help reduce glare and regulate thermal conditions, creating a more comfortable flying experience for passengers. As research and development continue to advance, smart glass and smart windows are expected to uncover new and innovative applications across various industries, reshaping how users interact with glass surfaces in their daily lives.

The smart glass and smart window market outlook indicates robust growth driven by these diverse applications. Moreover, the smart glass and smart window market share is expected to expand significantly, with increasing adoption across multiple sectors, reinforcing the technologies' potential to transform industries globally.

.

The smart glass and smart window industry is anticipated to expand significantly during the forecast period owing to surge in demand for smart glass-based products in the construction sector. This technology is increasingly adopted due to its energy efficiency and aesthetic appeal, which can reduce energy consumption. Smart glass helps regulate light and heat transmission, thus enhancing the comfort and sustainability of both commercial and residential buildings.

Stringent government regulations to control risk-oriented incidents are also driving the adoption of smart glass technologies. These regulations aim to reduce carbon emissions and improve building safety, thus encouraging the use of advanced materials such as smart glass that comply with these standards. In addition, technological advancements in smart glass, such as electrochromic and suspended particle device (SPD) technologies, are enhancing its functionality and efficiency. These innovations allow for better control over light transmission and integration with building management systems, thus improving overall operational efficiency. However, the high initial cost of smart glass, including material and installation expenses, remains a significant barrier to widespread adoption. Despite its long-term benefits, the upfront investment required for smart glass can be prohibitive for many potential users, thus limiting market growth.

In addition, the smart glass and smart window market forecast indicates significant growth as technological advancements continue to lower costs and enhance performance. As regulatory pressures and demand for energy-efficient solutions increase, smart glass technologies are expected to gain broader market acceptance, driving further expansion across industries.

Nevertheless, the automotive and aviation industries are increasingly adopting smart glass for its benefits in glare reduction, temperature control, and enhanced passenger comfort. In automobiles, smart glass is used in sunroofs and windows to improve fuel efficiency by reducing the need for air conditioning. In aviation, it enhances passenger experience by providing adjustable transparency for windows. The market is further fueled by a surge in demand for green building initiatives. As part of global efforts to reduce environmental impact, smart glass plays a crucial role by improving energy efficiency and reducing reliance on artificial lighting and HVAC systems. The ability of smart glass to lower energy consumption and greenhouse gas emissions makes it a preferred choice for sustainable construction projects.

Segment Analysis

The smart glass and smart window market are segmented into Technology, End User, and Region.

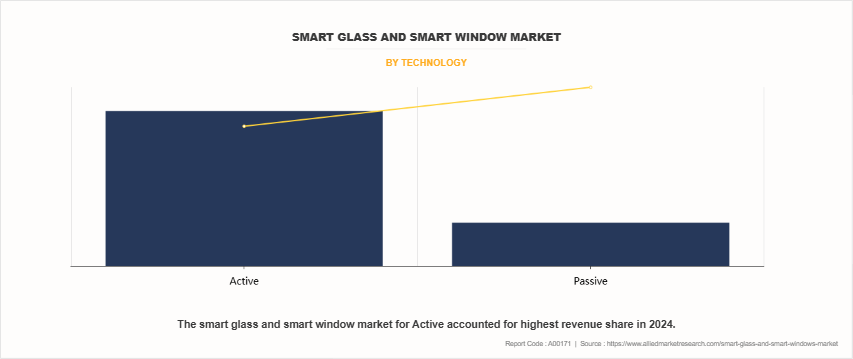

By technology, the market is divided into active and passive categories. In 2024, the active segment led the market in revenue and is expected to maintain a dominant share through 2034.

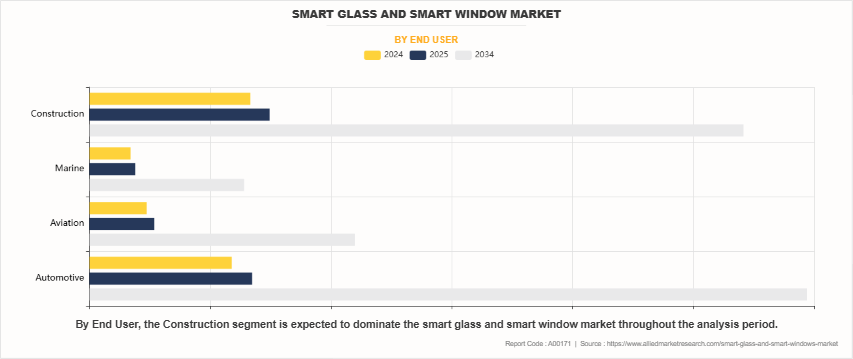

The smart glass and smart window market is further segmented by end user, with key industries including automotive, aviation, marine, and construction. The construction sector held the largest smart glass and smart window market in 2024 and is projected to grow at a significant compound annual growth rate (CAGR) from 2025 to 2034.

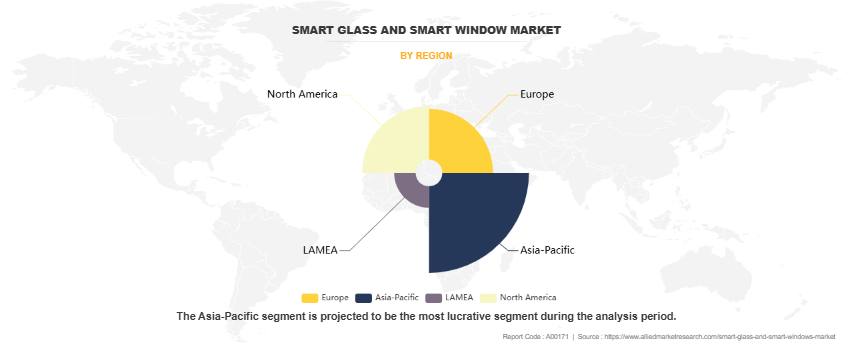

Region wise, the smart glass and smart window market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region accounted for a major share of the smart glass and smart window market in 2024, owing to rapid urbanization, significant investments in infrastructure development, and an increase in the adoption of smart city initiatives. In addition, the growing focus on energy-efficient buildings and rising environmental awareness in countries like China and India have further propelled the demand for smart glass and smart windows in the region.

Competitive Analysis

The report also provides a competitive analysis and profiles of leading players in the global smart glass and smart window market, including Polytronix, Inc., Gauzy, View Inc., Saint Gobain, Gentex Corporation, Research Frontiers Incorporated, Smartglass International, AGC Inc., Ravenbrick LLC (Ravenwindow), and PLEOTINT LLC. Additionally, it highlights the significant smart glass and smart window market opportunity, focusing on emerging trends and growth potential within the industry.

Key Developments/ Strategies

In January 2022 - View, Inc. partnered with Bjarke Ingels to provide sustainable materials and carbon neutrality in operations. The partnership is expected to feature View Smart Windows, which adjust automatically to provide continuous access to natural light and outdoor views while minimizing heat and glare.

In June 2023, Saint-Gobain India announced the production of the country's first low-carbon glass, achieving a 40% reduction in carbon footprint compared to existing products. This advancement is attributed to incorporating two-thirds recycled materials, utilizing natural gas, and sourcing electricity from renewable energy. The new glass maintains the same technical, quality, and aesthetic standards as regular glass and will be integrated into Saint-Gobain's energy-efficient portfolio.

In December 2023, Saint-Gobain's subsidiaries, SageGlass and Vetrotech, collaborated to equip Geneva's Alto Pont-Rouge building with advanced glazing solutions. The SageGlass Harmony smart double glazing is integrated with CONTRAFLAM fireproof safety glass. This combination optimizes natural light, reduces glare and heat, and meets stringent fire protection standards. The project underwent two years of development, including rigorous testing, and has been certified by TUV Rheinland Nederland BV.

In January 2024, Gauzy Ltd. unveiled its latest smart glass technologies and Advanced Driver Assistance System (ADAS)solutions at CES 2024. The company introduced dynamic glazing solutions for automotive and architectural applications, alongside next-generation ADAS and Cabin Monitoring Systems(CMS) for improved safety and efficiency. These innovations highlight Gauzy's commitment to enhancing visibility, privacy, and energy efficiency across multiple industries.

On July 20, 2024, SageGlass, a subsidiary of Saint-Gobain, introduced RealTone, an advanced electrochromic glass that eliminates the typical "blue hue," offering a more neutral and true-to-life color experience. This innovation maintains the performance benefits of electrochromic technology, such as superior glare control and thermal regulation, while enhancing aesthetic appeal. RealTone is compatible with SageGlass's existing product lines, including Harmony and specialized coatings like Bright Silverâ„¢ and bird-friendly solutions, providing architects with greater design flexibility.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the smart glass and smart window market size, segments, current trends, estimations, and dynamics of the smart glass and smart window market analysis from 2024 to 2034 to identify the prevailing smart glass and smart window market opportunities.

- The smart glass and smart window market analysis is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart glass and smart window industry segmentation assists in determining the prevailing smart glass and smart window market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global smart glass and smart window market growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart glass and smart window market trends, key players, market segments, application areas, and market growth strategies.

Smart Glass and Smart Window Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 29.7 billion |

| Growth Rate | CAGR of 16.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 216 |

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Gentex Corporation, Polytronix, Inc., View Inc., Smartglass International, Research Frontiers Incorporated, Gauzy, Ravenbrick LLC (Ravenwindow), AGC Inc., Saint Gobain, PLEOTINT LLC |

| Other players in the value chain include | Active Glass Technologies, PPG Industries |

Analyst Review

According to the perspectives of CXOs of a leading global smart glass and smart window market company, the industry's future appears highly optimistic, with substantial growth expected in the coming years. The CXOs express confidence in the market's potential, citing various key factors that are driving the increase in demand and adoption of smart glass and smart window technologies worldwide.

A strong focus on energy efficiency and sustainability across multiple industries, such as construction, automotive, and transportation, is propelling the popularity of smart glass and smart windows. Governments and businesses alike are actively seeking solutions to reduce carbon footprints and energy consumption, making smart glass an attractive option to optimize natural light utilization and regulate indoor temperatures, thereby enhancing overall energy efficiency for buildings and vehicles.

Continuous advancements in smart glass technologies have resulted in the development of cost-effective and versatile solutions. These innovations have broadened the accessibility of smart glass products to a wider range of customers, fostering increased adoption in both residential and commercial applications. In addition, the CXOs express enthusiasm for further research and development efforts that hold the potential to enhance the performance and features of smart glass and smart window products.

In addition, the construction and automotive industries are experiencing significant growth, particularly in regions such as the Asia-Pacific and Middle East, which serve as key markets for smart glass and smart window technologies. The expanding urbanization and infrastructure development in these regions are driving the demand for energy efficient and technologically advanced building solutions, leading to the rising popularity of smart glass solutions for buildings and vehicles.

The largest regional market for smart glass and smart windows is Asia-Pacific.

The upcoming trends in the smart glass and smart window market include the integration of Internet of Things (IoT) platforms, advancements in electrochromic and photochromic technologies, and the development of self-powering systems.

The top companies holding the market share in smart glass and smart windows include Saint-Gobain, View Inc., Corning Inc., and Gentex Corporation.

The leading application of the smart glass and smart window market is in the construction industry, particularly for energy-efficient and aesthetically appealing buildings.

The estimated industry size of the smart glass and smart window market is projected to reach $29.6 billion by 2034.

Loading Table Of Content...

Loading Research Methodology...