Smart Home Appliances Market Research, 2034

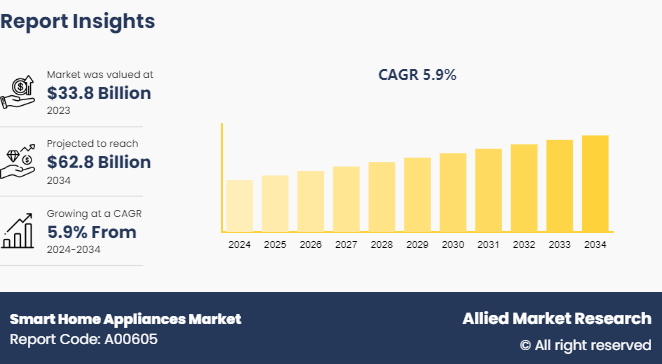

The global smart home appliances market was valued at $33.8 billion in 2023, and is projected to reach $62.8 billion by 2034, growing at a CAGR of 5.9% from 2024 to 2034. Smart home appliances are advanced household devices equipped with connectivity features, which enable remote control, automation, and monitoring through smartphones or voice assistants. These appliances utilize Internet of Things (IoT) technology to communicate with each other and with users, enhancing convenience, efficiency, and security in the home. Some examples include smart refrigerators that track inventory, smart ovens with remote preheating capabilities, smart washing machines that suggest optimal wash cycles, and smart thermostats that learn user preferences to optimize energy use. Integration with voice assistants such as Amazon Alexa, Google Assistant, or Apple's Siri allows for hands-free operation. Smart home appliances streamline daily tasks and also provide insights and automation that lead to a more connected and intelligent living environment.

Key Takeaways

The smart home appliances market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major smart home appliances industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in adoption of Internet of Things (IoT) technology significantly boosts the demand for smart home appliances by enabling seamless connectivity, enhanced convenience, and superior functionality. IoT allows these appliances to be interconnected, providing users with the ability to control and monitor devices remotely through smartphones or voice assistants. The interconnectedness leads to smarter homes, where appliances can communicate with each other and operate autonomously based on user preferences and patterns. For instance, Samsung’s SmartThings ecosystem allows various devices to integrate and automate tasks, while LG’s ThinQ platform offers similar connectivity across its range of appliances. Brands such as Amazon, with its Echo devices, and Google, with Nest products, use IoT to provide users with comprehensive smart home solutions that simplify daily routines and improve energy efficiency. Thus, with more consumers seeking convenience, efficiency, and enhanced living experiences, the integration of IoT in home appliances boosts market growth, thereby driving smart home appliances market size by widespread adoption and innovation in the sector.

However, compatibility issues with existing home systems restrain the market demand for smart home appliances market share by creating barriers to seamless integration and user adoption. Many consumers find it challenging to integrate new smart devices with their current non-smart appliances or differing smart ecosystems, which leads to a fragmented and less efficient smart home experience. For instance, a homeowner with a Google Nest thermostat may face difficulties if their security system operates on a different platform such as Apple's HomeKit, resulting in a disjointed user experience and reduced functionality. The lack of interoperability discourages potential buyers who seek simplicity and unified control over their home environment. In addition, the need for multiple apps or hubs to manage various devices adds complexity and frustration. As a result, consumers may hesitate to invest in such appliances, thereby slowing smart home appliances market growth and limiting the widespread adoption of these appliances.

Furthermore, the development of eco-friendly and energy-efficient smart appliances has created significant smart home appliances market opportunity by catering to the growing consumer demand for sustainable living. These advanced appliances reduce energy consumption and environmental impact while providing superior performance and convenience. For instance, LG’s Energy Star-certified smart refrigerators and washing machines utilize AI to optimize energy use, thereby lowering utility bills and reducing carbon footprints. Similarly, Samsung’s smart appliances, such as their smart washing machines and air conditioners, feature energy-saving modes and real-time monitoring capabilities that help users manage their energy consumption more effectively. Brands such as Nest, known for their smart thermostats, contribute by offering devices that learn user habits to optimize heating and cooling, leading to substantial energy. Thus, eco-friendly and energy-efficient smart appliances are anticipated to bring lucrative growth opportunities for manufacturers in the smart home appliances market in the coming years.

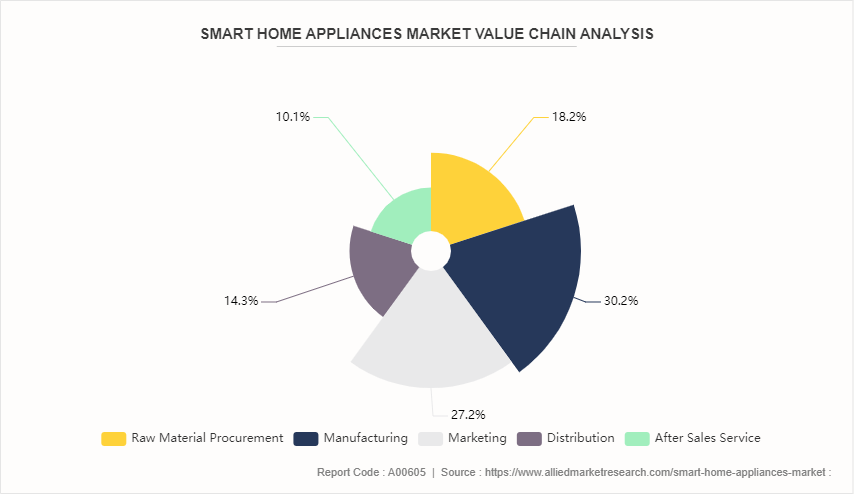

Value Chain of Global Smart Home Appliances Market

The global smart home appliances market value chain begins with research and development, where companies innovate to create products that integrate seamlessly with smart home ecosystems. The above stage involves software development, hardware design, and IoT integration. Raw material procurement follows, sourcing components such as semiconductors, sensors, and connectivity modules. Manufacturing consists of both the production of individual components and the assembly of finished appliances, with rigorous quality control measures in place.

Distribution networks include traditional retail channels, e-commerce platforms, and direct-to-consumer sales. Installation services, often provided by manufacturers or certified partners, play a crucial role in ensuring proper setup and connectivity. After-sales support, including software updates, troubleshooting, and maintenance, is vital in this tech-driven market. Marketing efforts focus on educating consumers about smart features and ecosystem compatibility. The value chain also incorporates data management and cybersecurity measures to protect user information. As the market evolves, sustainability initiatives and circular economy principles are increasingly shaping product design and lifecycle management.

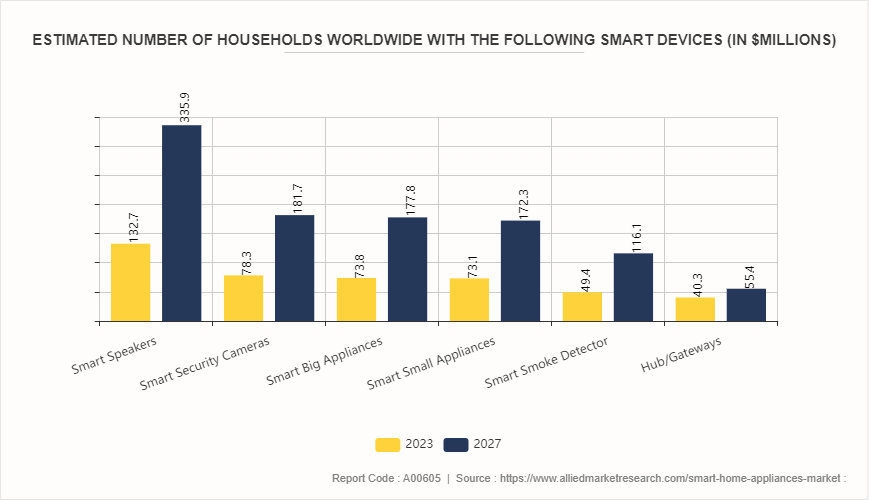

Estimated Number of Households Worldwide with the Following Smart Devices (in $Millions)

The global market for smart home appliances has rapidly expanded owing to increased consumer interest in convenience and energy efficiency. The proliferation of the Internet of Things (IoT) has made it easier to connect and control devices, improving the user experience. As these appliances become more affordable, they are accessible to a broader audience, encouraging widespread adoption. The growing awareness of energy conservation has also boosted interest in smart appliances that offer cost savings and environmental benefits. In addition, the COVID-19 pandemic increased the focus on home improvement, thus driving market demand. Furthermore, tech-savvy younger generations are particularly drawn to these innovations, further driving market growth as they integrate technology into their everyday lives.

Market Segmentation

The smart home appliances market is categorized into product type, technology, and region. By product type, it is classified into washing machine, refrigerator, dishwasher, air conditioner, and others. Depending on technology, it is divided into Wi-Fi, Radio Frequency Identification (RFID) , Cellular technology, ZigBee, Bluetooth, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Europe contributes significantly to the rise smart home appliances market demands through regulatory frameworks promoting energy efficiency, government incentives, and smart city initiatives. The stringent energy performance standards of the European Union under the Ecodesign Directive incentivize manufacturers to develop energy-efficient appliances, aligning with consumer preferences for sustainable living. Governments across the region offer subsidies and tax incentives for adopting smart technologies, fostering consumer adoption. Smart city projects in cities such as Barcelona and Amsterdam highlight the integration of smart home technologies into urban infrastructure, demonstrating their benefits to residents. Thus, increase in consumer awareness of the convenience and environmental benefits of smart appliances, coupled with supportive policies and initiatives, positions Europe as a pivotal region driving growth in the global smart home appliances market.

The Asia-Pacific region is a key contributor to the growing demand for smart home appliances, driven by rapid urbanization, increase in disposable incomes, and technological advancements. Countries across the region have adopted smart home technologies to enhance convenience, efficiency, and lifestyle. For instance, China, as a leading market, has seen significant adoption of smart appliances such as Xiaomi's Mi Smart Home Hub and Haier's smart refrigerators, catering to tech-savvy consumers seeking connected living solutions. In India, rise in urbanization and an increased middle class have driven the demand for smart appliances such as smart TVs and air conditioners from brands such as Samsung and LG, offering energy efficiency and connectivity features. Furthermore, government initiatives promote smart cities and digital transformation agendas in countries such as Singapore and South Korea has further helped accelerate the adoption of smart home technologies. For instance, Singapore's Smart Nation initiative aims to integrate IoT across urban infrastructure, boosting demand for connected devices including smart home appliances. Such factors have boosted the future growth trajectory of the global smart home appliances market in the region.

Industry Trends:

The adoption of AI and machine learning has set a transformative trend in the global smart home appliances market outlook by enhancing automation, personalization, and efficiency. For instance, smart thermostats such as the Ecobee SmartThermostat use AI algorithms to learn user preferences and adjust temperature settings, accordingly, optimizing energy usage. Similarly, robot vacuums such as the iRobot Roomba series employ AI to map and navigate homes efficiently, adapting cleaning patterns based on room layout and usage. AI-powered smart kitchen appliances, such as the LG InstaView refrigerator, offer food management suggestions and inventory tracking capabilities through machine learning algorithms. These advancements have improved convenience and user experience along with contribution to energy savings and operational efficiency, driving increased adoption of AI-integrated smart home appliances globally.

Competitive Landscape

The major players operating in the smart home appliances market include Panasonic Corporation, Haier Electronics Group Co., Ltd., Miele & Cie. KG, General Electric Company, Koninklijke Philips N.V., Electrolux AB, Whirlpool Corporation, BSH Hausgerate GmbH, LG Electronics Inc., Apple Inc., Samsung Electronics Co., Ltd.

Other players in the smart home appliances market includes Honeywell International Inc., Amazon.com, Inc., Google LLC, Sony Corporation, ADT Inc., Arlo Technologies, Inc., SimpliSafe, Inc., iRobot Corporation, August Home, Inc., Netatmo (Legrand) , Ecobee Inc., TP-Link Technologies Co., Ltd., Belkin International, Inc., Vivint, Inc., Legrand S.A., and so on.

Recent Key Strategies and Developments

In March 2024, Ecobee introduced the SmartThermostat Premium, an upgraded version of its popular smart thermostat to provide more precise climate control and energy savings for smart homes. The new model features a sleek design with a larger display, improved voice control with built-in Alexa, and enhanced sensors for better temperature and occupancy detection.

In January 2024, Xiaomi launched the Mi Smart Home Hub, a central control unit for its ecosystem of smart home products to strengthen the product portfolio with smart appliances products. The Mi Smart Home Hub supports Zigbee, Wi-Fi, and Bluetooth connectivity, which allows it to connect with a wide range of smart devices.

In July 2023, Signify, the company behind Philips Hue, launched Philips Hue Secure, a line of smart home security products to expand the business into the home security market. The product line includes security cameras, motion sensors, and secure integration with the Philips Hue app.

In June 2022, Amazon introduced the Echo Show 15, a smart display designed for the kitchen, which features a 15.6-inch screen that can be mounted on the wall or placed on a counter. It supports Alexa voice assistant, that allows users to control other smart home devices, display recipes, manage calendars, and stream content. The device also includes a visual ID feature that personalizes the experience based on the user.

Key Sources Referred

U.S. Department of Energy (DOE)

U.S. Census Bureau

European Commission

National Institute of Standards and Technology (NIST)

U.S. Department of Housing and Urban Development (HUD)

Statistics Canada

Office for National Statistics (ONS) - UK

Japan Ministry of Economy, Trade and Industry (METI)

Australian Bureau of Statistics (ABS)

European Union Agency for Cybersecurity (ENISA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart home appliances market analysis from 2024 to 2034 to identify the prevailing smart home appliances market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart home appliances market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart home appliances market trends, key players, market segments, application areas, and market growth strategies.

Smart Home Appliances Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 62.8 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 298 |

| By Product Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | LG Electronics Inc., Panasonic Corporation, Koninklijke Philips N.V., Whirlpool Corporation, Electrolux AB, Samsung Electronics Co., Ltd., Miele & Cie. KG, Haier Electronics Group Co., Ltd., General Electric Company, BSH Hausgerate GmbH |

Analyst Review

Although smart home appliances were introduced almost a decade ago, smart home appliances market picked pace only in the last 4-5 years and is presently exhibiting a sizeable growth. Factors such as increased compatibility of the appliances, enhanced internet penetration, evolving lifestyle patterns and growing concerns about energy prices, have fostered the increasing sales of smart home appliances. North American region is leading the global market due to the early adoption of these appliances, resulting in large market base. However, Asia Pacific region is expected to exhibit remarkable growth, driven by the emerging markets of countries such as India & China.

Wi-Fi technology is one of the most frequently used technologies owing to its long range operation capabilities. Besides Wi-Fi, technologies such as ZigBee, Bluetooth and RFID are used on account of their lower operation costs and lesser power requirements. Increasing demand for appliances such as smart air-conditioners, smart refrigerators, smart washing machines, smart dishwashers and others smart home appliances would boost the market for smart home appliance products. Market participants have introduced innovative smart appliances as well as novel apps in the recent past, in an effort to enhance the overall customer satisfaction. For instance, players such as LG Electronics, Haier, Samsung and Panasonic Corp. among others have introduced several new appliances at the recently held trade show in Berlin in September 2015. Followed by product launch, these players are concentrating on acquiring smaller industry players to gain a competitive edge. Additionally, these players are consolidating their efforts to spread awareness through aggressive advertising and promotional activities.

Upcoming trends in the global smart home appliances market include increased AI integration, enhanced voice control, energy efficiency features, improved interoperability, focus on cybersecurity, and expansion of remote monitoring capabilities.

The leading application of the smart home appliances market is home automation, which includes devices like smart thermostats, lighting, and security systems. These appliances enhance convenience, efficiency, and security for users.

By region, North America held the highest market share in terms of revenue in 2023.

The global smart home appliances market was valued at $33.8 billion in 2023.

The major players operating in the smart home appliances market include Panasonic Corporation, Haier Electronics Group Co., Ltd., Miele & Cie. KG, General Electric Company, Koninklijke Philips N.V., Electrolux AB, Whirlpool Corporation, BSH Hausgerate GmbH, LG Electronics Inc., Apple Inc., and Samsung Electronics Co., Ltd.

Loading Table Of Content...