Smart Toys Market Research, 2033

The global smart toys market size was valued at $16.7 billion in 2023, and is projected to reach $106.8 billion by 2033, growing at a CAGR of 20.9% from 2024 to 2033.

The smart toys market is segmented into Type, Technology and Distribution Channel.

A smart toy is referred to as a technologically enhanced toy that integrates connectivity, digital elements, and interactive features. Smart toys are meant to offer an educational and engaging experience to the kids. Technologies such as Wi-Fi, Bluetooth, AI, and sensors are used in toys that make them smart.

The proliferation of digital technologies and their integration into toys has resulted in a significant growth in demand for smart toys among customers. The desire of parents to engage their kids in educational experiences through engaging and interactive mediums for providing them with innovative learning experiences is a major factor that boosts the smart toys market demand across the globe. Moreover, a significant rise in the disposable income of consumers in the past decade has positively influenced the global smart toys market demand.

The rise in acceptance of new age technologies such as the Internet of Things (IoT) and AI among global consumers and their integration with toys to provide children with a learning experience along with enjoyment has significantly driven the smart toys market growth across the globe. Moreover, the growth in popularity of STEM (Science, Technology, Engineering, and Math) toys among people to assist their kids in developing their knowledge and skills from an early age has significantly driven the demand for the smart toys market across the globe. The rapid advancements in technology are the major factor that has driven the growth of the global smart toys market growth. The rise in investments by the major players to introduce advanced and innovative technologies in toys is expected to foster the growth of the market. Furthermore, the major players have adopted expansion strategies to strengthen their position in the market. For instance, LEGO Group opened its first Lego Retail Store in Salt Lake City in the U.S. in December 2020. This strategy aimed to provide an immersive experience to the customers along with a wide variety of toys.

A significant rise in digital literacy among children is another common factor, which has fueled the demand for smart toys. The increased penetration of smartphones and the internet across the globe has provided exposure to digital platforms and the internet to children at an early age. The demand for digitally integrated toys is expected to grow significantly during the forecast period as the kid population gets more digitally literate. According to the National Center for Education Statistics, “In 2021, the percentage of 3 to 18 year olds who had home internet access through a computer was highest for those whose parents had attained a bachelor or higher degree (98 %) and lowest for those whose parents had attained less than a high school credential (78%).” The growth in literacy rates across the globe is also expected to have a positive impact on the growth of the smart toys industry shortly. Smart toys have acted as a bridge between traditional play and digital engagement, therefore catering to the needs of tech-savvy youngsters.

The smart toys market is segmented on the basis of type, technology, distribution channel, and region. On the basis of type, the smart toys market is segregated into robots, interactive games, and educational robots. On the basis of technology, the market is divided into Wi-Fi, Bluetooth, RFID or NFC, and others. On the basis of distribution channel, the market is bifurcated into offline and online. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

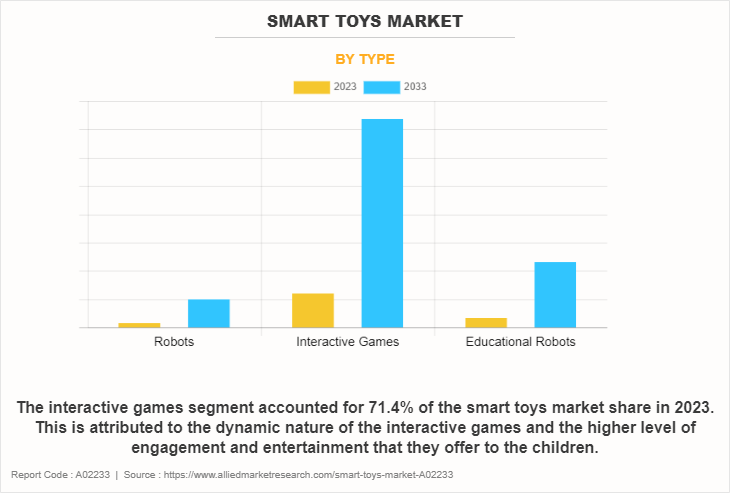

The interactive games segment accounted for 71.4% of the smart toys market share in 2023 and is expected to retain its dominance during the forecast period as per the smart toys market trends. This is attributed to the dynamic nature of the interactive games and the higher level of engagement and entertainment that they offer to the children. The immersive play experiences it provides to children keeps them actively involved, which is a major advantage of interactive games over traditional toys. Moreover, the interactive games-based smart toys are designed to offer educational content to the children which turns the learning into an interactive and fun experience. This compels the parents to opt for interactive toys that may help to develop cognitive, creative, and problem-solving skills in their children. Furthermore, the integration of advanced technologies such as virtual reality, augmented reality, sensors, and AI makes interactive games attractive and encourages social engagement among children. Apart from these aforementioned benefits of interactive games, parents are able to control and monitor the content that their children consume, and this further encourages the parents to procure interactive games for their children. Therefore, interactive games are the largest segment and are expected to sustain their significance during the forecast period.

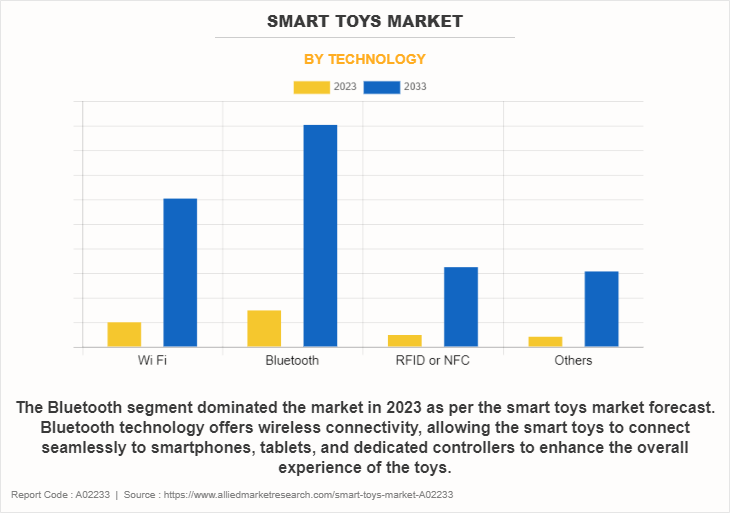

Based on the technology, the Bluetooth segment dominated the market in 2023 as per the smart toys market forecast. Bluetooth technology offers wireless connectivity, allowing the smart toys to connect seamlessly to smartphones, tablets, and dedicated controllers to enhance the overall experience of the toys. Furthermore, the ease of use and convenience associated with Bluetooth technology has significantly fueled the demand for Bluetooth technology-based smart toys market across the globe. Bluetooth ensures compatibility with a wider range of devices, which allows consumers to connect their smartphones or tablets easily. These factors significantly fostered the growth of the Bluetooth segment in the smart toys market.

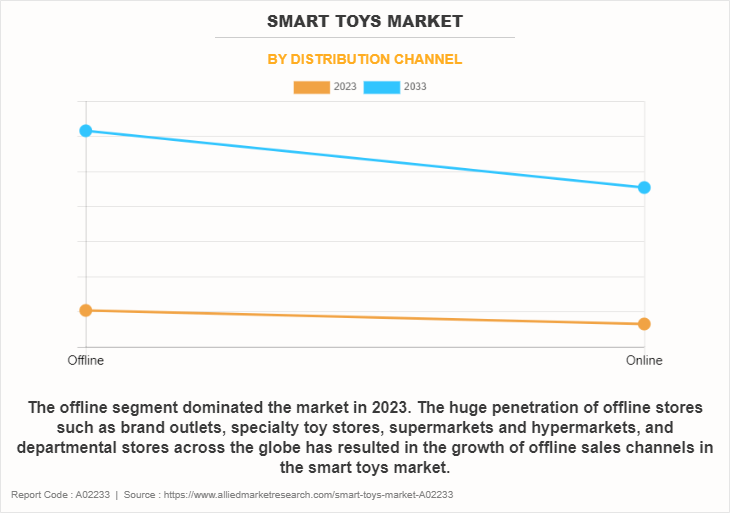

On the basis of distribution channel, the offline segment dominated the market in 2023. The huge penetration of offline stores such as brand outlets, specialty toy stores, supermarkets and hypermarkets, and departmental stores across the globe has resulted in the growth of offline sales channels in the smart toys market. However, online is estimated to be the fastest-growing segment during the forecast period. This is attributed to the rapid growth in penetration of the internet and the growth in adoption of smartphones across the globe, which provide easy access to online shopping platforms to people. According to the International Telecommunication Union (ITU), in 2015, around 40% of the global population had access to the Internet, which increased to 67% in 2023. Most internet users use their smartphones to access the internet. Therefore, the growth in adoption of digital technologies and rise in popularity of online shopping platforms due to their huge discounts, cashback offers, easy payment, and user-friendly interface is expected to drive the growth of the smart toys market through online sales channels during the forecast period.

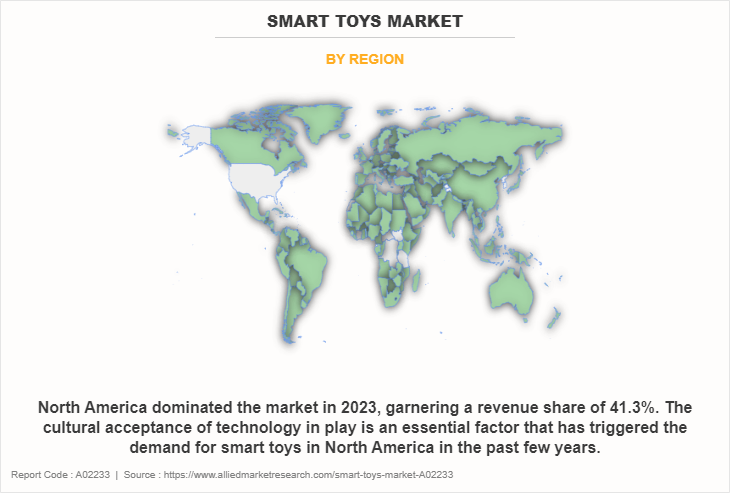

On the basis of region, North America dominated the market in 2023, garnering a revenue share of 41.3%. The major drivers of the North American smart toys market include higher disposable income of the consumers, higher adoption or preference for technology-based products, increase in investments by the manufacturers in innovation and R&D, huge presence of smart toy manufacturers, and presence of the high number of tech-savvy parents in the region. Moreover, the cultural acceptance of technology in play is an essential factor that has triggered the demand for smart toys in North America in the past few years. The majority of the population in North America embraces technology in various aspects of life including toys. This has driven North American parents to provide their kids with learning opportunities through toys. Moreover, the presence of leading market players in the region and their large and strong distribution network have provided visibility and easy availability of smart toys which has boosted the growth of the North American smart toys market.

On the other hand, Asia-Pacific is estimated to be the fastest-growing market during the forecast period. The strong economic growth in developing nations such as India, China, and Indonesia have significantly contributed to the rise in the disposable income of consumers which is positively impacting the growth of the smart toys market. Moreover, the growth in penetration of modern trade channels along with the growth in adoption of online shopping platforms in tier 1 and tier 2 cities due to rapid urbanization is resulting in increase in awareness regarding smart toys and their benefits, which positively influences the growth of the market in the region. Furthermore, Asia-Pacific has a large and growing population and the rise in digital literacy of such a huge population is expected to boost the growth of the smart toys market during the forecast period. In addition, cultural factors have also played an influential role in market growth. The rise in popularity of anime and manga and local cultural influences are expected to drive the smart toys market growth in Asia-Pacific during the forecast period.

Mattel, Inc., LEGO Group, Hasbro, Inc., K’NEX Industries, Inc., Jakks Pacific, Inc., WowWee Group Limited, Anki, Inc., Sphero, Inc., LittleBits Electronics, Inc., UBTECH Robotics, Inc., and Fisher-Price, Inc. are the major companies profiled in the smart toys industry report. These players are constantly engaged in various developmental strategies such as partnerships, mergers, acquisitions, and new product launches to gain a competitive edge and exploit the prevailing smart toys market opportunities.

Some examples of product launches include:

- In April 2022, LeapFrog Enterprises, Inc. launched Scout and Violet plush pals to offer a creative touch-sensitive toy to provide fun learning experiences to the children.

Some examples of acquisition include:

- In July 2022, Smart Toys and Games acquired The Happy Puzzle Company to merge the product portfolio of Happy Puzzle into Smart Toys and Games' growing portfolio. This acquisition aimed at strengthening the Smart Toys and Games’ portfolio and distribution network.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the smart toys market statistics, market segments, current trends, estimations, and dynamics of the smart toys market analysis from 2023 to 2033 to identify the prevailing smart toys market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart toys market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart toys market trends, key players, market segments, application areas, and market growth strategies.

Smart Toys Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Technology |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | hasbro inc, littleBits Electronics, Inc., Mattel, Inc., UBTECH Robotics Corporation, Anki, Inc., K'NEX Industries, Inc., JAKKS Pacific Inc., WowWee Group Ltd., Sphero Inc., The Lego Group |

Analyst Review

According to the CXOs, the threat to privacy is a major concern associated with the use of smart toys. Government regulations about data protection may hamper market growth, especially in a dominating market such as the U.S. For instance, The Children’s Online Privacy Protection Act (COPPA), is a law that protects children 13 years old and younger from having data collected from them, in the U.S. Furthermore, the willingness of the consumer to buy and the price of the smart toys are the major influencing factors that affect buying behavior of the consumers, especially in case of AI toys. The demand for smart toys for preschool kids may increase as smart toys are built to enhance the playing experience along with the development of cognitive skills in kids.

Moreover, the high prices of smart toys are a major factor that may hamper market growth. Generally, a traditional toy is priced between $10 to $15 in developed markets such as Europe and the U.S. However, the integration of AI raises this cost to around $60 to $80, which may be too expensive for most of parents. Therefore, the demand for smart toys is expected to remain relatively lower, until they become more affordable. The smart toys market constitutes around 0.1% to 0.2% of the total toys industry. Hence, the pricing of smart toys is expected to remain a prominent factor that may decide the growth rate of the overall smart toys industry in the foreseeable future.

The global smart toys market size was valued at $16,685.9 million in 2023 and is estimated to reach $106,839.4 million by 2033, growing at a CAGR of 20.9% from 2024 to 203

3. The proliferation of digital technologies and their integration into toys has resulted in a significant growth in demand for smart toys among customers.

The smart toys market report is available on request on the website of Allied Market Research.

The forecast period considered in the global smart toys market report is from 2024 to 203

3. The report analyzes the market sizes from 2023 to 2033 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Mattel, Inc., LEGO Group, Hasbro, Inc., K’NEX Industries, Inc., Jakks Pacific, Inc., WowWee Group Limited, Anki, Inc., Sphero, Inc., LittleBits Electronics, Inc., UBTECH Robotics, Inc., and Fisher-Price, Inc. are the major companies profiled in the smart toys market report. These players are constantly engaged in various developmental strategies such as partnerships, mergers, acquisitions, and new product launches to gain a competitive edge and exploit the prevailing smart toys market opportunities.

The smart toys market is segmented on the basis of type, technology, distribution channel, and region. On the basis of type, the smart toys market is segregated into robots, interactive games, and educational robots. On the basis of technology, the market is divided into Wi-Fi, Bluetooth, RFID or NFC, and others. On the basis of distribution channel, the market is bifurcated into offline and online. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

Asia-Pacific is estimated to be the fastest-growing market during the forecast period. The strong economic growth in developing nations such as India, China, and Indonesia have significantly contributed to the rise in the disposable income of consumers which is positively impacting the growth of the smart toys market. Moreover, the growth in penetration of modern trade channels along with the growth in adoption of online shopping platforms in tier 1 and tier 2 cities due to rapid urbanization is resulting in increase in awareness regarding smart toys and their benefits, which positively influences the growth of the market in the region.

On the basis of region, North America dominated the market in 2023, garnering a revenue share of 41.3%. The major drivers of the North American smart toys market include higher disposable income of the consumers, higher adoption or preference for technology-based products, increase in investments by the manufacturers in innovation and R&D, huge presence of smart toy manufacturers, and presence of the high number of tech-savvy parents in the region.

Loading Table Of Content...

Loading Research Methodology...