Smoking Cessation And Nicotine De-Addiction Products Market Research, 2031

The global smoking cessation and nicotine de-addiction products market size was valued at $20 billion in 2021, and is projected to reach $54.7 billion by 2031, growing at a CAGR of 10.6% from 2022 to 2031. Smoking cessation refers to the act of quitting smoking. Nicotine, an alkaloid, makes people dependent on cigarettes and other smoking products. According to the Center for Disease Control and Prevention (CDC), the smoke consist of many harmful chemicals and cigarettes smoking can causes various chronic disease like lung cancer, COPD, asthma, etc. In addition, there are about 30.8 million adults in the U.S. who currently smoke cigarettes and more than 16 million Americans have the smoking-related disease. As the normal cigarette consist of 90% of tobacco, which can cause a severe damage to the health, there has been witnessed an increasing the shift of the smokers toward e-cigarettes which are battery-powered devices that generate an inhaled aerosol.

Additionally, various initiatives taken by the government, increase in the awareness about the diseases related to the smoking and various anti-smoking campaign organized by leading organizations have made a larger shift of the smokers towards smoking cessation products. This factors causes the rise in the demand for the smoking cessation and nicotine de-addiction products and further leads to the smoking cessation and nicotine de-addiction products market growth. Additionally, the top market players are investing on a huge rate in the development and discovery of these products, which leads to the invention of various advanced smoking cessation products which further attracts the youth smokers and propels the market growth.

National Center for Biotechnology Information, NCBI, states that NRTs increase the rate of quitting tobacco by 50 to 70%, in addition to this, in UK the license for some nicotine replacement therapies has been extended to allow longer term use for those who are not willing or able to quit immediately, thereby helping them to cut down smoking and facilitating the increase in the sales of the cessation products around the globe.

Also, in 2018, an estimated 8.1 million U.S. adults were electronic cigarette (e-cigarette) users. Additionally, it is seen that youth is preferably turning towards e-cigarettes, which showed the increase in the sale of this segment and caused the growth of the market. However, high cost of these therapies can lead to the decrease in the purchase of these products which can ultimately hinder the growth of the market to some extent.

Impact of COVID-19 on Smoking Cessation And Nicotine De-Addiction Products Market

Every business has been impacted by the unmatched worldwide public health crisis known as COVID-19, and the long-term impacts are expected to have an influence on industry growth during the smoking cessation and nicotine de-addiction products market forecast period. Several changes in consumer demand and behavior, buying habits, supply chain redirection, and significant government initiatives have been seen around the globe. The COVID-19 pandemic has changed the patterns of smoking, other substance use and other health-related behaviors of the smokers. Smokers in several nations have increased their tobacco consumption since the epidemic. On the other hand, there has also been a surge in interest in stopping, quit attempts, and successful cessation rates which further caused the prevalence of factors affecting the growth of the smoking cessation and nicotine de-addiction products market share. According to WHO, smoking is associated with increased severity of disease and death in hospitalized COVID-19 patients, which caused a large number of population to quit smoking and creating prevalence of the growth factor for the smoking cessation and nicotine de-addiction products market size.

The smoking cessation and nicotine de-addiction products market is segmented into Product, Form and Distribution Channel.

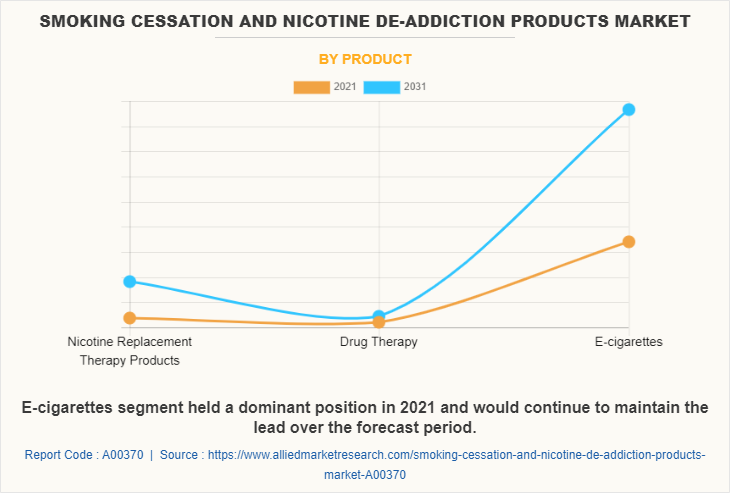

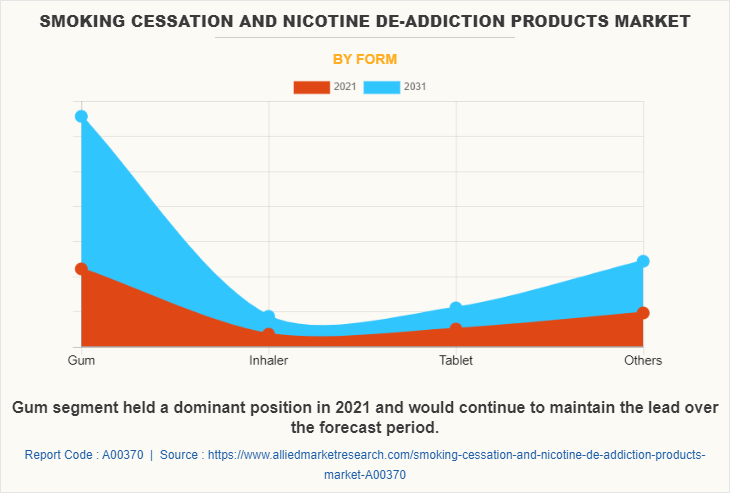

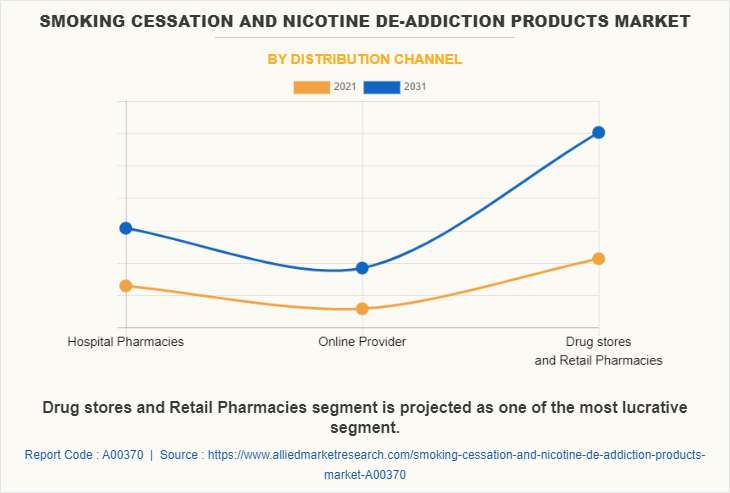

The market is segmented on the basis of product type, form, distribution channels and region. On the basis of product type, the market is segmented into nicotine replacement therapy products, drug therapy and e-cigarettes. The nicotine replacement therapy products are further segmented into nicotine lozenges, nicotine gums, nicotine sprays and nicotine inhalers. On the basis of form, the market is segmented into gum, inhaler, tablet and others. On the basis of distribution channels, the market is segmented into hospital pharmacies, online providers and drug stores & retail pharmacies.

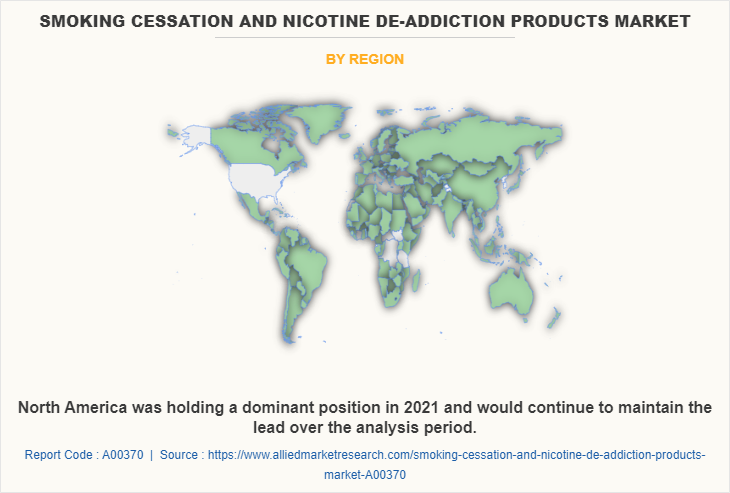

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

By product type, the market is segmented into nicotine replacement therapy products, drug therapy and e-cigarettes. The e-cigarettes segment dominated the market in 2021 and with a high CAGR whereas, the nicotine replacement therapy products segment is expected to grow at the highest CAGR during the forecast period.

Depending on the form, the market is divided into gum, inhaler, tablet and others. The gum segment generated the maximum revenue in 2021, and is expected to be the fastest growing segment during the forecast period with a CAGR, owing to rise in the demand for the nicotine replacement therapy products and rising awareness about quit smoking.

Depending on distribution channels, the market is divided into hospital pharmacies, online providers and drug stores & retail pharmacies. . The drug store & retail pharmacies segment dominated the market in 2021, with a CAGR and the online providers segment is expected to grow at the highest CAGR, during the forecast period, owing to rise in digitalization, ease of purchase, faster delivery of products and accessibility of smartphones

Region wise, in smoking cessation and nicotine de-addiction products industry, North America acquired a major share, owing to the presence of key players, rising government initiatives, well-developed healthcare infrastructure, and rising prevalence of viral and bacterial related infectious diseases. The region is witnessed the growth of CAGR in 2021. However, Asia-Pacific is expected to witness the highest growth rate for the smoking cessation market throughout the forecast period with a CAGR.The major factors that drives the growth of the smoking cessation and nicotine de-addiction products market share are the rising number of population who are quitting smoking and free initiative by government and organization’s anti-smoking initiatives, shift of the youth towards the e-cigarette, the approved smoking cessation drugs and rise in market players investing in research and development are leveraging smoking cessation products market.

The major players profiled in the smoking cessation and nicotine de-addiction products industry are British American Tobacco Inc., 22nd Century group Inc., Cipla Ltd., Dr. Reddy’s Laboratories Ltd, GlaxoSmithKline PLC (Haleon), Imperial Brands Plc. (Fontem Ventures), Johnson and Johnson (McNeil Consumer Health), Njoy Company, Pfizer Inc., Perrigo Company Plc., Rusan Pharma, Zydus Cadila.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smoking cessation and nicotine de-addiction products market analysis from 2021 to 2031 to identify the prevailing smoking cessation and nicotine de-addiction products market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smoking cessation and nicotine de-addiction products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smoking cessation market trends, key players, market segments, application areas, and market growth strategies.

Smoking Cessation and Nicotine De-Addiction Products Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 54.7 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Product |

|

| By Form |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Imperial Brands Plc., Dr. Reddy’s Laboratories Ltd., 22nd Century group Inc., GlaxoSmithKline Plc., Johnson and Johnson Inc, Perrigo Company Plc., Zydus Cadila, Inc., Njoy Company, Cipla Ltd., Rusan Pharma Ltd, British American Tobacco Plc, Pfizer Inc. |

Analyst Review

This section provides opinions of top level CXOs in the global smoking cessation and nicotine de-addiction products market. According to insights of CXOs, leading market players and development of advanced and reliable smoking cessation and nicotine de-addiction products has led to extensive expansion of the market. Increase in demand for smoking cessation and rise in awareness regarding healthy lifestyle is also expected to propel the market.

The smoking cessation and nicotine de-addiction products market holds high potential, owing to innovative concepts and multidisciplinary expertise, which demands for new advancements in creation of therapies. Nicotine replacement therapies are popular therapies and have a larger share in growth of the market. In addition, various government initiatives to stop smoking have made a huge demand for these products. Furthermore, there is also a great demand for e-cigarettes among the youth, which propels growth of the market. On the other hand, new inventions and innovations by top market players also facilitate the market growth. North America was the largest segment in the year 2021, and Asia-Pacific is expected to grow at the highest rate during the forecast period.

The upcoming trends of Smoking Cessation and Nicotine De-Addiction Products Market includes rise in number of populations who are quitting smoking and ant-smoking initiatives and campaigns by various governments and private organizations.

Quitting smoking is the leading application of Smoking Cessation and Nicotine De-Addiction Products Market.

North America is the largest regional market for Smoking Cessation and Nicotine De-Addiction Products.

Smoking Cessation and Nicotine De-Addiction Products is estimated to reach $54,708.87 million by 2031, growing at a CAGR of 10.6% from 2022 to 2031.

Major players profiled in the report are British American Tobacco Inc., 22nd Century group Inc., Cipla Ltd., Dr. Reddy’s Laboratories Ltd, GlaxoSmithKline PLC (Haleon), Imperial Brands Plc. (Fontem Ventures), Johnson and Johnson (McNeil Consumer Health), Njoy Company, Pfizer Inc., Perrigo Company Plc., Rusan Pharma, and Zydus Cadila.

The base year is 2021 in Smoking Cessation and Nicotine De-Addiction Products market.

Yes, the Smoking Cessation and Nicotine De-Addiction Products market report provides PORTER Analysis.

Loading Table Of Content...