Sodium Silicate Market Research, 2033

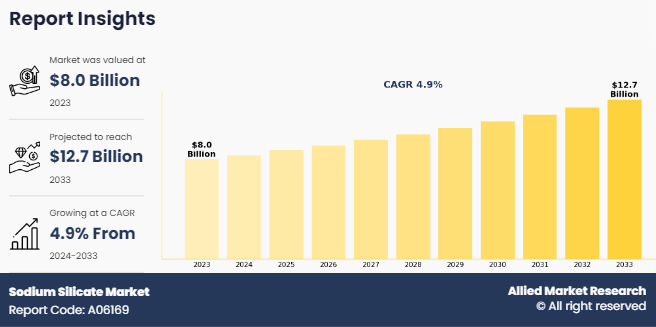

The global sodium silicate market size was valued at $8 billion in 2023, and is projected to reach $12.7 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Introduction

Sodium silicate, commonly known as water glass or liquid glass, is a chemical compound formed by the reaction of sodium oxide (Na2O) and silica (SiO2). It exists in various forms, including a colorless, odorless, and glassy solid or as a viscous liquid. The compound is characterized by its high solubility in water, producing an alkaline solution that has a high pH level. Sodium silicate's composition can vary, with different ratios of sodium oxide to silica, leading to various applications based on its specific properties. Sodium silicate serves as a vital component in many cleaning formulations due to its ability to enhance cleaning efficiency. It functions as a builder that softens water, improves the performance of surfactants, and helps to prevent soil redeposition during the washing process.

Key Takeaways

- The key players in the sodium silicate market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Shijiazhuang Shuanglian Chemical Industry Co. Ltd., and Kiran Global Chem Limited.

- The segment analysis of each country in terms of value and volume during the forecast period 2023-2033 is covered in the global sodium silicate market report.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

Market Dynamics

As construction projects increasingly focus on durability and sustainability, sodium silicate's unique properties make it an essential component in various applications. Its role as a binding agent enhances the strength and resilience of concrete and cement, which is crucial for modern construction standards. Sodium silicate contributes to improved water resistance and adhesion in building materials, thereby extending the lifespan of structures and reducing maintenance costs. This increased focus on durability aligns with global trends toward sustainable building practices, further elevating the demand for sodium silicate in the construction industry. All these factors are expected to drive the demand for the sodium silicate market during the forecast period.

Sodium silicate is mainly produced from sodium carbonate and silica, both of which experience price fluctuations influenced by various factors, including supply chain disruptions, changes in production costs, and global economic conditions. When the prices of these raw materials increase unexpectedly, it results in higher production costs for sodium silicate manufacturers, which are often transferred to customers. This situation creates uncertainty around raw material pricing, making long-term planning and investment decisions more challenging for the sodium silicate industry. All these factors are expected to hamper the sodium silicate market growth during the forecast period.

Sodium silicate, commonly known as water glass, is widely used in the formulation of detergents due to its excellent properties, such as acting as a builder, providing alkalinity, and enhancing the cleaning efficacy of detergents. As the global detergent market continues to expand, driven by rising consumer awareness regarding hygiene, cleanliness, and the need for effective cleaning solutions, the demand for sodium silicate is expected to grow correspondingly. In addition to its role in boosting detergent performance, sodium silicate serves as a corrosion inhibitor and stabilizer, which further enhances the longevity and quality of detergents. With the shift towards more eco-friendly and phosphate-free detergents, sodium silicate is becoming a preferred choice due to its non-toxic, biodegradable nature. All these factors are anticipated to offer new growth opportunities for the global sodium silicate market throughout the forecast period.

Segments Overview

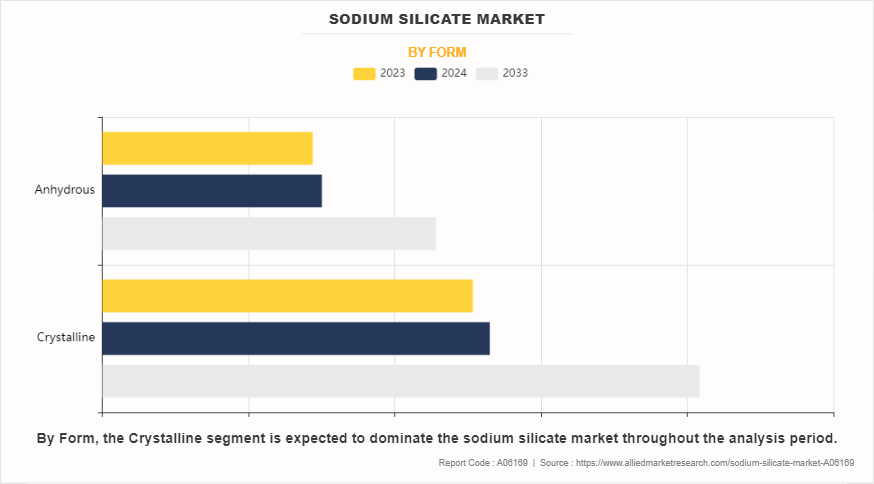

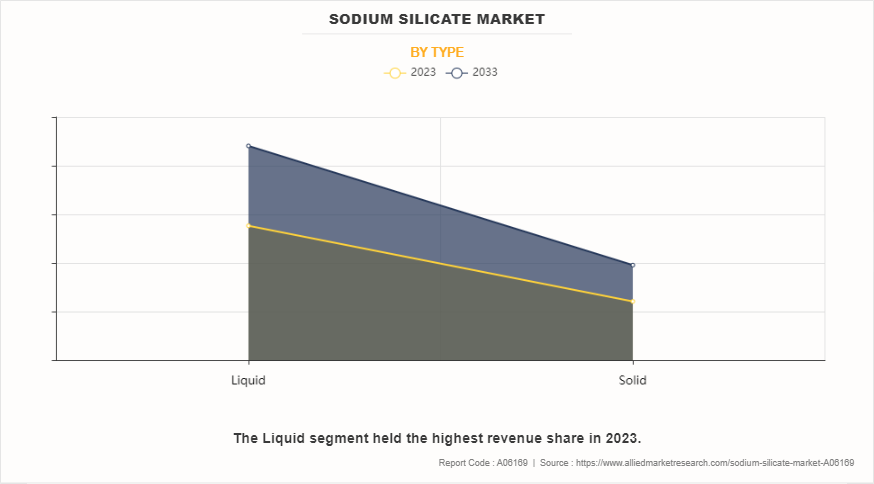

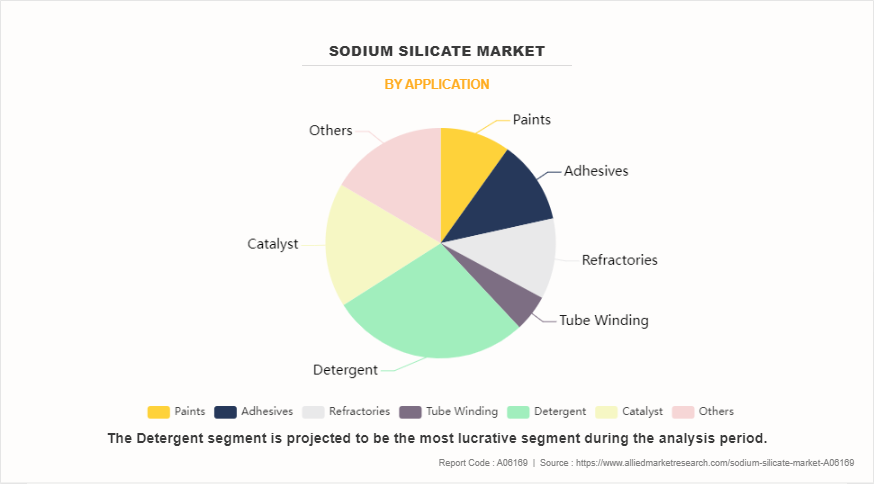

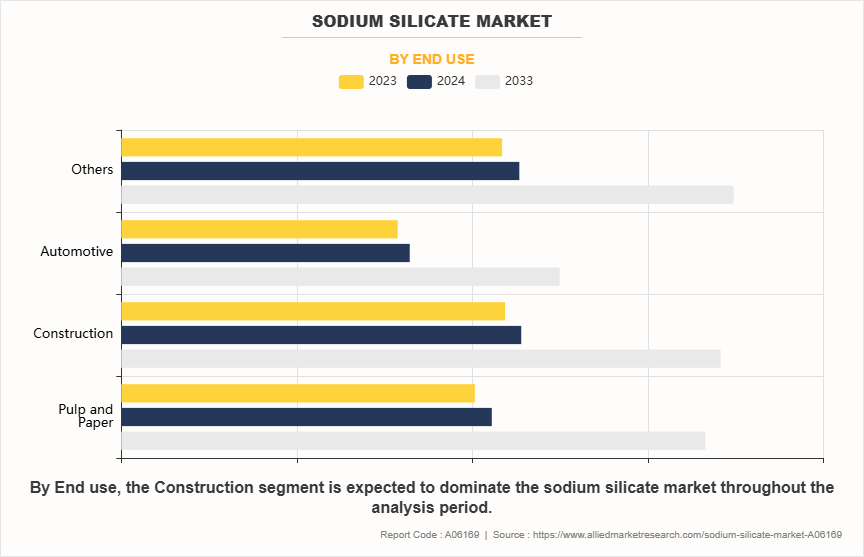

The sodium silicate market is segmented on the basis of form, type, grade, application, end use, and region. Depending on form, the market is segmented into crystalline and anhydrous. By type, the market is bifurcated into liquid and solid. The grade segment is further divided into neutral and alkaline. Based on application, the market is divided into paints, adhesives, refractories, tube winding, detergent, catalyst, and others. Based on the end use, the market is categorized into pulp & paper, construction, automotive, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The crystalline segment led the sodium silicate market in 2023. This growth was primarily driven by its extensive applications in fireproofing mixtures, laundry, dairy, metal, and floor cleaning. Additionally, crystalline sodium silicates are widely used in deinking paper, insecticides, fungicides, cleaning carbonated drink bottles, and as antimicrobial agents, further contributing to the segment's market expansion.

The liquid segment was the largest revenue contributor to the sodium silicate market in 2023. This growth was driven by its widespread use in various industrial and commercial applications, such as detergents and cleaning agents, pulp and paper, paperboard, construction materials, textiles, ceramics, petroleum processing, and metals. While these applications continue to drive demand for liquid sodium silicates, the solid segment is expected to grow at a higher CAGR during the forecast period, owing to its ease of handling and storage benefits.

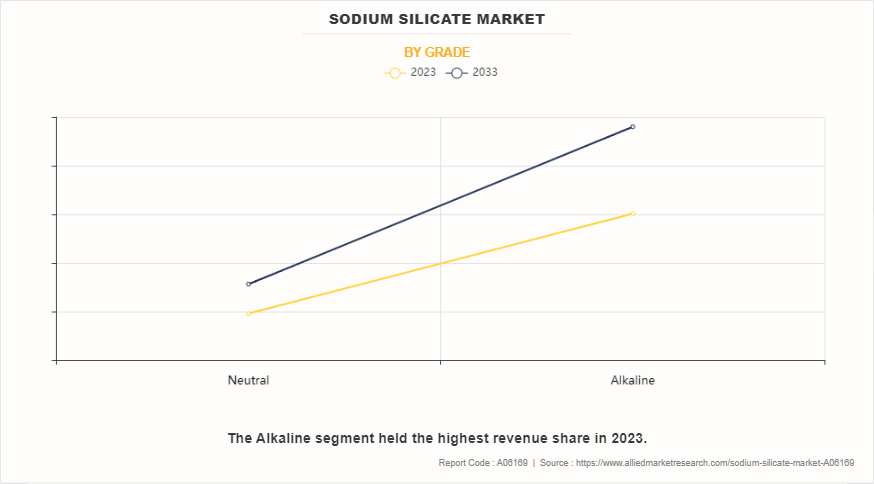

The alkaline segment dominated the market in 2023, driven by its applications in adhesives and binders, pulp and paper, deinking, detergents and soaps, catalysts, textiles, drilling fluids, mineral processing, refractory cements, and zeolites, which continue to support market growth. Alkaline sodium silicate is widely used as a binder in adhesives due to its excellent bonding strength and chemical stability. It is utilized in applications such as corrugated box manufacturing, foundry molds, and industrial adhesives, where it helps improve durability and structural integrity. In the pulp and paper industry, alkaline sodium silicate plays a key role in improving paper quality. It is used in bleaching processes and acts as a buffering agent, aiding in deinking recycled paper. Its ability to enhance the brightness and cleanliness of paper products supports the growing recycling and sustainability trends in the industry.

The detergent segment dominated the sodium silicate market in 2023, primarily driven by the growing demand for cleaning and washing activities across households, commercial spaces, and industries. Sodium silicate plays a vital role in detergent formulations due to its unique properties, such as providing alkalinity, enhancing cleaning efficiency, and acting as a builder to soften water. These attributes improve the performance of detergents, making them more effective at removing grease, stains, and dirt.

Additionally, sodium silicate serves as a corrosion inhibitor, which helps protect metal surfaces, such as washing machine components, during cleaning processes. The increasing emphasis on hygiene and cleanliness, particularly in the wake of rising health awareness and urbanization, has led to a surge in detergent consumption globally. Moreover, the growing demand for industrial and commercial cleaning solutions in sectors like hospitality, healthcare, and manufacturing has further propelled the use of sodium silicate in detergents. These trends are expected to sustain the dominance of the detergent segment in the sodium silicate market.

The construction segment dominated the sodium silicate market in 2023, driven by its extensive applications in soil stabilization, concrete hardening, and cement refractories. Sodium silicate plays a critical role in enhancing the durability and performance of construction materials. In soil stabilization, it is used to solidify loose soils, improving load-bearing capacity for roads, foundations, and other infrastructure projects. For concrete hardening, sodium silicate acts as a sealing and strengthening agent, reducing permeability and increasing the overall strength and durability of concrete structures. Additionally, its use in cement refractories enhances heat resistance and thermal stability, making it ideal for high-temperature applications such as furnaces and kilns. These benefits align with the construction industry's growing focus on sustainability, durability, and cost-efficiency, further driving demand for sodium silicate in the sector.

Competitive Analysis

The key players operating in the market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Solvay, and Kiran Global Chem Limited.

In 2023, Solvay, a Belgian science company, announced the launch of its first unit for producing circular highly dispersible silica (HDS) using bio-based sodium silicate derived from rice husk ash. This innovative silicate process creates a circular solution by repurposing rice husk within a localized value chain. Combined with the integration of renewable energy at the facility, this approach will enable Solvay to reduce COâ‚‚ emissions by 50% per ton of silica. As a result, their Livorno site in Italy will become Europe’s leading silica production facility in terms of COâ‚‚ footprint. Production is set to commence by the end of 2024. Solvay plans to gradually transition its existing Zeosil portfolio to circular HDS, offering a sustainable solution for the tire industry by increasing the use of eco-friendly raw materials and lowering its COâ‚‚ footprint. This next-generation precipitated silica will also cater to the demands of the home and personal care sectors, as well as the feed and food industries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sodium silicate market analysis from 2023 to 2033 to identify the prevailing sodium silicate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sodium silicate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sodium silicate market trends, key players, market segments, application areas, and market growth strategies.

Sodium Silicate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 12.7 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Form |

|

| By Type |

|

| By Grade |

|

| By Application |

|

| By End use |

|

| By Region |

|

| Key Market Players | Occidental Petroleum Corporation, PQ Group Holdings Inc., Merck Millipore Limited, Tokuyama Corporation, Solvay, Evonik Industries AG, Sinchem Silica Gel Co. Ltd., Kiran Global Chem Limited, CIECH S.A., Nippon Chemical Industrial Co. Ltd. |

Analyst Review

According to the insights from executives, the sodium silicate market is growing at significant rate. This is attributed to availability of the product in bulk size. Moreover, it is a cost friendly product and is easy to use and thus has several applications across various end-use industries such as construction, agriculture, textiles, automobile, pulp & paper, and others. In addition, the demand from paper & pulp, rubber & tire, and detergents & soap industries further boosts the sodium silicate market growth. Moreover, rise in application in the construction industry also offers lucrative opportunity for the sodium silicate industry growth. However, presence of substitutes in the market and hazardous nature of the product acts as restraint for market growth.

According to the insights from executives, the sodium silicate market is growing at significant rate. This is attributed to availability of the product in bulk size. Moreover, it is a cost friendly product and is easy to use and thus, has several applications across various end-use industries such as construction, agriculture, textiles, automobile, pulp & paper, and others. In addition, the demand from paper & pulp, rubber & tire, and detergents & soap industries further boosts the sodium silicate market growth. Moreover, rise in application in the construction industry also offers lucrative opportunity for the sodium silicate industry growth. However, presence of substitutes in the market and hazardous nature of the product acts as restraint for market growth.

The growing demand for sodium silicate is driven by its versatile applications across industries such as construction, automotive, pulp and paper, detergents, and agriculture. Its use as a binding agent, water resistance enhancer, and cleaning solution boosts its popularity. Additionally, its role in sustainable practices and eco-friendly products further accelerates the demand for sodium silicate in various sectors.

Detergent is the leading application of Sodium Silicate Market.

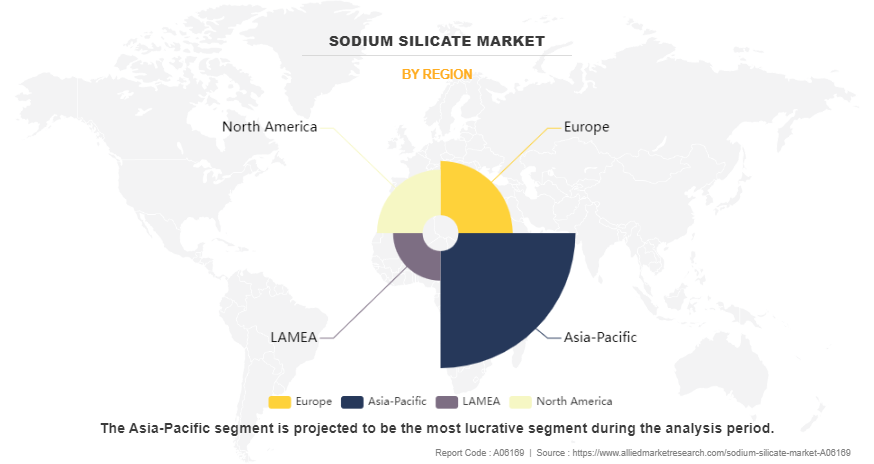

Asia-Pacific is the largest regional market for Sodium Silicate.

The sodium silicate market was valued at $8 billion in 2023, and is estimated to reach $12.7 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The key players operating in the market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Solvay, and Kiran Global Chem Limited.

Loading Table Of Content...

Loading Research Methodology...