Software As A Medical Device (SaMD) Market Research, 2033

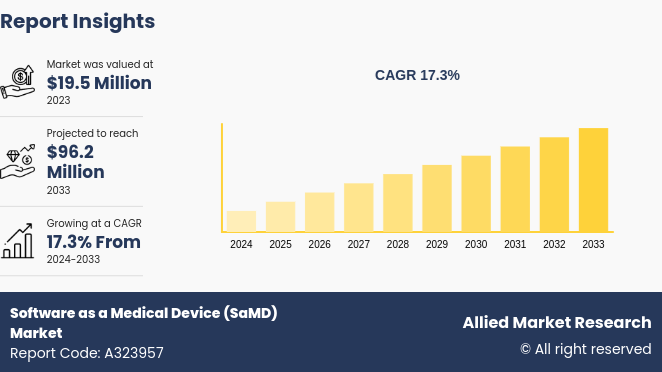

The global software as a medical device market size was valued at $19.5 million in 2023, and is projected to reach $96.2 million by 2033, growing at a CAGR of 17.3% from 2024 to 2033. The major driving factors for the market include advancements in technology such as artificial intelligence and machine learning, which enhance diagnostic capabilities and treatment planning.

Market Introduction and Definition

Software as a medical device (SaMD) refers to software intended to be used for medical purposes that perform these purposes without being part of a hardware medical device. This includes applications designed for various functions such as diagnosing conditions, recommending treatments, or managing patient health data. SaMD can operate on general-purpose computing platforms, including smartphones and tablets, making it highly versatile and accessible. Its capabilities range from complex algorithms that assist in clinical decision-making to simple applications that monitor patient health metrics. The key distinction of SaMD is its ability to fulfill medical objectives independently of traditional physical medical devices, thereby enhancing the scope and efficiency of modern healthcare delivery.

Key Takeaways

The software as a medical device market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major (SaMD) software as a medical device industry participant along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The software as a medical device market (SaMD) is driven by advancements in digital health technologies, such as artificial intelligence (AI) and machine learning, which are significantly enhancing the capabilities and efficiency of SaMD applications. These technologies enable more accurate diagnostics, personalized treatment plans, and improved patient outcomes. In addition, increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, is also fueling the demand for innovative medical software solutions that can facilitate early detection, continuous monitoring, and effective management of these conditions, which drives the software as a medical device market size.

Moreover, the global push towards telemedicine has driven the importance of remote patient monitoring and digital health solutions, further propelling the growth during the software as a medical device market forecast period. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) , are developing more robust and clear frameworks for SaMD approvals, which is encouraging more companies to enter the market with innovative products. These regulatory advancements are crucial for ensuring the safety and efficacy of SaMDs, thus increasing both healthcare providers' and patients' trust in these technologies.

However, one of the primary restraining factors is the complex and evolving regulatory landscape which may limit the adoption of SaMD devices. Regulatory bodies such as the FDA, EMA, and other international authorities are still developing comprehensive frameworks specific to SaMD. This evolving nature of regulations can create uncertainties for companies, making it difficult for them to ensure compliance and secure approvals. The stringent and lengthy approval processes can delay the time-to-market for new SaMD solutions, discouraging innovation and investment in this space which may restrict the market growth.

On the other hand, the growing trend towards value-based care and outcome-driven reimbursement models creates incentives for healthcare organizations to invest in SaMD solutions that can demonstrate measurable improvements in patient outcomes, quality of care, and cost-effectiveness which provides an software as a medical device market opportunity. SaMD applications that can help healthcare providers achieve better clinical outcomes, reduce hospital readmissions, and optimize resource utilization are expected to gain traction in the market.

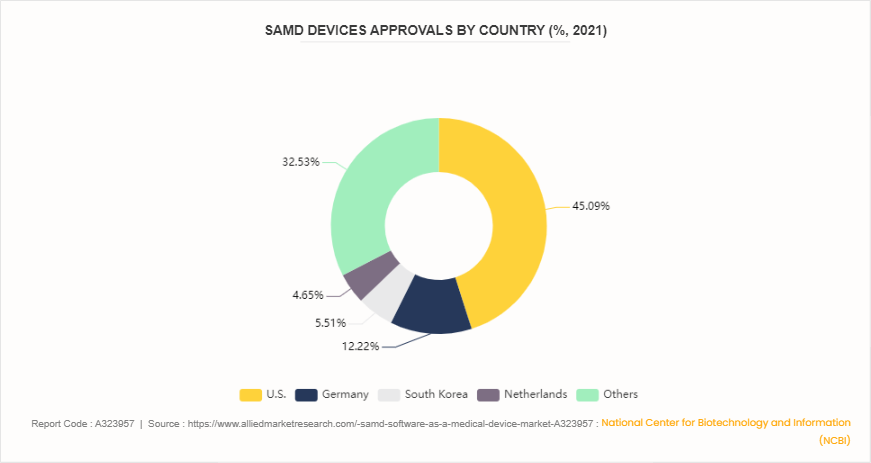

Distribution of SaMD Device Approvals by Country

According to an article published by National Center for Biotechnology and Information (NCBI) in November 2023, the U.S. leads in the number of Software as a Medical Device (SaMD) approvals, with 262 devices, accounting for 45.1% of the total approvals in 2021. Germany follows with 71 devices (12.2%) , South Korea with 32 devices (5.5%) , and the Netherlands with 27 devices (4.6%) . The remaining 189 devices, constituting 32.5%, were approved in other countries. This data indicates that the U.S. is at the forefront of the SaMD market, significantly outpacing other nations in the development and approval of new medical software devices. The dominance of the U.S. in the SaMD market is reflective of its robust healthcare technology infrastructure and a regulatory environment conducive to innovation. Established companies in the medical device industry, particularly those based in the U.S., are leveraging incremental innovations to enhance existing medical processes. These improvements include advancements in image resolution and automation, reducing the need for manual intervention in medical image processing.

Market Segmentation

The software as a medical device market (SaMD) is segmented into deployment type, application, end user, and region. On the basis of deployment type, the market is categorized into cloud based and on premise. On the basis of application, the market is classified into screening and diagnosis, monitoring and alerting, chronic disease management, digital therapeutics, and others. On the basis of end user, the market is segregated into hospitals and clinics, home care settings, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In developed regions such as North America has software as a medical device market share in 2023, owing to strong regulatory frameworks, and a high level of technological sophistication. The U.S. leads in SaMD innovation and adoption, driven by a favorable regulatory environment, extensive investment in healthcare IT infrastructure, and a thriving ecosystem of technology companies and healthcare providers. Similarly, countries within the European Union, such as Germany, the UK, and France, exhibit significant opportunities for SaMD growth, supported by favorable reimbursement policies, government initiatives to promote digital health, and a growing acceptance of telemedicine. In Asia-Pacific, countries such as Japan, South Korea, and China are emerging as key players in the software as a medical device market growth fueled by rapid technological advancements, increasing healthcare expenditure, and a growing demand for innovative healthcare solutions.

Industry Trends

A study published in the Journal of Medical Internet Research revealed significant growth in the SaMD industry. Between 2012 and 2021, the number of FDA-approved SaMDs increased from one to 581, with notable progress in artificial intelligence/machine learning-based SaMDs, accounting for 22% of all FDA-approved SaMDs. Thus, the surge in FDA-approved SaMDs, especially those leveraging AI and ML, boosts the growth of SaMD market.

According to Medical Technology, by December 2023, nearly 700 AI and machine learning (ML) -enabled devices had been granted marketing authorization. The FDA released guidelines for the clinical evaluation of these devices, including recommendations for a Predetermined Change Control Plan for AI/ML-enabled device software functions.

In 2023, the World Health Organization (WHO) estimated that 2 million different kinds of medical devices are expected to be in the world market, categorized into more than 7000 generic devices groups. The increased regulatory approvals reflect greater confidence in these technologies' safety and efficacy, accelerating their market adoption.

Competitive Landscape

The major players operating in the software as a medical device (SaMD) market include MindMaze, Siemens, Biofourmis, BrightInsight, Inc., 4S Information Systems Ltd, Viz.ai, Inc., F. Hoffmann-La Roche Ltd, Koninklijke Philips N.V., Orthogonal, and Zühlke Engineering AG. Other players in (SaMD) software as a medical device market includes Silicon & Software Systems Ltd., Capgemini, and so on.

Recent Key Strategies and Developments in (SaMD) software as a medical device Industry

In March 2023, NVIDIA announced that it has collaborated with Medtronic, the world’s largest healthcare technology provider, to accelerate the development of AI in the healthcare system and bring new AI-based solutions into patient care.

In March 2023, Viz.ai, a leader in AI-powered disease detection and care coordination announced a multi-year agreement with Bristol Myers Squibb, a global biopharmaceutical company, to deploy an artificial intelligence (AI) algorithm and provider workflow software (VizTM?HCM) intended to identify and triage patients who may require further evaluation for the detection of hypertrophic cardiomyopathy.?

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the (SaMD) software as a medical device market analysis from 2024 to 2033 to identify the prevailing software as a medical device (SaMD) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the (SaMD) software as a medical device market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global (SaMD) software as a medical device market trends, key players, market segments, application areas, and market growth strategies.

Software as a Medical Device (SaMD) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 96.2 Million |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 233 |

| By Deployment Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Biofourmis, Viz.ai, Inc. , Zühlke Engineering AG, BrightInsight, Inc. , MindMaze , 4S Information Systems Ltd,, F. Hoffmann-La Roche Ltd , Siemens, Orthogonal, Koninklijke Philips N.V., |

The total market value of (SaMD) software as a medical device market is $19.5 billion in 2023.

The forecast period for (SaMD) software as a medical device market is 2024 to 2033.

The market value of (SaMD) software as a medical device market in 2033 is $96.2 billion.

North America accounted for largest market share in 2023. This is attributed to the advanced healthcare infrastructure, significant investments in digital health technologies, and supportive regulatory frameworks.

The leading application of the (SaMD) software as a medical device market is in diagnostic and monitoring solutions. SaMD is extensively used to enhance diagnostic accuracy, facilitate early disease detection, and continuously monitor patients' health conditions.

Key drivers include the increasing adoption of digital health solutions, advancements in software technology, regulatory support, rising prevalence of chronic diseases, and the demand for personalized medicine.

SaMD refers to software intended to be used for medical purposes without being part of a hardware medical device. It performs medical functions such as diagnosing, monitoring, or treating diseases.

Loading Table Of Content...