Software Defined Vehicle Market Insights:

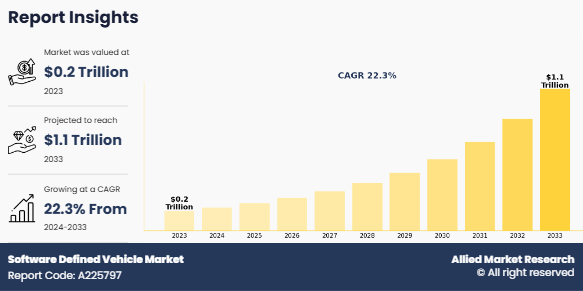

The global software defined vehicle market size was valued at USD 0.2 trillion in 2023 and is projected to reach USD 1.1 trillion by 2033, growing at a CAGR of 22.3% from 2024 to 2033.

Increase in adoption of advanced connectivity solutions such as AI and ML in vehicles, rise in demand for autonomous and connected vehicles, and the ongoing shift toward electrification are expected to drive the global SDV market growth during the forecast period. However, high initial development costs and cybersecurity concerns are anticipated to hamper the growth of the market during the forecast period. Moreover, the growth in over-the-air (OTA) updates and emergence of new business models are expected to offer lucrative opportunities for the market in the future.

Report Key Highlighters:

- The software defined vehicle industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the software defined vehicle market are Aptiv PLC, Tesla, Inc., Continental AG, NVIDIA Corporation, Robert Bosch GmbH, Li Auto Inc., Rivian Automotive, Inc., Volkswagen AG, General Motors Company, Qualcomm Incorporated. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A software defined vehicle (SDV) is a vehicle that relies primarily on software to manage its operations, introduce new features, and enhance functionality. This concept marks a significant evolution in the automotive industry, serving as the foundation for advancements like self-driving and connected cars.

SDVs represent a transformation from traditional electromechanical vehicles to intelligent, upgradeable mobile electronic systems. The benefits of SDVs include enhanced safety through features such as anti-collision systems and driver assistance, improved comfort with integrated infotainment systems offering connected services such as music and video streaming, and deeper insights into vehicle performance via telematics and diagnostics, enabling effective preventative maintenance. Furthermore, SDVs empower automotive manufacturers to introduce new features and functionalities seamlessly through over-the-air updates, solidifying their role as a critical component of the industry's future.

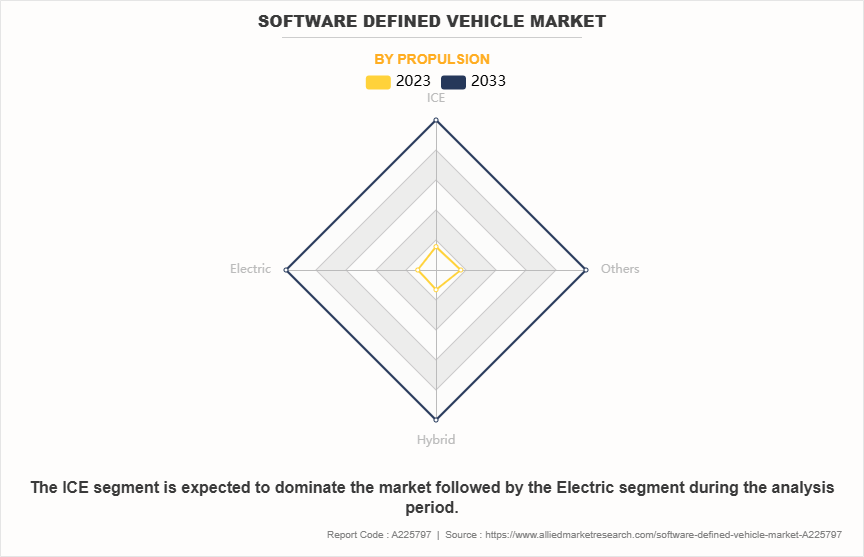

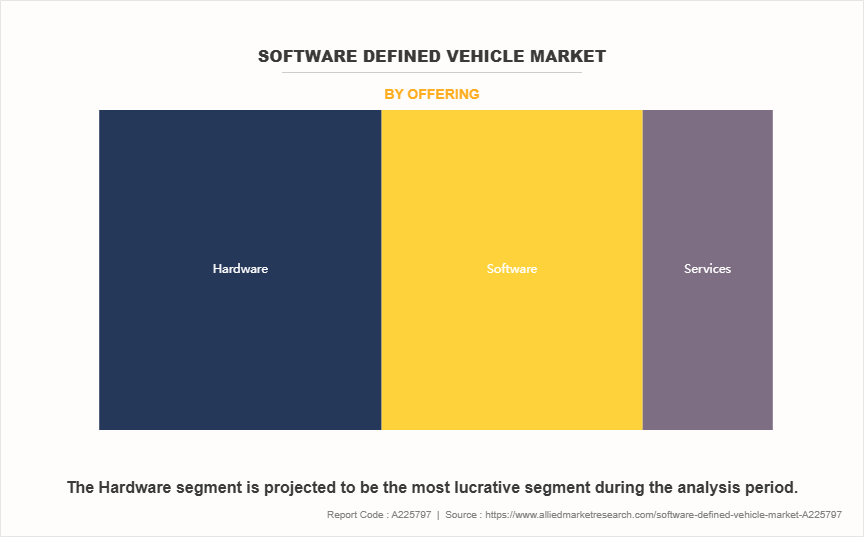

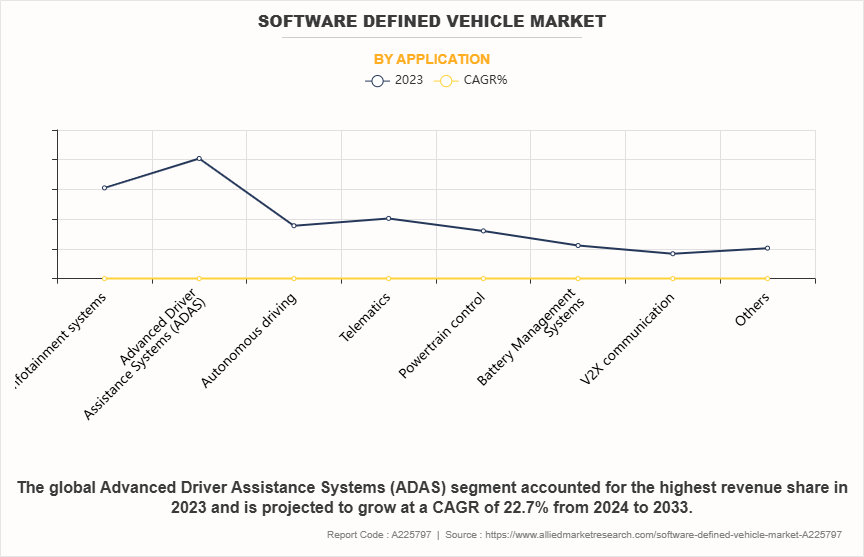

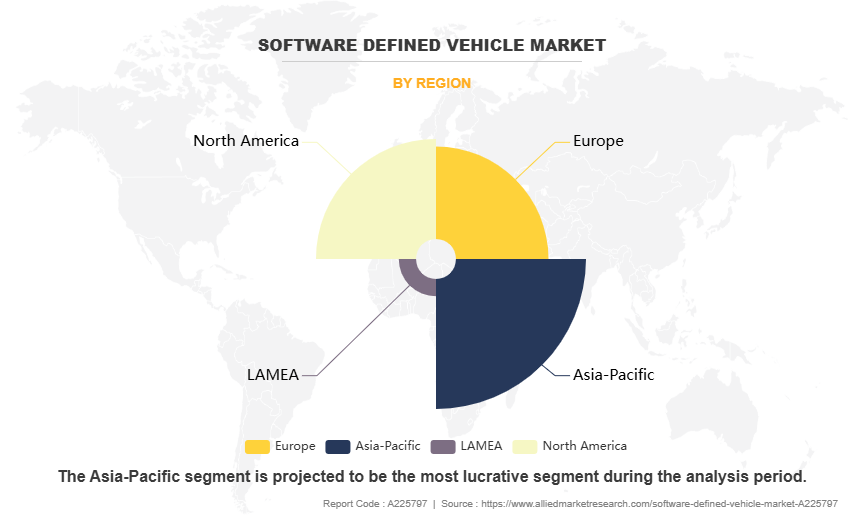

The software defined vehicle market is segmented into SDV type, electrical and electronic architecture, vehicle type, propulsion, offering, application, and region. On the basis of SDV type, the market is divided into Semi-SDV and SDV. As per electrical and electronic architecture, the market is categorized into distributed architecture, domain centralized architecture, zonal control architecture, and hybrid architecture. By vehicle type, the market is segmented into passenger cars and commercial vehicles. On the basis of propulsion, the market is classified into ICE, electric, hybrid, and others. By offering, the market is divided into software, hardware, and services. As per application, the market includes infotainment systems, advanced driver assistance systems (ADAS), autonomous driving, telematics, powertrain control, battery management systems, V2X communication, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The software defined vehicle market size is rapidly evolving, driven by advancements in vehicle connectivity, electrification, and automation. A key trend is the increasing integration of Over-the-Air (OTA) update capabilities, which allow manufacturers to remotely update software, enhancing the functionality and security of vehicles without the need for physical service visits. This is particularly important as vehicles become more connected and rely heavily on software to manage features like infotainment systems, advanced driver assistance systems (ADAS), and autonomous driving functionalities.

Electrification is another major driver of the SDV market, as electric vehicles (EVs) are inherently more dependent on software for managing powertrain control, battery systems, and energy efficiency. The global shift towards sustainable transportation has accelerated the adoption of EVs, further fueling the need for robust software defined architectures. Software advancements are contributing to the rapid rise in software defined vehicle market value.

Key Developments:

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In October 2024, Qualcomm Technologies, Inc. announced a multi-year technology collaboration with Google to drive digital transformation in automotive. The partnership will combine Qualcomm’s Snapdragon Digital Chassis with Google’s in-vehicle technologies to create a standardized reference framework. This framework will focus on developing generative AI-enabled digital cockpits and advancing Software-Defined Vehicles (SDVs), paving the way for innovation and enhanced in-car experiences.

- In June 2024, Rivian Automotive and the Volkswagen Group announced plans to establish a joint venture (JV) with equal ownership to develop next-generation electrical architecture and advanced software technology. This collaboration aims to accelerate software development for both companies, reduce costs per vehicle through economies of scale, and foster faster innovation. The JV will leverage Rivian’s zonal hardware design and integrated technology platform as the foundation for future software defined vehicle development, which will be implemented across both companies' vehicle lineups.

- In January 2023, Qualcomm Technologies, Inc. unveiled a new concept vehicle featuring its Snapdragon Digital Chassis solutions, which serve as the foundation for Software-Defined Vehicles (SDVs) at CES 2023. These solutions integrate technologies from a broad ecosystem of partners to deliver highly personalized and intuitive in-vehicle experiences, including immersive infotainment, driver assistance, and enhanced safety features.

Segmental Analysis:

The software defined vehicle market is segmented into SDV type, electrical and electronic architecture, vehicle type, propulsion, offering, application, and region. On the basis of SDV type, the market is divided into semi-SDV and SDV. As per electrical and electronic architecture, the market is categorized into distributed architecture, domain centralized architecture, zonal control architecture, and hybrid architecture. By vehicle type, the market is segmented into passenger cars and commercial vehicles. On the basis of propulsion, the market is classified into ICE, electric, hybrid, and others. By offering, the market is divided into software, hardware, and services. As per application, the market includes infotainment systems, advanced driver assistance systems (ADAS), autonomous driving, telematics, powertrain control, battery management systems, V2X communication, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By SDV Type

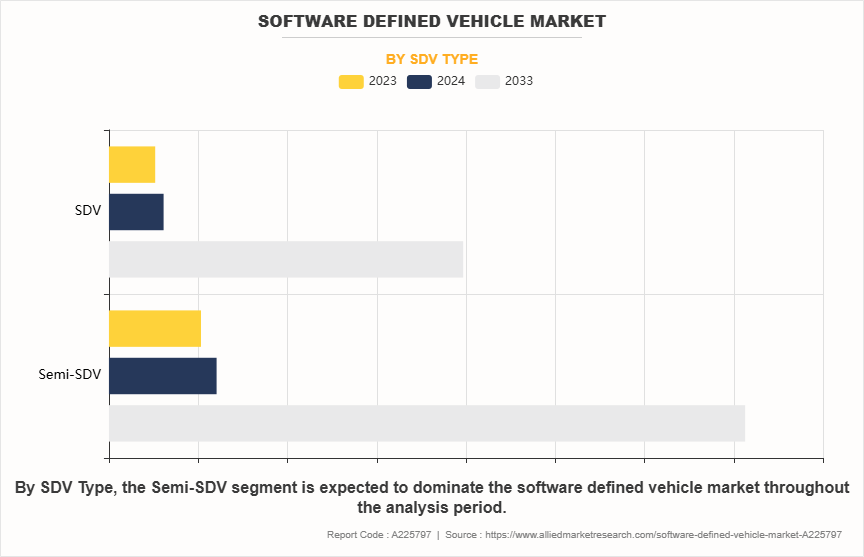

By SDV type, the global software-defined vehicle market is segmented into semi-SDV and SDV. The semi-SDVs segment accounted for the largest market share in 2023, owing to their balanced integration of software-defined capabilities and cost efficiency. These vehicles offer features such as over-the-air (OTA) updates and basic autonomous functionalities, making them appeal to mainstream consumers. Moreover, their adaptability to infrastructure limitations in developing regions further contributes to their widespread adoption.

By Electrical and Electronic Architecture

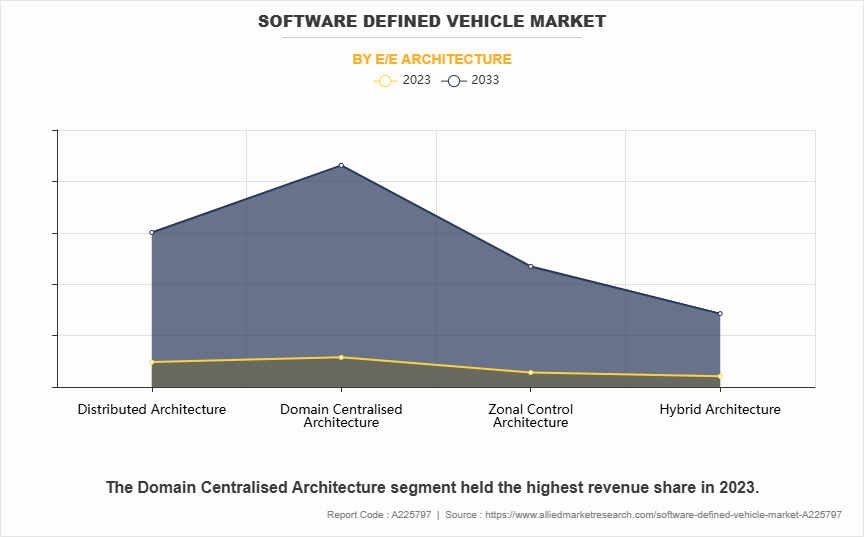

By electrical and electronic architecture, the global software defined vehicle market is segmented into distributed architecture, domain centralized architecture, zonal control architecture, and hybrid architecture. The domain centralized architecture segment accounted for the largest market share in 2023, due to its cost-effective approach to transitioning from traditional distributed systems to modern, software-centric frameworks. By consolidating multiple electronic control units (ECUs) into specific domains, such as ADAS or infotainment, this architecture reduces system complexity, enhances performance, and supports seamless over-the-air (OTA) updates, making it a preferred choice for modern automotive designs.

By Vehicle Type

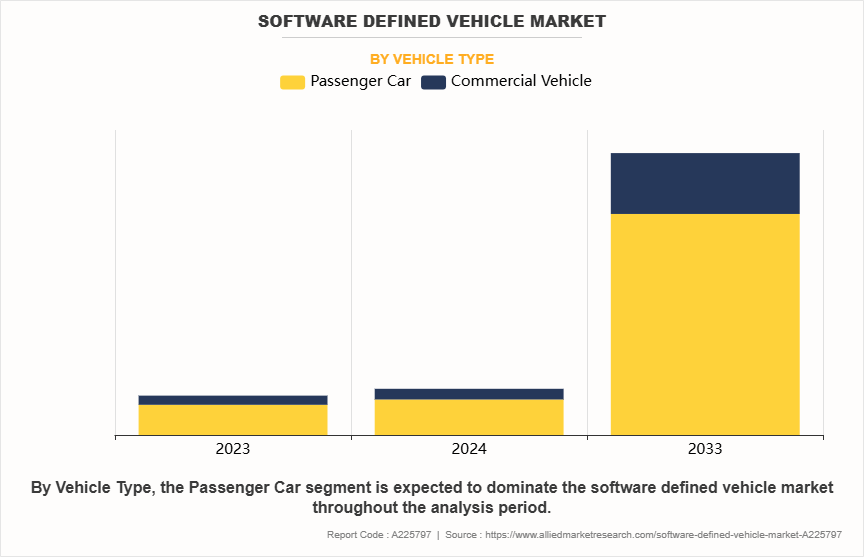

By vehicle type, the global software defined vehicle market is segregated into passenger cars and commercial vehicles. The passenger car segment accounted for a dominant market share in 2023, driven by the high demand for advanced infotainment, safety systems, and autonomous driving features in passenger cars.

By Propulsion

By propulsion, the global software defined vehicle market is segregated into ICE, electric, hybrid, and others. The ICE segment accounted for a dominant market share in 2023. This dominance is attributed to the well-established global manufacturing infrastructure for ICE vehicles, the availability of widespread fueling networks, and their affordability compared to electric and hybrid vehicles.

By Offering

By offering, the global software defined vehicle market is segregated into software, hardware, and services. The hardware segment accounted for a dominant market share in 2023 as every SDV needs advanced components such as high-performance computers (HPCs), zone control units (ZCUs), sensors, and ECUs to support new technologies such as autonomous driving and connectivity. These hardware components form the foundation of SDVs, enabling software to work effectively. As SDVs rely on powerful and specialized hardware, this segment continues to lead the market.

By Application

By application, the global software defined vehicle market is segregated into infotainment systems, advanced driver assistance systems (ADAS), autonomous driving, telematics, powertrain control, battery management systems, V2X communication, and others. The advanced driver assistance systems (ADAS) segment accounted for a dominant market share in 2023. The growing emphasis on vehicle safety and the introduction of government regulations mandating ADAS features are driving this segment.

By Region

Region wise, Asia-Pacific held the largest market share in 2023, because countries like China, Japan, and South Korea are leaders in making electric cars, advanced technology, and self-driving features. China is growing fast due to government support, strong demand for electric cars, and big investments in smart vehicles. The SDV market share is growing due to increasing demand for connected vehicles in India. Also, the software defined vehicle market forecast highlights Asia-Pacific as the fastest-growing region.

Top Impacting Factors:

Increasing demand for advanced driver assistance systems (ADAS)

Advanced driver assistance systems (ADAS) have emerged as a critical focus in the automotive industry, driven by growing consumer demand for safety, convenience, and automation. ADAS includes features like adaptive cruise control, automatic emergency braking, lane departure warnings, and parking assist, which are designed to enhance the driving experience while minimizing the risk of accidents. Governments worldwide are enforcing stringent safety regulations, compelling automakers to integrate ADAS in their vehicles to comply with standards such as Euro NCAP, NHTSA, and others.

Moreover, automobile companies are focusing on the development of SDVs integrated with ADAS. For instance, in May 2023, Tata Technologies, a global provider of engineering and product development digital services, signed a Memorandum of Understanding (MoU) with TiHAN IIT Hyderabad to collaborate on advancements in Software-Defined Vehicles (SDVs) and Advanced Driver Assistance Systems (ADAS). As automotive companies increasingly focus on developing SDVs integrated with autonomous technologies, they face challenges related to reducing technology incubation time and development costs. This partnership aims to create innovative solutions and accelerators to address these challenges, enabling the development of SDVs equipped with the latest technologies while optimizing efficiency and cost-effectiveness.

In addition, increasing urbanization and the challenges of traffic congestion have amplified the demand for smart vehicle technologies, where ADAS plays a vital role. Technological advancements in sensors, cameras, LiDAR, and radar have improved the precision and functionality of these systems, making them more reliable and cost-effective. With the push toward autonomous vehicles, ADAS technologies serve as the foundation for higher levels of automation, further driving their adoption across both passenger and commercial vehicle segments. As awareness grows and regulatory frameworks tighten, the demand for ADAS is expected to be a significant driver of software defined vehicle market growth.

Rise in demand for autonomous and connected vehicles

The increasing demand for autonomous and connected vehicles is significantly driving software defined vehicle market growth. As consumers and industries prioritize safety, convenience, and efficiency, the adoption of vehicles equipped with advanced features such as self-driving capabilities, real-time navigation, and vehicle-to-everything (V2X) communication is on the rise. Autonomous vehicles rely on a network of sensors, cameras, and software to operate, which has led to a growing need for innovative components and technologies. Similarly, connected vehicles enable seamless communication between vehicles, infrastructure, and the cloud, enhancing road safety and reducing congestion. These advancements are prompting automotive manufacturers to integrate cutting-edge solutions, thereby boosting the SDV market demand.

Moreover, automotive companies are collaborating with tech companies to accelerate the development of SDVs. For instance, in March 2024, Wind River and Hyundai Mobis expanded their partnership to accelerate the development of Software-Defined Vehicles (SDVs). This collaboration focuses on advancing technologies related to autonomous driving, connectivity, and electrification, aligning with the growing emphasis on the smart mobility era. By leveraging IoT and automation solutions, the partnership aims to drive innovation in smart mobility systems, supporting Hyundai Mobis's efforts to lead in the fields of autonomous technologies and connected electrified vehicles. Such development further propels the growth of the software defined vehicle industry.

Cybersecurity concerns

Cybersecurity concerns pose a significant challenge to the growth of the software defined vehicle market. With the increasing integration of advanced technologies like connectivity and automation in vehicles, the risk of cyberattacks has risen sharply. Modern vehicles rely on extensive data exchange between components, systems, and external networks, making them vulnerable to unauthorized access and potential hacking. A breach in vehicle cybersecurity can lead to serious consequences, including compromised passenger safety, data theft, and even the potential for vehicle manipulation.

This growing risk has made consumers and manufacturers more cautious, often delaying the adoption of advanced technologies. Additionally, developing and implementing robust cybersecurity measures requires significant investments, which adds to the cost burden for manufacturers. The complexity of securing connected, and autonomous vehicles further complicates the issue, as ensuring end-to-end protection across various systems is a challenging task. These concerns are likely to limit the growth potential of the software defined vehicle market if not addressed effectively.

Growth in over-the-air (OTA) updates

The increasing adoption of Over-the-Air (OTA) updates presents a significant software-defined vehicle market opportunity. OTA updates allow manufacturers to remotely upgrade and enhance vehicle software without requiring physical visits to service centers. This capability not only reduces maintenance costs but also enhances customer convenience by providing timely updates for features, performance improvements, and security patches.

One of the key benefits of OTA updates is their ability to ensure vehicles remain up to date with the latest technologies and safety protocols throughout their lifecycle. For instance, a leading automaker like Tesla has successfully utilized OTA updates to introduce new features such as enhanced autopilot capabilities and improved energy efficiency. This has helped the company maintain a competitive edge and build customer trust.

Moreover, OTA updates support the growing trend of connected and autonomous vehicles by enabling real-time updates to navigation systems, infotainment features, and vehicle-to-everything (V2X) communication. This functionality is particularly valuable in addressing emerging issues or vulnerabilities, ensuring the vehicles remain reliable and secure.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the software defined vehiclemarket segments, current trends, estimations, and dynamics of the software defined vehicle market analysis from 2023 to 2033 to identify the prevailing software defined vehicle market opportunities.

- The software defined vehicle market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the software defined vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global software defined vehicle market trends, key players, market segments, application areas, and market growth strategies.

Software Defined Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1109.2 billion |

| Growth Rate | CAGR of 22.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 340 |

| By SDV Type |

|

| By Electrical and Electronic Architecture |

|

| By Vehicle Type |

|

| By Propulsion |

|

| By Offering |

|

| By Application |

|

| By Region |

|

| Key Market Players | Robert Bosch GmbH, NVIDIA Corporation, Li Auto Inc., Aptiv PLC, Volkswagen AG, Continental AG, Rivian Automotive, Inc., Tesla, Inc., General Motors Company., QUALCOMM Incorporated |

Upcoming trends of Software Defined Vehicle Market are the growth in over-the-air (OTA) updates and the emergence of new business models.

The leading application of Software Defined Vehicle Market is the advanced driver assistance systems (ADAS).

The largest regional market for Software Defined Vehicle is Asia-Pacific

According to the report, the "software defined vehicle market" was valued at $154.9 billion in 2023, and is estimated to reach $1109.2 billion by 2033, growing at a CAGR of 22.3% from 2024 to 2033.

The key players in the software defined vehicle market are Aptiv PLC, Tesla, Inc., Continental AG, NVIDIA Corporation, Robert Bosch GmbH, Li Auto Inc., Rivian Automotive, Inc., Volkswagen AG, General Motors Company, Qualcomm Incorporated. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Loading Table Of Content...

Loading Research Methodology...