Solar Cell And Module Market Research, 2033

The global solar cell and module market was valued at $166.6 billion in 2023, and is projected to reach $373.6 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033.

Market Introduction and Definition

Solar cell and modules are devices that convert sunlight directly into electricity through the photovoltaic effect. They are the building blocks of solar panels or modules, which are comprised of multiple interconnected solar cell. Solar cell are typically made of semiconductor materials, such as silicon, which have unique properties that allow them to generate electricity when exposed to sunlight. Solar cell and modules come in various types and configurations to meet different energy needs and environmental conditions. Mono-crystalline and multi-crystalline silicon solar cell stand out as extensively employed variants, recognized for their superior efficiency and dependability. Solar cell and modules find applications across various end-use industries such as residential, commercial, industrial, agricultural, transportation, aerospace, defense, and others.

Key Takeaways

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

The solar cell and modules market is fragmented in nature among prominent companies such as Novasys, Saatvik Solar, Insolation Energy Ltd., SunGarner Energies Ltd, Allesun, AIKO, Centro Energy Co., Ltd., aolisolar, DAS Solar, and AIDU ENERGY.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, and LAMEA regions.

Latest trends in global cell and modules market such as undergoing R&D activities, government policies, incentives, upcoming projects, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 3, 000 solar cell and modules-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global solar cell and modules market.

Key Market Dynamics

Rise in awareness and adoption of renewable energy has emerged as a pivotal driver propelling the growth of the solar cell and modules market. Rise in global focus on mitigating climate change and reducing carbon emissions has led to significant shift towards cleaner and more sustainable energy sources. Solar energy has gained widespread attention due to its abundant availability, environmentally friendly nature, and technological advancements making it increasingly accessible and cost-effective. The growing recognition of solar energy's ability to reduce reliance on fossil fuels and promote sustainability is a major driver for the adoption of solar cell and modules, thus driving the growth of the market. For instance, according to a report published by the Solar Energy Industries Association in 2023, the solar industry in the U.S has experienced an average annual growth rate of 22% in 2022. Moreover, the declining costs associated with solar modules installation and the availability of government incentives and subsidies further stimulate the adoption of solar energy systems. Surge in awareness and adoption of renewable energy, particularly solar power, is driving the market growth.

Furthermore, surge in government incentives and policies in the solar industry is driving the growth of the solar cell and modules market. For instance, the Indian government has launched the PM Surya Ghar Muft Bijli Yojana that provides up to 60% concession to residential consumers for installing rooftop solar modules. Moreover, financial incentives such as tax credits, grants, rebates, and feed-in tariffs play a crucial role in driving the market growth. These incentives aim to make solar energy more financially attractive for both residential and commercial consumers. Thus, the government incentives and policies create a conducive environment for the widespread adoption of solar energy, driving the growth of the solar cell and modules market.

However, the efficiency and performance issues of solar cell and modules hinder the growth of the solar cell and modules market. This is attributed to solar cell converting only a fraction of sunlight into electricity. For instance, the solar module has efficiencies ranging from 15% to 22% which means only 15-22% of the sunlight that falls on the modules gets converted into electricity and utilized as a power source. Additionally, the installation of solar modules requires high capital investments which in turn has led the customers with less expending potential to refrain themselves from using solar modules as a power generation source. These factors are expected to hamper the growth of the solar cell and modules market during the forecast period.

On the contrary, technological advancements play a pivotal role in shaping the landscape of the solar cell and modules market, presenting significant opportunities for innovation and growth. For instance, in December 2023, LONGi Green Energy Technology Co. Ltd. set a new world record of manufacturing crystalline silicon PV cell with an efficiency of 33.9%. This event may surge the potential application of silicon solar PV cell across various end-use sectors. Furthermore, these advancements encompass a wide range of developments spanning solar photovoltaic (PV) technology, energy storage systems, grid integration solutions, and manufacturing processes. By leveraging cutting-edge technologies, the manufacturers can unlock new opportunities to reduce costs, enhance efficiency, and thus, overcome existing barriers to the adoption of solar cell and modules. This factor may create lucrative opportunities for the solar cell and modules market during the forecast period.

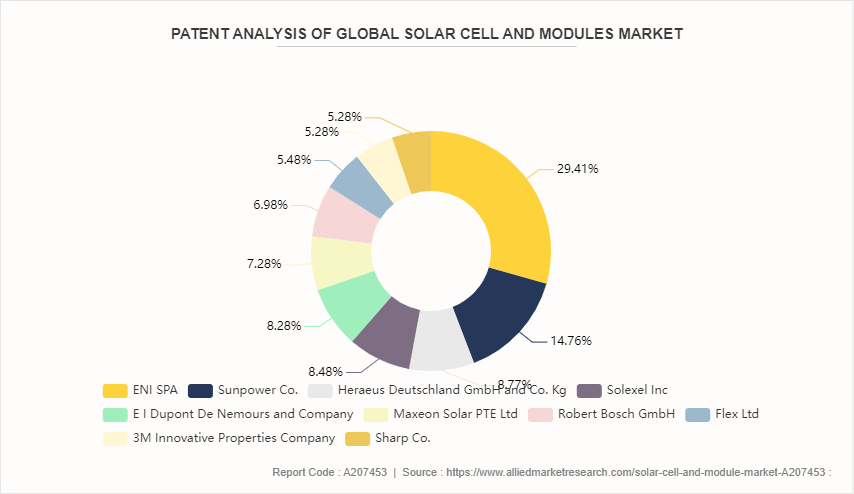

The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future-outlook within the solar cell and modules market. Patent filings related to solar cell and modules have shown a steady increase over the past decade, indicating growing interest and investment in solar cell and modules R&D. The majority of patents focus on residential and commercial applications, particularly in the development of high efficiency solar cell and modules.

Key patent holders in the solar cell and modules market include pharmaceutical companies, research institutions, universities, and solar cell and modules manufacturers. Companies such as ENI SPA, Sunpower Co., Heraeus Deutschland GmbH and Co. Kg, Solexel Inc, E I Dupont De Nemours and Company, Maxeon Solar PTE Ltd, Robert Bosch GmbH, Flex Ltd, 3M Innovative Properties Company, and Sharp Co. hold significant patent portfolios covering various aspects of solar cell and modules production, and applications. Research institutions and universities contribute to patent filings related to novel R&D and uses of solar cell and modules.

Market Segmentation

The solar cell and modules market is segmented on the basis by type, product type, module efficiency, application, and region. By type, the market is classified polycrystalline, monocrystalline, bifacial, thin film, and others. By product type, the market is segmented into N-Type and P-Type. By module efficiency, the market is classified into 13-16%, 16-20%, 20-22%, and 22-23.5%. On the basis of application, the solar cell and modules market is divided into residential, commercial, and utility scale. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for solar cell and modules market, driven by factors such as rapid economic growth and industrialization, attractive government policies and incentives, rise in expenditure in R&D, growing concerns for environmental concerns and climate mitigation, and rise in sustainable development initiatives.

China has implemented the National Energy Administration’s policies promoting solar power, offering substantial subsidies and incentives for solar projects.

India has launched initiatives such as the National Solar Mission, aiming to achieve 100 GW of solar power capacity by 2022.

Countries such as Japan and South Korea have also established feed-in tariffs (FiTs) and renewable energy quotas, making solar investments more attractive.

These factors are expected to surge the demand for solar cell and modules across numerous end-use sectors in the Asia-Pacific region; thus, fueling the growth of the solar cell and modules market.

Competitive Landscape

The major players operating in the solar cell and modules include Novasys, Saatvik Solar, Insolation Energy Ltd., SunGarner Energies Ltd, Allesun, AIKO, Centro Energy Co., Ltd, aolisolar, DAS Solar, and AIDU ENERGY. Other players in the solar cell and modules market include Rhine Solar Ltd., VIKRAM SOLAR LTD., EMMVEE SOLAR, RenewSys India Pvt. Ltd., Photon Energy Systems, and others.

Parent Market Overview:

Parameter | Description |

Parent Market Name | Solar Panel Market |

CAGR (2023-2032) | 8.1% |

Market Value (2022) | $ 152.3 Billion |

Growth Factor | Increase in demand for renewable energy sources, Government incentives, and Technological advancements |

According to a report published by the International Energy Agency in 2023, solar PV additions are expected to double by 2028 as compared to 2022 with global capacity to reach around 710GW. This factor is expected to surge the installations of various types of solar cell and modules across both developed and developing economies. In addition, countries such as the U.S., China, India, Japan, and others have put more emphasis on shifting their power dependency from conventional sources to renewable sources which in turn has surged installations of solar cell and modules. Also, government initiatives such as production linked incentive (PLI) scheme, construction of both floating and non-floating solar parks, and other domestic schemes such as PM Surya Ghar Muft Bijli Yojana for installing rooftop solar panels may further augment the growth of the solar cell and modules market. Moreover, the growing emphasis of sustainable sources of energy has led public sectors and corporates to shift their energy dependency towards solar PV cell, which in turn has led the solar cell and modules market to witness a significant growth.

Industry Trends

According to a report published by the U.S. Department of Energy in 2022, R&D is being done for reducing the amount of raw material such as ultra-thin crystalline silicon absorber layers, developing kerf-free wafer production techniques, and optimizing growth processes. This strategic innovation will reduce the investment of silicon cell manufacturers to a greater extent.

According to the International Renewable Energy Agency (IRENA) , solar PV is the fastest-growing energy source having grown 26-fold since 2010. At the end of 2022, globally installed solar PV capacity was at 1, 047GW. The amount added in 2022 alone was 191GW which indicates the rapid growth of this technology.

In November 2023, LONGi Green Energy Technology Co. Ltd. has set a new world record of manufacturing crystalline silicon PV cell with an efficiency of 33.9%. This event may surge the potential application of this novel product across various end-use sectors.

According to an article published by The Economic Times in September 2023, India’s PV module manufacturing output has reached 38GW in 2023 and is projected to reach 110GW by 2026.

In December 2023, researchers from Chinese company LONGi Green Energy Technology Co. Ltd. have developed flexible silicon PV cell that can be folded as a sheet of paper. It contains brittle silicon wafers that are 150-200 μm thick. This product is specially designed to fit in curves of vehicles, buildings, and others.

Key Sources Referred

National Promotion and Facilitation Agency

National Institutes of Solar Energy

International Energy Agency

Global Energy Forum

National Renewable Energy Laboratory (NREL)

International Renewable Energy Agency (IRENA)

Ministry of New and Renewable Energy

Economic Times

Princeton University Press

Central Electronics Limited

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the solar cell and module market analysis from 2024 to 2033 to identify the prevailing solar cell and module market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the solar cell and module market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global solar cell and module market trends, key players, market segments, application areas, and market growth strategies.

Solar Cell and Module Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 373.6 Billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 550 |

| By Type |

|

| By Product Type |

|

| By Module Efficiency |

|

| By Application |

|

| By Region |

|

| Key Market Players | Centro Energy Co., Ltd, Insolation Energy Ltd., AIDU ENERGY, aolisolar, SunGarner Energies Ltd, Novasys, Saatvik Solar, AIKO, Allesun, DAS Solar |

Loading Table Of Content...