Solid State Relay Market Research, 2032

The global Solid State Relay Market was valued at $1.1 billion in 2022 and is projected to reach $2.1 billion by 2032, growing at a CAGR of 6.8% from 2023 to 2032.

The rising trend towards energy efficiency, where SSRs offer reduced power consumption. Additionally, the increasing automation in industrial processes fuels the demand for reliable switching solutions, boosting the solid state relay market growth.

A solid-state relay (SSR) is a compact electronic device that controls power delivery to a load based on an input signal. Unlike conventional electronic relays, SSRs utilize semiconductor components like thyristors, transistors, or integrated circuits for switching, offering advantages such as quicker response times, diminished mechanical wear, and noiseless operation. Typically comprising a control circuit, SSRs activate an internal LED upon receiving a control signal, which then initiates the semiconductor switch to either connect or disconnect the load. This innovative technology enables SSRs to deliver efficient and dependable switching solutions across a wide range of applications, from small electronic setups to industrial equipment.

Key Takeaways

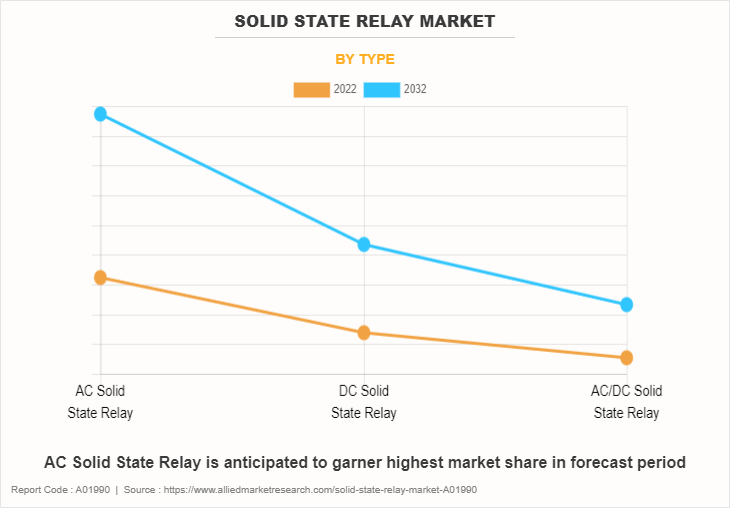

- By type, the AC solid state relay segment held the largest share of the solid state relay market in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

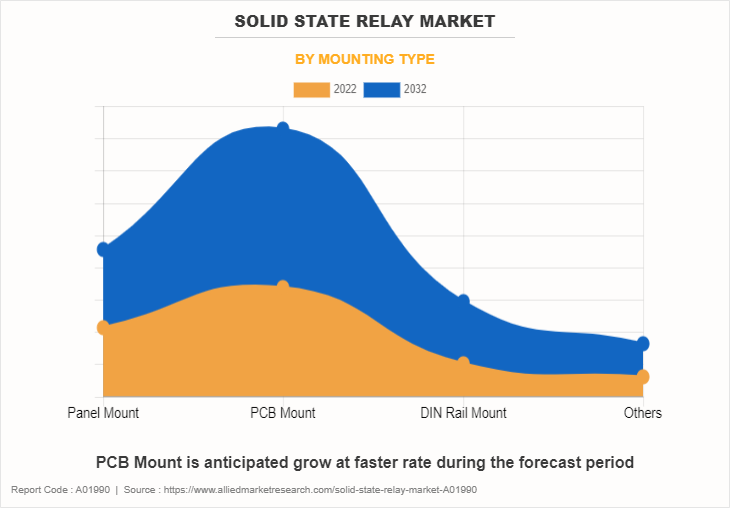

- By mounting type, the PCB mount segment dominated the solid-state relay market size in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

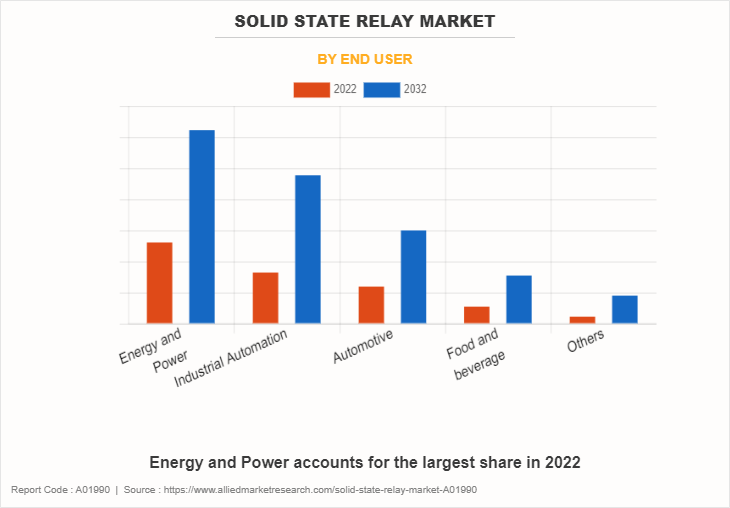

- By end user, the energy & power segment held the largest share in the Solid-State Relay industry in 2022. However, the industrial automation segment is expected to grow at the fastest CAGR during the forecast period.

- Region-wise, Asia-Pacific held the largest market share in 2022 and is expected to witness the highest CAGR during the forecast period.

Segment Overview

The solid state relay market is segmented into End User, Type and Mounting Type, and Region.

Based on end-users, the solid state relay market market is fragmented into energy & power, industrial automation, automotive, food and beverage and others. In 2022, the energy & power segment held the largest share in the solid-state relay industry revenue. Moreover, the industrial automation segment is projected to manifest the highest CAGR during the forecast period due to the escalating adoption of automation technologies across manufacturing industries, driving the demand for reliable and efficient switching solutions like SSRs to enhance process control, productivity, and operational efficiency.

On the basis of type, the solid state relay market is broken down into AC solid state relay, DC solid state relay and AC/DC solid state relay. In 2022, the AC solid state relay held the largest share of the solid state relay market due to its efficient performance, reliability, and ability to handle varying AC loads making it a preferred choice across industries, including industrial automation, and lighting control.

On the basis of mounting type, the market is classified into panel mount, PCB mount, DIN rail mount and others. In 2022, the PCB mount segment dominated the relay market size in terms of revenue due to its widespread adoption across various industries. It offers compactness, ease of installation, and compatibility with printed circuit boards. PCB mount solid state relays cater to diverse applications such as telecommunications, automotive electronics, and industrial controls.

Based on region, the global solid state relay market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, South East Asia and rest of Asia-Pacific), Latin America (Brazil, Argentina, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, Africa, rest of MEA). In 2022, Asia-Pacific held the largest market share in the solid state relay industry due to its robust industrial infrastructure, rapid technological advancements, and expanding manufacturing sector. The region's burgeoning automotive, electronics, and telecommunications industries have fueled the demand for solid state relays.

Competitive Analysis

The solid state relay market outlook report highlights the highly competitive nature of the solid state relay market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing solid state relay market opportunities. The competitive environment in this market is expected to increase as product launch, acquisition and partnership kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major solid state relay market players that have been provided in the report include Crydom (Sensata Technologies), Omron Corporation, Carlo Gavazzi, Vishay Intertechnology, Panasonic Corporation, IXYS Corporation (Littelfuse), TE Connectivity, Infineon Technologies AG, Sharp Corporation, and Fujitsu Limited.

Market Dynamics

The increasing integration of advanced electronics and automation in consumer electronics

The solid state relay market share is experiencing growth propelled by the increasing integration of advanced electronics and automation in consumer electronics. As consumers seek more sophisticated devices with improved performance and durability, manufacturers are turning to SSRs due to their superior switching capabilities. SSRs offer benefits such as rapid response times, minimized electromagnetic interference, and extended longevity compared to traditional electronic relays. Furthermore, their compact size and efficiency make them ideal for incorporation into smaller consumer electronics and automation setups. With the expansion of smart home devices, IoT applications, and advanced control systems, the demand for SSRs is expected to continue rising. This trend highlights the crucial role SSRs play in driving innovation and meeting the evolving demands of the consumer electronics sector.

High initial cost and operation expenses

Solid state relay market growth is likely to be hampered due to the high initial and ongoing expenses associated with the devices. It offers several advantages over traditional electromechanical relays such as faster response times, reduced electromagnetic interference, and longer lifespan. SSRs typically have higher purchase prices due to the complex semiconductor components and advanced technology. In addition, maintaining and repairing SSRs can be costly. It often requires specialized knowledge and sometimes necessitates complete unit replacements rather than simple component repairs. These increased expenses present challenges, particularly for cost-conscious consumers or businesses seeking more budget-friendly alternatives. Consequently, despite their superior performance and reliability in certain applications, the perception of SSRs as a pricier option might impede their market growth.

The growing semiconductor technology

The growing semiconductor sector presents a Solid State Relay Market Opportunity. As semiconductor technology evolves, there's an increasing solid state relay market trend for reliable switching solutions across various domains like consumer electronics and industrial automation. SSRs, which utilize semiconductor-based switching, offer numerous advantages over traditional relays such as faster response times, reduced power consumption, and prolonged lifespan. Furthermore, SSRs align with the semiconductor industry's emphasis on miniaturization and integration, making them a preferred choice for contemporary electronic systems. With semiconductor devices and systems becoming more complex, the need for SSRs is expected to surge, leading to significant growth and innovation in the SSR market.

Regional/Country Market Outlook

Every year, the solid state relay market share takes up a significant proportion of the market globally; particularly, the Asia-Pacific region leads in this great development. The Asia-Pacific region occupies the largest share of the solid-state relay market because of increased industrialization, the increasing role of automation in manufacturing, and the increasing use of energy-efficient technologies. The automotive industry in China, and India and automotive electronics in South Korea as well as renewable energy all serve to drive growth and expand the use of solid state relays widely in its applications. The North American Solid State Relay market is growing due to advancements in industrial automation, increasing use of renewable energy, and the demand for reliable energy-efficient solutions. Key industries like automotive, aerospace, and electronics are major contributors, particularly in the U.S. and Canada.

- In February 2023, In China, ATO, a leading relay original equipment manufacturer (OEM), launched solid-state relays (SSR) and timer relays. These relays are designed for various industrial applications, offering high switching speeds and no noise. ATO’s SSR product line includes single-phase and three-phase relays with load currents ranging from 10A to 120A.

Report Coverage & Deliverables

This report delivers in-depth insights into the solid state relay market covering type, mounting type, end user and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Type Insights

AC Solid State Relays (SSRs) are being used frequently in alternating current control applications like motors, HVAC, etc. due to their ability to handle high voltage loads. DC solid state relays are designed to control direct current, which tends to be used in automotive, solar, and low-voltage driving topographies. AC/DC Solid State Relays offer versatility by functioning in both AC and DC circuits, making them ideal for industries requiring flexible control in mixed power environments like automation and robotics.

Mounting Type Insights

Panel Mount Solid State Relays (SSRs) are widely used in industrial settings due to their ease of installation and robustness, commonly found in large machinery and HVAC systems. PCB Mount SSRs are compact and ideal for circuit boards in applications like consumer electronics and automotive systems, where space-saving is crucial. DIN Rail Mount SSRs offer modularity, making them popular in control panels and automation setups. Other mounting types include socket mounts and plug-in relays, providing flexibility for specific configurations and environments.

End User Insights

In the Energy and Power sector, Solid State Relays (SSRs) are essential for efficient switching in renewable energy systems and smart grids. Industrial Automation relies on SSRs for precise control, reliability, and fast switching in robotics and manufacturing processes. The Automotive industry uses SSRs for electric vehicle components and advanced driver assistance systems (ADAS). In Food and Beverage, SSRs support temperature control and automated processes. Other end users include consumer electronics, aerospace, and telecommunications, where SSRs enhance performance and energy efficiency.

Regional Insights

Asia-Pacific dominates the Solid State Relay market due to rapid industrialization and growing automation. North America follows, driven by advancements in renewable energy and automotive sectors. Europe also shows significant growth, especially in automation and energy efficiency, while Latin America and the Middle East witness rising adoption in industrial applications.

Recent Developments in Solid State Relay Industry

- May 2022 - Texas Instruments launched solid-state relays, comprising automotive qualified isolated drivers and switches, designed to ensure industry-leading dependability and contribute to electric vehicles (EVs) safety. The new isolated solid-state relays also have modest solution sizes to minimize powertrain bill-of-materials (BOM) costs and 800-V battery management systems.

- May 2022 – Crouzet, a French producer, launched its single-phase SSRs, which are separated into four series: GN, GN+, GNA, and GNS, and are all IP20-rated.

- May 2022- Panasoic launched advanced industrial components and electronic devices to businesses in India. These include industrial automation devices, relays, connectors, sensors, wireless connectivity, and other passive components. Within the INDD business, Panasonic supports the country’s automobile original equipment manufacturers (OEMs) and their suppliers with cutting-edge Automotive Solutions. Panasonic PhotoMOS Relays are used for the EV battery monitoring system. These are MOSFET-enabled Solid State Relays featuring low off-state leakage current and stable on-resistance over the component lifetime.

Key Benefits for Stakeholders

- To provide an accurate view of future investment pockets, this study provides analytical estimates for solid state relay market size along with current trends and estimations.

- To be able to achieve a more prominent position, the overall Solid State Relay market analysis is based on an understanding of prevailing profitability trends.

- The report presents information related to key drivers, restraints, and solid state relay market opportunities with a detailed impact analysis.

- To measure financial competence, solid-state relay market forecasts shall be quantitatively analyzed from 2022 until 2032.

- Porter’s five forces analysis shows that buyers and suppliers are more powerful in the solid state relay market.

- Key vendor shares and solid state relay market trends are included in the report.

Solid State Relay Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.1 billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By End User |

|

| By Type |

|

| By Mounting Type |

|

| By Region |

|

| Key Market Players | IXYS Corporation., Carlo Gavazzi Automation S.p.A., Vishay Intertechnology Inc., Sharp Corporation., Infineon Technologies AG, TE Connectivity, Crydom (Sensata Technologies), Fujitsu Limited, Omron Corporation., Panasonic Corporation |

Analyst Review

The global Solid State Relay market holds high potential for the semiconductor industry. The business scenario witnesses increase in demand for Solid State Relay devices, particularly in developing regions, such as China, India, the U.S., Germany, Southeast Asia and others. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

Expanding applications in electric vehicles and renewable energy systems drive the growth of the market. However, high initial cost impedes this growth. Furthermore, an expansion of electric vehicles (EVs) is expected to create lucrative opportunities for the key players operating in the market.?

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by market players. For instance, OMRON industrial automation added two new industrial relay designs to its existing product line. The slim-style relays are offered in mechanical or solid-state configurations and have a 6.2mm broad footprint

Advances in semiconductor technology, including improvements in power electronics and materials science and integration of solid-state relays with IoT (Internet of Things) technology and smart devices enables remote monitoring, control, and diagnostics of electrical systems.

Energy and power is the leading application of solid-state relay market.

Asia-Pacific is the largest regional market for solid-state relay.

The solid-state relay market was valued at $1.12 billion in 2022.

Crydom (Sensata Technologies), Omron Corporation, Carlo Gavazzi, Vishay Intertechnology, Panasonic Corporation, IXYS Corporation (Littelfuse), TE Connectivity, Infineon Technologies AG, Sharp Corporation, and Fujitsu Limited are the top companies to hold the market share in solid state relay.

Loading Table Of Content...

Loading Research Methodology...