Space as a Service Market Statistics, 2031

The global space as a service market was valued at $8.7 billion in 2021, and is projected to reach $14 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Space as a service (SPaaS) refers to the provision of flexible workspace solutions to individuals and businesses on a rental or subscription basis, rather than traditional extensive leasing. The rise of remote work has led to an increased demand for flexible workspace solutions. With more people working from home or remotely, businesses are looking for ways to provide their employees with access to professional workspace when needed, without the costs and commitment of a traditional office lease. As remote work becomes more prevalent, SPaaS providers are offering hybrid workspace solutions that combine the benefits of working from home with access to professional workspace. This includes coworking spaces, flexible office spaces, and virtual offices that allow employees to work from anywhere while still having access to the resources and amenities of a traditional office. Startups and small businesses are turning to SPaaS providers for affordable office space solutions that allow them to operate in prime locations without the overhead costs of a traditional office lease. This allows them to focus on their core business operations and scale more rapidly.

Economic uncertainty is a significant restraint for the Space as a Service (SPaaS) market. During economic downturns or periods of instability, businesses tend to cut costs and reduce their real estate footprint, which can reduce demand for flexible workspace solutions. To mitigate the impact of economic uncertainty, SPaaS providers can focus on offering affordable and flexible workspace solutions that allow businesses to scale up or down quickly as needed. This includes short-term leases, pay-per-use models, and customized solutions that meet the unique needs of each business.

Global expansion is a significant opportunity for Space as a Service (SPaaS) providers, as demand for flexible workspace solutions continues to grow around the world. The SPaaS market is already established in many developed markets, but there is still significant room for growth in emerging markets where demand for flexible workspace solutions is on the rise. SPaaS providers can develop industry-specific workspace solutions tailored to the unique needs of businesses in different sectors. For example, healthcare providers may require specialized workspace solutions that meet regulatory requirements, while creative industries may require spaces that promote collaboration and innovation. These factors are anticipated to create space as a service market growth opportunity.

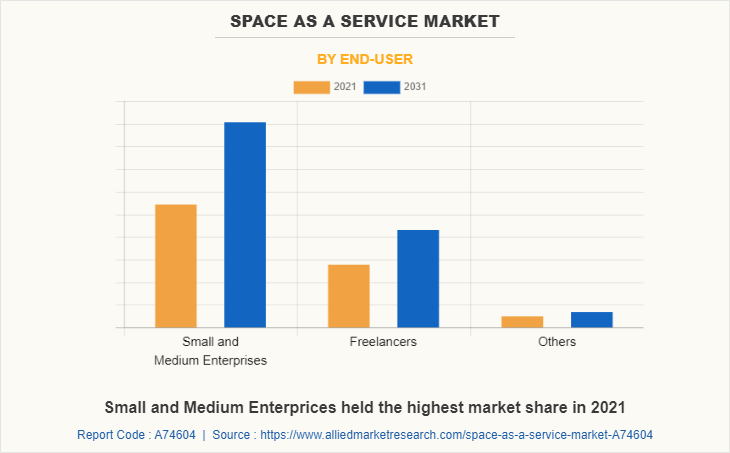

The global space as a service market is segmented on the basis of end-user and region. By end-user, the market is classified into small & medium enterprises, freelancers, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include WeWork, 91springboard, Awfis, Common Ground, Innov8, Workbar LLC, Regus, Colive, MindSpace, and Industrious.The space as a service market is segmented into and End-User.

By end-user, the small & medium enterprises sub-segment dominated the space as a service market share in 2021. Small and medium-sized enterprises (SMEs) are choosing flexible workspace options for numerous reasons including increased agility, cost savings, and access to a broader range of amenities and services. SPaaS providers are helping SMEs to attract and retain employees by offering more modern as well as flexible working conditions. The novel coronavirus outbreak underlined the significance of flexibility and remote working, making flexible workspaces an attractive alternative for SMEs. These are predicted to be the major factors affecting the Space as a service market size during the forecast period too.

By region, Asia-Pacific region is projected to have the highest CAGR during the forecast period. The Asia-Pacific region is crucial to the future of the real estate sector. It contains several of the fastest-growing economies and accounts for nearly one-third of the world's population. The demand for space as a service is steadily rising in the Asia-Pacific region along with the growth of small companies. The region is anticipated to accelerate the development of the space as a service market due to the rise in SMEs and the advantages of SPaaS.

Impact of COVID-19

- The COVID-19 pandemic had a significant impact on the Space as a Service (SPaaS) market, as many businesses were forced to shut down or operate remotely, leading to a decrease in demand for flexible workspace solutions. However, the pandemic also highlighted the importance of flexibility and adaptability in the workspace, which has led to new opportunities for the SPaaS market.

- The pandemic has highlighted the need for flexibility and adaptability in the workspace, with many businesses seeking more flexible lease terms and alternative workspace solutions. SPaaS providers have had to adapt to these changing customer needs, offering shorter lease terms and more flexible pricing models.

- The pandemic has also increased the focus on health and safety in the workspace, with SPaaS providers implementing new protocols and procedures to ensure the safety of their customers and employees.

- The pandemic has accelerated the adoption of technology in the workspace, with many businesses relying on digital tools and platforms to facilitate remote collaboration and communication. SPaaS providers have had to adapt by providing technology infrastructure that supports remote work.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the space as a service market forecast, market segments, current trends, estimations, and dynamics of the space as a service market analysis from 2021 to 2031 to identify the prevailing space as a service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the space as a service industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global space as a service market trends, key players, market segments, application areas, and market growth strategies.

Space as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By End-User |

|

| By Region |

|

| Key Market Players | Workbar LLC, Common Ground, mindspace, innov8, 91springboard, regus, Awfis Space Solutions, colive - shared space rentals, industrious ltd, WeWork |

Analyst Review

Space as a Service market is expected to continue growing as businesses and individuals seek flexible, cost-effective, and scalable workspace solutions. By offering prime locations, amenities, technology integration, and sustainable practices, SaaS providers can differentiate themselves and attract a diverse range of customers. When using shared workspace solutions, businesses may have concerns about the privacy of their information and data, particularly when using shared IT infrastructure or network systems. In addition, there may be security risks associated with sharing space with individuals or companies that have different security protocols or levels of access. By adopting the right strategies and investing in the right resources, SaaS providers can successfully expand their business and meet the growing demand for flexible workspace solutions around the world.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031, followed by Europe, North America, and LAMEA on account of numerous factors including the increasing number of startups, the rise of the gig economy, and the growing popularity of remote working practices.

This growth of the space as a service market is majorly attributed to the rise of the gig economy worldwide, the increasing popularity of flexible working spaces, and the growing need for businesses to reduce costs and improve agility. The SPaaS market is already established in many developed economies, but there is still significant room for growth in emerging economies where demand for flexible workspace solutions is on the rise.

Small & medium enterprises, sub-segment of the end-use industry acquired the maximum share of the global Space as Service market in 2021.

The concept of Space as a Service is focused on providing businesses and workers with the flexibility, agility, and support they need to succeed in today's fast-paced and dynamic business environment.

Asia-Pacific will provide more business opportunities for the global Space as Service market in future.

WeWork, 91springboard, Awfis, Common Ground, Innov8, Workbar LLC, Regus, Colive, MindSpace, and Industrious are the major players in the Space as Service market.

The major growth strategies adopted by Space as Service market players are investment and agreement.

Small and Medium Enterprises (SMEs) are the major customers in the global Space as Service market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global Space as Service market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...