Space Radar Market Research, 2033

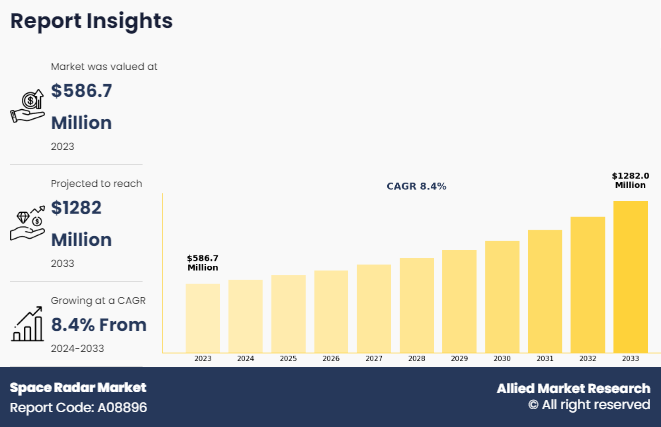

The global space radar market size was valued at $586.7 million in 2023, and is projected to reach $1,282 million by 2033, growing at a CAGR of 8.4% from 2024 to 2033.

Space radar refers to radar systems specifically designed for use in space-based or space-related applications, including satellite tracking, Earth observation, space debris monitoring, and planetary exploration. These systems utilize radio waves to detect, track, and image objects in space, offering critical data for navigation, safety, and scientific research. Space radars are deployed on satellites, spacecraft, or ground-based stations with capabilities to monitor near-Earth objects, atmospheric phenomena, and extraterrestrial surfaces.

Key Takeaways

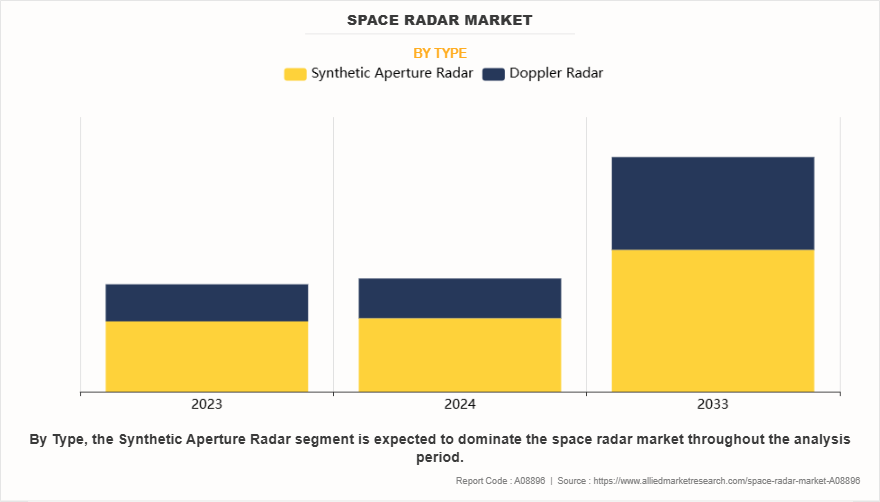

- On the basis of type, the synthetic aperture radar segment held the largest share in the space radar market in 2023.

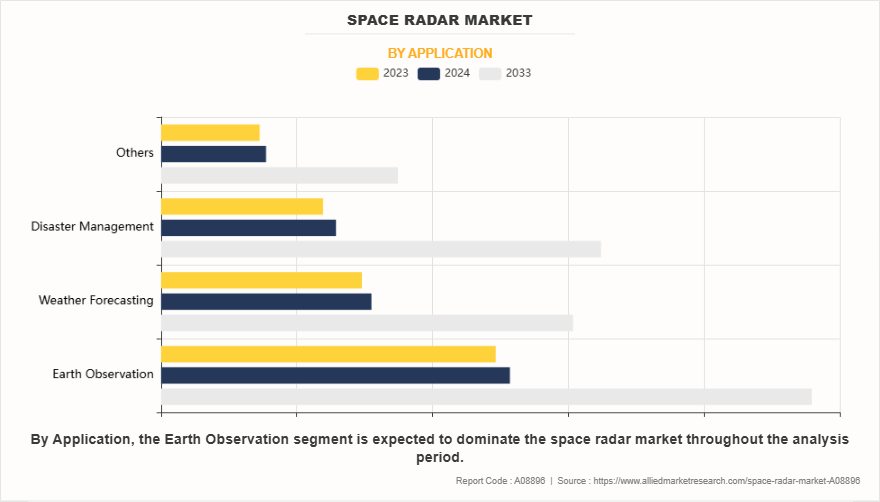

- By Application, the earth observation segment was the major shareholder in 2023.

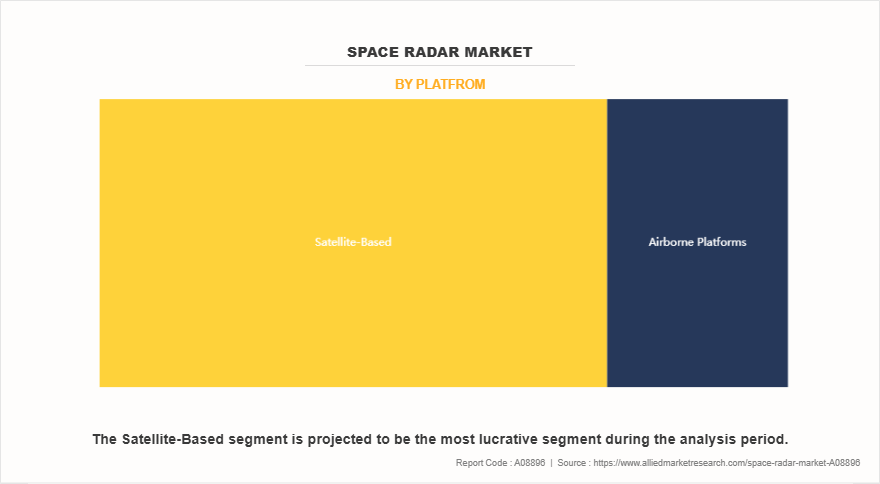

- By Platform, the satellite-based segment dominated the market, in terms of share, in 2023.

- By Frequency band, the x-band (8-12 GHz) segment dominated the market, in terms of share, in 2023.

- By End User, the defense and security segment dominated the market, in terms of share, in 2023.

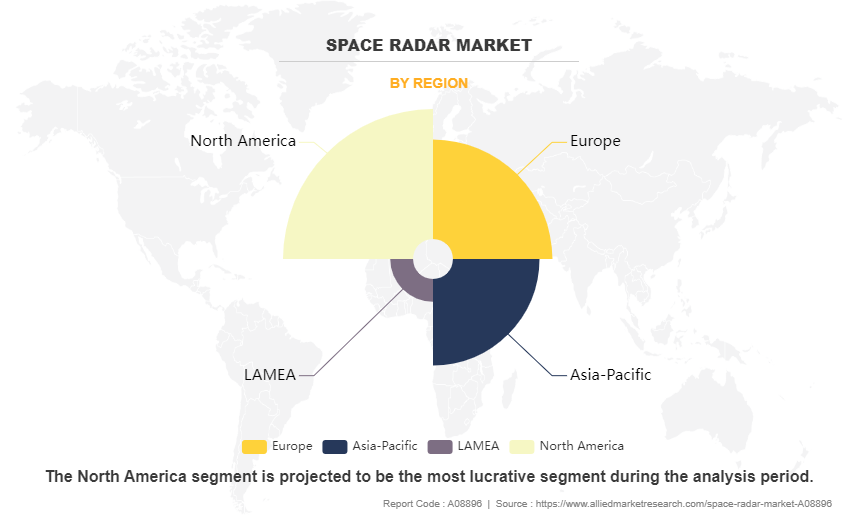

- Region wise, North America held the largest market share in 2023.

Advanced radar types, such as Synthetic Aperture Radar (SAR), enable high-resolution imaging regardless of weather or lighting conditions, making them essential for mapping and surveillance. Space radar industry also play a pivotal role in collision avoidance by tracking orbital debris and providing real-time data to operators. Additionally, they support defense and security operations by monitoring satellite movements and detecting potential threats. These technologies are integral to space exploration and maintaining the safety and sustainability of activities in Earth's orbit and beyond.

For instance, in September 2024, Capella Space, an Earth observation company specializing in synthetic aperture radar (SAR) satellites, has secured a $15 million contract from the U.S. Air Force to enhance its sensor and data collection systems for military use. AFWERX, a U.S. Air Force innovation program, granted the funding as part of a Strategic Funding Increase (STRATFI) agreement, which supports small businesses in developing advanced technologies for defense applications. This initiative aims to bolster Capella Space capabilities to meet the evolving needs of military operations.

For instance, in October 2023, Capella Space Corp. is specializing in synthetic aperture radar (SAR) satellite systems, has been selected for the Hybrid Acquisition for Proliferated LEO (HALO) procurement vehicle. This designation allows Capella to bid on prototype orders for satellite systems for the Space Development Agency (SDA), aligning with its expertise in SAR technology. SAR satellites, known for their ability to capture high-resolution radar imagery in all weather conditions, are critical for monitoring, reconnaissance, and Earth observation.Moreover, in September 2024, Capella Space Corp., a provider of high-resolution synthetic aperture radar (SAR) imagery, partnered with SATIM, a global leader in automatic object detection and classification software, as part of the Capella Certified Analytics Partner program. This partnership enables SATIM to utilize Capella’s extensive SAR imagery archive to enhance its advanced analytics capabilities, providing more precise and actionable intelligence for various applications. By combining Capella's cutting-edge SAR technology with SATIM's expertise in object detection, this partnership aims to deliver improved solutions for industries requiring high-quality data and insights, such as defense, disaster response, and infrastructure monitoring.

The increase in need for space-based surveillance and earth observation is driving demand in the space radar market share, particularly for defense and security applications. Space radar systems, such as synthetic aperture radar (SAR), provide critical capabilities for monitoring threats, tracking objects, and gathering real-time intelligence in all weather conditions. Governments and defense organizations are increasingly investing in advanced radar technologies to enhance situational awareness, ensure national security, and support global military operations, making space radar an essential tool in modern defense strategies. Furthermore, grow in awareness of space debris monitoring to ensure safe orbital operations have driven the demand for space radar market growth.

However, the high development and deployment costs of space radar industry are hindering the space radar market demand. These systems require advanced technology, specialized materials, and extensive testing, leading to significant financial investments. The expenses associated with launching and maintaining satellites further increase the overall costs. Smaller organizations and emerging economies often face financial constraints, limiting their participation in the market. As a result, the affordability challenge hampers the widespread adoption of space radar systems across various sectors. Moreover, limited technological expertise and infrastructure in emerging economies are major factors that hamper the growth of the space radar market.

On the contrary, the increasing use of radar satellites for climate monitoring and disaster management presents a lucrative opportunity for the space radar market forecast. Radar satellites, particularly synthetic aperture radar (SAR), can provide high-resolution data in all weather conditions, making them essential for tracking environmental changes, monitoring deforestation, and observing polar ice shifts. In disaster management, these satellites enable rapid damage assessment, flood mapping, and real-time response coordination. This growing reliance on radar technology for critical environmental and humanitarian applications drives demand in the space radar market.

Segment Review

The global Space radar market is segmented on the basis of type, application, platform, frequency band, end user, and region. By type, the market is bifurcated into synthetic aperture radar, and doppler radar. On the basis of application, the market is divided into earth observation, weather forecasting, disaster management, and others. On the basis of system platform, the market is bifurcated into satellite-based, and airborne platform. By frequency band, the market is segmented into X-Band (8-12 GHz), C-Band (4-8 GHz), L-Band (1-2 GHz), Ku, Ka, and V Bands. On the basis of end user, the market is segmented into defense and security, government and commercial. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Type

On the basis of type, the synthetic aperture radar (SAR) segment attained the highest market share in 2023 in the space radar market. This is due to its ability to provide high-resolution imaging regardless of weather conditions or time of day. SAR systems are capable of penetrating clouds, fog, and darkness, making them ideal for Earth observation, surveillance, and disaster management. Their versatility in applications like environmental monitoring, defense, and agriculture has driven widespread adoption. Additionally, advancements in SAR technology have made it more accessible and cost-effective, further boosting its market dominance.

By Application

On the basis of application, the weather forecasting segment acquired the highest market share in 2023 in the space radar market. This is due to the critical role space radar systems play in providing accurate, real-time weather data. Radar systems, particularly Synthetic Aperture Radar (SAR), are able to monitor atmospheric conditions, track storm systems, and measure rainfall or snowfall, all essential for weather prediction. These capabilities enable better forecasting of severe weather events such as hurricanes, tornadoes, and floods. As the demand for more precise and timely weather information grows globally, especially in the face of climate change, space radar systems have become indispensable tools for meteorological agencies and governments.

By Platform

On the basis of platform, the satellite-bases segment acquired the highest market share in 2023 in in the space radar market. This is due to their ability to provide continuous, global coverage of Earth surface. Unlike ground-based systems, satellites can observe remote and inaccessible areas, offering vital data for a wide range of applications, including Earth observation, defense, and disaster management. With advancements in satellite technology and the ability to maintain persistent monitoring, satellite-based radar systems enable real-time surveillance, environmental monitoring, and mapping. Their cost-effectiveness, flexibility, and ability to cover vast regions make them the preferred choice, driving their dominance in the space radar market.

By Region

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the Space radar market. This is due to its strong aerospace and defense sectors, technological advancements, and substantial investments in space exploration. The U.S., in particular, leads in the development and deployment of advanced radar systems for both commercial and military applications. Government agencies such as NASA and the Department of Defense, along with private companies such as SpaceX and Lockheed Martin, drive innovation in satellite-based radar technologies. North America's strategic focus on national security, environmental monitoring, and scientific research further contributes to its dominance in the space radar market.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to rapid advancements in space technologies, increasing investments in satellite infrastructure, and the growing demand for Earth observation services. Countries such as China, Japan, and India are major players, with strong government support for space missions and radar-based satellite systems. The region's expanding defense sectors, focus on climate monitoring, and large-scale infrastructure projects further drive the adoption of space radar technologies. The rise of commercial space ventures and the need for real-time data in agriculture, disaster management, and urban planning contribute to the market's growth in Asia-Pacific.

The report focuses on growth prospects, restraints, and trends of the space radar market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Space radar market.

Competitive Analysis

The report analyses the profiles of key players operating in the space radar market such as Lockheed Martin Corporation, Raytheon Technologies, Northrop Grumman Corporation, Thales Group, Leonardo S.p.A., Saab AB, BAE Systems plc, Capella Space, ICEYE, Airbus Defence, Boeing, Thales Group, NEC Corporation, and Denel Dynamics. These players have adopted various strategies to increase their market penetration and strengthen their position in the Space radar market.

Increase in demand for space-based surveillance and Earth observation for defense and security applications.

The increase in demand for space-based surveillance and Earth observation is a key driver for the growth of the space radar market, particularly for defense and security applications. Radar systems, such as Synthetic Aperture Radar (SAR), play a crucial role in providing high-resolution imaging of Earth surface, regardless of weather conditions or time of day. This makes them indispensable for monitoring military activities, tracking objects in orbit, and detecting potential threats in real-time. In defense, space radar systems enable enhanced situational awareness, surveillance of borders, and monitoring of conflict zones. For instance, in August 2024, ICEYE, a global leader in synthetic aperture radar (SAR) satellite operations, has successfully launched four new SAR satellites, further expanding its world-leading SAR constellation. The satellites were integrated by Exolaunch and launched aboard SpaceX's Transporter-11 Rideshare mission from Vandenberg Space Force Base in California. This product enhances capabilities in Earth observation, persistent monitoring, and natural catastrophe solutions.

In addition, their ability to support search-and-rescue operations and disaster management further expands their utility. Governments and defense organizations are increasingly investing in space radar technologies to strengthen national security, improve defense capabilities, and maintain safe and effective operations in space. As global security concerns grow, the need for advanced space-based surveillance and Earth observation solutions continues to drive the demand for space radar systems. Therefore, increase in demand for space-based surveillance and earth observation for defense and security applications are driving the demand for the space radar market.

Grow in awareness of space debris monitoring to ensure safe orbital operations.

The growing awareness of space debris monitoring is significantly driving demand for the space radar market to ensure safe orbital operations. As the number of satellites and space missions increases, so does the accumulation of space debris, which poses a threat to operational spacecraft and satellites. For instance, in September 2024, Plextek is strengthening its involvement in space debris removal technology through an expanded collaboration with ClearSpace and the UK Space Agency, focusing on the CLEAR mission aimed at enhancing space sustainability and safety. Through this initiative, space radar technology, especially Synthetic Aperture Radar (SAR), is crucial for detecting and tracking space debris. Space radar systems provide real-time tracking data, facilitating debris removal and ensuring safe orbital operations by reducing collision risks. This partnership increases demand for advanced radar solutions to manage the growing volume of space debris and support long-term sustainability in space.

Moreover, space radar systems, particularly Synthetic Aperture Radar (SAR), are essential for tracking and monitoring space debris, providing critical data for collision avoidance and safe satellite operation. These radar systems enable continuous observation of objects in space, identifying potential risks and tracking debris in real-time. Governments, space agencies, and private companies are increasingly relying on space radar technology to prevent satellite collisions, mitigate risks to space infrastructure, and maintain sustainable orbital environments. As the global space industry expands, the need for accurate and reliable space debris monitoring will continue to grow, further boosting the demand for space radar solutions. Therefore, grow in awareness of space debris monitoring to ensure safe orbital operations is driving the demand for the space radar market.

Advancements in Synthetic Aperture Radar (SAR) technology for high-resolution imaging.

Advancements in synthetic aperture radar (SAR) technology are significantly driving the demand for the space radar market, particularly for high-resolution imaging. For instance, in June 2023, ICEYE expanded its SAR satellite constellation with the launch of four new Gen3 satellites via SpaceX. These satellites offer 50 cm resolution and introduce the Spot Fine mode, enhancing image quality and enabling faster monitoring. This expansion strengthens ICEYE's ability to provide high-resolution imagery for a wide range of applications, reinforcing the importance of SAR in global remote sensing. The increased capabilities support climate research, land surveillance, and resource management, driving the growing adoption of SAR technology across diverse industries.

Moreover, synthetic aperture radar systems are capable of capturing detailed, high-resolution images of Earth surface in all weather conditions, making them invaluable for various applications such as Earth observation, defense, and disaster management. With improvements in radar signal processing and satellite capabilities, SAR technology now provides clearer, more accurate images, even in challenging environments such as dense cloud cover or darkness. These advancements have expanded SAR's utility across industries such as agriculture, forestry, urban planning, and environmental monitoring. Moreover, the ability to monitor changes over time with frequent revisit times has further boosted SAR's demand for applications such as tracking deforestation, monitoring climate change, and assessing natural disasters. As SAR technology continues to evolve, its growing ability to deliver detailed and reliable data drives the increasing adoption of space radar systems across diverse sectors. Therefore, advancements in synthetic aperture radar (SAR) technology for high-resolution imaging.

High Development and Deployment Costs for Space Radar Systems.

High development and deployment costs for space radar systems are a significant challenge, hampering the growth of the space radar market. These systems require advanced technology, specialized materials, and extensive testing, making them expensive to design, develop, and launch. The costs associated with building, launching, and maintaining satellites further compound the financial burden. In addition, the infrastructure needed for data collection, analysis, and storage adds to the overall expense. For smaller companies and emerging economies, these high costs often present significant barriers to entry, limiting market competition and innovation. Although the long-term benefits of space radar systems, such as enhanced surveillance, Earth observation, and disaster management, are clear, the financial commitment required for initial deployment and ongoing maintenance deters some potential adopters. As a result, the high cost of space radar systems slows their widespread adoption and limits their accessibility, particularly for organizations with limited budgets. Therefore, high development and deployment costs for space radar systems is hampering the demand of the space radar market.

Limited Technological Expertise and Infrastructure in Emerging Economies.

Limited technological expertise and infrastructure in emerging economies are significant barriers to the growth of the space radar market. Many developing countries lack the necessary technical knowledge, skilled workforce, and research capabilities to design, develop, and operate advanced space radar systems. Moreover, the absence of robust space infrastructure, including satellite launch facilities and ground stations, makes it difficult to deploy and maintain radar satellites. These limitations hinder the adoption of space radar technology, as the high costs associated with development and operations often outweigh the benefits for these economies. Without the right resources, emerging nations struggle to integrate space radar systems into critical sectors like defense, environmental monitoring, and disaster management. In addition, the lack of local expertise and infrastructure reduces the ability to maintain and update radar systems effectively, further impeding the widespread adoption of space radar technologies. Consequently, this technological gap slows the market’s growth in these regions. Therefore, Limited technological expertise and infrastructure in emerging economies is hampering the demand for the space radar market.

Increase in use of Radar Satellites in Climate Monitoring and Disaster Management.

The increasing use of radar satellites in climate monitoring and disaster management presents a lucrative opportunity for the space radar market. Radar satellites, particularly Synthetic Aperture Radar (SAR), offer unique advantages in these fields due to their ability to capture high-resolution images regardless of weather conditions or time of day. This makes them invaluable for tracking climate change, monitoring environmental changes such as deforestation or desertification, and assessing natural disasters such as floods, earthquakes, and wildfires. The demand for accurate, real-time data in these areas is growing, especially as extreme weather events become more frequent and severe. Radar satellites can provide critical insights for disaster response teams, allowing for faster damage assessment, resource allocation, and recovery efforts.

For instance, in November 2024, NASA partnered with the Indian Space Research Organisation (ISRO) and is poised to revolutionize Earth observation and disaster preparedness through the launch of the NISAR (NASA-ISRO Synthetic Aperture Radar) satellite. This cutting-edge satellite will monitor a broad range of Earth features, such as surface changes, glaciers, ice sheets, sea ice, and vegetation. With remarkable precision, measuring shifts down to fractions of an inch, NISAR will deliver vital data to better understand environmental changes, contribute to climate research, and enhance disaster management efforts. The advanced radar technology onboard will play a pivotal role in global initiatives aimed at monitoring and mitigating the effects of natural disasters and climate change. Moreover, the ability to monitor long-term environmental trends with frequent satellite revisits helps in early warning systems for climate-related risks. This increasing reliance on space radar technologies opens significant growth prospects in the climate monitoring and disaster management sectors. Therefore, increase in use of radar satellites in climate monitoring and disaster management is a lucrative opportunity of the space radar market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Space radar market analysis from 2023 to 2032 to identify the prevailing Space radar market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Space radar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Space radar market trends, key players, market segments, application areas, and market growth strategies.

Space Radar Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.3 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 354 |

| By Type |

|

| By Application |

|

| By Platfrom |

|

| By Frequency Band |

|

| By End User |

|

| By Region |

|

| Key Market Players | Thales, Northrop Grumman, Denel Dynamics, NEC Corporation, AIRBUS, BAE Systems, ICEYE, Lockheed Martin Corporation, Saab AB, RTX, Boeing, Capella Space, Leonardo S.p.A. |

The global space radar market is witnessing trends such as the adoption of advanced Synthetic Aperture Radar (SAR) for high-resolution Earth observation, increasing deployment of satellite-based radar for space debris monitoring, integration of AI and big data analytics for enhanced surveillance, and growing investments in defense and commercial space applications for improved situational awareness.

Earth Observation is the leading application of Space Radar Market

North America is the largest regional market for Space Radar

$1,128 million is the estimated industry size of Space Radar

Lockheed Martin Corporation, Raytheon Technologies, Northrop Grumman Corporation, Thales Group, Leonardo S.p.A., Saab AB, BAE Systems plc, Capella Space, ICEYE, Airbus Defence, Boeing, Thales Group, NEC Corporation, and Denel Dynamics. These players have adopted various strategies to increase

Loading Table Of Content...

Loading Research Methodology...