Space Service Market Research, 2033

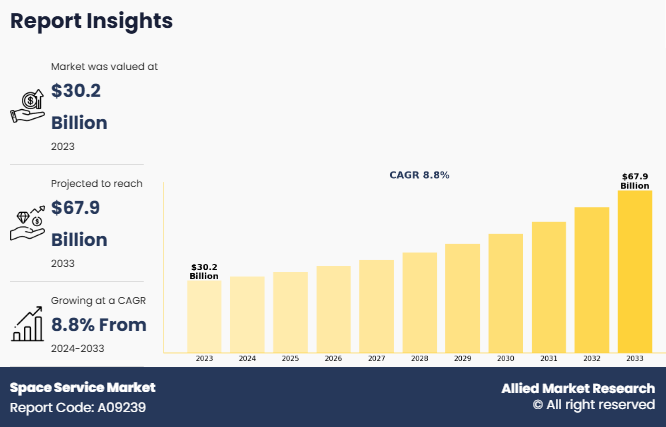

The global space service market size was valued at $30.2 billion in 2023, and is projected to reach $67.9 billion by 2033, growing at a CAGR of 8.8% from 2024 to 2033.

Report Key Highlighters:

- The space service market study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the space service market are SpaceX, Blue Origin, Airbus, Lockheed Martin, Northrop Grumman, Eutelsat, Viasat, Inc., SES, Maxar Technologies, and Rocket Lab. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Space service refers to a broad range of commercial, governmental, and defense-related activities that utilize space-based infrastructure, technologies, and operations to provide services on Earth and beyond, including activities in low Earth orbit (LEO), and geostationary orbit (GEO). These services include satellite communication, Earth observation, navigation, space exploration, space tourism, and in-orbit operations, supporting various industries, including telecommunications, defense, scientific research, and commercial enterprises.

A key driver of the space service market is a rise in demand for satellite-based services, including telecommunications, Earth observation, and navigation. Rise in dependence on satellite communication for broadband connectivity, television broadcasting, and mobile network expansion is a major factor propelling the market growth.

In the telecommunications sector, companies such as Starlink (SpaceX), OneWeb, and Amazon's Project Kuiper are deploying thousands of low Earth orbit (LEO) satellites to provide global broadband coverage. These satellite constellations are designed to reduce the gap between people who have Internet access and those who do not, especially in remote or rural areas.

For instance, in March 2025, the U.S. Federal Communications Commission (FCC) granted SpaceX approval to provide direct-to-smartphone satellite services at higher power levels. This decision is aimed at enhancing connectivity in areas lacking cell tower coverage across the U.S. The FCC approval allows SpaceX to operate in frequency bands adjacent to those used by T-Mobile, enabling stronger and more reliable satellite-based mobile communications.

Moreover, global navigation satellite systems (GNSS) such as GPS, Galileo, BeiDou, and GLONASS play a crucial role in location-based services, autonomous vehicles, and military applications. The expansion of precision navigation and real-time geospatial analytics is further driving the market growth. As industries continue to embrace space-based solutions, the market for satellite services is expected to grow exponentially, making it one of the most dominant segments in the space service industry. This trend aligns with the space service market forecast, which predicts sustained growth as demand for advanced satellite capabilities and space-based infrastructure continues to rise.

Rise in demand for satellite-based services, increase in private sector investment and commercialization, and advancements in reusable launch technology are expected to drive the global space service market growth during the forecast period. However, high costs associated with space missions and satellite deployments and regulatory and legal challenges in space operations are anticipated to hamper the growth of the market during the forecast period. Moreover, rise in demand for space tourism and commercial spaceflight and the expansion of in-orbit services are expected to offer lucrative opportunities for the market in the future.

The space service market is segmented into service type, satellite type, payload, launch vehicle type, application, and region. On the basis of service type, the market is divided into launch services, satellite services, space exploration services, and ground segment services. As per satellite type, the market is segregated into communication satellites, Earth observation satellites, navigation satellites, and scientific satellites. On the basis of payload, the market is bifurcated into small payloads and large payloads. By launch vehicle type, the market is classified into reusable launch vehicles and expendable launch vehicles. As per application, the market is categorized into satellite communication services, Earth observation & remote sensing, navigation & positioning services, scientific research & space exploration, and space tourism & commercial spaceflight. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include SpaceX, Blue Origin, Airbus, Lockheed Martin, Northrop Grumman, Eutelsat, Viasat, Inc., SES, Maxar Technologies, and Rocket Lab.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In March 2025, SpaceX received approval to offer direct-to-smartphone satellite services with higher power levels, improving connectivity in areas without cell tower coverage across the U.S. The U.S. Federal Communications Commission (FCC) granted permission for SpaceX to use increased power in frequency bands near those of its partner T-Mobile.

- June 2024, Telespazio, a joint venture between Italian defense company Leonardo (67%) and French group Thales (33%), expanded into the satellite communications sector through a partnership with SpaceX to distribute Starlink services. With Starlink’s mission to provide high-speed global internet access, this collaboration highlights the growing importance of satellite communications in the digital age. Starlink’s satellite network primarily aims to improve connectivity in rural and underserved areas, where traditional telecommunications infrastructure is limited.

Segmental analysis

The space service market is segmented into service type, satellite type, payload, launch vehicle type, application, and region. On the basis of service type, the market is divided into launch services, satellite services, space exploration services, and ground segment services. As per satellite type, the market is segregated into communication satellites, Earth observation satellites, navigation satellites, and scientific satellites. On the basis of payload, the market is bifurcated into small payloads and large payloads. By launch vehicle type, the market is classified into reusable launch vehicles and expendable launch vehicles. As per application, the market is categorized into satellite communication services, Earth observation & remote sensing, navigation & positioning services, scientific research & space exploration, and space tourism & commercial spaceflight. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

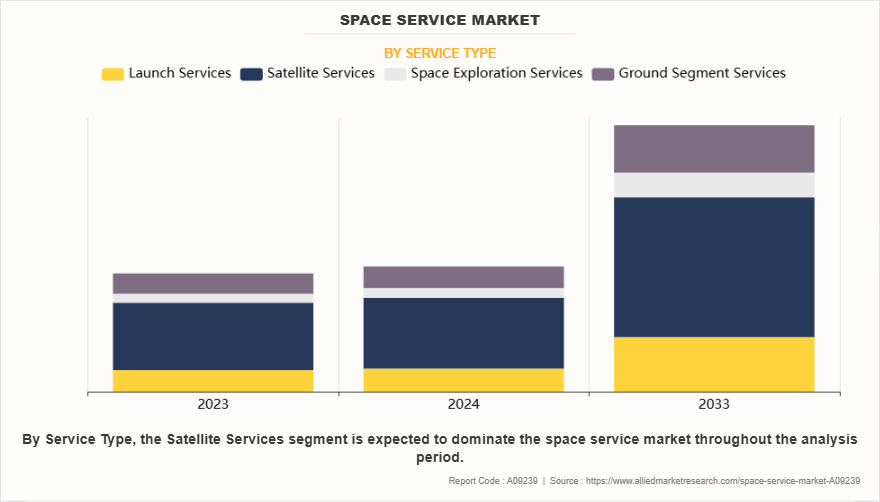

By service type, the market is divided into launch services, satellite services, space exploration services, and ground segment services. The satellite services segment accounted for the largest market share in 2023. This is due to increased reliance on satellite communication, Earth observation, and navigation services. With the rise of high-speed satellite internet, companies such as Starlink, OneWeb, and Amazon’s Project Kuiper are launching mega-constellations to provide global broadband connectivity, especially in remote and underserved areas.

By Satellite Type

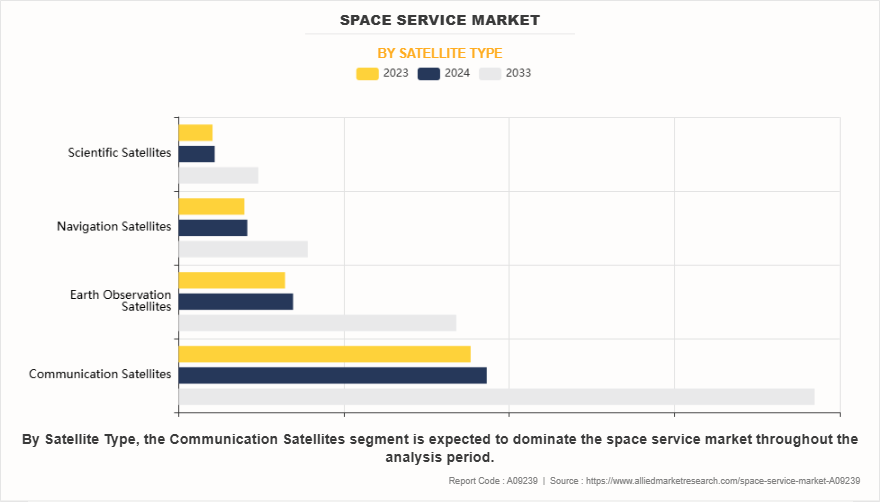

By satellite type, the market is segregated into communication satellites, Earth observation satellites, navigation satellites, and scientific satellites. The communication satellites segment accounted for the largest market share in 2023, due to the rise in need for broadband connectivity, mobile communication, and television broadcasting. One of the biggest trends is the deployment of LEO satellite constellations, which provide faster internet speeds with lower latency compared to traditional geostationary satellites. Companies such as SpaceX, OneWeb, and SES are leading this transformation, offering global coverage for businesses, governments, and individuals.

By Payload

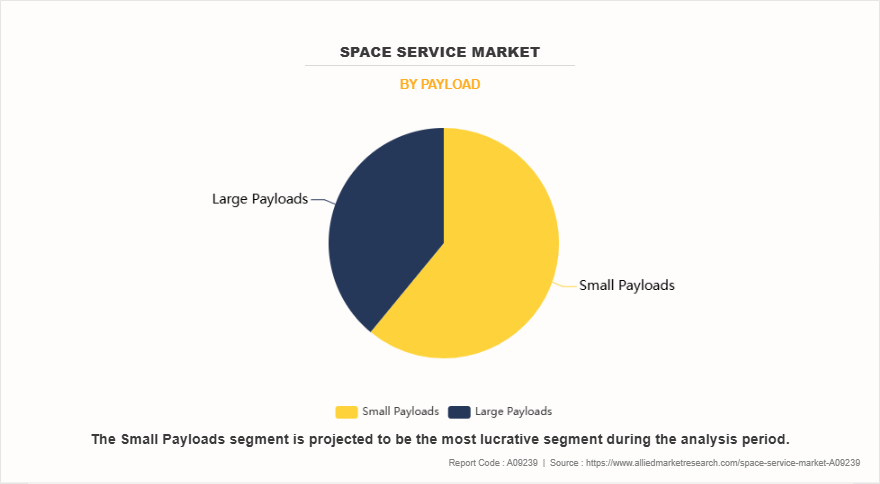

By payload, the market is bifurcated into small payloads and large payloads. The small payloads segment accounted for a dominant market share in 2023, due to a rise in demand for low-cost, flexible satellite solutions. Small payloads typically include CubeSats, nanosatellites, and microsatellites, which weigh less than 500 kg and are used for applications such as Earth observation, communication, scientific research, and military surveillance.

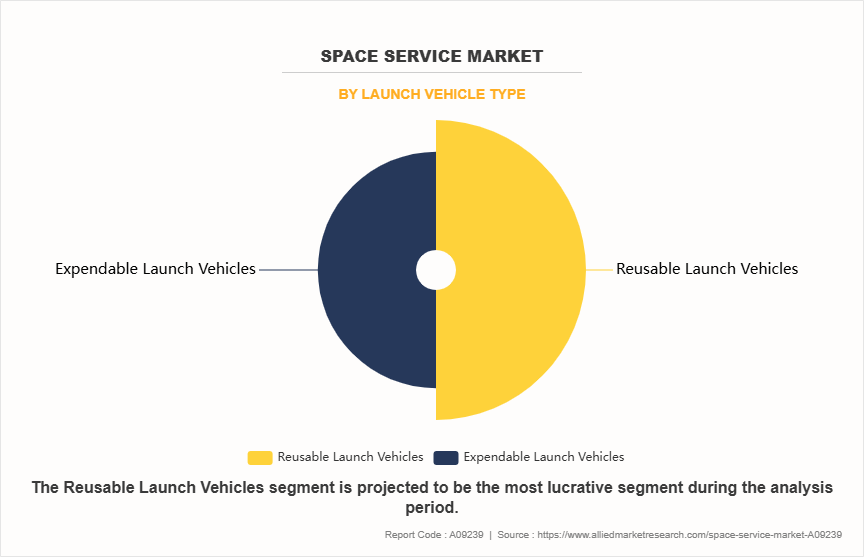

By Launch Vehicle Type

By launch vehicle type, the market is classified into reusable launch vehicles and expendable launch vehicles. The reusable launch vehicles segment accounted for a dominant market share in 2023, driven by economic efficiency, sustainability, and increasing demand for satellite deployment. With the rise of mega constellations in low Earth orbit (LEO), companies need frequent and affordable launches, which RLVs provide. Moreover, government space agencies are adopting reusable launch systems for crew and cargo missions to the International Space Station (ISS) and future lunar bases.

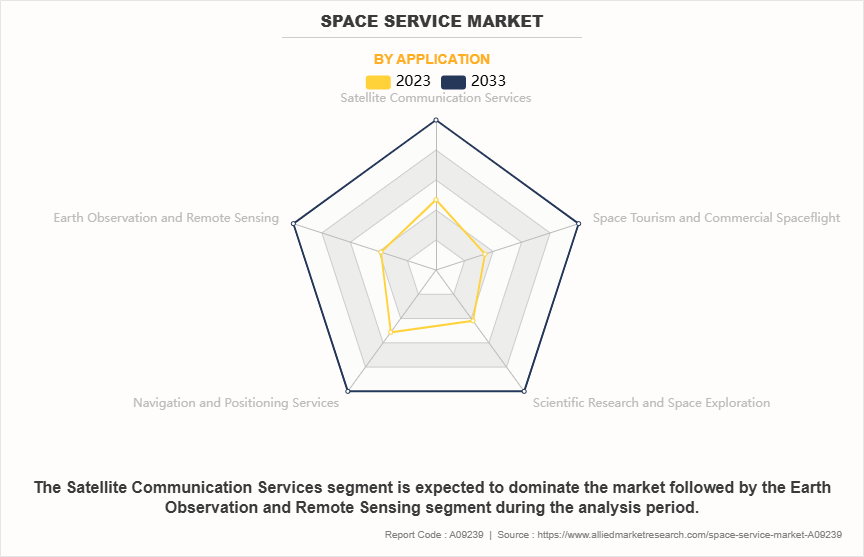

By Application

By application, the market is categorized into satellite communication services, Earth observation & remote sensing, navigation & positioning services, scientific research & space exploration, and space tourism & commercial spaceflight. The satellite communication services segment accounted for a dominant market share in 2023, driven by due to rise in demand for high-speed internet, global connectivity, and secure military communications. The increasing deployment of low Earth orbit (LEO) satellite constellations by companies such as Starlink (SpaceX), OneWeb, and Amazon’s Project Kuiper is reshaping the market by offering low-latency broadband services worldwide. In addition, geostationary satellites (GEO) continue to play a crucial role in broadcasting, maritime and aviation connectivity, and government communication networks.

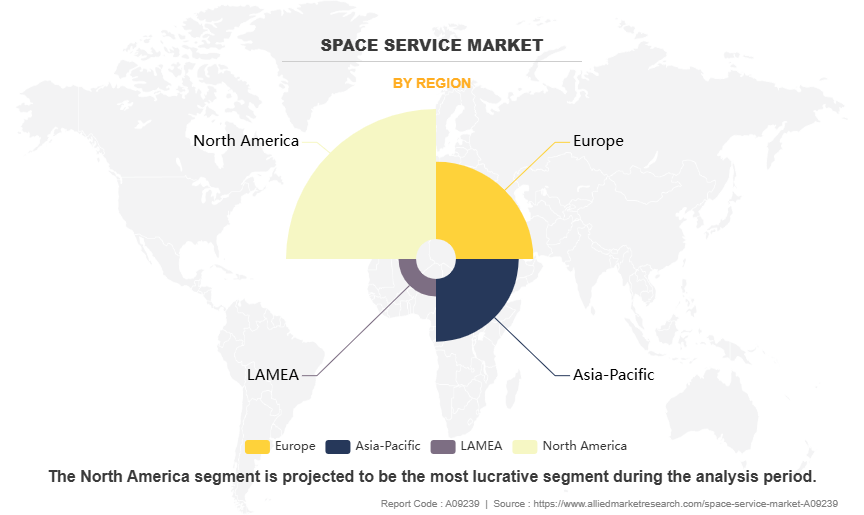

By Region

Region wise, North America held the largest space service market share in 2023, driven by high government spending, strong private-sector participation, and technological advancements. The region is home to leading space agencies such as NASA and major commercial space companies such as SpaceX, Blue Origin, and Boeing.

Rise in demand for satellite-based services

One of the most significant drivers of the space service market is the rising demand for satellite-based services, including telecommunications, earth observation, and navigation. The increasing reliance on satellite communication for broadband connectivity, television broadcasting, and mobile network expansion is a primary factor accelerating market growth.

In the telecommunication sector, companies like Starlink (SpaceX), OneWeb, and Amazon’s Project Kuiper are deploying thousands of low Earth orbit (LEO) satellites to provide global broadband coverage. These constellations are expected to bridge the digital divide, especially in remote and underserved regions.

For instance, in March 2025, SpaceX received approval from the U.S. Federal Communications Commission (FCC) to provide direct-to-smartphone satellite services with higher power levels. This approval aims to improve connectivity in areas where cell towers are unavailable across the U.S. The FCC has allowed SpaceX to use more power in certain frequency bands near those used by its partner, T-Mobile.

However, SpaceX must ensure that these signals do not interfere with other networks, as some competing telecom companies have raised concerns. This decision builds on the FCC’s earlier approval in November, which allowed SpaceX to use T-Mobile’s frequencies on up to 7,500 second-generation (Gen2) Starlink satellites for a service known as Supplemental Coverage from Space (SCS). This service aims to expand mobile coverage using satellites.

Moreover, the demand for high-speed internet, driven by the 5G rollout, smart cities, and IoT applications, further amplifies the need for reliable satellite communication services. Similarly, the earth observation sector is witnessing rapid growth due to the increasing use of satellite imagery for disaster management, climate monitoring, agriculture, and defense applications. Governments and private organizations are investing in satellite-based analytics to improve resource management, environmental monitoring, and national security.

Moreover, global navigation satellite systems (GNSS) such as GPS, Galileo, BeiDou, and GLONASS play a crucial role in location-based services, autonomous vehicles, and military applications. The expansion of precision navigation and real-time geospatial analytics is further driving market demand. As industries continue to embrace space-based solutions, the market for satellite services is expected to grow exponentially, making it one of the most dominant segments within the broader space service industry.

Increase in private sector investment and commercialization

The space service market is expanding rapidly due to rise in involvement of private sector companies and the commercialization of space activities. Traditionally, space exploration and satellite operations were dominated by government agencies such as NASA, ESA, CNSA, and ISRO. However, in recent years, private companies have entered industry with innovative technologies, cost-effective solutions, and new business models, leading to significant growth in the market.

Moreover, the government also encourages the private sector to participate in space service industry. For instance, in May 2024, EU ministers called for increased public and private investment to support innovation in the space sector and strengthen Europe’s global competitiveness. In a joint resolution, they emphasized the role of space services in providing a technological edge to industries, supporting climate protection, and safeguarding critical infrastructure, including energy systems.

Anna Christmann, Germany’s federal aerospace coordinator and ESA ministerial council chair, highlighted the importance of private investments, particularly in start-ups and SMEs. She stressed that Europe must encourage private investment, following global trends in the space industry.

In addition, satellite-based internet services have become a major focus for private investment. Companies such as Starlink (by SpaceX), OneWeb, and Amazon’s Project Kuiper are deploying large constellations of low Earth orbit (LEO) satellites to provide high-speed internet access globally. These satellite constellations are meant to close the gap between people with internet access and those without, especially in rural and hard-to-reach areas.

Furthermore, public-private partnerships (PPPs) and venture capital funding are accelerating innovation in space services. Governments are increasingly collaborating with private firms to develop next-generation satellite technologies, lunar exploration missions, and deep space research projects. Startups and space-tech companies are also receiving substantial funding from investors who recognize the long-term growth potential of the industry.

With the rise in private sector investments and the commercialization of space-based services, the space service market is expected to experience strong and sustained growth. The entry of non-traditional players and the diversification of space applications will continue to shape the industry, making space services more accessible and affordable for businesses and consumers globally.

Regulatory and legal challenges in space operations

The space service market is heavily influenced by regulatory and legal challenges, which can slow down growth and make operations more complex. Since space activities involve multiple countries, government agencies, and private companies, they are subject to strict regulations, international treaties, and national security laws.

One of the key challenges is compliance with international space laws. Agreements such as the Outer Space Treaty (OST) of 1967 set legal frameworks for space activities, prompting the peaceful use of space. However, new advancements in commercial spaceflight, satellite constellations, and space mining are not fully covered by existing laws, leading to uncertainties about ownership rights, liability, and military use of space assets.

Moreover, national regulations vary widely between countries. Space agencies such as NASA (USA), ESA (Europe), CNSA (China), and ISRO (India) have different policies for launch approvals, frequency spectrum allocation, and satellite operations. Private companies must navigate complex licensing processes, security restrictions, and data sharing agreements before they can operate in different regions. These legal requirements can delay projects and increase operational costs.

In addition, concerns over space debris management and orbital congestion have led to stricter policies on satellite deployment. Governments and regulatory bodies are introducing new rules on satellite de-orbiting, collision avoidance, and responsible space usage. Companies launching large satellite constellations, such as Starlink and OneWeb, face growing pressure to ensure their satellites do not contribute to the increasing problem of space debris.

Growing demand for space tourism and commercial spaceflight

Rise in demand for space tourism and commercial spaceflight presents a major opportunity for the space service market. In recent years, companies such as Blue Origin, SpaceX, and Virgin Galactic have successfully launched private passengers into space, marking the beginning of a new commercial industry. As technology improves and costs decrease, more individuals and businesses are expected to participate in space tourism, fueling the space service market growth.

One of the key drivers behind this trend is rise in interest from wealthy individuals and private investors. With the success of suborbital flights, more people are willing to pay for short-duration space experiences, which include weightlessness and views of Earth from space. Companies such as Virgin Galactic offer suborbital spaceflights, while Blue Origin's New Shepard has already flown multiple passengers. These experiences are gaining popularity, and as competition increases, ticket prices may become more affordable, allowing a broader audience to participate. Moreover, the demand for orbital space tourism is also growing.

SpaceX’s Crew Dragon has already transported private astronauts to the International Space Station (ISS), and future missions are expected to include stays at commercial space stations. Companies such as Axiom Space and Orbital Assembly Corporation are working on developing private space habitats, which could serve as hotels, research labs, and entertainment venues for tourists and businesses.

Furthermore, advancements in spaceplane technology and point-to-point suborbital travel could revolutionize long distance travel on Earth. Concepts such as high-speed spaceflight for intercontinental travel are being explored, potentially reducing flight times between major cities from hours to minutes. This could create new space service market revenue streams.

With continuous technological improvements and growing interest from both individuals and corporations, the space tourism and commercial spaceflight industry is set to expand significantly in the coming years. As costs decline and infrastructure develops, space services will play a crucial role in supporting this evolving market.

.Key Benefits For Stakeholders

- Space service market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the space service market analysis from 2023 to 2033 to identify the prevailing space service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the space service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global space service market trends, key players, market segments, application areas, and market growth strategies.

Space Service Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 67.9 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 386 |

| By Service Type |

|

| By Satellite Type |

|

| By Payload |

|

| By Launch Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation., Viasat, Inc., SES S.A., BLUE ORIGIN LLC, SpaceX, Rocket Lab USA, Inc., Eutelsat, Northrop Grumman, Maxar Technologies, AIRBUS |

The largest regional market for Space Service is North America.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include SpaceX, Blue Origin, Airbus, Lockheed Martin, Northrop Grumman, Eutelsat, Viasat, Inc., SES, Maxar Technologies, and Rocket Lab.

The leading application of Space Service Market is satellite communication services.

The global space service market was valued at $30.2 billion in 2023, and is projected to reach $67.9 billion by 2033, growing at a CAGR of 8.8% from 2024 to 2033.

The upcoming trends of Space Service Market in the globe are rise in demand for space tourism and commercial spaceflight and the expansion of in-orbit services.

Loading Table Of Content...

Loading Research Methodology...