Specialty Adhesives Market Research, 2033

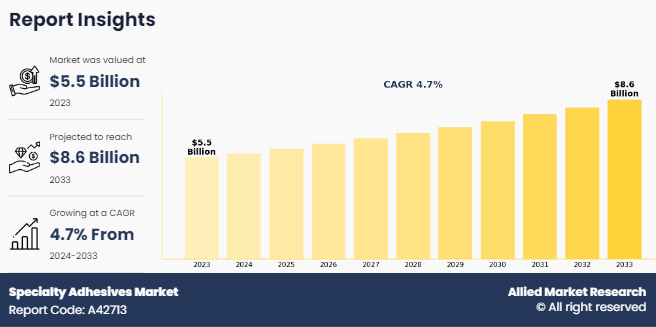

The global specialty adhesives market was valued at $5.5 billion in 2023, and is projected to reach $8.6 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033. A specialty adhesive refers to a type of adhesive or bonding agent that is specifically formulated to meet unique or specific requirements for bonding, joining, or adhering materials in particular applications or industries. These adhesives are developed to address challenges that standard or general-purpose adhesives may not effectively handle. Specialty adhesives provide enhanced performance, durability, and compatibility with specific materials, environments, or conditions. They offer attributes such as high-temperature resistance, chemical resistance, flexibility, rapid curing, conductivity, optical clarity, biocompatibility, and more, depending on the intended use.

Introduction

Medical device adhesives are tailor-made adhesives designed for medical applications. They are vital for assembling medical devices and materials, ranging from basic wound dressings to intricate surgical implants and wearable healthcare gadgets. These adhesives are crucial in applications such as wound care, surgical tapes, bandages, catheters, surgical closures, and orthodontic brackets. Notable features include biocompatibility, sterilization suitability, robust bonding, flexibility, tissue friendliness, rapid curing, and potential for drug delivery. These attributes collectively enhance the reliability of medical device adhesives across a spectrum of functions. All these factors increase the demand for specialty adhesives in the healthcare industry.

Key Takeaways

- The global specialty adhesives market has been analyzed in terms of value ($billion) and volume (kiloton). The analysis in the report is provided on the basis of application, end-use industry, 4 major regions, and more than 15 countries.

- The global specialty adhesives market report includes a detailed study covering underlying factors influencing the industry opportunities and trends. The key players in the specialty adhesives market are 3M Company, Nexus Adhesives, Savare Specialty Adhesives LLC, Master Bond Inc., Permatex Inc., Specialty Adhesives and Coatings, Inc., Henkel Corporation, Bostik SA., Worthen Industries, Advanced Adhesive Technologies Inc., and Dow.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the alternators industry.

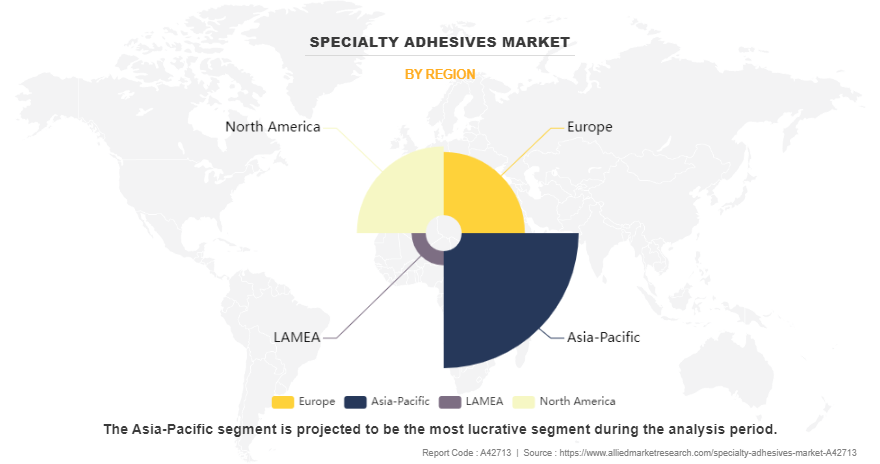

- Asia-Pacific region hold a significant share in the global specialty adhesives market.

Market Dynamics

Advancements in medical devices and adhesives is expected to drive the growth of specialty adhesives market. Medical device adhesives are specialized adhesives, designed for use in healthcare settings and medical applications. These adhesives play a crucial role in assembling, attaching, and bonding various medical devices, components, and materials. They are used in a wide range of medical devices from simple wound dressings to complex surgical implants and wearable healthcare devices. Specialty adhesives are used in a variety of medical applications such as wound dressings, surgical tapes & medical bandages, plasters, catheters & tubing, surgical incision closure, orthodontic brackets & bonding, and others. The key characteristics of these specialized adhesives encompass biocompatibility, sterilization compatibility, bond strength, flexibility, hemocompatibility, tissue specificity, curing time, and drug delivery capabilities. These properties collectively contribute to the success and reliability of medical device adhesives in various applications. All these factors increase the demand for specialty adhesives in the healthcare industry In August 2024, Resivant Medical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its first products: the Cutiva Topical Skin Adhesive and the Cutiva PLUS Skin Closure System. The Cutiva PLUS Skin Closure System stands out for combining an adhesive mesh patch with the high-viscosity Cutiva liquid adhesive.

However, high-cost production and limited shelf life is expected to restraint the growth of specialty adhesives market during the forecast period. Specialty adhesives are formulated with specific properties to meet particular construction requirements. The research, development, and production of these specialized formulations can be complex and resource[1]intensive, leading to higher production costs as compared to standard adhesives. The use of specialized raw materials and the need for stringent quality control during manufacturing contribute to the overall higher costs. Moreover, many specialty adhesives have a limited shelf life such as they can only be stored for a specific period before their effectiveness and properties begin to degrade. This limitation is particularly relevant for adhesives containing reactive components, as they may undergo chemical changes over time, leading to reduced performance or curing difficulties. Consequently, manufacturers and suppliers must manage inventory carefully to minimize wastage and ensure that customers receive adhesives with acceptable shelf life.

Segments Overview

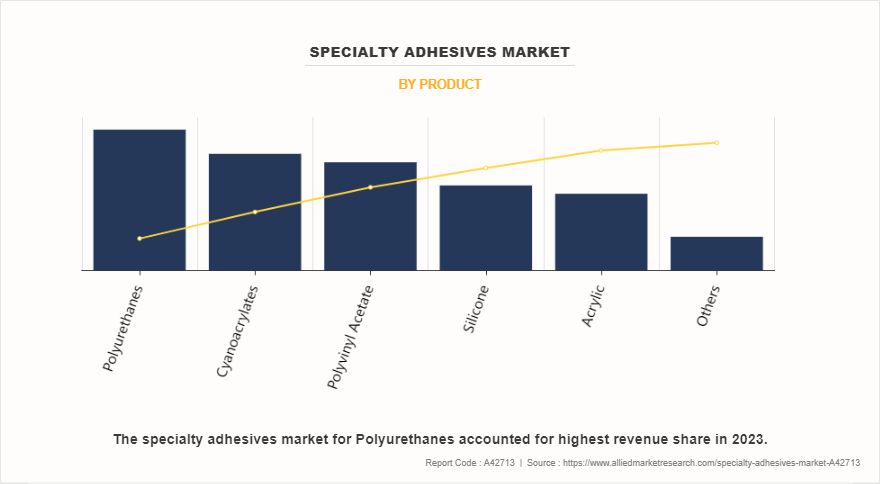

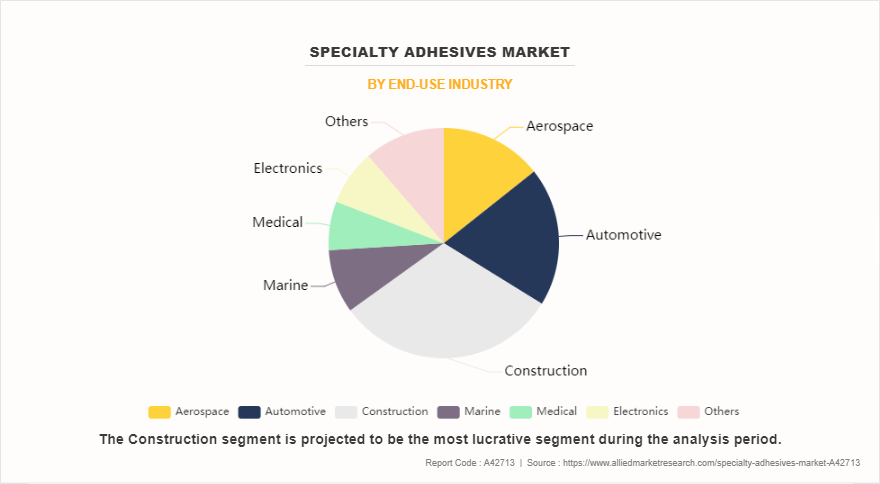

The specialty adhesives market is segmented on the basis of product, end-use industry, and region. By product, the market is segregated into cyanoacrylates, polyvinyl acetate, polyurethanes, acrylic, silicone, and others. By end-use industry, the market is divided into aerospace, automotive, construction, marine, medical, electronics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product, the polyurethanes dominated the specialty adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. Polyurethanes are increasingly used in specialty adhesives due to their versatile properties, which cater to a wide range of applications across various industries. The construction industry leverages polyurethane adhesives for their excellent bonding capabilities in flooring, roofing, and wall applications. Their moisture-cured formulations allow for quick setting times and strong initial grab, which is vital in environments where speed and efficiency are paramount. The ability to apply polyurethane adhesives in varying thicknesses also provides versatility in application, enabling effective bonding even in gaps or irregular surfaces.

By end-use industry, construction segment dominated the specialty adhesives market in 2023, growing with the CAGR of 4.0% during the forecast period. Specialty adhesives play a crucial role in the construction industry, providing essential bonding solutions for various applications. These adhesives are designed to meet specific performance requirements that standard adhesives may not fulfill, offering enhanced strength, durability, and resistance to environmental factors. Their usage spans multiple areas within construction, including structural bonding, flooring, roofing, and the installation of facades and insulation materials.

By region, Asia-Pacific was the highest revenue contributor in the specialty adhesives market share in 2023 and is expected to maintain its dominance during the forecast period, growing with a CAGR of 4.9%. Specialty adhesives are increasingly gaining traction across various industries in Asia-Pacific countries due to their superior bonding capabilities and the growing demand for high-performance materials. China is the largest market for specialty adhesives in the Asia-Pacific region, driven by its robust manufacturing sector, particularly in automotive, electronics, and construction.

Competitive Analysis

Key players in the specialty adhesives industry include 3M Company, Nexus Adhesives, Savare Specialty Adhesives LLC, Master Bond Inc., Permatex Inc., Specialty Adhesives and Coatings, Inc., Henkel Corporation, Bostik SA., Worthen Industries, Advanced Adhesive Technologies Inc., and Dow.

Apart from these major players, there are other key players in the specialty adhesives market. These include Ashland Global Holdings Inc., Avery Dennison Corporation, Dymax Corporation, Franklin International, H.B. Fuller Company, Huntsman Corporation, ITW Performance Polymers, Jowat SE, LORD Corporation, Momentive Performance Materials Inc., Permabond LLC, Pidilite Industries Limited, RPM International Inc., and Sika AG.

Industry Trends of Specialty Adhesives Market

- In July 2022, Mapei commenced the construction of its third manufacturing facility in Kosi, Mathura. This new facility is designed to cater to the increasing demand in the Northern India market. The expansion highlights Mapei's dedication to boosting its production capacity and strengthening its regional presence.

- In July 2022, Arkema completed the acquisition of Permoseal, a leading company known for its innovative adhesive solutions across DIY, packaging, and construction sectors. This strategic move significantly bolstered Arkema's footprint in South Africa, enhancing its market position and expanding its product offerings to better serve the region's growing demand for high-performance adhesive technologies.

- In May 2022, Henkel launched innovative products aimed at enhancing packaging recyclability. The new adhesives, Loctite Liofol LA 7818 RE / 6231 RE and Loctite Liofol LA 7102 RE / 6902 RE, are designed to support sustainable packaging solutions. These formulations are tailored to improve the efficiency and eco-friendliness of recycling processes. Henkel's initiative underscores its commitment to advancing environmentally friendly packaging technologies.

Historical Trends of Specialty Adhesives

- In the early 1970s, specialty adhesives began to gain attention as industries recognized the need for more advanced bonding solutions tailored to specific applications. Initial efforts were focused on developing adhesives for specialized industries and purposes such as aerospace, electronics, and medical devices.

- During the 1980s, advancements in adhesive technologies led to improved formulations with enhanced bonding properties, durability, and versatility. These developments expanded the use of specialty adhesives from niche applications to broader industries, including automotive, construction, and consumer goods.

- In the 1990s, the evolution of specialty adhesives was driven due to increased focus on efficiency, safety, and environmental considerations. Adhesive manufacturers started developing products that were high-performing and environmentally friendly, leading to rise of low-VOC and solvent-free adhesives.

- In the early 2000s, specialty adhesives gained prominence in addressing global sustainability concerns. As industries sought alternatives to traditional fastening methods, advanced adhesives emerged as key components for lightweight, joining dissimilar materials, and enhancing overall product performance.

- By the 2010s, specialty adhesives became integral to modern manufacturing and design. With advancements in nanotechnology, bio-based materials, and smart adhesives, industries found innovative ways to use adhesives in cutting-edge applications, including wearable, 3D printing, and advanced electronics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the specialty adhesives market analysis from 2023 to 2033 to identify the prevailing specialty adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the specialty adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global specialty adhesives market trends, key players, market segments, application areas, and market growth strategies.

Specialty Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.6 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 330 |

| By Product |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Master Bond Inc., Bostik SA., Savare Specialty Adhesives LLC, Henkel Corporation, Permatex Inc., 3M Company, Advanced Adhesive Technologies Inc., Specialty Adhesives and Coatings, Inc., Worthen Industries, Dow, Nexus Adhesives |

Analyst Review

According to the opinions of various CXOs of leading companies, the specialty adhesive market is expected to witness increased demand during the forecast period. Advancements in medical device adhesives and growth in buildings and construction sectors are expected to lead to an increase in the demand for specialty adhesives during the forecast period.

Specialty adhesives refer to a category of adhesive products that are specifically formulated to address unique and demanding bonding requirements in specific industries or applications. These adhesives are designed to provide exceptional performance characteristics as compared to standard adhesives. Specialty adhesives are tailored to meet the specific needs of industries where traditional bonding methods may not suffice due to extreme conditions, unique substrates, or stringent performance criteria.

The market expansion is driven due to an increase in use of medical device adhesives, which are vital for assembling healthcare tools such as dressings and implants. In addition, rapid urbanization drives the demand for specialty adhesive with governments investing in infrastructure projects, thus boosting the building sector. Adhesives protect surfaces, strengthen materials, and resist corrosion, particularly in flooring applications.

The global specialty adhesives market was valued at $5.5 billion in 2023, and is projected to reach $8.6 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Asia-Pacific is the largest regional market for specialty adhesives.

Construction is the leading end-use of specialty adhesives market.

Strong emphasis on sustainable and eco-friendly adhesives are the upcoming trends of specialty adhesives market.

Key players operating in the specialty adhesives market include 3M Company, Nexus Adhesives, Savare Specialty Adhesives LLC, Master Bond Inc., Permatex Inc., Specialty Adhesives and Coatings, Inc., Henkel Corporation, Bostik SA., Worthen Industries, Advanced Adhesive Technologies Inc., and Dow.

Loading Table Of Content...

Loading Research Methodology...