Specialty Gas Market Research, 2031

The global specialty gas market size was valued at $10.9 billion in 2021, and is projected to reach $17.7 billion by 2031, growing at a CAGR of 5% from 2022 to 2031.

Report Key Highlighters:

- The specialty gas market is fragmented in nature with various players such as Air Liquide S.A.; Airgas, Inc.; Air Products Inc.; Linde plc; Messer group GmbH; MESA International Technologies, Inc.; Norco Inc.; Showa Denko K.K; Taiyo Nippon Sanso Corporation; and Weldstar, Inc. Also analyzed key strategic moves and developments such as product launches, acquisitions, mergers, expansion etc. of the palyers operating in the market.

- 20 countries are covered in the specialty gas market report. The segment analysis of each country in both value ($million) and volume (million liters) for the forecast period 2021-2031 is covered in the report.

- Over 3,700 product literatures, industry releases, annual reports, and other such documents of key industry participants have been reviewed to obtain a better market understanding and gain competitive intelligence. In addition, authentic industry journals, trade associations’ releases, and government websites were also reviewed for generating high-value industry insights.

Specialty gases are gaseous substances of high purity and are essential to various sectors, including the healthcare, environmental, petrochemical, semiconductor, pharmaceutical, and chemical markets. These gases are widely employed in industrial processes as analytical lab gases as well as intermediates. The high purity gases, noble gases, carbon gases, and halogen gases are the most common types of specialty gases. They may be either pure gases or gas mixtures containing components at concentrations extending from the percent range down to part per billion and sometimes even part per trillion. These gases are utilized in analytical methods including, fourier transform infrared (FTIR) and non-dispersive infrared (NDIR) as well as gas and liquid chromatography. Further, these gases are employed in the electronics sector to manufacture components including, integrated circuits and silicon wafers as well as to produce of compound semiconductors and flat panel display products.

Growing demand for photovoltaic products & plasma display panels along with rising demand from the healthcare industry is anticipated to bolster the specialty gas market growth during the forecast period.

Specialty gas is a complex end-to-end business that supports advancements in chip architectures that require new materials and more material consumption per chip. Paired with new requirements to support AR, AI, IoT & VR, aerospace & automotive applications, the semiconductor sector is experiencing unparalleled growth. With the rise of remote workforce, online gaming, and e-commerce, mobile devices and personal computers, virtual learning, are in massive demand. Specialty gas is widely used across different applications in the semiconductor chip production method. Nitrogen is an extensively used gas in manufacturing of semiconductors. It is employed in abatement systems for purging vacuum pumps and as a process gas. In large, advanced fabs, nitrogen consumption can reach 50,000 cubic meters per hour, which makes the case for low-energy, cost-effective, on-site nitrogen generators.

Factors such as the high growth of the end-user industry and the increase in demand for photovoltaic products & plasma display panels are expected to serve as crucial growth factors for the global specialty gas market. Besides, increase in environmental awareness, rising demand from the healthcare industry, raised use of specialty gases in the electronic industry, and surge in demand for bio-based products are the other crucial factors anticipated to bolster the specialty gas market growth during the forecast period. Specialty gas is predicted to gain traction in the healthcare industry due to the rising consumption of high purity and noble gases in numerous medical application areas such as anesthetic, reanimation process, and mechanical ventilation.

Moreover, it is used in Magnetic Resonance Imaging (MRI). Medical gases and specialty gas mixtures are utilized in numerous medical procedures such as pathology, patient care, and research. Medical gases are supplied in portable cylinders at hospitals or even directly through the pipeline to hospital wards. Manufacturers such as Messer Group GmbH offers a wide product portfolio of specialty gases. The company offers services ranging from consultation on the delivery of medical gases to the planning, installation, and maintenance of supply systems.

However, increasing regulations and restrictions on the production as well as quality control of specialty gas along with the presence of substitutes of specialty gas is predicted to hamper the market growth. On contrary, the production of new environmentally friendly technologies and products along with emerging markets is likely to offer lucrative growth opportunities for the specialty gas market.

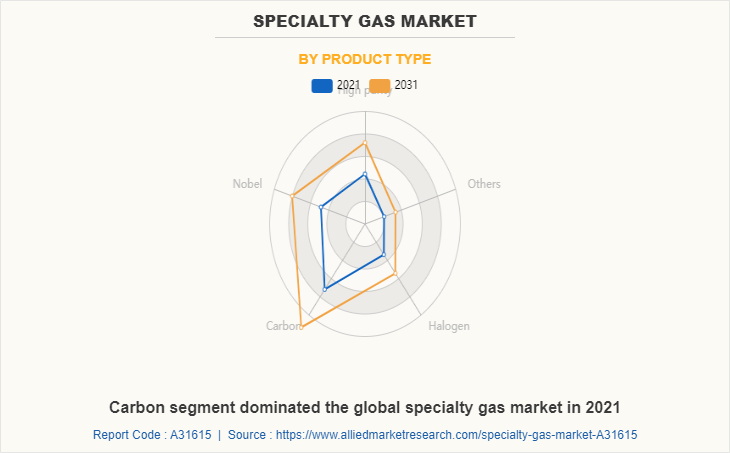

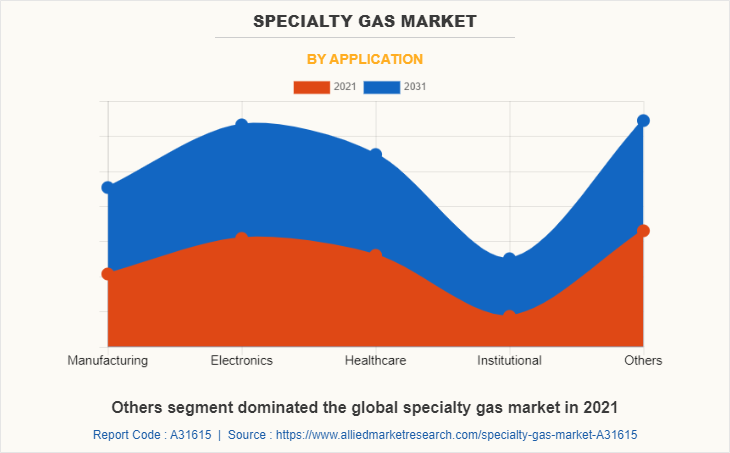

The specialty gas market is segmented on the basis of product type, application, and region. On the basis of product type, the market is categorized into high purity, noble, carbon, halogen, and others. On the basis of application, the market is classified into manufacturing, electronics, healthcare, institutional, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The specialty gas market share is analyzed across all significant regions and countries.

North America dominated the global specialty gas market in 2021. The rise in the automotive and healthcare sectors is influencing the growth of the specialty gas market. Also, the demand for semiconductors has gained immense popularity leading to the growth of the market.

In recent decades, the automotive sector has dramatically expanded its use of specialty gases. Car headlamps are made of xenon, whereas indicator lamps are made of argon and nitrogen. The automobile body and door sheet metal are cut with lasers using specialized gas combinations. Tires are inflated with nitrogen or dry synthetic air for maximum race performance and fuel efficiency. Additionally, a variety of specialty gases calibration mixtures and high purity gases for process control and analysis are used in the production of these fuels and lubricants.

A number of specialized gas mixes are used to calibrate analyzers, like atomic absorption spectrometers, in the manufacturing and quality control of automotive engines to ensure that emissions are minimized, and fuel consumption and performance are optimized. Due to the growth of the automobile industry in the continent, the U.S. dominates the specialty gas market in North America. Airgas, Inc. offers various specialty gas which are used widely in automotive sectors such as nitrogen, argon, oxygen and others. Due to the above-mentioned factors, the market has shown tremendous growth in North American region.

Carbon gases are obtained from various natural sources and used by end-use industries such as chemicals, oil, food and beverages and others. Majorly carbon dioxide and carbon monoxide have an increasing demand in the market owing to the high applicability rate in many industrial applications. In healthcare, carbon gases are used on large scale in devices such as nuclear magnetic resource imaging, magnetic resonance imaging, ophthalmology, and others. The increasing demand by various end-use industries such as manufacturing, electronics, healthcare, and chemicals as well as growing application scope for analytical purposes and instrument calibration. Increasing demand for noble gas from manufacturing and electronics industries is anticipated to propel the industry growth.

Others segment dominated the global specialty gas market in 2021. The other applications of specialty gas include chemicals, food, biotechnology, materials processing, environmental, and others. Heat treaters and metals and materials processors worldwide have come to rely on specialty gases, gas atmospheres, and technical support in order to help improve product quality, lessen operating costs, and boost production. Further, specialty gases are employed in analytical processes such as non-dispersive infrared (NDIR), Fourier transforms infrared (FTIR), and gas and liquid chromatography.

Key Players and Strategies:

The major players operating in the global specialty gas market include Air Liquide S.A.; Airgas, Inc.; Air Products Inc.; Linde plc; Messer group GmbH; MESA International Technologies, Inc.; Norco Inc.; Showa Denko K.K; Taiyo Nippon Sanso Corporation; and Weldstar, Inc. These players have been adopting numerous key strategies to retain leading positions in the market. For instance, in August 2022, Air Products Inc. signed long-term supply agreement with Indian Oil Corporation Limited. It is expected to provide an efficient combination of industrial gas production technologies, enabling IOCL to meet ever-increasing transportation fuel demand. The new industrial gas complex is likely to aid the capacity expansion of IOCL from 6 to 9 million tonnes yearly, manufacturing Euro-VI or BS-VI compliant gasoline and diesel at its Barauni complex. The complex will also incorporate the latest generation multi-feed hydrogen production facility supplying 70,000 Nm3/hr. of hydrogen and steam, along with a highly efficient air separation unit producing 4,000 Nm3/hr. of nitrogen.

Further, in April 2022, Linde signed a new long-term helium off-take agreement for recovering the helium contained in freeport LNG's manufacturing site in Texas, U.S. As per Linde, the company will also build a new helium processing facility in Freeport in order to purify and liquefy the recovered helium, thereby securing an additional liquid helium source in the country. The helium will be delivered to the company’s customers across multiple end markets such as aerospace, healthcare, electronics, and manufacturing, which continue to demonstrate robust demand across the country and globally. The project is likely to be initiated in 2024 and offer about 200 million cubic feet of helium into the company’s supply portfolio.

COVID-19 Analysis:

COVID-19 had a negative impact on the market in 2020. Most production plants were temporarily shut down due to lockdowns in many countries, resulting in a decrease in demand for numerous specialty gases. Moreover, due to an increase in coronavirus cases, building activity was stopped, resulting in a decrease in the usage of welding gases such as hydrogen and argon. The pandemic, on the other hand, has created new possibilities in the healthcare industry due to increased demand for high-purity gases such as oxygen, nitrogen, and other specialty gases.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the specialty gas market analysis from 2021 to 2031 to identify the prevailing specialty gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the specialty gas market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global specialty gas market trends, key players, market segments, application areas, and market growth strategies.

Specialty Gas Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 17.7 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Linde plc, Air Liquide S.A., Showa Denko K.K, Norco Inc., MESA International Technologies, Inc., Air Products Inc., Weldstar, Inc., Messer group GmbH, Airgas, Inc., Taiyo Nippon Sanso Corporation |

Analyst Review

According to the perspective of CXOs of leading companies, the global specialty gas market is anticipated to grow in the near future due to its extensive use in applications, such as manufacturing, electronics, healthcare, institutional, and others. Surfactants derived from specialty gas have an essential role in cleaning, wetting, dispersing, emulsifying, foaming, and anti-foaming agents. It is found in a variety of agrochemical formulations, including herbicides (in certain cases), insecticides, biocides (sanitizers), and spermicides. Specialty gases are widely utilized in the electronics sector for the production of electronic devices, which are then assembled in systems and various processes such as film etching, film deposition, substrate doping, and chamber cleaning. The LEDs, devices-semiconductors, and ad displays are processed on a large substrate before being separated and assembled. Fluorocarbons, corrosives (halides/hydrates), deposition precursors, hydrocarbons, dopants, and rare gas mixtures are the examples of specialty gases used in the electronics sector.

The global specialty gas market was valued at $10.9 billion in 2021, and is projected to reach $17.7 billion by 2031, registering a CAGR of 5.0% from 2022 to 2031.

Factors such as the high growth of the end-user industry and the increase in demand for photovoltaic products & plasma display panels are expected to serve as crucial growth factors for the global specialty gas market. Besides, increase in environmental awareness, rising demand from the healthcare industry, raised use of specialty gases in the electronic industry, and surge in demand for bio-based products are the other crucial factors anticipated to bolster the specialty gas market growth during the forecast period.

Electronics segment is the leading application of Specialty Gas Market.

North America is the largest regional market for Specialty Gas.

Air Liquide S.A.; Airgas, Inc.; Air Products Inc.; Linde plc; Messer group GmbH; MESA International Technologies, Inc.; Norco Inc.; Showa Denko K.K; Taiyo Nippon Sanso Corporation; and Weldstar, Inc. are the top companies to hold the market share in Specialty Gas.

Loading Table Of Content...