Specialty Insurance Market Overview

The global specialty insurance market was valued at $104.7 billion in 2021, and is projected to reach $279 billion by 2031, growing at a CAGR of 10.6% from 2022 to 2031. Rise in the demand for specialized coverage, increase in technological advancements, growing awareness regarding risk management, customized policies, and expansion in emerging markets offering untapped potential, are contributing to the growth of the market.

Market Dynamics & Insights

- The specialty insurance industry in Europe held a significant share of 35% in 2021.

- The specialty insurance industry in China is expected to grow significantly at a CAGR of 8.5% from 2022 to 2031.

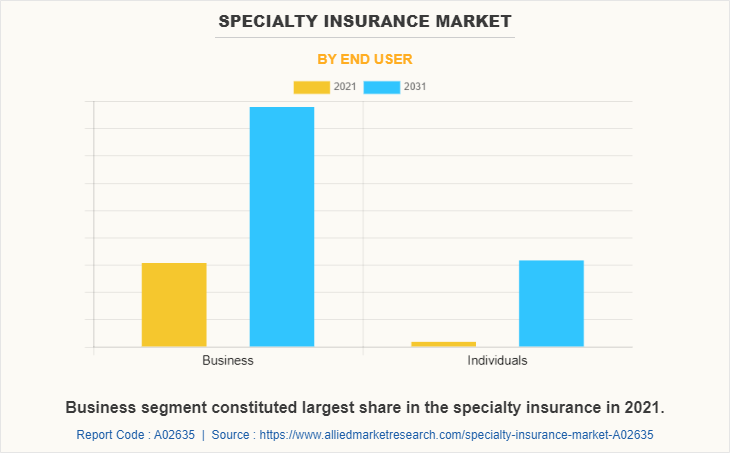

- By end user, the business segment is one of the dominating segment in the market, accounting for the revenue share of 78% in 2021.

- By distribution channel, the brokers segment dominated the industry in 2021 and accounted for the largest revenue share of 68%.

Market Size & Future Outlook

- 2021 Market Size: $104.7 Billion

- 2031 Projected Market Size: $279 Billion

- CAGR (2022-2031): 10.6%

- Europe: Largest market in 2021

- Asia Pacific: Fastest growing market

What is Meant by Specialty Insurance

Specialty insurance is designed to cover businesses with nontraditional needs, protects against negligence claims, and allows the payment of judgment & legal fees. In addition, this insurance is obtained for items or events that are considered unique and are rarely covered by standard insurance policies. The demand for specialty insurance is significantly high across the construction, healthcare, environmental, and energy industries.

The global specialty insurance market is expected to grow owing to the surge in demand for specialized expertise during the forecast period. In addition, the growth of the specialty insurance industry is anticipated to be fueled by the increased integration of technology into specialty insurance solutions.

Furthermore, the use of technologies like the internet of things (IoT) and blockchain makes it possible to correctly assess both present and potential risks in the specialty insurance market. In addition, specialty insurance offers a wide range of coverage alternatives with great flexibility regarding the policy term, policy duration, and coverages, which is considerably boosting specialty insurance market growth. However, an extremely volatile market and lack of awareness & understanding toward specialty insurance are some of the factors that limit the market growth. On the contrary, increase in demand for specialty insurance among Program Administrators (PAs), which are one of the key distributors of specialty insurance products, is expected to fuel the market growth during the forecast period.

The report focuses on growth prospects, restraints, and trends of the specialty insurance market outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the specialty insurance market forecast.

The specialty insurance market is segmented into Type, Distribution Channel and End User.

Specialty Insurance Market Segment Review

The specialty insurance market is segmented on the basis of type, distribution channel, end user, and region. On the basis of type, it is segregated into marine, aviation & transport (MAT) insurance, political risk & credit insurance, entertainment insurance, art insurance, livestock & aquaculture insurance, and others. On the basis of distribution channel, it is bifurcated into brokers and non-brokers. On the basis of end user, the specialty insurance market is bifurcated into business and individuals. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of end user, the business segment attained the highest specialty insurance market share in 2021. This is attributed to the rapid expansion of new geographic markets and the increase in commercial threat to the trade. Furthermore, expansion of business with the aim of supplying goods & services globally is expected to provide immense opportunity for the specialty insurance market.

On the basis of region, the specialty insurance market size was dominated by Europe in 2021. This is attributed to increased trade-related political risk such as counterparty non-payment, non-delivery for pre-paid goods, embargo, and license cancellation. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period, due to increased flow of imports and rise in number of small & medium enterprises.

The report analyzes the profiles of key players operating in the specialty insurance market such as AXA, American International Group, Inc., Allianz, Assicurazioni Generali SpA, Berkshire Hathaway Inc., Chubb, Munich Re, PICC, Tokio Marine HCC, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the specialty insurance market.

Specialty Insurance Market Landscape and Trends

The industries leading the specialty insurance industry include healthcare, mortgage banking, disaster products, and non-profit protection. In addition, specialty insurance providers are concentrating on utilizing digital services platforms and Application Programming Interfaces (APIs) to get access to a variety of tasks and data across the whole policy lifecycle, including further integrating third-party services. Furthermore, specialty insurance offers a wide range of coverage alternatives with great flexibility regarding the policy term, policy duration, and coverages, which considerably boosts the specialty insurance market growth.

Venture capital firms across the globe are focusing on investing in specialty insurance companies owing to the increase in growth prospects of the specialty insurance market. For instance, in September 2021, Ategrity Specialty, a specialty property & casualty insurance provider, announced that it had raised $75 million capital led by Sequentis Financial LLC to strengthen its product offerings and support its continued growth. This funding is anticipated to be used by the business to go to the next stage of growth and invest in data and analytics capabilities.

The specialty insurance market has been negatively impacted by the COVID-19 outbreak. This is attributed to the fact that businesses operating in the market have changed their business model, therefore, the demand for specialty insurance has been affected. In addition, with the changing business trends, key players in the specialty insurance market are adopting technologies such as artificial intelligence-based solutions for claim processing & cognitive automation for real-time interaction with businesses & individuals.

What are the Top Impacting Factors in Specialty Insurance Sector

Surge in Demand for Specialized Expertise

There is an increase in the demand for specialized expertise in the specialty insurance programs, as it provides both comprehensive and custom designed to meet the needs of business segments with unique risk profiles. In addition, program administrators (PAs), which is one of the major distributors of specialty insurance, plays a vital role in the market. These administrators act as a specialized expertise, which are engaged in understanding exposures of target market. In addition, several specialty insurers, brokers, and policyholders increasing rely on this expertise to provide niche specialty coverages in the market. For instance, in January 2023, Starfish Specialty Insurance announced that it has launched a new program designed for Community Associations. The "CAProtect" program offers D&O, crime, and excess liability coverages for non-profit planned unit projects, condominiums, businesses, and organizations of homeowners. As a result, surge in demand for specialize expertise among businesses and other end users propels the demand for specialty insurance, globally.

Technological Advancements

Technologies such as blockchain and Internet of Things (IoT) enable real-time tracking and monitoring information regarding the activity of insured for business lines. Furthermore, implementation of these technologies provides an ability to more accurately assess both current and future risk occurring in the specialty insurance. In addition, it allows underwriters to clearly understand risk scores, the contributory factors in the losses, and accordingly settling claims of specialty insurance. Thus, with these major benefits and technological advancements in the offerings are driving the specialty insurance market growth.

Numerous Benefits are Provided by Specialty Insurance Covering Unique needs & Preferences

Specialty insurance covers niche & unique perils across a wide range of business lines with the ability to provide both admitted and non-admitted products. It provides multiple coverage options with huge flexibility in terms of coverages, policy term, and policy period. Moreover, several business lines such as directors & officers liability insurance (D&O) and errors & omissions insurance (E&O) have led to massive demand for customized coverages in specialty insurance due to the COVID-19 pandemic situation. In addition, businesses expect a rapid re-evaluation of risk portfolios, which are covering their unique needs and preferences.

Furthermore, the key players in the market are introducing innovative products in the market to strengthen their position. For instance, in September 2022, Berkshire Hathaway Specialty Insurance (BHSI) announced the introduction of new property damage, general liability, D&O, professional indemnity and marine cargo insurance policies in Spain. Numerous benefits provided by specialty insurance in terms of huge flexibility and covering niche business lines drive the market growth.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the specialty insurance market analysis from 2022 to 2031 to identify the prevailing specialty insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the specialty insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global specialty insurance market trends, key players, market segments, application areas, and market growth strategies.

Specialty Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 279 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 244 |

| By Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Chubb, Assicurazioni Generali S.p.A., Munich Re, American International Group, Inc., Zurich, AXA, Allianz, Tokio Marine HCC, Berkshire Hathaway Inc., PICC |

Analyst Review

Enhancing digital capabilities, driving operational efficiency, and leveraging data analytics & artificial intelligence (AI) are major trends in the specialty insurance industry. Moreover, during the COVID-19 pandemic, specialty insurers were affected by change in business infrastructure, government regulations toward insurance policies, consumer demand, and disruption in supply chain globally. In addition, customers switch toward domestic insurers in search of better prices & coverage, and thus demand for specialty insurers significantly decreased. However, a considerable number of companies perceive that they have minimum specialty insurance exposure. There is a change in, and 2020 has witnessed a decrease in sale of specialty insurance, owing to shutdowns of several industry verticals globally and increased geopolitical risk in the market.

The COVID-19 outbreak had a negative impact on the specialty insurance market. Moreover, businesses operating in the market have changed their business model, therefore, the demand for specialty insurance has been affected. In addition, with this change in business trends, key players in the market adopt technologies such as artificial intelligence-based solutions for claim processing & cognitive automation for real-time interaction with businesses & individuals.

The specialty insurance market is fragmented with the presence of regional vendors such as AXA, American International Group, Inc., Allianz, Assicurazioni Generali SpA., Berkshire Hathaway Inc., Chubb, Munich Re, PICC, Tokio Marine HCC, and Zurich. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with increase in awareness & demand for specialty insurance across the globe.

The specialty insurance is estimated to grow at a CAGR of 10.6% from 2022 to 2031.

The specialty insurance is projected to reach $278.97 billion by 2031.

Surge in demand for specialized expertise, technological advancements and numerous benefits are provided by specialty insurance covering unique needs & preferences majorly contribute toward the growth of the market.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as AXA, American International Group, Inc., Allianz, Assicurazioni Generali SpA, Berkshire Hathaway Inc., Chubb, Munich Re, PICC, Tokio Marine HCC, and Zurich.

The key growth strategies of specialty insurance players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...