Specialty Tire Market Insights, 2032

The global specialty tire market size was valued at $12.9 billion in 2022, and is projected to reach $19.4 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032.

Report Key Highlighters:

- The report covers a detailed analysis on the specialty tires used in automotive industry.

- The specialty tire market share has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

Specialty tires represent a diverse category of rubber and treaded wonders tailored for specific applications beyond the realm of standard vehicles. From off-road adventures to industrial machinery, these specialized tires play a crucial role in optimizing performance, safety, and durability across numerous industry verticals. One notable application of specialty tires is off-road tires, designed for vehicles that traverse challenging terrains like mud, sand, or rocky landscapes. These tires often feature reinforced sidewalls, aggressive tread patterns, and durable compounds to withstand the rigors of off-road exploration, providing enhanced traction and durability.

In the agricultural sector, specialty tires cater to the unique demands of farming equipment. Farm tires are engineered to support heavy loads, minimize soil compaction, and navigate diverse field conditions. Their design often includes deep treads and robust construction to ensure optimal grip and longevity in demanding agricultural environments. Industrial and construction machinery also rely on specialty tires crafted to withstand heavy loads, resist punctures, and endure challenging surfaces. These tires contribute to the efficiency and safety of equipment like forklifts, skid steers, and loaders in industrial settings. The specialty tire market continues to evolve with innovations such as run-flat technology, which allows vehicles to travel short distances even after a puncture. As industries diversify and technology advances, the demand for specialty tires is expected to grow, driving further research and development in tire engineering to meet the specific needs of diverse applications.

Factors such as increase in vehicle production in developing countries and rise in competition among tire manufacturers drive the market toward a positive growth during the forecast period. However, the factors such as increase in demand for tire remolding and volatile prices of raw materials create a barrier hampering the growth of the market across the globe. Moreover, the factors such as advancement in technology and fuel efficiency & safety concerns create numerous opportunities for the growth of the market across the globe.

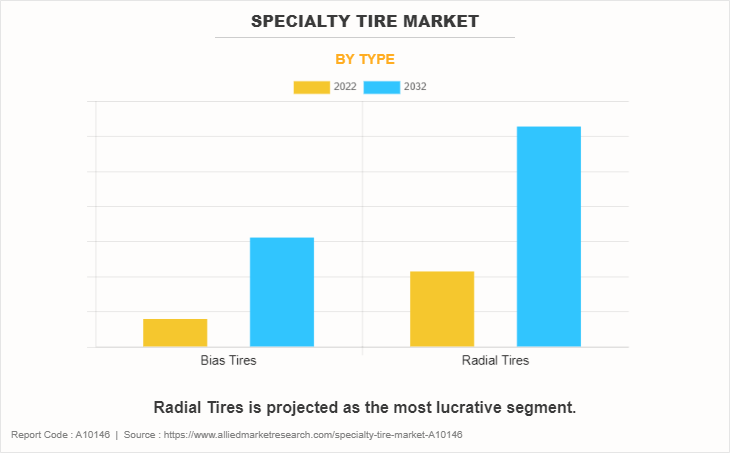

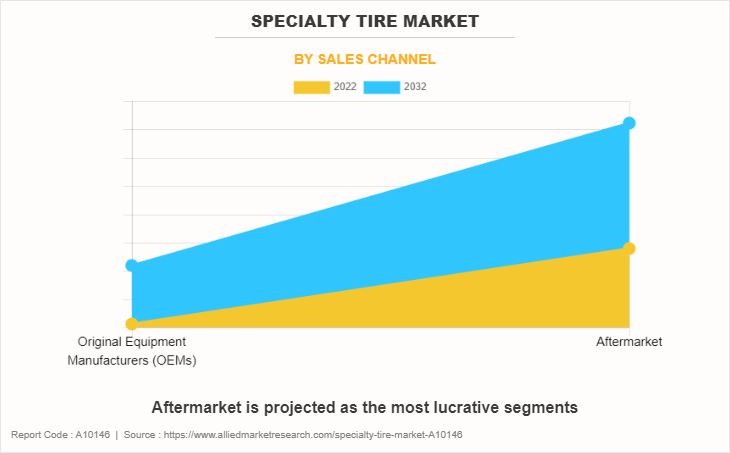

The global specialty tire market has been segmented into type, end user, sales channel, and region. By type, the market is categorized into bias tires and radial tires. As per end user, the market is categorized into agriculture, construction & mining, off-roading, and others. Depending on sales channel, the global market is categorized into original equipment manufacturers (OEMs) and aftermarket. Region wise, the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

The specialty tire industry manufactures include CEAT Ltd., Michelin, GRI Tires, Maxam Tire, Specialty Tires of America, Inc., The Carlstar Group, LLC, Bridgestone Corporation, Continental AG, Nokian Tyres plc., and Zhongce Rubber Group Co., Ltd.

Increase in vehicle production in developing countries

Automobile demand in developing countries such as India, Brazil, and ASEAN countries is expected to grow significantly in the coming years as a result of urbanization and increased industrial activity. Owing to growing demand for automobiles in these countries, manufacturers are increasingly establishing manufacturing plants and expanding their presence in these countries. Developing nations have observed an increase in the production of automobiles owing to factors such as favorable government policies, increasing GDP, and rising consumer spending. For instance, various incentives such as 200% in tax deduction for engaging in vocational activities and tax incentives of up to 300% for conducting R&D have been offered by the governments of Southeast Asian countries in order to boost the automotive industry in the region.

Emerging companies and market leaders in many industries throughout developing nations, such as e-commerce, the food industry, and others, have boosted demand for delivery and transportation solutions, thereby boosting the production of commercial vehicles such as trucks, tractors, and trailers even further. Increased manufacturing of heavy-duty vehicles raises demand for specialty tires significantly. Furthermore, the growing demand for passenger vehicles in developing countries has considerably increased automobile production in the area. Customers in developing countries such as India, Brazil, and others, have shown considerable growth in their adoption of sedans, SUVs, and heavy commercial vehicle resulting in increased demand for specialty tires in the region. Vehicle production in emerging nations is anticipated to increase considerably in the future, providing an opportunity for the specialty tire market to witness growth.

Rise in competition among tire manufacturers

Leading automotive manufacturers continue to invest in the developing countries due to low costs of labor, which further decrease the production costs. This factor is expected to meet the increase in demand for vehicles. The tire industry has witnessed phenomenal growth in the last decade. Also, the automotive sector is experiencing exponential growth due to a rise in the demand for automobiles and use of collaborative & consolidation manufacturing in tire business. This, in turn, is anticipated to boost the growth of the specialty tires business. For instance, in 2019, the Hankook Tire launched “Dynapro AT2” for on & off-road SUVs. These tires have post optimal performance in all road conditions as they are characterized by quietness and a comfortable ride on-road and a powerful drive on the off-road.

In addition, the global tire manufacturers are showing interest in Pakistan by taking an active step with different strategies. For instance, South Korea’s second largest tire manufacturer Kumho Tire has sealed a deal with a Pakistani company, Century Engineering Industries to transfer its tire making technology for the next 10 years, due to rise in intense competition in the rubber tire market. Also, this factor is responsible for swift changes in the tire market that makes it more dynamic. Therefore, there is a rise in competition among tire manufacturers, which fosters the demand of specialty tires.

Increase in demand for tire remolding

The process of replacing the tread on worn tires is known as remolding or retreading. It is recognized as the tire re-manufacturing process and is also known as recap or remold. When compared to the manufacturing of a new tire, the re-manufacturing process of the tire saves a significant amount of material.

As a result, the materials for this procedure are less expensive. Furthermore, compared to building a new tire, it saves a significant amount of money on tire and material costs. As the labor and costs are much lower, retreading is environmentally friendly and far less expensive than purchasing new tires. Single tire can be retreaded up to ten times, extending its service life and saving significant energy and time in the manufacturing process, all while lowering landfill waste and carbon emissions. Owing to these benefits, the savings can be significant for businesses with large fleets of vehicles. Over the years, the tire manufacturing industry has made significant progress all over the world. Premium technologies are used to produce high-quality tires that will perform flawlessly not only in their first life, but also in their second, third, and even fourth.

Moreover, in tire retreading industry, the use of stronger tire casings, improved re-manufacturing procedures, and high-quality rubber compounds is increasing significantly for tire remold. Retreading directly reduces aftermarket costs. A significant increase in tire prices due to high production costs has accelerated the demand for retreaded tires. Retreading gives tires a new lease on life, and it can be done two to three times depending on the condition of the tire. This boosts the retreading tire market while slowing the growth of the specialty tire industry trends.

Advancement in technology

Most manufacturing companies are using automation to increase productivity and profitability due to rapid technological advancements. The specialty tire market is expected to grow as a result of technological advancements in the global tire industry, such as the introduction of rimless tires, green tires, and the use of lightweight elastomers and metals such as alloys and carbon fiber or composites such as manganese bronze and nickel aluminum bronze to manufacture tires.

In addition, major tire manufacturers are employing nanotechnology and other innovations or software to create a variety of advanced tire types. For instance, Bridgestone Tires, a leading tire and rubber manufacturer uses Contact Area Information Sensing (CAIS), which collects and analyses the tire contact area to sense road conditions. Shared and autonomous vehicles will shape the future of mobility.

Ride-sharing and ride-hailing are becoming more popular, supporting urban mobility as well as cargo and service transportation. Bridgestone, Michelin, Goodyear, and Continental, among others, are testing software platforms and Internet of Things (IoT)-connected sensors to monitor and evaluate tire quality. Tire manufacturers are concentrating their efforts on the development of smart tires that rely on IoT connectivity to provide improved safety, enhanced fuel efficiency, lower maintenance costs and efforts, and longer tire life. All of these elements are projected to open plenty of new opportunities for the specialty tire market report expansion.

Key Developments in Specialty Tire Industry

- In November 2023, The Carlstar Group, LLC. launched Carlstar branded tires at the Agritechnica Expo 2023 in Germany. This strategy enables to promote a brand exclusive to the specialty tire and wheel space. The Carlstar Group display a diverse selection of specialty tires bearing the Carlstar name, including the Versa Turf, Turf Master, Fairway Pro, Turf Trac R/S, AT 489, and All Trail tires.

- In March 2023, Bridgestone Corporation, through its subsidiary Bridgestone Americas, launched V-Steel Port Container Straddle (VPCS) radial tire. It is designed for straddle containers used in ports terminals and intermodal yards. The new VPCS is engineered with enhanced load capacity, speed rating, and durability for more efficient operations and extended service life.

- In October 2023, Nokian Tyres plc. launched Soil King VF & Float King VF tire that utilize Flexforce VF technology. It is a unique new tire technology that enables more efficient agricultural work by creating an XXL-sized ground contact and by reducing loss of power.

- In June 2023, GRI Tires launched Green XLR Earth series of tires that are made from 78.6% of sustainable materials, including pure natural rubber sustainably sourced from Sri Lankan rubber farmers. The use of environmentally friendly raw materials and processes reduce the environmental impact of the tire series and offer performance enhancements such as low abrasion loss, better durability, reduced soil compaction, and decreased rolling resistance for improved fuel consumption.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the specialty tire market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Specialty Tire Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 19.4 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 200 |

| By Type |

|

| By End-User |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Maxam Tire, Continental AG, GRI Tires, Michelin, Specialty Tires of America, Inc., Nokian Tyres plc., Zhongce Rubber Group Co., Ltd., The Carlstar Group, LLC., CEAT Ltd., Bridgestone Corporation |

Radial Tires are the upcoming trends of Specialty Tire Market in the world

Off-Roading is the leading application of Specialty Tire Market

Asia-Pacific is the largest regional market for Specialty Tire

The Specialty Tire Market is expected to experience a significant growth rate of 4.3% from 2023-2032

The key players profiled in the study include CEAT Ltd., Michelin, GRI Tires, Maxam Tire, Specialty Tires of America, Inc., The Carlstar Group, LLC, Bridgestone Corporation, Continental AG, Nokian Tyres plc., and Zhongce Rubber Group Co., Ltd.

Loading Table Of Content...

Loading Research Methodology...