Sports Electronics Devices Market Research, 2031

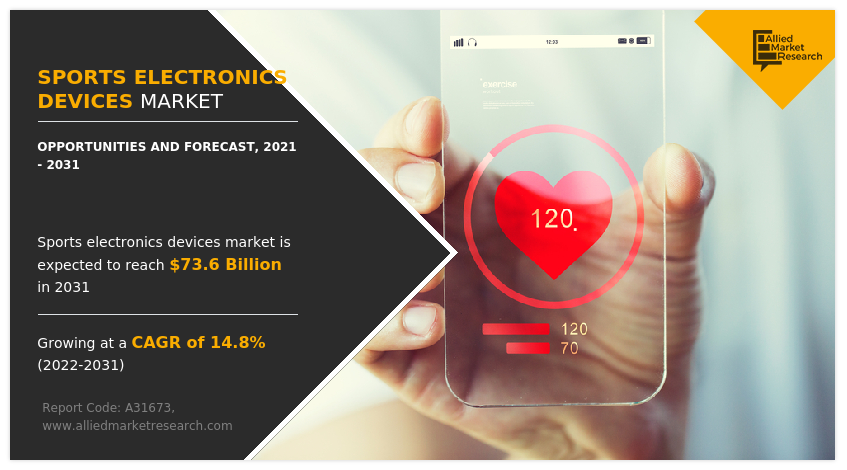

The global sports electronics devices market was valued at $19.6 billion in 2021 and is projected to reach $73.6 billion by 2031, growing at a CAGR of 14.8% from 2022 to 2031.

Sports electronics devices such as smart wearables for athletes, cameras & drones for stadiums, and biosensors used in fitness centers to track the biorhythm of the athletes on and off the ground, are the products controlled by electronic components and software to provide the desirable results in the sport. Such devices are increasingly used in the sports industry to keep track of the well-being of athletes. Furthermore, one of the major ways AI is transforming the sports industry is through the use of businesses to analyze individual player performances. With the help of AI-integrated technology, coaches and analysts can evaluate a player's strengths and weaknesses and track their development over time.

Metrics may also be used to compare player data and discover flaws in overall play execution. Sports electronics devices can provide one team with an advantage in defense by detecting strategic trends and devising effective remedies. Sports electronic devices are also profoundly changing how coaches view players’ health and safety on the field. Furthermore, it shows that physical and mental illnesses are being identified and treated more quickly than ever before. In addition, wearables such as watches, and heart rate monitors include artificial intelligence. These gadgets monitor a player's movements during workouts and maintain track of where the player is off the field to ensure safety.

Sports trainers can measure and monitor performance in real-time by attaching sensors to the body or weaving them into smart fabric, which is sportswear with sensing fibers. Almost every component of an athlete's performance may be assessed, including temperature, hydration, respiration, and heart rate. The trainer can utilize these real-time measurements to determine which areas each athlete should focus on more closely.

Furthermore, hawk-eye technology has been extensively used in sports like cricket, football, tennis, rugby, and badminton, which includes several cameras that capture the locations of the ball as it travels, and a model of the field of play. In addition, Ultra Edge is a modified version of the Snickometer, which helps in edge detection by analyzing various frequencies on the field.

The global sports electronics devices market is expected to witness notable growth during the forecast period, owing to an increase in investment in the sports industry by manufacturing companies, and a surge in the use of wearable devices by athletes. Moreover, demand for biosensor solutions is growing rapidly due to advanced technologies across fitness and sports centers to monitor the biorhythm of the athletes is expected to provide the sports electronics devices market opportunity during the forecast period. However, high initial investment, low budgets, and data privacy and cybersecurity concerns are some of the prime factors that restrain the global sports electronics devices market growth.

The sports electronics devices market is segmented into Product Type and End-User.

Based on product type, the market is divided into pedometers, fitness and heart rate monitors, smart fabrics, smart cameras, shot trackers, and others. In 2021, the smart camera segment dominated the market, in terms of revenue, and the pedometer segment is anticipated to witness a major share during the forecast period.

By Product Type

Pedometers segment is anticipated to acquire major share during the forecast period.

By end user, the market is segmented into sports centers, fitness centers, and home care settings. The fitness centers segment dominated the market in 2021, in terms of revenue, and is expected to dominate the market during the forecast period.

By End-user

Fitness Centers segment dominated the market in 2021.

Region-wise, the sports electronics devices market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). North America remains a significant participant in the sports electronics devices market. Major organizations and government institutions in the country are intensely putting resources into technology.

By Region

North America segment garnered significant market share in 2021.

Country-wise, the U.S. acquired a prime share in the sports electronics devices market in the North American region and is expected to grow at a high CAGR of 13.78% during the forecast period of 2022-2031. The U.S., holds a dominant position in the sports electronics devices market, owing to the rise in investment by prime vendors to boost the sports electronics devices market outlook.

In Europe, the UK, dominated the sports electronics devices market, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's sports electronics devices with a CAGR of 17.08%, owing to a significant development in smart stadiums and smart cameras in sports centers, in the country.

In Asia-Pacific, China is expected to emerge as a significant market for the sports electronics devices, owing to a significant rise in investment by prime players in next-generation sports electronics devices such as goal-line technology, ultra edge, decision review system (DRS) and others to boost the market across sports such as cricket, football, tennis, and others.

By LAMEA region, the Latin America country garnered significant market share in 2021 owing to the presence of start-ups such as Treinus, Go4it Capital, and others that are significantly investing in sports electronics device production in Latin America. Moreover, the Middle East region is expected to grow at a high CAGR of 12.14% from 2022 to 2031, because UAE is the host of several international cricket tournaments such as the Indian Premier League (IPL) and Asia World Cup, which is expected to reshape the growth of sports centers for sports electronics devices industry in the Middle East.

Competitive analysis and profiles of the major global Sports electronics devices market players that have been provided in the report include Apple, Blast Motion, Catapult Sports, Fitbit (Google), Garmin, Hawk-Eye Innovations (Sony Corporation), Panasonic Corporation, Polar Electro, Adidas, and Zepp.

Apple, Fitbit(Google), Polar Electro, Adidas, and Hawk-Eye Innovations (Sony Corporation) are the top 5 companies holding a prime share in the sports electronics devices market. Top market players have adopted various strategies, such as product launches, partnerships, innovation, and product development, to expand their foothold during the sports electronics devices market forecast.

- In June 2020, Kinexon, a performance-tracking company, partnered with Sporta, a Tokyo-based sports technology licensing company for wearable devices and player-tracking tools to sports teams in Japan. As part of the partnership, Alvark Tokyo, a Japanese basketball team, has become the first professional Asian sports team to begin tracking players with Kinexon's wearable devices.

- In September 2020, Samsung partnered with SoFi Stadium, a 70,000-seat sports, and entertainment complex in the US. Under this partnership, the multinational electronics & technology manufacturer would become the official mobile, TV & display partner of the world district, including a 6,000-seat performance venue.

- In May 2021, the Mexican Football Federation (FMF) and Hyperice, the industry leader in recovery technology and pioneer of percussion, vibration, dynamic air compression, and thermal technology, announced the partnership with Hyperice the organization's official recovery technology partner. According to Martí Matabosch Pijuan, Sports Science Coordinator for the Mexican National Team, Hyperice will provide access to the most innovative products for post-training recovery is fundamental to achieving its sporting objectives, which will allow the coaches and athletes to build a safe strategy, and get the results to the team.

- In February 2022, Zut was appointed by Cheshire-based Swellaway Ltd to launch its new brand ProMOTION, and its sports therapy product, the ProMOTION EV1. The ProMOTION EV1 delivers portable compression, heating, and cooling that enables physiotherapists to support injured athletes to get back to fitness, faster.

- In July 2022, KINEXON's LPS system will be used for live player monitoring in American Football during the upcoming Championship Game in Klagenfurt in collaboration with the European League of Football. The European League of Football also intends to improve the fan experience by providing high-quality live stats.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the sports electronics devices market size, market segments, current trends, estimations, and dynamics of the sports electronics devices market analysis from 2021 to 2031 to identify the prevailing sports electronics devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the sports electronics devices market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes sports electronics devices market share analysis of the regional as well as global sports electronics devices market trends, key players, market segments, application areas, and market growth strategies.

Sports Electronics Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 73.6 billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 251 |

| By End-User |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Apple, Inc., Adidas, Fitbit(Google), Zepp Labs, Inc., Polar Electro, Garmin Ltd., Catapult, Hawk-Eye Innovations (Sony Corporation), Panasonic Corporation, Blast Motion |

Analyst Review

The sports electronics devices market is anticipated to depict prominent growth during the forecast period, owing to an increase in demand for biosensors solutions for fitness and sports center end-use. In addition, the surge in the need for sports electronics devices for smart stadiums, AR and VR, digital signage, and others is increasing rapidly.

One of the biggest sectors in sports technology is, of course, wearables. From wristwear, GPS trackers, and heart monitors, to fully connected sports analytics vests. According to Allied Analytics LLP, the sports wearables technology market was predicted to be worth nearly $54,841 billion in 2020 and is projected to reach $184,403.60 billion by 2031. Connected, compact form sensors in watches, vests, headgear and even footwear can give athletes and their support staff crucial information. In addition to wearable technology, modern computing-capable cameras and drones have become more prevalent in competitive sports. As an illustration, consider the Hawkeye System, which has recently been employed as a goal line monitor in international soccer events.

For instance, in July 2022, Cisco partnered with Octagon, a sports agency. This partnership focused on the launch of The Connected Scarf, a new technology project to support Cisco’s partnership with Manchester City FC and City Football Group. Under this partnership, Octagon helped the company bring to life its vision for The Connected Scarf.

The market growth is supplemented by proactive industrialization efforts and a surge in manufacturing output, owing to technological advancements such as ultraedge and hawk-eye. These factors have allowed emerging markets to evolve as the largest markets during the forecast period, both from the demand and supply sides. Public and private organizations have substantially invested in R&D activities and advanced features to develop sports electronics devices.

Biosensor solutions are the upcoming trends of Sports Electronics Devices Market in the world.

North America is the largest regional market for Sports Electronics Devices.

The global sports electronics devices market was valued at $19,630.79 million in 2021.

Apple, Blast Motion, Catapult Sports, Fitbit (Google), Garmin, Hawk-Eye Innovations (Sony Corporation), Panasonic Corporation, Polar Electro, Adidas, and Zepp, are the top companies to hold the market share in sports electronics devices.

Fitness centers and sports centers are the leading application of sports electronics devices market.

Loading Table Of Content...

Loading Research Methodology...