Stable Isotope Labeled Compounds Market Research, 2035

The global stable isotope labeled compounds market was valued at $291.82 million in 2023, and is projected to reach $420.1 million by 2035, growing at a CAGR of 3.1% from 2024 to 2035. According to the National Cancer Institute's Division of Cancer Control & Population Sciences (DCCPS) in 2022, there were 623,405 individuals living with metastatic breast, prostate, lung, colorectal cancer, or metastatic melanoma in the U.S. This significant number drives the increasing demand for advanced diagnostic and therapeutic solutions, which are facilitated by stable isotope-labeled compounds.

Stable isotope-labeled compounds are molecules in which specific atoms are replaced with their stable isotopes, such as carbon-13 or nitrogen-15. These compounds are used in various scientific fields, including pharmacology, biochemistry, and environmental science, to track and analyze metabolic pathways, study molecular interactions, and improve the sensitivity of analytical techniques such as mass spectrometry. Unlike radioactive isotopes, stable isotopes do not decay over time, making them safer for use in research and allowing for long-term studies.

Key Takeaways

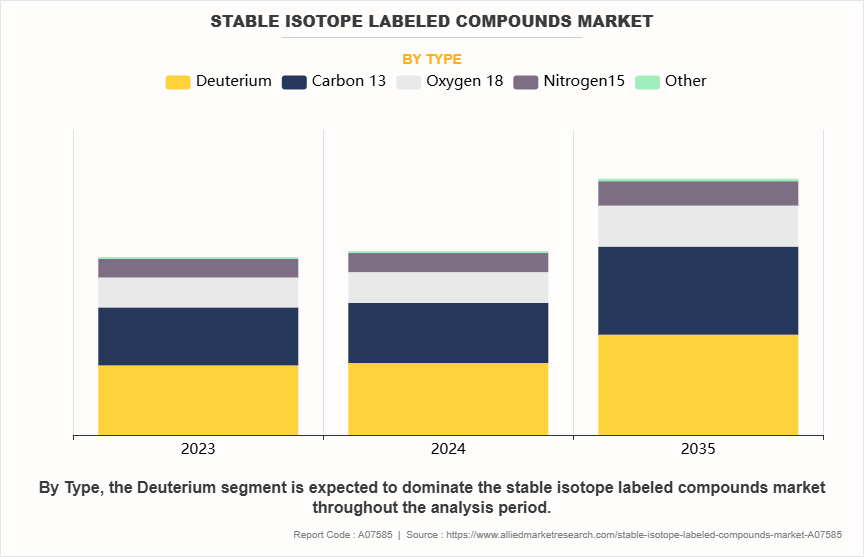

- On the basis of type, the Deuterium segment dominated the stable isotope labeled compounds market share in 2023. However, the Carbon13 segment is anticipated to grow at the highest CAGR during the forecast period.

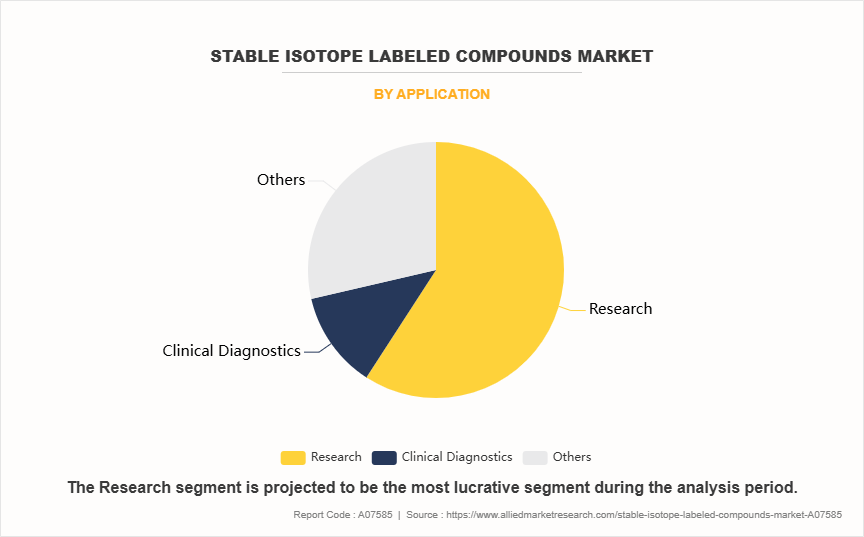

- On the basis of application, the research segment dominated the market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

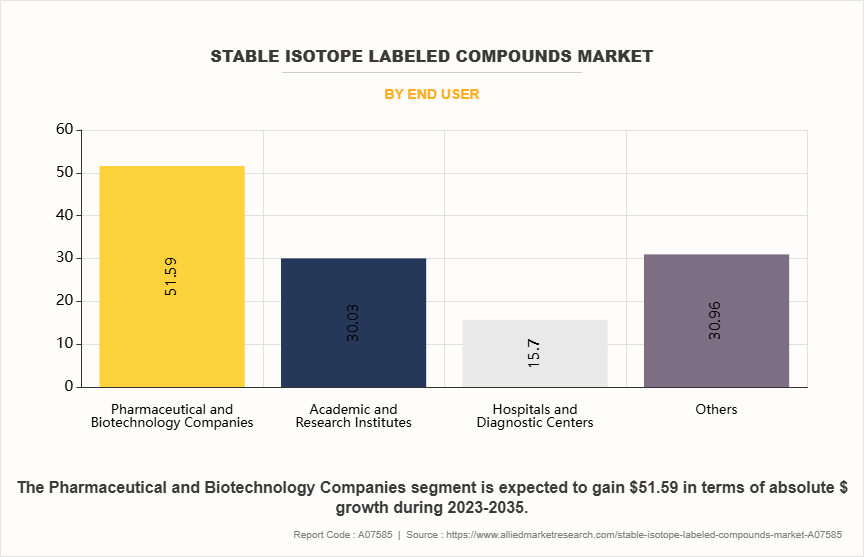

- On the basis of end user, the pharmaceutical and biotechnology companies segment dominated the market size in 2023. However, the academic and research institutes segment is anticipated to grow at the highest CAGR during the forecast period.

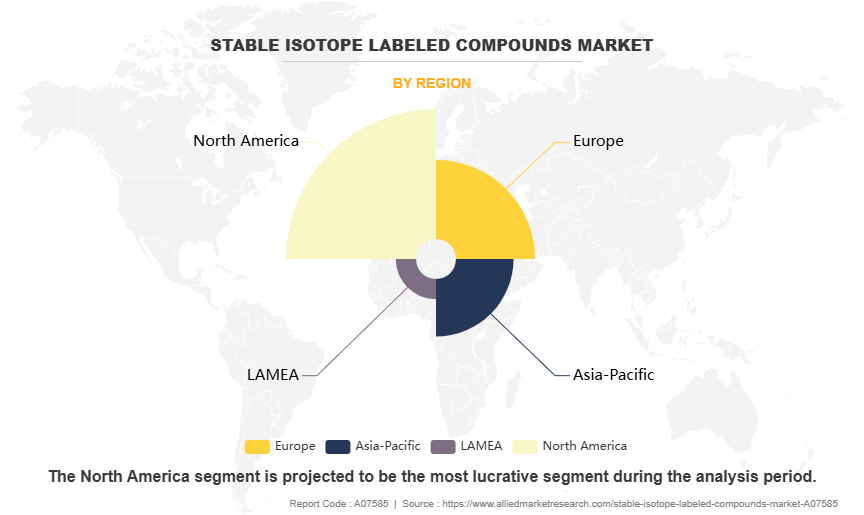

- Region wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The increasing adoption of stable isotope tracing for cancer metabolism studies is a significant driver of the stable isotope labeled compounds market growth. A study published in May 2024 by the National Library of Medicine highlights that stable isotope tracing has become a widely utilized method for monitoring cancer metabolism in both in vitro and in vivo settings. Technological advancements, the introduction of new tracers, and enhancements in data analysis tools have broadened the scope of cancer research, thereby increasing the value of isotope tracing.

Moreover, the rising prevalence of cancer cases worldwide further fuels this growing interest. According to the American Cancer Society (ACS), approximately 20 million new cancer cases were diagnosed in 2022, resulting in 9.7 million deaths. Projections indicate that by 2050, the number of cancer cases could soar to 35 million. This alarming rise in cancer incidence highlights the need for precise analytical tools such as stable isotope-labeled compounds, which are essential for understanding cancer metabolism and developing innovative therapies. Consequently, the demand for these compounds is expected to surge, thus driving significant stable isotope labeled compounds market growth.

In addition to the increased adoption of stable isotope tracing in cancer research, government funding and support are pivotal in propelling the growth of the stable isotope-labeled compounds market. For example, in October 2022, the U.S. Department of Energy inaugurated the Stable Isotope Production and Research Center (SIPRC) at Oak Ridge National Laboratory in Tennessee. This facility is slated to receive $75 million in funding from the Inflation Reduction Act, aimed at bolstering the nation's capacity to enrich stable isotopes for medical, industrial, and research applications. Such substantial investments reflect a governmental commitment to enhancing isotope production infrastructure, thereby fostering innovation across healthcare, pharmaceuticals, and scientific research. These initiatives are crucial in expanding the availability of stable isotopes, thus driving the stable isotope labeled compounds market opportunity.

Furthermore, growth opportunities in emerging countries significantly contribute to market expansion. Many developing nations are investing in healthcare and scientific research, creating a burgeoning demand for advanced analytical tools, including stable isotope-labeled compounds. As these countries aim to improve their healthcare infrastructure and research capabilities, they present a lucrative market for companies specializing in stable isotope production, thereby driving the stable isotope labeled compounds market forecast.

In addition, the increasing focus on precision medicine also plays a crucial role in market growth. Precision medicine seeks to tailor treatments based on individual patient characteristics, necessitating sophisticated analytical techniques to identify specific biomarkers and metabolic pathways. Stable isotope-labeled compounds are integral to this process, offering valuable insights that can lead to more effective and personalized treatment options. As the healthcare industry increasingly embraces precision medicine, the demand for stable isotope-labeled compounds is expected to rise, further driving stable isotope labeled compounds market growth.

The integration of stable isotope-labeled compounds in various fields, including metabolic studies, drug development, and biomarker discovery, continues to expand. Their versatility allows researchers to apply these compounds in a wide range of applications, including pharmacokinetics and toxicology studies. Additionally, as awareness of the benefits of stable isotope tracing increases among researchers and healthcare professionals, the market is projected to witness significant growth.

Thus, the stable isotope-labeled compounds market is experiencing robust growth driven by multiple factors, including the rising adoption of stable isotope tracing in cancer metabolism studies, increasing government funding, and the expanding focus on precision medicine. The growth in prevalence of cancer cases and the need for advanced analytical tools further amplify this trend. Additionally, emerging markets present new opportunities for growth, as these countries invest in healthcare and research. Overall, the stable isotope-labeled compounds market is set to thrive as demand for innovative and precise analytical solutions continues to escalate.

Segmental Overview

The stable isotope-labeled compounds market is segmented into type, application, end user, and region. On the basis of type, the market is segmented into Deuterium, Carbon13, Oxygen 18, Nitrogen 15, and others. On the basis of application, the market is classified into research, clinical diagnostics, and other. The research segment is further divided into biomedical research, pharma research, and others. On the basis of end user, the market is categorized into pharmaceutical and biotechnology companies, academic and research institutes, hospitals and diagnostic centers, and other end users. On the basis of region, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA.

By Type

On the basis of type, the deuterium segment dominated the stable isotope labeled compounds market share in 2023, which was attributed to its extensive application in pharmaceutical research, especially in deuterium-substituted drugs that provide improved stability and metabolic resistance. Its significance in metabolic studies and labeling during drug development further boosts its market demand. The non-radioactive nature and versatility of deuterium make it a favored option for various scientific and industrial uses. However, the Carbon-13 segment is expected to register the highest CAGR during the forecast period owing to its growing application in metabolomics, NMR spectroscopy, and drug development, the demand for it is increasing. Its capacity to deliver detailed molecular insights and its expanding role in investigating metabolic pathways and disease mechanisms contribute to this rising demand in research and diagnostics.

By Application

By application, the research segment dominated the stable isotope labeled compounds market share in 2023 and is expected to register the highest CAGR during the forecast period. This growth is driven by the widespread utilization of stable isotope-labeled compounds in metabolic studies, drug development, and biochemical research. Their capability to trace molecular pathways and deliver accurate data in clinical trials and pharmacokinetics significantly enhances demand among research institutions.

By End User

By end user, the pharmaceutical and biotechnology companies segment dominated the stable isotope labeled compounds market size in 2023. This is attributed to the widespread application of stable isotope-labeled compounds in drug development, metabolic studies, and biomarker research. Additionally, their commitment to advanced research and development, coupled with the demand for accurate analytical tools, has driven their dominant market share. However, the academic and research institutes segment is expected to register the highest CAGR during the forecast period. This is attributed to the rising funding and investment in scientific research and innovation. The increasing focus on advanced research methodologies and the demand for high-resolution analytical tools are driving the need for stable isotope-labeled compounds in academic environments.

By Region

Region wise, North America held the largest stable isotope labeled compounds market size in 2023, owing to its robust pharmaceutical and biotechnology industries, extensive research and development activities, and advanced analytical infrastructure. The region's significant investments in scientific research and high demand for innovative diagnostic and therapeutic solutions contributed to its market dominance.

However, Asia-Pacific is anticipated to register the highest CAGR during the forecast period owing to rapid expansion of pharmaceutical and biotech industries, increased research investments, and growth in demand for advanced diagnostic tools. Enhanced healthcare infrastructure and a rise in focus on innovation and development in the region further drive its market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the stable isotope labeled compounds industry MerckKGaA, Otsuka Holdings Co., Ltd., Entegris, Omicron Biochemicals, Inc, Shimadzu Corporation, Nippon Sanso Holding Corporation, Vivan Life Sciences, BOC Sciences, Silantes, and Symeres. Major key players have adopted product launch, geographical expansion, partnership, agreement as a key developmental strategy to improve the product portfolio of the stable isotope labeled compounds market.

Recent Developments in Stable Isotope Labeled Compounds Industry

- In January 2022, Merck KGaA, a leading science and technology company, announced the expansion of its Stable Isotope Center of Excellence in Miamisburg, Ohio. The new infrastructure increases production capacity of the GMP-grade urea-13C Active Pharmaceutical Ingredient (API) used by Urea-13C Breath Test (UBT) kit manufacturers by more than 50%.

- In September 2022, Cambridge Isotope Laboratories, Inc. (CIL) announced partnership with ISO topic Solutions to release the new stable isotope-labeled and unlabeled Crude Lipid Yeast Extracts. These are designed to render 100s of fatty acids and lipids for use in MS lipidomics research and development.

- In October 2022, Cambridge Isotope Laboratories, Inc. (CIL), the world leader in stable isotope chemistry and the separation of carbon-13 (13C), announced the largest expansion in the company’s history. This strategic undertaking, which has been aptly named North Star, will significantly increase 13C production by building a separate cryogenic distillation facility for carbon monoxide.

- In January 2024, Merck KGaA, a leading science and technology company, announced five-year agreement with the Heavy Water Board (HWB) in India. This strategic partnership aligns with Merck's expansion plans in the country, focusing on the local manufacturing of deuterated compounds.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the stable isotope labeled compounds market analysis from 2023 to 2035 to identify the prevailing stable isotope labeled compounds market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stable isotope labeled compounds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stable isotope labeled compounds market trends, key players, market segments, application areas, and market growth strategies.

Stable Isotope Labeled Compounds Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 420.1 million |

| Growth Rate | CAGR of 3.1% |

| Forecast period | 2023 - 2035 |

| Report Pages | 317 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | NIPPON SANSO HOLDINGS CORPORATION, Merck KGaA, Shimadzu Corporation, Otsuka Holdings Co., Ltd., Entegris, Symeres, Silantes, BOC Sciences, Omicron Biochemicals, Inc., VIVAN Life Sciences |

Analyst Review

This section provides various opinions of top-level CXOs in the stable isotope-labeled compounds market. According to the insights of CXOs, the market is primarily driven by the increasing pharmaceutical development, which fuels demand for precise diagnostic and therapeutic tools.

CXOs further added that the rise in investments for research and development activities, along with advancements in analytical techniques, accelerates market growth. In addition, the growing focus on personalized medicine and sophisticated diagnostic methods contributes to the market expansion. However, CXOs note that the high cost of stable isotope-labeled compounds and complex production processes can pose challenges to market growth. The need for significant investment in infrastructure and technology, as well as ongoing innovation, can limit accessibility and affordability.

North America currently holds the largest market share due to its advanced healthcare infrastructure, high prevalence of cancer, and substantial investments in research. However, Asia-Pacific is expected to experience significant growth due to increased awareness, government initiatives, and a rise in public-private investments in the healthcare sector.

Research is the leading application of stable isotope labeled compounds market.

The global stable isotope labeled compounds market was valued at $291.82 million in 2023, and is projected to reach $420.1 million by 2035, growing at a CAGR of 3.1% from 2024 to 2035.

North America is the largest regional market for stable isotope labeled compounds.

The major companies include MerckKGaA, Otsuka Holdings Co., Ltd., Entegris, Omicron Biochemicals, Inc, Shimadzu Corporation, Nippon Sanso Holding Corporation, Vivan Life Sciences, BOC Sciences,Silantes, and Symeres.

Pharmaceutical and biotechnology companies is the leading end user of stable isotope labeled compounds market.

2023 is the base year of stable isotope labeled compounds market.

2024 to 2035 is the forecasted years of stable isotope labeled compounds market.

Loading Table Of Content...

Loading Research Methodology...