Stainless Insulated Bottle Market Research, 2035

The global stainless insulated bottle industry was valued at $4,383.0 million in 2023, and is projected to reach $9,997.2 million by 2035, registering a CAGR of 7.2% from 2024 to 2035. A stainless insulated bottle is a container made from high-quality stainless steel, designed to maintain the temperature of beverages for extended periods. It features double-wall construction, with a vacuum seal between the walls that minimizes heat transfer. This design helps keep drinks hot or cold for hours. The stainless insulated bottle is durable, resistant to corrosion, and features a food-grade interior to ensure safety. Stainless insulated bottles are commonly used for hydration, offering portability and temperature control for various outdoor, fitness, and daily use scenarios.

Market Dynamics

The growth in popularity of outdoor and fitness activities has significantly increased the demand for stainless insulated bottle market. As more people engage in hiking, camping, cycling, and sports, the need for durable, temperature-retaining hydration solutions has increased rapidly. Stainless insulated bottles offer superior performance by keeping beverages hot or cold for extended periods, which has thus made them an essential accessory for outdoor activities. In addition, many consumers prefer stainless steel bottles over plastic alternatives owing to better health and sustainability benefits. Higher disposable incomes and a shift toward an active lifestyle have further strengthened the stainless insulated bottle market size.

According to the Outdoor Industry Association, in 2023, the outdoor recreation participant base grew by 4.1% to a record 175.8 million participants, representing 57.3% of all Americans aged 6 and older. The increase in outdoor activity participation has directly driven the growth of the stainless insulated bottle market, with more consumers seeking reliable hydration solutions. Brands have responded by introducing rugged, leak-proof, and ergonomically designed stainless insulated bottles tailored for outdoor use. The strong demand from outdoor and fitness enthusiasts continues to encourage manufacturers to improve durability, portability, and thermal efficiency, further strengthening stainless insulated bottle market share.

Along with other drivers, advancements in vacuum insulation technology have driven the growth in demand for stainless insulated bottles by significantly enhancing thermal retention capabilities. Modern vacuum-sealed designs create a near-airless space between double-walled stainless steel layers, effectively reducing heat transfer and maintaining beverage temperatures for extended periods. Superior insulation performance has made stainless insulated bottles a preferred choice for consumers seeking sustainable, high-quality alternatives to disposable plastic bottles.

Moreover, the integration of cutting-edge features such as copper lining, advanced sealing mechanisms, and high-grade stainless steel materials has further improved product durability and efficiency, fueling market growth. Innovations ensure stainless insulated bottles remain lightweight, leak-proof, and resistant to wear, making them ideal for active individuals, professionals, and daily commuters. As consumer demand for reusable, eco-friendly hydration solutions increase, ongoing technological advancements continue to shape the market, strengthening the importance of stainless insulated bottles in modern lifestyles of consumers.

However, the high cost of stainless insulated bottles compared to plastic and aluminum alternatives poses a significant challenge to market growth. Stainless steel, known for its durability and superior thermal retention, requires advanced manufacturing processes such as vacuum insulation and precision engineering, leading to higher production costs. On the other hand, plastic and aluminum bottles are more affordable to produce, thus making them attractive to cost-conscious consumers. The price gap between stainless insulated bottles and lower-cost alternatives discourages budget-sensitive buyers, particularly in developing regions where affordability plays a large role in purchasing decisions. In addition, bulk purchases for businesses, schools, and institutions often prefer lower-priced options, limiting the widespread adoption of higher-priced stainless insulated bottle market growth.

While premium hydration products such as stainless insulated bottles cater to professionals and eco-conscious consumers, mainstream buyers often prioritize affordability over performance. This cost difference has slowed the penetration of stainless insulated bottles in various consumer segments, limiting their market reach and preventing adoption among consumers.

In addition, limited recycling infrastructure for stainless steel bottles has restrained market demand by raising environmental concerns among consumers. Many buyers prioritize sustainability when choosing reusable products, but inadequate recycling facilities have made it difficult to properly dispose of old and damaged stainless insulated bottles. Without accessible recycling programs, consumers may perceive stainless steel bottles as less eco-friendly, discouraging purchases. The lack of recycling options contributes to waste accumulation, weakening the sustainability factor that drives demand for reusable alternatives.

High recycling costs and logistical challenges further deter manufacturers from promoting stainless steel bottle recycling programs. Without efficient collection and processing systems, repurposing stainless steel from used bottles remains inefficient, reducing incentives for consumers to invest in premium stainless insulated bottles. As environmental awareness grows, consumers may shift toward materials with more established recycling pathways, such as glass or aluminum. The perception of stainless steel bottles as less sustainable due to recycling limitations ultimately reduces market adoption and slows overall growth.

Furthermore, innovation in smart and tech-integrated bottles is creating new opportunities in the global stainless insulated bottle market by improving functionality and convenience. Features such as temperature control, hydration tracking, and app connectivity attract consumers who prioritize health monitoring and efficiency. Smart stainless insulated bottles with built-in sensors monitor water intake, provide hydration reminders, and display real-time beverage temperature. The demand for stainless insulated bottles with digital integration has increased rapidly among individuals focused on wellness, professionals managing busy schedules, and travelers seeking advanced hydration solutions.

The integration of technology allows brands to introduce premium pricing and build stronger customer loyalty. Customization options such as LED displays, UV sterilization, and wireless charging create demand for stainless insulated bottles designed with modern lifestyles of consumers. Growing consumer interest in smart lifestyle products has led to increased adoption rates for tech-integrated stainless insulated bottles. Thus, continuous innovation in bottle design and functionality is shaping global stainless insulated bottle market trends, encouraging manufacturers to develop solutions that align with evolving consumer preferences.

Market Segmentation

The stainless insulated bottle market is divided into type, end user, distribution channel, and region. Based in type, the market is bifurcated into single-wall insulated bottle and double-wall insulated bottle. Based on end user, the market is categorized into individual and commercial. Based on distribution channel, the market is classified into supermarkets-hypermarkets, specialty stores, b2b, online sales channel, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and rest of Asia Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, and rest of Lamea).

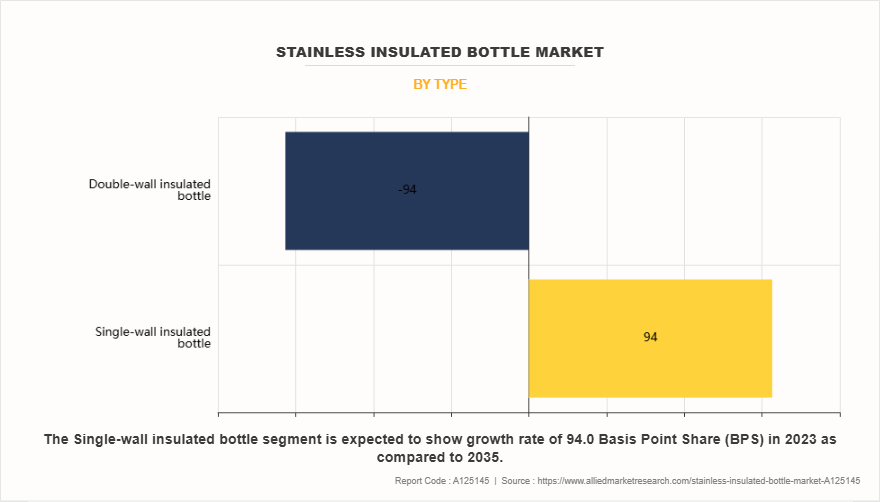

By Type

By type, double-wall insulated bottle segment dominated the global stainless insulated bottle market demand in 2023 and is anticipated to maintain its dominance during the forecast period. The demand for double-wall stainless insulated bottles in the global market is driven by superior temperature retention and long-lasting performance. Brands such as Yeti Coolers, LLC, Takeya, and Zojirushi provide bottles that effectively maintain beverage temperature for extended periods, making them ideal for outdoor activities, travel, and sports. The ability to keep drinks hot or cold for hours has positioned double-wall insulated bottles as a preferred choice for consumers seeking reliable hydration solutions. Increasing awareness of health, wellness, and sustainability further contributes to market growth of double-wall insulated bottles. As more consumers shift toward reusable alternatives to single-use plastics, brands such as Iron Flask and Simple Modern focus on eco-friendly materials and sustainable manufacturing, thus driving growth of this segment.

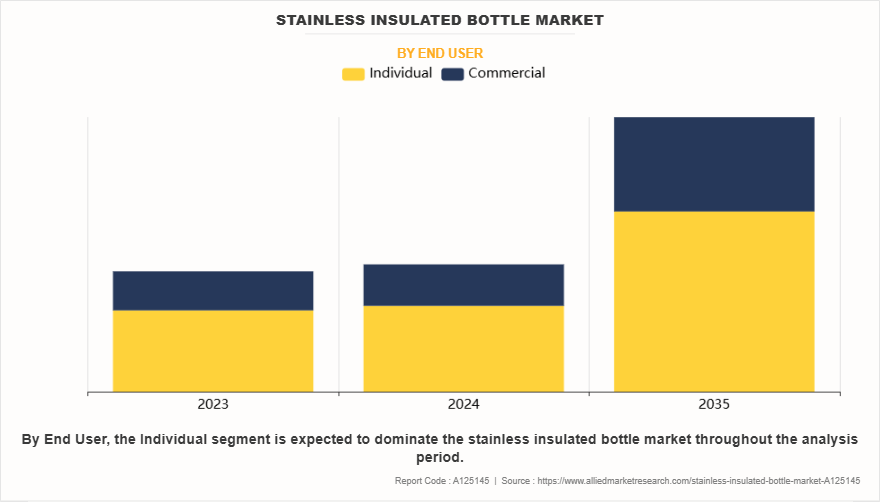

By End User

By end user, individual segment dominated the global stainless insulated bottle market in 2023 and is anticipated to maintain its dominance during the forecast period. The demand for stainless insulated bottles among individual users continues to grow due to the need for convenient and high-performance hydration solutions. These bottles keep drinks hot for hours or cold for up to 24 hours, which has made them ideal for daily use, outdoor activities, and exercise. Their durable, leak-proof design ensures practicality for work, travel, and physical activity. Temperature control enhances the user experience, catering to those who prioritize performance and convenience. The shift toward sustainability further drives demand, as consumers reduce reliance on single-use plastic bottles in favor of reusable, eco-friendly alternatives. Stainless insulated bottles offer a long-lasting solution that minimizes plastic waste, supporting environmentally responsible choices. As a result, functionality and sustainability factor of stainless insulated bottle is anticipated to expand market growth in individual segment during the stainless insulated bottle market forecast.

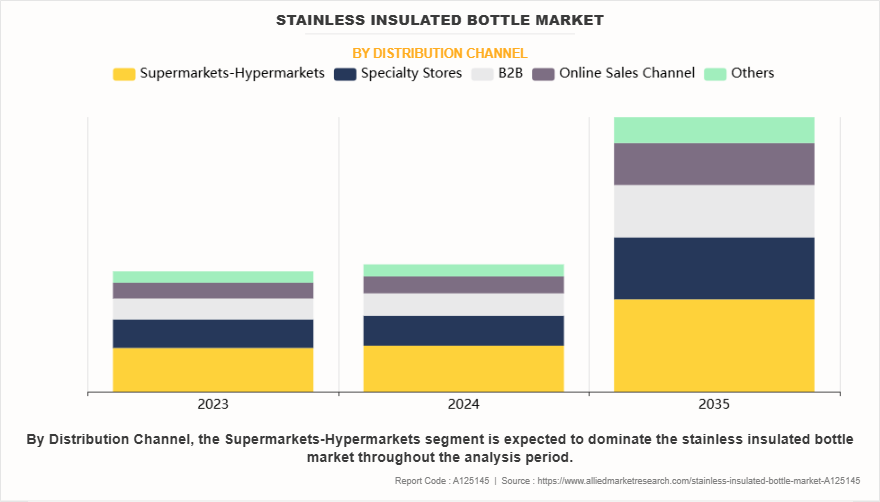

By Distribution Channel

By distribution channel, supermarkets-hypermarkets segment dominated the global stainless insulated bottle market in 2023 and is anticipated to maintain its dominance during the forecast period. Sales of stainless insulated bottles in supermarkets and hypermarkets are driven by the convenience of finding hydration products alongside everyday essentials. High foot traffic in these retail spaces allows consumers to physically inspect and compare multiple brands and models, making selection easier. Immediate availability attracts shoppers who prefer in-store purchases. Competitive pricing, promotions, and bulk discounts encourage sales, especially for personal use and gifting. Seasonal sales events and product bundles with fitness or outdoor gear further boost interest among consumers to purchase stainless insulated bottles from supermarkets and hypermarkets.

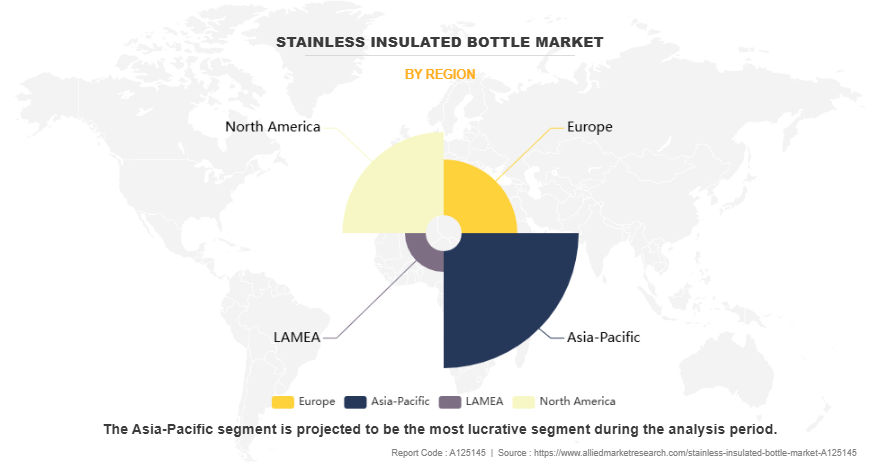

By Region

By region, Asia-Pacific is anticipated to dominate the global stainless insulated bottle market with the largest share during the forecast period. The increase in prominence of the food service sector, particularly in countries such as China, Japan, and India, has made insulated bottles essential for maintaining beverage temperatures, especially for hot drinks such as tea and herbal infusions, which align with traditional health rituals and growing interest in wellness. In South Korea, the emphasis on well-being and hydration with purified or alkaline water has led to higher demand for bottles that preserve water quality and temperature.

Government ban on plastic, such as Thailand's 2020 ban and the Swachh Bharat campaign in India, have encouraged consumers toward reusable products, which in turn has increased stainless insulated bottle sales. Corporate gifting has also contributed to market growth, with businesses in Japan offering insulated bottles as corporate gifts to employees as part of CSR initiatives.

In the tropical climates of Southeast Asia, the need for ice-cold drinks in humid environments has further fueled the demand for insulated bottles, while colder regions value them for retaining heat. Established brands such as Lock&Lock and Mosh cater to diverse needs with products tailored to local preferences, driving adoption of stainless insulated bottles across the region.

Competitive Analysis

The key players operating in the global stainless insulated bottle industry include Klean Kanteen, MiiR.com, Zojirushi Corporation, Lifetime Brands, Inc., Thermos LLC, Hydro Flask, LLC, Simple Modern, Vista Outdoor Operations LLC, Tiger Corporation, and YETI Holdings, Inc. Several well-known and upcoming brands are vying for market dominance in the expanding stainless insulated bottle market in the region. Smaller, niche firms are more well-known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the stainless insulated bottle market analysis from 2023 to 2035 to identify the prevailing stainless insulated bottle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stainless insulated bottle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stainless insulated bottle market trends, key players, market segments, application areas, and market growth strategies.

Stainless Insulated Bottle Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 10 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2023 - 2035 |

| Report Pages | 407 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Hydro Flask, LLC (Helen of Troy Limited), Klean Kanteen, Simple Modern, MiiR.com, Zojirushi Corporation, Tiger Corporation, Lifetime Brands, Inc., YETI Holdings, Inc., Vista Outdoor Operations LLC., Thermos LLC |

Analyst Review

This section consists of the opinion of the top CXO in the stainless insulated bottle market. Sustainability is recognized as a key driver in the growth of the stainless insulated bottle market. With plastic bans and global sustainability mandates gaining traction, the demand for eco-friendly alternatives is expected to rise. Regulations in regions such as the EU, India, and Latin America have encouraged consumers toward stainless bottles. Brands are aligning with circular economic principles, focusing on recyclability and reducing carbon footprints. Companies such as Hydro Flask and Klean Kanteen are investing in sustainable production processes to attract environmentally conscious consumers.

The rise in focus on health and wellness, especially after the COVID-19 pandemic, has positioned insulated bottles as essential lifestyle products. Consumers are increasingly prioritizing hydration and safe drinking, particularly in regions where water quality is a concern. By marketing stainless insulated bottles as BPA-free and hygienic, brands are anticipated to tap into health-conscious demographics, especially in urban markets like North America and Asia-Pacific.

Moreover, the trend of premiumization is expected to drive market expansion, with consumers willing to pay more for high-quality, customizable products. Limited-edition designs, influencer collaborations, and advanced features like temperature displays are driving higher margins. Brands such as S’well have successfully positioned themselves as luxury items, and startups are offering personalized engraving options through direct-to-consumer models. Furthermore, strong growth potential is expected in emerging markets, driven by urbanization, rising disposable incomes, and climate adaptability. Lastly, CXOs believe local manufacturing is crucial to making insulated bottles affordable in regions such as Southeast Asia and Latin America.

Upcoming trends in the stainless insulated bottle market include smart hydration technology, increased customization, eco-friendly materials, lightweight designs, and expanding demand for sports, travel, and outdoor-focused bottles with advanced insulation features.

Double wall insulated bottles has leading application of Stainless Insulated Bottle Market.

Asia-Pacific is the largest regional market for Stainless Insulated Bottle.

The global stainless insulated bottle market was valued at $4,383.0 million in 2023.

The key players operating in the global stainless insulated bottle industry include Klean Kanteen, MiiR.com, Zojirushi Corporation, Lifetime Brands, Inc., Thermos LLC, Hydro Flask, LLC, Simple Modern, Vista Outdoor Operations LLC, Tiger Corporation, and YETI Holdings, Inc.

Loading Table Of Content...

Loading Research Methodology...